-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Powell And Producer Prices Pending

EXECUTIVE SUMMARY:

- UK CPI SPIKES AS TRANSPORT COSTS RISE

- RBNZ TO END Q.E. PURCHASES

- FOMC'S KAPLAN UPS INFLATION OUTLOOK AS HIKE TALK GROWS (REPEAT - MNI INTERVIEW)

- POWELL FACES BIDEN POLICY QUIZ WITH RENOMINATION IN BACKGROUND

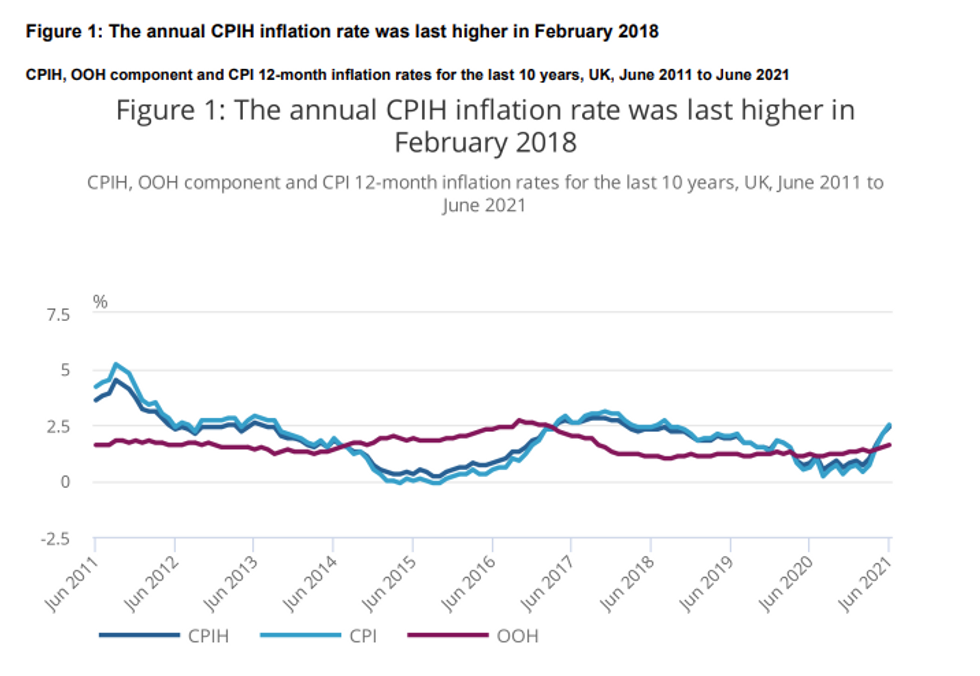

Fig. 1: UK CPI

Source: Office for National Statistics

NEWS:

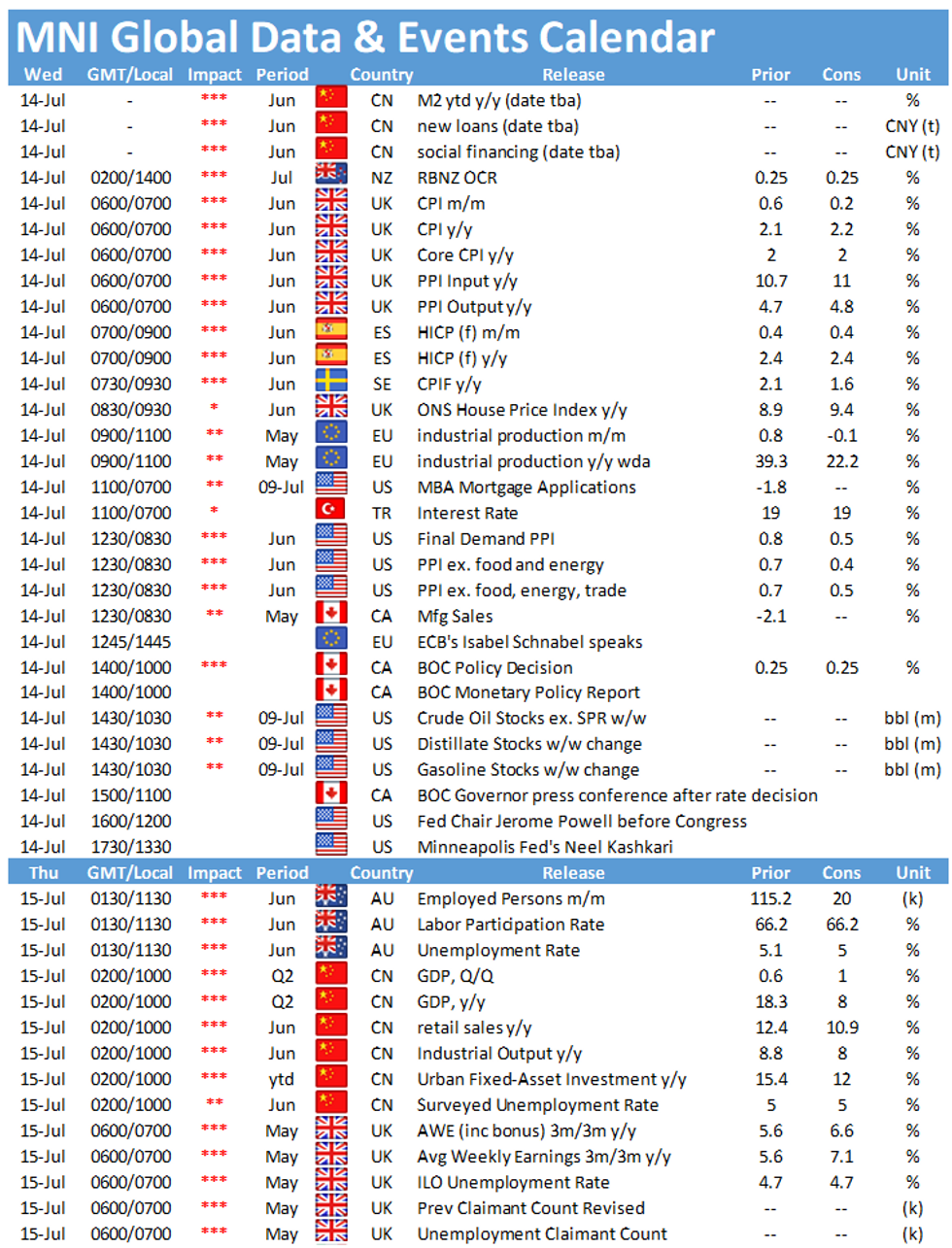

RBNZ: The Reserve Bank of New Zealand will end any additional purchases under its Large Scale Asset Purchase (LSAP) bond buying programme. The RBNZ's Monetary Policy Committee made the decision at its meeting today and also left the Official Cash Rate unchanged at a record low 0.25%. The central bank has purchased around NZD60 billion (USD41.9 billion) of bonds under the LSAP, which originally had a limit of NZD100 billion. The central bank said it would halt additional purchases from July 23.

FED (REPEAT FROM JUL 13): Dallas Fed President Robert Kaplan told MNI in an interview first published Tuesday he has raised his inflation forecast for the remainder of the year, as a Fed model indicated that U.S. inflation is set to stay elevated. In another interview with MNI, an ex-Fed staffer said mounting inflation pressures and soaring growth will likely force the Federal Reserve to raise interest rates sometime next year.

FED (BBG): U.S. Democratic lawmakers this week will invite Federal Reserve Chair Jerome Powell to support another big round of government spending -- testing him just months before President Joe Biden is expected to consider his renomination. Powell appears before the House Financial Services Committee Wednesday at 12 p.m. in Washington and Chair Maxine Waters, a California Democrat, has already praised him for cooperating with the Treasury and Congress during the pandemic. He testifies before the Senate banking panel a day later. Powell gave full support to robust fiscal spending as the pandemic raged last year, in the hope of minimizing the lasting labor-market scarring seen in previous recessions.

R.B.A. (MNI INTERVIEW): Fiscal stimulus to address the impact of extended Covid-19 lockdowns in Sydney should mitigate the impact on employment and growth and it is "still too early to tell" whether a resurgent pandemic will derail a V-shaped recovery, Reserve Bank of Australia board Ian Harper told MNI. For full interview contact sales@marketnews.com

E.U. (BBG): The European Union will begin legal proceedings against Hungary and Poland for laws the bloc says discriminate against LGBTQ people as the EU steps up its fight against democratic backsliding.The European Commission, the bloc's executive arm, will send the so-called letters of formal notice as soon as Thursday, according to people familiar with the decision who asked not to be identified because the matter is private. The move is one of the steps leading up to a suit at the European Court of Justice.

BANKS (BBG): Sumitomo Mitsui Financial Group Inc. will acquire a stake in Jefferies Financial Group Inc. for about $380 million to bolster its securities business in the U.S., the Nikkei newspaper reported.The second-largest Japanese bank will invest about 42 billion yen to acquire a roughly 5% position in the American firm, according to the report, which didn't cite the source of the information. The tie-up would see Jefferies sourcing and financing deals in the U.S., while Sumitomo Mitsui will provide financing, the report said.

SOUTH AFRICA (BBG): South Africans are expected to face major food shortages in the wake of days of violent unrest across two key provinces, as rioters upend supply chains by looting supermarkets and torching goods trucks.Footage of empty or sparse grocery-store shelves has been a staple of local news reports since the weekend, while chains such as Shoprite Holdings Ltd. and Pick n Pay Stores Ltd. closed many outlets altogether. In parts of Durban, the coastal KwaZulu-Natal city at the center of the upheaval, long queues formed outside the few open food shops and basics such as bread and milk were in short supply.

DATA:

UK CPI Jumps To Highest Since Aug 2018

JUN CPI +0.5% M/M, +2.5% Y/Y VS +2.1% Y/Y MAY

JUN CORE CPI +0.5% M/M, +2.3% Y/Y VS +2.0% Y/Y MAY

JUN OUTPUT PPI +0.4% M/M; +4.3% Y/Y VS +4.4% Y/Y MAY

JUN INPUT PPI -0.1% M/M; +9.1% Y/Y VS +10.4% Y/Y MAY

- The Y/Y CPI jumped to 2.5% in Jun, beating markets expectations (BBG: 2.2%). This marks the second straight reading above the BOE's 2.0% target, a fourth consecutive gain and the highest level since Aug 2018.

- Core inflation rose to 2.3%, showing the highest level since Feb 2018 and coming in stronger than markets projected (BBG: 2.0%).

- The largest upward contribution came from transport, adding 0.11pp to price growth, with prices for second-hand cars (adding 0.08pp and biggest monthly rise on record) and fuels and lubricants (adding 0.06pp) being the main drivers. Fuel prices continued to increase in Jun and continue to be driven by base effects.

- The second largest positive contribution stemmed from food as well as restaurants and hotels, both adding 0.07pp to price growth in Jun.

- Clothing and footwear was another main driver of CPI growth in Jun, contributing 0.06pp to price growth. The ONS noted that clothing prices increased in Jun in contrast to a normal seasonal pattern of summer sales, which contributes to the upward pressure.

- The largest downward pressure came from games, toys and hobbies; however, price movements are particularly large in this category.

- Output inflation decelerated to 4.3% in Jun, down from 4.4% seen in May. The increase was again led by transport equipment.

- Input inflation slowed to 9.1% in May, showing the first deceleration since Aug 2020. Metals and non-metallic minerals continued to be largest drivers.

MNI DATA BRIEF: UK June PPI Elevated, But Off Multi-year Highs

UK pipeline inflation slowed from May's elevated levels, but remained high by historical standards. Input prices rose by an annual rate of 9.1%, undershooting the expected 11.0% pace, and well below the downwardly-revised 10.6% rate in May, the Office for National Statistics said Wednesday. Metals and non-metallic minerals provided the biggest upward contribution to input prices. Core input PPI rose by 7.4%, matching the downwardly-revised pace of May, the biggest rise since January of 2009.

Output PPI slowed to an annual rate 4.3% from 4.4%, but core output PPI rose to 2.7% from 2.3%, the fastest pace since January of 2019. Transport equipment provided the biggest upward contribution to output PPI. After reweightings to the basket early this year, transport equipment became the second biggest output PPI category, while petroleum products fell from second to fifth. Statisticians do not release the precise weightings of sector in the PPI basket.

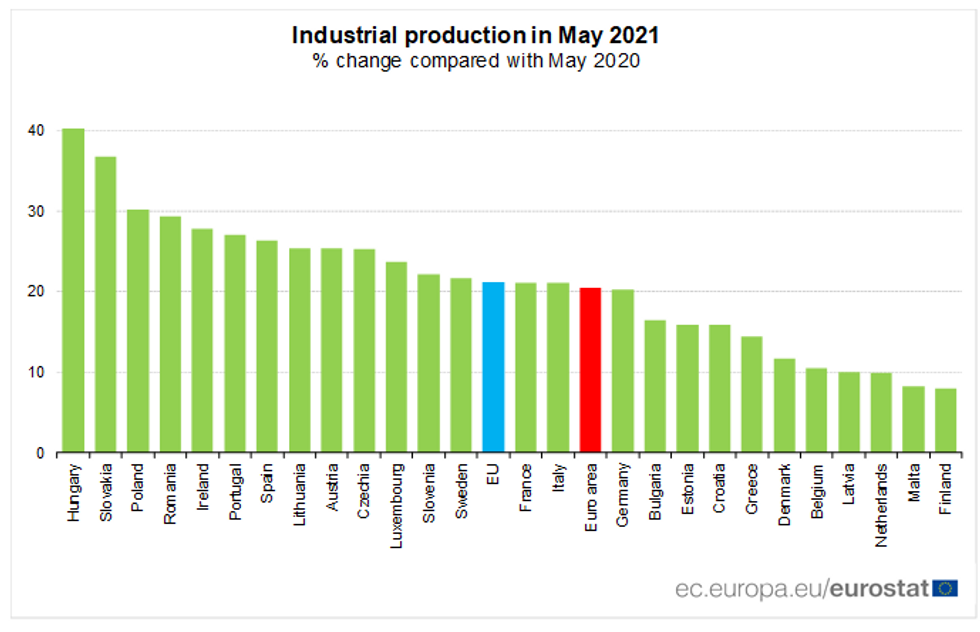

EZ Industrial Production Dipped in May

EZ MAY IND PROD -1.0% M/M, +20.5% Y/Y; APR +0.6%r M/M

- EZ industrial production fell by 1.0% in May, following two months of consecutive gains, coming in weaker than markets expected (BBG: -0.1%).

- Annual output grew by 20.5% in May, reflecting weak production figures at the beginning of the pandemic.

- May's downtick was broad based with every category except for durable consumer goods (up 1.6%) posting a monthly decline.

- Output of non-durable consumer goods saw the largest drop, down 2.3%, following 4 months of consecutive growth.

- Energy output decreased 1.9% in May, while energy output was down 1.6% and intermediate goods production eased 0.2%.

- Among the member states, Greece (-4.7%), Ireland (-4.6%) and Portugal (-4.5%) posted the biggest declines, while Lithuania (+7.7%), Finland (+2.2%) and the Netherlands (+0.8%) recorded the largest gains.

Source: Eurostat

FIXED INCOME: Gilts underperform as UK inflation spikes

Gilt are the clear underperformers in core fixed income markets this morning with 10-year yields up 3.9bp at the time of writing. USTs are higher than yesterday's close while Bunds are a bit lower.

- UK inflation was the highlight of the European morning session with the headline print rising 2.5%Y/Y (2.2% expected) with a similar 0.3ppt surprise in core CPI to 2.3%Y/Y. RPI saw an ever bigger surprise of 0.5ppt to rise to 3.9%Y/Y. The gilt curve has bear steepened with 2-year yields up 1.6bp and 10-year yields up 3.9bp.

- BOE Deputy Governor Cunliffe is due on CNBC at 11:00BST while Ramsden is due to speak at 18:00 (after the market close) and tomorrow will see Saunders make a speech entitled "The Inflation Outlook". The views of all three of these members will be closely watched by the market.

- Elsewhere we have US PPI and the Fed's Beige Book alongside a couple of ECB and Fed speakers later today.

- TY1 futures are up 0-5 today at 133-04+ with 10y UST yields down -2.5bp at 1.392% and 2y yields down -0.4bp at 0.250%.

- Bund futures are down -0.11 today at 174.01 with 10y Bund yields up 0.2bp at -0.293% and Schatz yields up 0.2bp at -0.674%.

- Gilt futures are down -0.51 today at 128.66 with 10y yields up 3.9bp at 0.670% and 2y yields up 1.6bp at 0.101%.

FX SUMMARY - USD stays offered

- Main early price action during the morning European session, has been a continuation of the overnight trade.

- USD stays offered and in the red against all G10s.

- NZD is still in the lead, following the hawkish RNBZ overnight, but NZDUSD has faded somewhat off its best levels at the time of typing.

- GBP has gained, after a decent beat on the Inflation data release.

- This has pushed EURGBP back towards the 0.8500 figure, printed 0.85069 low.

- Most other G10 FX have mostly traded range bound, with market participants awaiting on Fed Powell this afternoon.

- Looking ahead, BoE Cummings will be on CNBC, EU's VDL presser on climate package.

- Other speakers include ECB Schnabel, BoE Ramsden and Fed Kashkari

EQUITIES: Tech Stocks Defy Broader Weakness

- Asian markets closed lower, with Japan's NIKKEI down 109.75 pts or -0.38% at 28608.49 and the TOPIX down 4.48 pts or -0.23% at 1963.16. China's SHANGHAI closed down 38.021 pts or -1.07% at 3528.501 and the HANG SENG ended 175.95 pts lower or -0.63% at 27787.46.

- European equities are lower, with the German Dax down 30.77 pts or -0.19% at 15746.88, FTSE 100 down 34.83 pts or -0.49% at 7091.49, CAC 40 down 19.28 pts or -0.29% at 6541.57 and Euro Stoxx 50 down 10.76 pts or -0.26% at 4082.82.

- U.S. futures are weaker apart from the NASDAQ, with the Dow Jones mini down 51 pts or -0.15% at 34725, S&P 500 mini down 4.5 pts or -0.1% at 4356.75, NASDAQ mini up 13.25 pts or +0.09% at 14878.25.

COMMODITIES: Precious Metals Outperforming

- WTI Crude down $0.4 or -0.53% at $75.13

- Natural Gas down $0 or -0.05% at $3.706

- Gold spot up $5.72 or +0.32% at $1812.94

- Copper down $1.65 or -0.38% at $429.35

- Silver up $0.09 or +0.36% at $26.0628

- Platinum up $6.52 or +0.59% at $1111.59

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.