-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: U.K. Growth Surges

EXECUTIVE SUMMARY:

- UK'S GDP RECOVERY CONTINUES WITH RECORD YEAR-ON-YEAR GROWTH

- IEA CUTS OIL DEMAND OUTLOOK ON VIRUS

- FED'S DALY SAYS MAY START ASSET PURCHASE TAPERING BY YEAR-END

- UK'S SUNAK: "NO RETURN TO AUSTERITY"

Fig. 1: UK GDP

NEWS:

FED (FT): The Federal Reserve could start dialling back its ultra-accommodative monetary stimulus by the end of the year, given the strength of the economic rebound, according to a top official at the US central bank. In an interview with the Financial Times, Mary Daly, president of the San Francisco Fed, expressed confidence that the robust recovery in household and business activity from the depths of the Covid-19 collapse would continue to gather momentum as more people returned to the workforce and consumer spending remained buoyant, setting the stage for a policy pivot in the coming months. "I remain very optimistic and positive about the fall and ongoing improvements in the key variables we care about," she said on Wednesday. "That for me means it's appropriate to start discussing dialling back the level of accommodation that we're giving the economy on a regular basis, and the starting point for that is of course asset purchases.

OIL (BBG): The International Energy Agency cut forecasts for global oil demand "sharply" for the rest of this year as the resurgent pandemic hits major consumers, and predicted a new surplus in 2022. It's a marked reversal for the Paris-based agency, which just a month ago was urging the OPEC+ alliance to open the taps or risk a damaging spike in prices. The oil cartel heeded calls to hike supply, which is now arriving just as consumption slackens. The analysis also jars with Wednesday's call from the U.S. -- the IEA's most influential member -- for the Organization of Petroleum Exporting Countriesand its allies to ramp production up faster.

U.K.: Chancellor of the Exchequer Rishi Sunak just finished an interview with Sky News. Has stated that there will be 'no return to austerity' despite the dire fiscal picture engendered by the pandemic. Confirms that the universal credit uplift will come to an end in the autumn, stating that "The increase in welfare benefits was only temporary, it is more worthwhile to help people find well-paid jobs." Demurs when asked on three separate occassions whether he has ambitions to lead the Conservative Party. Comes after stories emerge speculating of a growing rift between the Chancellor and Prime Minister Boris Johnson.

CHINA / SHIPPING (BBG): China partly shut the world's third-busiest container port after a worker became infected with Covid, threatening more damage to already fragile supply chains and global trade as a key shopping season nears. All inbound and outbound container services at Meishan terminal in Ningbo-Zhoushan port were halted Wednesday until further notice due to a "system disruption," according to a statement from the port. An employee tested positive for coronavirus, the eastern Chinese city's government said. The closed terminal accounts for about 25% of container cargo through the port, calculates security consultant GardaWorld, which said "the suspension could severely impact cargo handling and shipping." Germany's Hapag-Lloyd AG said there will be a delay in sailings.

COPPER/CHILE (BBG): Workers at the Andina mine in Chile will begin a strike Thursday after rejecting owner Codelco's final wage offer, in a stoppage that may further tighten global copper supplies. About 82% of members of the two main unions at Andina voted to walk off the job, snubbing a proposal delivered by the state-owned company during mediated talks.

CANADA POLITICS: Opinion polling continues to show Prime Minister Justin Trudeau's centre-left Liberal Party of Canada on the verge of having enough support to win a parliamentary majority should he go ahead and call a snap election for the autumn. The latest from Angus Reid shows the Liberals on 36%, 5 per cent ahead of the centre-right Conservatives of Erin O'Toole. The leader favourabilities also look positive for Trudeau, as he comes in with net -16%, compared to a net -31% for O'Toole. Left-wing New Democratic Party (NDP) leader Jagmeet Singh scores the best of of nationwide party leaders, with a net +5% favourability.

INDIA / BOEING 373 MAX (BBG): India is set to allow Boeing Co.'s 737 Max jets to resume flights in the country within days, according to a person familiar with the matter, clearing one of the last remaining hurdles for the U.S. planemaker as it seeks to get the model flying again worldwide. The South Asian nation has been satisfied with the plane's performance since it was un-grounded in the U.S., Europe and a number of other nations, and Boeing has met India's own requirements, which included setting up a Max simulator there, the person said, asking not to be identified because the matter is confidential.

POLAND (BBG): Poland risks undermining relations with the U.S. and further antagonizing the European Union after the ruling party pushed through a controversial media law in 24 hours of political drama. Parliament's lower chamber voted 228-216 late on Wednesday to approve the legislation. It's ostensibly to protect broadcasters from takeovers, though targets Discovery Inc., the American owner of Poland's largest private television network. The bill now goes to the Senate.

DATA:

UK DATA: GDP Recovery Continues, Record Y/Y Growth

UK Q2 GDP +4.8 Q/Q (MEDIAN +4.8%, Q1 -1.6%)

UK Q1 GDP 22.2% Y/Y (MEDIAN +22.0% PREV -6.1%)

UK JUN GDP +1.0% M/M (MEDIAN +0.8%, MAY +0.6%R)

UK JUN INDEX OF SERVICES +1.5% M/M (MEDIAN 0.8%, MAY 0.9%)

UK JUN IND PRODUCTION -0.7% M/M; +8.4% Y/Y (MAY +20.6% Y/Y)

UK JUN MANUFACTURING +0.2% M/M; % Y/Y (MAY +27.7% Y/Y)

-------------------------------------------------------------------------------------------------------------------------------------------

UK GDP bounced back smartly in Q2, with quarterly growth of 4.8%, in line with forecasts. Services performed strongly, helped by the gradual reopening of the sector through the quarter. Against that, manufacturing was below expectations, as in part at least, global supply chain issues hit output. The overall Q/Q outcome is modestly below the BOE's forecast of 5.0% growth in the quarter.

UK DATA: June GDP Growth Boosted by Health Care

UK GDP expanded by 1.0% in June, the Office for National Statistics said Thursday, exceeding the 0.8% forecast by City analysts, but the consumer-led boom seemed to falter toward the latter part of the quarter. Services expanded by 1.5%, well above an expected 0.9% outturn, lifted by a 4.5% jump in the healthcare sector, as GPs returned to more-normal service after implementing emergency measures during the depths of the pandemic.

Healthcare accounted for nearly half of total growth in June. Wholesale and retail trade rose by just 0.1% in June, following a 0.1% decline in May, but the sector contributed positively to quarterly growth, courtesy of a 9.7% surge in April. Production declined by 0.7%, largely due to scheduled closures of North Sea oil fields, while manufacturing rose by 0.2%. Construction fell by 1.3%, the third straight decline, with shortages of materials impacting output. May GDP was revised downward to +0.6% (+0.8% previous) while April was revised upward to +2.2% (+2.0% previous).

UK DATA: Growth Outpaces Peers, Below Pre-Covid Peak

The UK economy rebounded by 4.8% in Q2, a touch below the Bank of England's "around 5%" forecast, but matching private economists' expectations. That takes UK growth well above that of other big nations in the period, although many will note the UK has further to recover having outperformed to the downside in 2020.

The U.S. expanded by 1.6% in Q2, while China rose by 1.3% and the Eurozone by 2.0%.

However, UK output remained 4.4% below the level of Q4 2019 at the end of the second quarter, even as the US and China have already topped pre-pandemic levels. After a 1.0% increase in June, UK output remains 2.2% below the level of February 2020.

Source: Bloomberg -- Netherlands, Japan Sweden and Australia to report in coming weeks.

EUROZONE DATA: June Industrial Production Falls

- Eurozone industrial production declined by 0.3%, worse than the 0.2% expected decline

- Capital goods down 1.5%, extending a 2.5% decline in May, as component shortages hit finished output

- May production revised downward to -1.1% from the previously-reported 1.0% fall

FIXED INCOME: Divergence in core FI

There has been some more divergence in core fixed income this morning. Bunds have been largely flat, Treasuries have been grinding higher (but off of yesterday's highs) and gilts have moved a little lower.

- The main event of the morning has been the release of UK GDP and its subcomponents. Q2 GDP was in line with market consensus of 4.8%Q/Q and a little below the BoE's 5.0% forecast. But June data was better than expected with May data revised lower.

- Peripheral spreads have continued to reverse some of yesterday's widening, with BTP-Bund 10-year spreads 1.8bp wider on the day.

- Looking ahead the highlight of the data calendar will be US PPI (following yesterday's CPI print) while the 30-year UST auction will also be watched.

- TY1 futures are up 0-2+ today at 133-21 with 10y UST yields down -1.0bp at 1.343% and 2y yields unch at 0.220%.

- Bund futures are down -0.02 today at 176.55 with 10y Bund yields up 0.7bp at -0.458% and Schatz yields down -0.1bp at -0.754%.

- Gilt futures are down -0.06 today at 129.57 with 10y yields up 1.9bp at 0.590% and 2y yields up 2.5bp at 0.143%.

FOREX: USD Holding Post-CPI Losses

- The USD index is holding the majority of the post-CPI weakness, with the greenback broadly flat against most others in G10. Markets watch today's PPI release for any further evidence of a slowdown in price growth, with M/M expected to slow to 0.6% (Prev. 1.0%) and 0.5% (Prev. 1.0%) for core.

- AUD is the notable underperformer, putting AUD/USD toward first support at 0.7350, albeit well above the week's lows of 0.7316.

- EUR/USD remains toward the top end of the week's range, but well within striking distance of the key support at 1.1704. A break below here would be resolutely bearish.

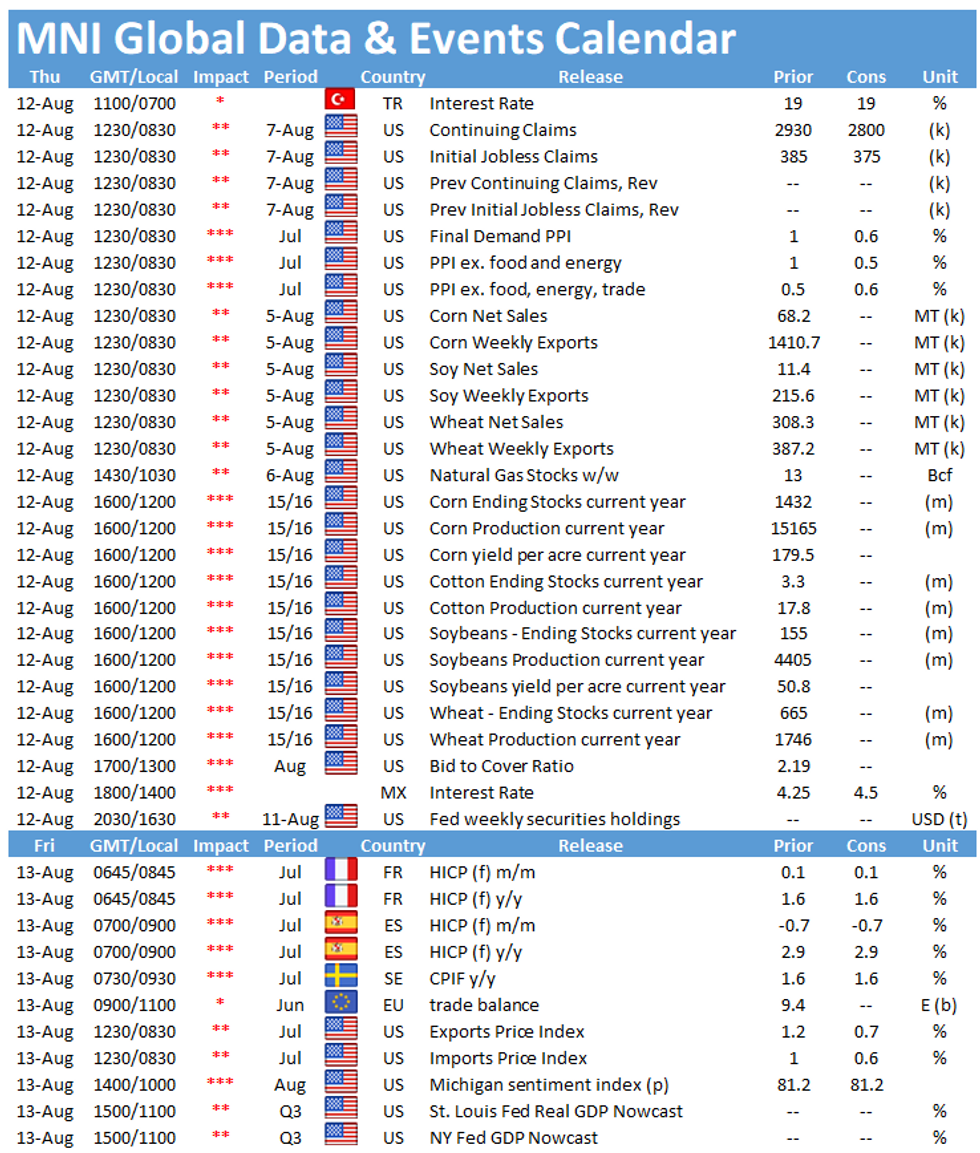

- Weekly US jobless claims data takes focus going forward, with PPI numbers also crossing. Central bank decisions are also due from Mexico and Turkey, with former seen hiking 25bps, while the latter is seen unchanged.

EQUITIES: FTSE Underperforming In Mixed Start To Thursday Trade

- Asian markets closed slightly lower, with Japan's NIKKEI down 55.49 pts or -0.2% at 28015.02 and the TOPIX down 0.53 pts or -0.03% at 1953.55. China's SHANGHAI closed down 7.884 pts or -0.22% at 3524.737 and the HANG SENG ended 142.34 pts lower or -0.53% at 26517.82

- European futures are mixed (UK underperforming), with the German Dax up 18.88 pts or +0.12% at 15826.09, FTSE 100 down 13.61 pts or -0.19% at 7220.14, CAC 40 up 3.32 pts or +0.05% at 6857.99 and Euro Stoxx 50 up 6.37 pts or +0.15% at 4206.33.

- U.S. futures are flat/mixed, with the Dow Jones mini up 38 pts or +0.11% at 35410, S&P 500 mini up 0.25 pts or +0.01% at 4440.75, NASDAQ mini down 14 pts or -0.09% at 15005.5.

COMMODITIES: Copper Continues To Edge Higher On Chile Mining Strike

- WTI Crude down $0.02 or -0.03% at $69.18

- Natural Gas down $0.02 or -0.37% at $4.054

- Gold spot up $4.66 or +0.27% at $1752.68

- Copper up $3.65 or +0.84% at $440.9

- Silver down $0.07 or -0.32% at $23.4813

- Platinum down $5.15 or -0.5% at $1019.36

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.