-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Treasuries Surge On Bessent And Oil

MNI ASIA OPEN: Israel-Hezbollah Ceasefire Cautiously Reached

MNI US Open: Stocks Continue To Climb

EXECUTIVE SUMMARY:

- E.C.B. MUST KEEP MONEY TAPS FULLY OPEN AS CRISIS NOT OVER: STOURNARAS

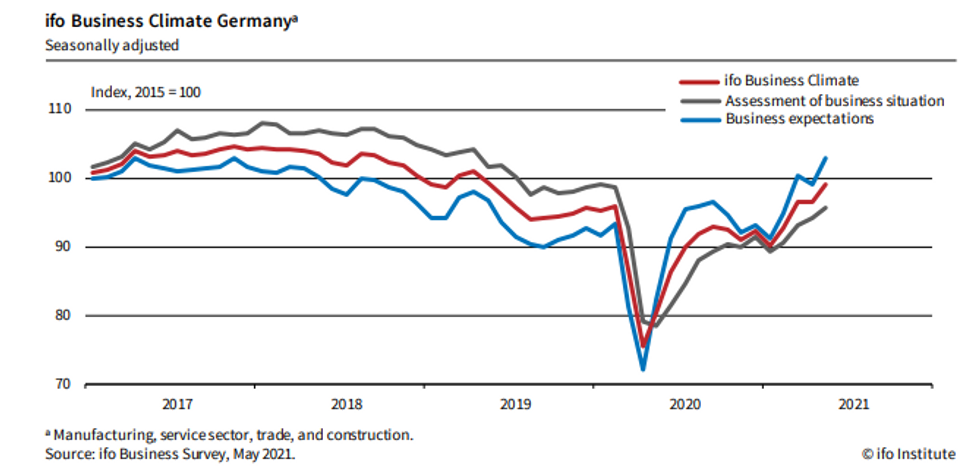

- GERMAN MAY IFO BUSINESS CLIMATE AT TWO-YEAR HIGH

- HALF OF E.U. ADULTS TO HAVE RECEIVED 1ST COVID VACCINE DOSE THIS WEEK: VON DER LEYEN

Fig. 1: German Ifo Hits 2-Yr High

NEWS:

ECB (RTRS): The European Central Bank must keep its money taps fully open, as the euro zone economy is still in the throes of the coronavirus pandemic despite progress in vaccination campaigns, ECB policymaker Yannis Stournaras said. ECB rate-setters will review the pace of emergency bond purchases at their June 10 meeting against an improved economic backdrop. Growth and inoculation rates are rising in the bloc as COVID-19 cases fall. However, in an exclusive with Reuters, Stournaras said the recovery remained fragile and, with no evidence to point to an era of high inflation in the foreseeable future, it was too early for the ECB to slow down emergency bond purchases.

GERMANY: German business confidence was higher again in May, rising to the highest level since May 2019, the Munich-based Ifo Institute said Tuesday. The headline index rose 2.6 points to 99.2 in May, as the corporate assessment of the current situation (95.7) improved, leaving firms more optimistic over the outlook (102.9). "The German economy is picking up speed", the Ifo Institute said. Manufacturing sentiment rose marginally with firms being more satisfied with their current situation, while their expectations dropped markedly, although "material shortages became an even more pressing concern." the survey noted. Service sentiment jumped to the highest level since the start of the pandemic as firms are more optimistic. Expectations also increased in hospitality and tourism, with "retailers hoping the economy will open up further," the Ifo added.

E.U.: Following the focus of the first day of the special European Council summit resting on Belarus' forced landing of a Ryanair flight to arrest an opposition journalist, today EU leaders have just begun to discuss the bloc's response to COVID-19 and climate change policy. The Council last night made the decision to recommend additional sanctions to be placed on individuals and entities linked to the Lukashenko regime as well as flights from the Belarusian flag carrier airline being banned from flying in EU airspace or landing at EU airports. Both of these decisions will require approval by the relevant Council of Ministers in order to be implemented (conclusions here). EU Council conclusions onRussia, EU-UK, MENA, and SSA. Given that the primary focus of the evening's discussion focused on Belarus, many of these conclusions did not get significant debate or focus in the Council meeting.

U.S./MIDDLE EAST (AP): U.S. Secretary of State Antony Blinken has arrived in Israel at the start of a Middle East tour aimed at shoring up the Gaza cease-fire.He will face the same obstacles that have stifled a wider peace process for more than a decade, including a hawkish Israeli leadership, Palestinian divisions and deeply rooted tensions surrounding Jerusalem and its holy sites.The 11-day Gaza war killed more than 250 people, mostly Palestinians, and caused widespread destruction in the impoverished coastal territory. Blinken is expected to focus on coordinating reconstruction without engaging with Gaza's militant Hamas rulers, who are considered terrorists by Israel and Western countries.The truce that came into effect Friday has so far held, but it did not address any of the underlying issues.

RBNZ PREVIEW (MNI): We expect the RBNZ to leave all of the main monetary policy parameters unchanged on Wednesday, which should be coupled with upgrades to economic forecasts vis-à-vis February MPS. For full preview contact sales@marketnews.com

BANKS (BBG): Deutsche Bank AG is moving about a quarter of its corporate bank's U.K. staff to offices in the European Union and Asia as it looks to reduce costs at the division. The changes will see about 100 jobs move to cities like Berlin, Dublin, Frankfurt and various cities across Asia, according to people familiar with the matter, who asked not to be identified discussing private matters. While some London-based staff can reapply for their jobs in the new locations, they will be required to take a pay cut.

DATA:

UK Borrowing in FYE Mar 2021 Revised Lower

APR PSNB-X GBP 31,696BN VS GBP 47,315BN IN APR 2020

APR CGNCR GBP 30,512BN VS GBP 63,857BN APR 2020

APR PSNCR GBP 33,564BN VS GBP 74,227BN APR 2020

APR DEBT/GDP RATIO EX-BOE 88.3% VS 78.5% APR 2020

APR YTD BORROWING GBP 31.7BN VS GBP 47.3BN APR 2020

- Public sector net borrowing was 31.7% of GDP, the second highest Apr borrowing on record and GBP 15.6bn less than a year ago.

- UK year-to-date borrowing for the financial year 2020/21 was revised down by GBP2.8bn to GBP 300.3bn, but remains the highest borrowing on record. However, borrowing was GBP 27.1bn less than the OBR expected (GBP 327.4bn).

- Central gov. tax receipts registered at GBP 58.0bn in Apr, which is 7.0% more than in Apr 2020, while gov bodies spent GBP 95.9bn, 11.9% less than a year ago.

- Gov tax receipts and national insurance receipts were 4.7% smaller in FYE Mar 2021 than in the previous financial year and the gov support during the pandemic contributed to a rise of 27.6% in gov day-to-day spending.

- CGNCR was GBP 30.5bn in Apr, while in the FYE Mar 2021 it was GBP 334.5bn, the highest since the series began in 1984.

FIXED INCOME: Bonds are better bid today

- EGBs trade in fairly narrow ranges, but contract have been generally better bid, following the overnight risk on.

- Fed officials are playing down that risk of higher inflation will persist.

- Cheaper money for longer, and the dovish tone keeps Equities and Bond futures supported.

- German curve trades bull flatter on the margin, while peripheral spreads move tighter as they outperform Germany.

- Italy leads and is 3bps tighter on the session.

- Gilts underperform slightly versus EGBs, with volumes here once again dominated by rolling position into September. Roll pace is at 20% ahead of 1st notice on the 27th.

- US Treasuries are better bid on Risk on, and similar to Gilts, rolls are at the forefront, given the lack of Risk events and Data.

- Looking ahead, Fed Barkin, Evans, Quarles, ECB Villeroy, Lane, and BoE Tenreyro are the scheduled speakers.

- In Supplies, US 2yr $60bn

FOREX: Greenback Weaker as Equities Progress, Yields Slip

- The EUR/USD uptrend persists early Tuesday, with the pair showing above the recent 1.2245 high and hitting multi-month highs in the process. This narrows the gap with 2021's best levels at 1.2349.

- The greenback is weaker across the board, slipping alongside Treasury yields ahead of the NY open, with the curve modestly flatter through the European morning.

- Similarly, with the JPY is softer, underperforming alongside the USD, as markets watch the persistent equity strength boosting US futures further. EUR/JPY is nearing the cycle highs posted May 19th at 133.44.

- Vols are steady, with the front-end of the curve across DMFX holding much of the early May strength.

- Central bank speak remains the focus, with another busy slate Tuesday. Fed's Barkin, Evans and Quarles are due to speak as well as the ECB chief economist Lane and BoE's Tenreyro.

- US new home sales and consumer confidence numbers are the data highlight.

EQUITIES: European Stocks Hit Multi-Year Highs

- Asian stocks closed higher, with Japan's NIKKEI up 189.37 pts or +0.67% at 28553.98 and the TOPIX up 6.48 pts or +0.34% at 1919.52. China's SHANGHAI closed up 84.06 pts or +2.4% at 3581.342 and the HANG SENG ended 498.6 pts higher or +1.75% at 28910.86.

- European equities are mostly higher, with the German Dax up 113.88 pts or +0.74% at 15543.27, FTSE 100 down 1.18 pts or -0.02% at 7051.23, CAC 40 up 4.69 pts or +0.07% at 6414.32 and Euro Stoxx 50 up 17.33 pts or +0.43% at 4048.84.

- U.S. futures are rising, with the Dow Jones mini up 93 pts or +0.27% at 34445, S&P 500 mini up 13.5 pts or +0.32% at 4207.25, NASDAQ mini up 70.75 pts or +0.52% at 13706.

COMMODITIES: Oil, Copper Turn Lower From Overnight Highs

- WTI Crude down $0.38 or -0.58% at $65.81

- Natural Gas down $0 or -0.14% at $2.885

- Gold spot up $1.69 or +0.09% at $1884.92

- Copper down $0.5 or -0.11% at $452.6

- Silver down $0.14 or -0.49% at $27.7066

- Platinum up $4.75 or +0.4% at $1184.08

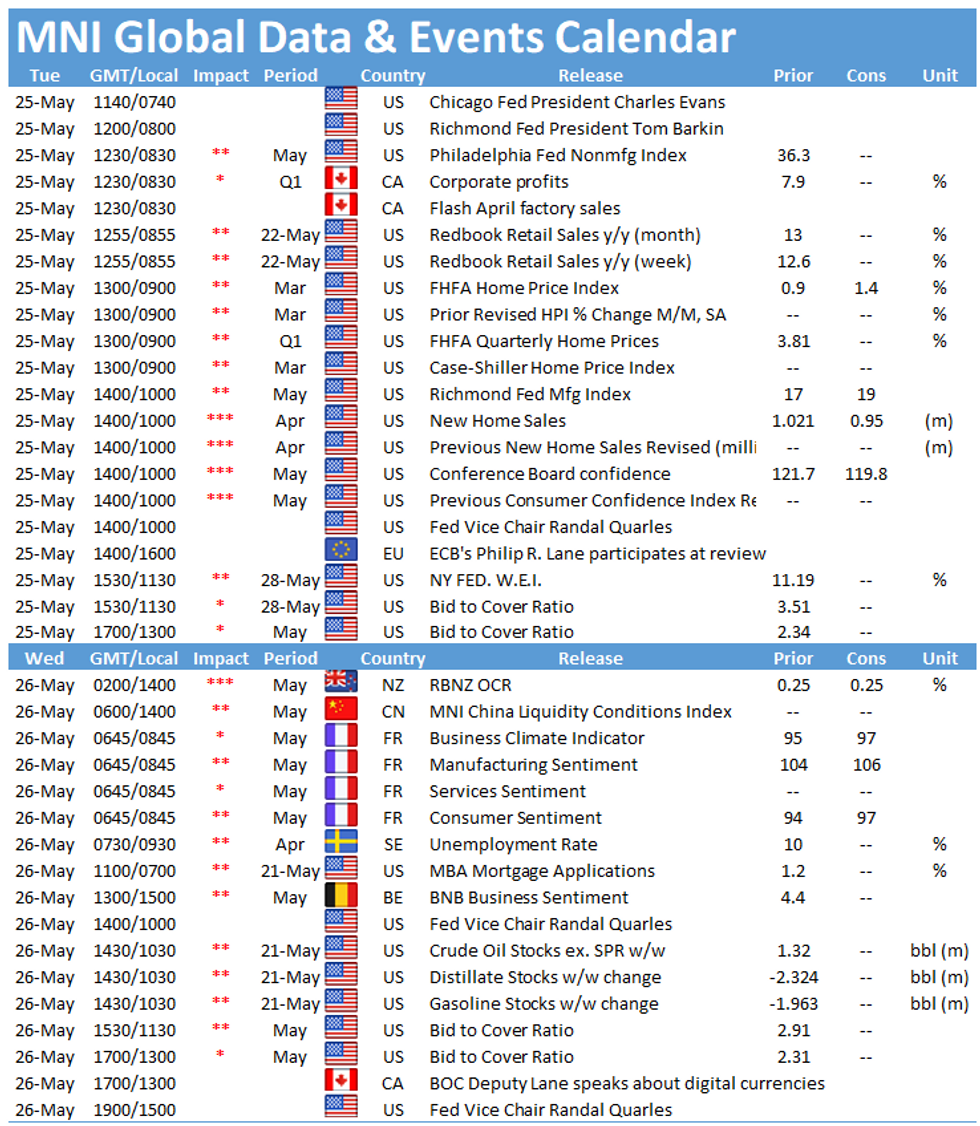

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.