-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Europe Q3 GDP More 'V' Than 'U'

EXECUTIVE SUMMARY:

- GERMAN, FRENCH, ITALIAN, SPANISH GDP STRONGER-THAN-EXPECTED IN Q3

- ...BUT EUR FAILS TO BENEFIT AMID LOCKDOWN FEARS AND E.C.B. DOVISHNESS

- EQUITIES UP FROM SESSION LOWS, BONDS MIXED

- B.O.J. CUTS FREQUENCY OF NOV SHORT-, MID- JGB BUYS

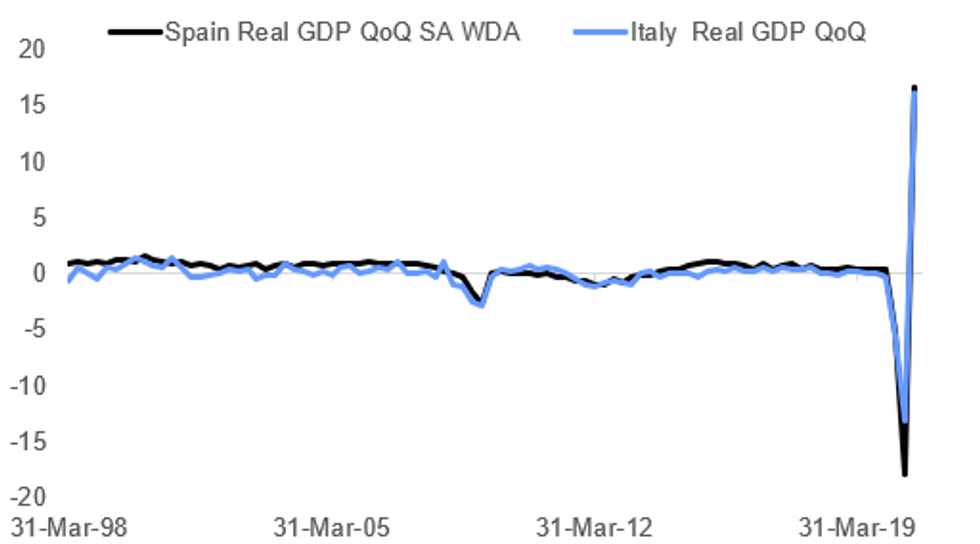

Fig. 1: European Q3 GDP Figures Surprise To The Upside

BBG, MNI

BBG, MNI

NEWS:

EUROPE DATA: Germany, France, Italy and Spain all reporting GDP above expectations this morning. This after ECB Pres Lagarde warned of upside surprises to Q3 data yesterday.

SPAIN DATA: The Spanish economy rebounded sharply in the third quarter, rising by 16.7%and coming in stronger than markets expected (BBG: +13.5 q/q)* Annual growth posted another decline, although at the slower pace of 8.7%.

* Growth rates for Q2 have been revised up slightly for both the quarterly andthe annual rate.* Household spending surged to 20.7% in Q3 after plunging by 20.4% in theprevious quarter.* On the other hand, government consumption eased by 0.4% after risingmarginally in Q2 by 0.2%.* National demand contributes positively to GDP, rising by 15% with importsgrowing 28.4%, while exports increased 34.3%* The report notes that hours worked only dropped by 6.2% in Q3, which is18.7pp higher than in Q2

FRANCE DATA: A better than expected Q3 Q/Q GDP number for France (although note that Lagarde had primed us for upside Q3 surprises yesterday). However, consumer spending in September fell much more than expected which is a concern going into a Q4 that is already expected to be very weak due to the lockdown.

GERMANY DATA (DJ): The German economy posted a record expansion in the third quarter in output, the German statistics office Destatis said Friday. The country's gross domestic product grew 8.2% compared with the previous quarter, according to Destatis. Economists polled by The Wall Street Journal forecast a 6.8% expansion. Growth was based on higher final consumption expenditure of households, higher capital formation in machinery and equipment and a sharp increase in exports, Destatis said.

ITALY DATA (DPA): Italy's gross domestic product (GDP) grew by a better-than-expected 16.1 per cent in the third quarter, official estimates showed on Friday. The quarter-on-quarter data was released by Istat, the national statistics office. In the previous quarter, Italian GDP shrank by 13 per cent, according to revised calculations.

EQUITIES: Some huge earnings releases after the bell Thursday. Highlights are:- Amazon down 2% pre-market on operating income miss (despite huge beat onsales & EPS)* Alphabet up 5.5% on better EPS & sales

- Facebook down 2.6% as US, Canadian users drop (despite EPS, Sales beat)

- Apple down 4.9% as iPhone sales miss expectations & China revenues drop

BOJ: The Bank of Japan said Friday it would reduce the frequency of government bond buying operations with a remaining life of 1 to 3 years and 3 to 5 years to five in November from six operations in October. The decision is based on the improvement of liquidity of those bonds and of functioning after the BOJ has increased the operation frequency in April to help stabilize bond markets. Reflecting the reduction in operations, the BOJ increased the scale to a range of JPY350 billion to JPY650 billion and a range of JPY250 billion to JPY600 billion from a range of JPY250 billion to JPY600 billion and a range of JPY200 billion to JPY500 billion, respectively.

- Credit Agricole: Neutral-to-mild USD buying across the board with the strongest signal in USD/JPY. Corp flow model shows EUR/USD buying at end-of-month.

- Deutsche Bank: Positive CHF, EUR, negative AUD, JPY.

- Citi: Flips to moderate USD buy signal driven by sharp fall in US & European equities.

BOJ: The Bank of Japan is mindful of the risk that prolonged weakness in the economy could hit capital investment and cause a serious downturn, the full text of the BOJ's Outlook Report released on Friday showed. The BOJ expects capital investment to continue to downtrend in sectors directly affected by Covid-19, such as the services industry.

UK: A new opinion poll from JL Partners shows support for Scottish independence running at 56%, compared to 44% opposed to Scotland becoming an independent nation. The poll continues the trend that shows support for independence higher thanfor remaining as part of the United Kingdom that has been in place sinceJune, with every poll carried out since then showing 'yes' to independenceleading 'no'.* It should be noted, though, that JL Partners are not members of the BritishPolling Council, and therefore at present their polling does not carry the same weight as those polls from members of the Council.

UK DATA: House prices extended their winning streak into October, data from the Nationwide published Friday showed, with the average price across the four nations up by 5.8% y/y. Robert Gardner, the lender's Chief Economist, said the gains came despite a slowing of the economy with market activity remaining 'robust'.

DATA:

MNI: SWISS OCT KOF ECON BAROMETER 106.6; SEP 110.1

MNI: SWISS SEP RET SALES -3.6% M/M, +0.3% Y/Y; AUG -0.7% M/M

MNI: FRANCE OCT FLASH HICP -0.1% M/M, 0.0 Y/Y; SEP 0.0% Y/Y

FRANCE FLASH Q3 GDP +18.2% Q/Q SA, -4.3% Y/Y WDA

MNI: FRANCE SEP CONSUMER SPENDING -5.1%, -1.3% Y/Y

MNI: GERMANY FLASH Q3 GDP +8.2% Q/Q SA, -4.3% Y/Y WDA

ITALY Q3 FLASH GDP +16.1% Q/Q sa, -4.7% Y/Y WDA

FIXED INCOME: Mixed session so far for core FI

Bunds and gilts are on the backfoot this morning but remain within yesterday's range after the early sell-off in European equity futures has been largely reversed. Q3 GDP has been above expectations in each of Germany, France, Italy and Spain this morning, following Lagarde's guidance yesterday that Q3 would likely see some upside surprises. However, Q4 remains a lot more questionable with many Eurozone countries having already announced November lockdowns or expected to announce them in coming days.

- Elsewhere, there will also be focus on month end rebalancing and the MNI Chicago Business Barometer and Michigan sentiment surveys will both be released.

- TY1 futures are up 0-2+ today at 138-15+ with 10y UST yields down -0.5bp at 0.819% and 2y yields down -0.2bp at 0.148%.

- Bund futures are down -0.18 today at 176.13 with 10y Bund yields up 1.0bp at -0.628% and Schatz yields up 0.7bp at -0.805%.

- Gilt futures are down -0.19 today at 135.98 with 10y yields up 1.1bp at 0.231% and 2y yields down -0.4bp at -0.65%.

FOREX: Better GDP Fails to Translate to a Stronger EUR

GDP data has fared better across Europe, with German, Italian, French and Spanish numbers proving better-than-expected. This failed to translate into a stronger single currency, however, with ECB's Lagarde just yesterday warning of the upside risk to Q3 growth numbers that's expected to fade materially into the end of 2020.

The greenback is paring some of the recent strength, but recent ranges have largely been respected. JPY is marginally stronger, while CHF is marginally weaker.

Month-end hedge rebalancing flows are broadly seen to be USD positive for October, although much of this order flow may have been completed earlier in the week alongside the broad greenback rally.

Earnings after-market Thursday were mixed, with Alphabet trading higher after-earnings, while Apple, Amazon and Facebook retreat.

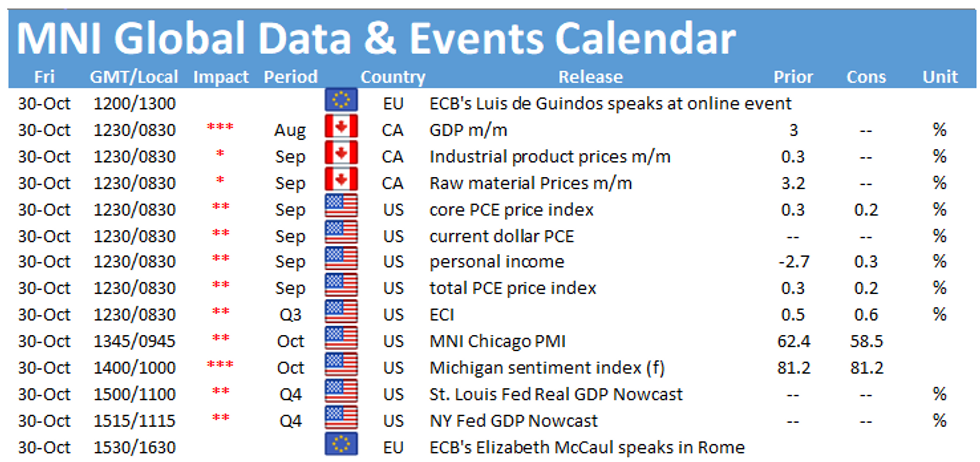

Canadian GDP, US personal income/spending and MNI Chicago PMI are the calendar highlights Friday.

EQUITIES: Still Reeling From Tech Weakness, But Off Lows

Equities are weaker globally following last night's earnings report-led tech rout, though well off session's weakest levels in European trade.

- Asian stocks closed sharply lower, with Japan's NIKKEI down 354.81 pts or -1.52% at 22977.13 and the TOPIX down 31.6 pts or -1.96% at 1579.33. China's SHANGHAI closed down 48.195 pts or -1.47% at 3224.532 and the HANG SENG ended 479.18 pts lower or -1.95% at 24107.42.

- European equities are weaker, with the German Dax down 47.72 pts or -0.41% at 11549.71, FTSE 100 down 23.13 pts or -0.41% at 5558.9, CAC 40 down 15.72 pts or -0.34% at 4556.07 and Euro Stoxx 50 down 8.93 pts or -0.3% at 2950.58.

- U.S. futures are off sharply (led by tech), with the Dow Jones mini down 390 pts or -1.47% at 26167, S&P 500 mini down 47.75 pts or -1.45% at 3254.5, NASDAQ mini down 217 pts or -1.91% at 11125.75.

COMMODITIES: Pausing For Breath

Commodities have found a bit of stability vs the swings of recent days, with the dollar flat and equities off only slightly.

- WTI Crude up $0.06 or +0.17% at $36.25

- Natural Gas up $0.01 or +0.27% at $3.311

- Gold spot up $4.81 or +0.26% at $1872.49

- Copper down $0.25 or -0.08% at $305.45

- Silver up $0.11 or +0.48% at $23.3735

- Platinum up $5.04 or +0.59% at $854.03

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.