-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Open: Norges Bank Signals September Rate Hike

EXECUTIVE SUMMARY:

- NORGES BANK FORECASTS SHOW SEPTEMBER HIKE, 3 FURTHER HIKES IN 2022

- SNB KEEPS RATES UNCHANGED, STILL SEES CHF AS "HIGHLY VALUED"

- INTERNET OUTAGES BRIEFLY DISRUPT ACCESS TO WEBSITES, APPS

- US, UK REACH BOEING-AIRBUS TRUCE FOLLOWING EU AGREEMENT

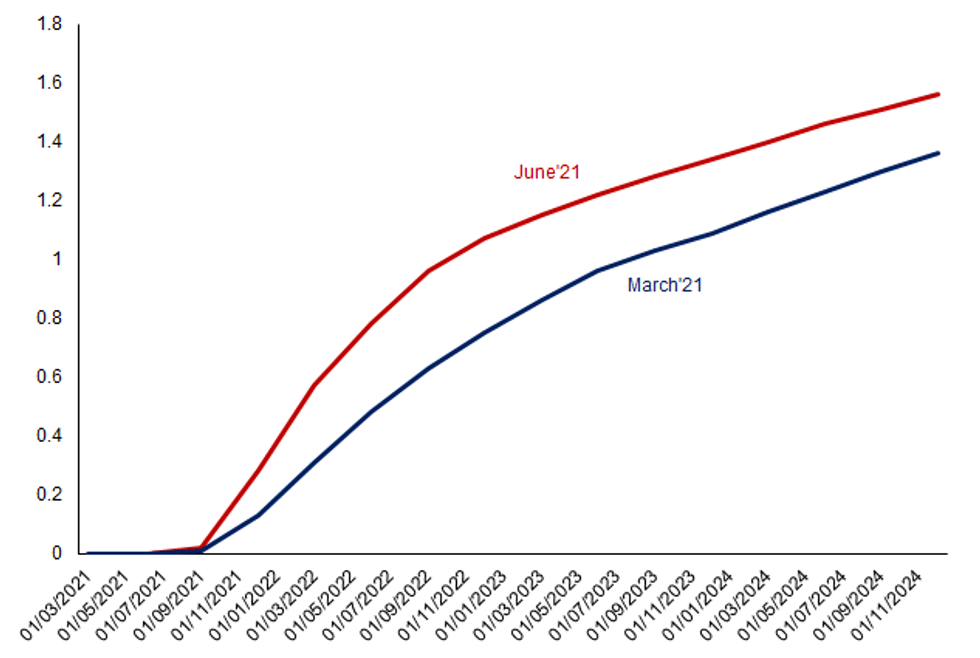

Fig. 1: Norges Bank Gets More Hawkish (Projected Policy Rate Paths)

NEWS:

NORGES BANK: After a delayed release to the rate path projections, the NOK has settled slightly, with EUR/NOK either side of 10.15. Rate liftoff has been brought forward (largely in line with exp) to September, with that month now being specifically mentioned in the statement. Path implies 1 rate hike by year-end and has fully priced three further rate hikes in 2022.Also some sizeable upticks in the path further out, with Q3 and Q4 2022 both being lifted by 32 and 33bps respectively. Terminal rate boosted to 1.56% from 1.36% prior.

SNB: SNB keep the policy rate unchanged at -0.75%, as expected. With decision broadly inline with expectations, very little response in CHF against either the USD or EUR. Monetary Policy Assessment here: https://www.snb.ch/en/mmr/reference/pre_20210617_2...

Inflation forecasts tick higher, as expected:

- CPI seen topping out at 1.0% in Q4 (Prev. 0.6%) this year, before drifting lower across the forecast horizon

- Retains comms that "The Swiss franc remains highly valued."

- Continues to assume H2 recovery

- Flags that vulnerability of mortgage & real estate market has increased further

GLOBAL INTERNET (AP): A wave of brief internet outages hit the websites and apps of dozens of financial institutions, airlines and other companies across the globe Thursday. The Hong Kong Stock Exchange said in a post on Twitter Thursday afternoon Hong Kong time that its site was facing technical issues and that it was investigating. It said in another post 17 minutes later that its websites were back to normal .Internet monitoring websites including ThousandEyes, Downdetector.com and fing.com showed dozens of disruptions, including to U.S.-based airlines.

UK-US (BBG): The U.S. and U.K. reached a truce in a trade dispute involving Airbus SE and Boeing Co., agreeing to a five-year suspension on tariffs affecting various goods.Products such as Scotch whisky, biscuits and clotted cream had been hit by additional duties of 25% because of the spat, and the agreement between the U.S. and Britain suspends the tariffs until 2026 while talks take place, U.S. Trade Representative Katherine Tai's office said in a statement on Thursday.

FIXED INCOME: Digesting the FOMC

Bond markets are still searching for neutral after yesterday's more hawkish-than-expected FOMC meeting. Treasuries and Bunds are off the lows seen in the immediate aftermath of the meeting while gilts are at their lows of the day at the time of writing. Cash curves have continued to bear steepen.

- Digestion is likely to be the theme of the day with the main data highlights the Philly Fed and US claims.

- It has been another fairly heavy morning of issuance for the Eurozone with Spain and France having already sold bonds and France also due to sell linkers shortly.

- TY1 futures are down -0-3+ today at 131-20+ with 10y UST yields down -0.9bp at 1.569% and 2y yields down -0.4bp at 0.204%.

- Bund futures are down -0.58 today at 171.95 with 10y Bund yields up 4.2bp at -0.161% and Schatz yields up 1.2bp at -0.669%.

- Gilt futures are down -0.83 today at 126.96 with 10y yields up 8.7bp at 0.826% and 2y yields up 5.7bp at 0.129%.

FOREX: Norges Bank in Pole Position to Be First DM CB to Raise Rates

- Central bank activity has drawn plenty of focus so far today, with decisions from the Indonesian, Taiwanese, Norwegian and Swiss central banks. All banks opted to keep rates unchanged, with the Norges Bank decision the most notable as they lent on their September decision as the first to see a post-pandemic rate hike. This puts the Norwegian central bank in pole position to be the first developed market to hike interest rates as the global economy recovers.

- The greenback remains firm following yesterday's Fed decision, with the USD Index adding to gains and printing new multi-month highs. The USD Index has now topped the 200-dma at 91.537, and is now within 2% of the 2021 highs printed in late March.

- Meanwhile, the CHF is among the worst performers in G10. While the SNB kept policy unchanged, medium- and long-term inflation forecasts were remarkably subdued, with CPI not seen topping 1.0% at all across the forecast horizon.

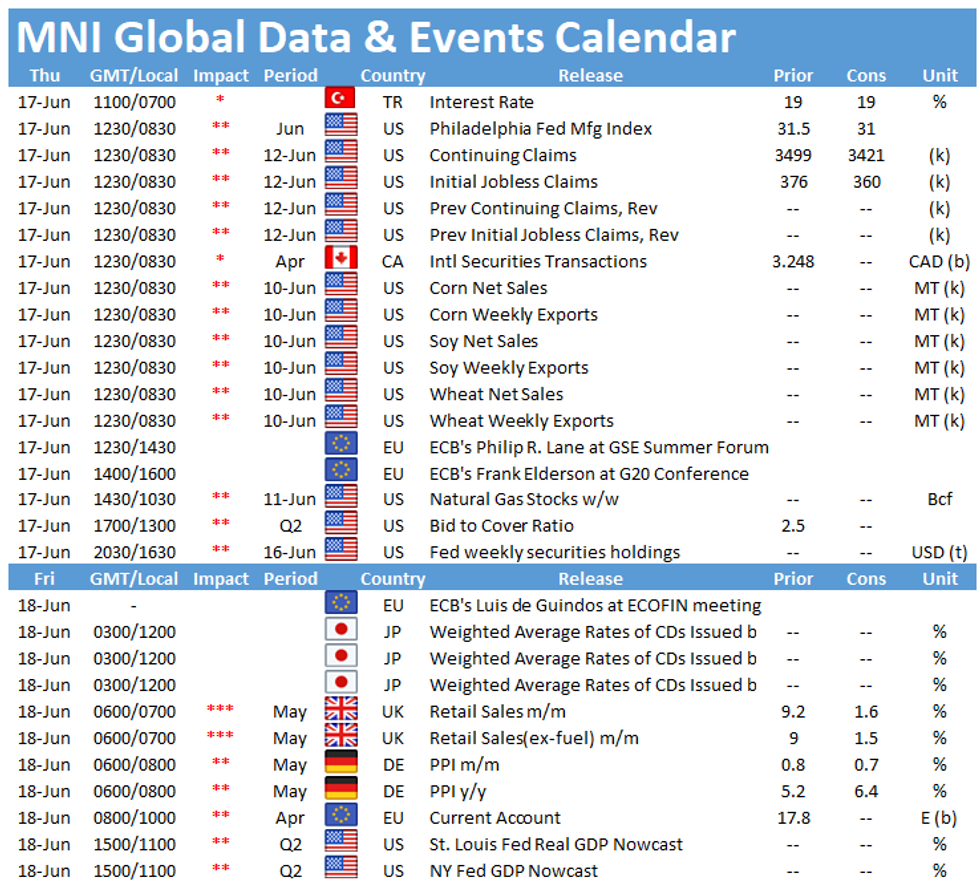

- Key data due today include weekly jobless claims and the latest Philly Fed data for June. The Turkish rate decision also crosses, with the CBRT keeping rates unchanged at 19.00%. Speeches from ECB's Lane, Elderson and Visco are all due.

EQUITIES: Nasdaq Leading US Futures Lower

- Asian stocks closed mixed, with Japan's NIKKEI down 272.68 pts or -0.93% at 29018.33 and the TOPIX down 12.29 pts or -0.62% at 1963.57. China's SHANGHAI closed up 7.275 pts or +0.21% at 3525.604 and the HANG SENG ended 121.75 pts higher or +0.43% at 28558.59.

- European stocks are lower, with the German Dax down 50.57 pts or -0.32% at 15660.5, FTSE 100 down 26.63 pts or -0.37% at 7157.98, CAC 40 down 6.95 pts or -0.1% at 6645.45 and Euro Stoxx 50 down 16.96 pts or -0.41% at 4134.9.

- U.S. futures are weaker, led by tech, with the Dow Jones mini down 158 pts or -0.46% at 33859, S&P 500 mini down 20.75 pts or -0.49% at 4202, NASDAQ mini down 98.25 pts or -0.7% at 13882.5.

COMMODITIES: Copper Underperforming As China Set To Release Reserves

- WTI Crude down $0.31 or -0.43% at $71.87

- Natural Gas down $0.02 or -0.49% at $3.235

- Gold spot down $6.65 or -0.37% at $1805.06

- Copper down $8.85 or -2.02% at $430.3

- Silver down $0.22 or -0.82% at $26.7607

- Platinum down $10.6 or -0.94% at $1114.58

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.