-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Mixed Messages Ahead of Tomorrow's ECB Meeting

MNI US Open: Mixed Messages Ahead of Tomorrow's ECB Meeting

EXECUTIVE SUMMARY:

- European sovereign bonds have firmed and equities push lower on fresh Covid-related growth concerns

- The UK PM will ask parliament to vote on his contentious plan to fund social care through higher national insurance contributions.

- Comments from the ECBs Holzman and Vasle hit the wires earlier today and reflect a widening rift ahead of tomorrow's GC meeting.

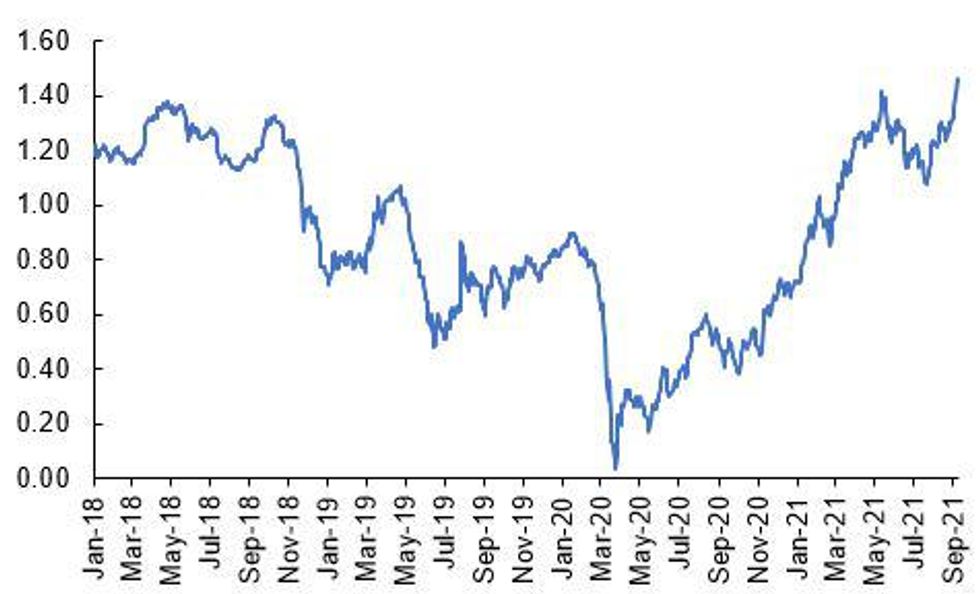

Source: MNI, Bloomberg

NEWS

UK (FT): Boris Johnson will on Wednesday challenge rebel Tory MPs to vote down his manifesto-breaking £12bn tax-raising plan to fund health and social care, as he pushed Britain's tax burden to the highest level since 1950. Johnson will ask MPs to endorse a strategy that moves the Conservatives firmly on to Labour territory and shreds traditional Tory claims to be a low-tax party. "We are the party of the NHS," Johnson declared on Tuesday. The prime minister is confident of victory in the Commons vote, as a threatened Tory rebellion over the tax increase melted away. One Tory rebel said he expected only "a handful" of MPs to defy Johnson. Keir Starmer, Labour leader, convened an emergency shadow cabinet meeting to decide how to respond to a prime minister who on Tuesday declined to rule out further tax rises in this parliament. After the income tax and corporation tax increases in the March Budget, Johnson's government was already intending to raise the burden of taxation to 35 per cent of national income by 2025-26, the highest since 1969.

US-AFGAHNISTAN (GUARDIAN): The US is convening an expanded group of western nations to set a framework for cooperation with the new Taliban government, amid fears that isolating the militant group could backfire. The meeting on Wednesday, chaired by the US secretary of state, Antony Blinken, and the German foreign minister, Heiko Maas, faces an all-male, Pashtun-dominated caretaker government that has ignored calls to form an inclusive administration. The virtual meeting, convening as many as 20 nations, will run through a familiar set of conditions for cooperation with the Taliban, including free movement for Afghan and foreign nationals who wish to leave, protection of rights for women and a commitment to protect aid workers. The meeting is likely to discuss the terms for giving humanitarian aid, after the UN warned this week that the Afghan economy was on the brink of collapse.

TURKEY (BLOOMBERG): The Turkish central bank shifted its policy focus to a core set of prices after earlier guidance to keep the benchmark interest rate above current inflation faltered. "The extraordinary conditions especially due to the pandemic increase the importance of core inflation indicators," said Kavcioglu in a speech in Ankara on Wednesday. "Globally, when monetary policy stance is determined, core indicators excluding transitory factors emanating from areas outside monetary policy's influence are taken as the basis," he said. "Central banks and policy makers follow food price changes, core inflation developments and impact of accelerating inflation on inflation expectations."

FIXED INCOME: Core FI rallies as European equities under pressure ahead of tomorrow's ECB

Yesterday's sell-off in US stocks has filtered through to the European session with European equities down over 1% and leading core global fixed income higher.

- Treasuries are outperforming gilts and Bunds, with TY1 futures moving back above the 100-dma which was breached yesterday.

- There have not really been any big headline drivers this morning, with some focus on ECB comments from Holzmann and Vasle published in EUROFI magazine. The comments have only been published today (ahead of tomorrow's ECB meeting) but are likely to have been made some time ago before the ECB blackout period.

- The main event of the day ahead will be the Treasury Select Committee testimony by the BOE's Bailey, Broadbent, Ramsden and Tenreyro at 16:00BST/11:00ET. With inflation and the labour market the two main discussion points for the MPC, any comments on how these data are seen to be evolving will be closely watched.

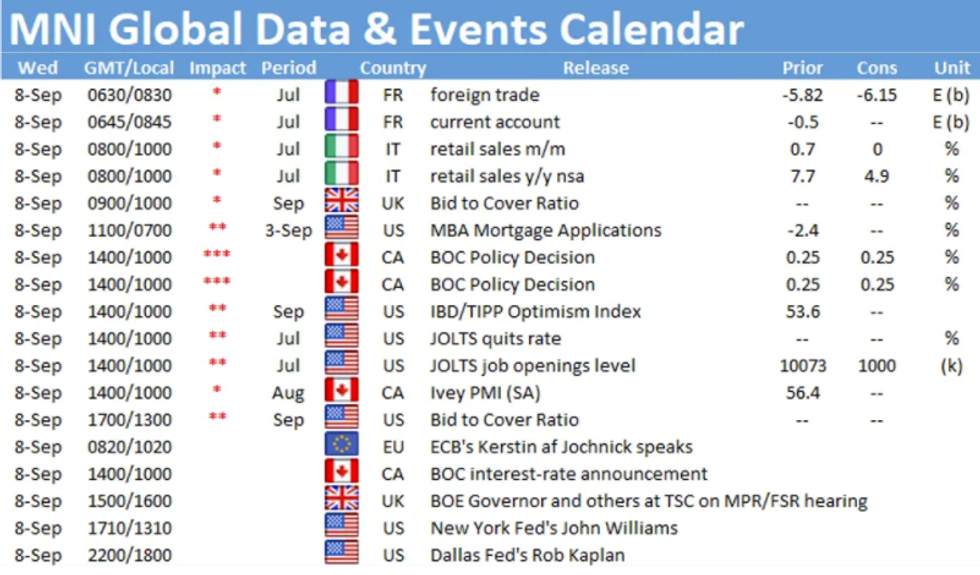

- In the US we will receive JOLTs and the Beige Book while Williams and Kaplan are both due to speak (the latter after the US market close).

- EGB supply has been a bit lighter this morning (Green Bund, UK linker, Slovenia) but EUR corporate issuance remains heavy. Focus will switch to the 10y UST note auction later today.

- TY1 futures are up 0-5 today at 133-05 with 10y UST yields down -2.4bp at 1.350% and 2y yields down -0.6bp at 0.215%.

- Bund futures are up 0.15 today at 171.77 with 10y Bund yields down -1.0bp at -0.333% and Schatz yields up 0.1bp at -0.705%.

- Gilt futures are up 0.13 today at 128.18 with 10y yields down -0.8bp at 0.728% and 2y yields up 0.1bp at 0.191%.

EUROPEAN SOVEREIGN ISSUANCE UPDATE

GILT AUCTION RESULTS: 0.125% Aug-31 linker

| 0.125% Aug-31 linker | Previous | |

| Amount | GBP1.00bln | GBP1.00bln |

| Avg yield | -3.009% | -2.687% |

| Bid-to-cover | 2.33x | 2.77x |

| Avg price | 136.534 | 133.140 |

| Pre-auction mid | 136.492 | |

| Previous date | 09-Jun-21 |

GERMAN AUCTION RESULTS: Germany Allots E3.198bn of the 0% Aug-31 Green Bund

- Average yield -0.38% Buba cover 1.1x, bid-to-cover 1.05x, pre-auction mid-price 103.79

GREEK AUCTION RESULTS: Greece Sells E812.5mn of 12m Bills

- Average yield -0.31%, bid-to-cover 1.63x

FOREX: USD Following Risk Sentiment Cues, Tops 50-dma

- Markets have worked in favour of the USD so far Wednesday, with the USD Index making progress north of the 50-dma to extend the bounce off last week's lows. In contrast to the price action earlier in the week, the USD looks to be following equities and global risk sentiment more closely this morning, with the greenback gaining as the e-mini S&P ebbs. This differs from Tuesday price action which saw the dollar gain as the US yield curve steepened and the 10y yield rose to multi-year highs.

- Despite moderately hawkish comments from ECB's Holzmann earlier Wednesday, the EUR trades lower ahead of the NY crossover, with sagging continental equities a focus. Weakness across the industrials and financials sectors has pressured the DAX, CAC-40 and others, with losses of over 1% across the board.

- The data slate is relatively light, keeping focus on the slightly busier central bank speaker slate. NY Fed's Williams is due to speak directly on the economic outlook, marking the first major Fed comms since last week's disappointing Nonfarm Payrolls print. He speaks at 1810BST/1310ET. A number of BoE members appear in front of the Treasury Select Committee to discuss the August monetary policy report also.

EQUITIES: European stocks under pressure

- Japan's NIKKEI up 265.07 pts or +0.89% at 30181.21 and the TOPIX up 16.23 pts or +0.79% at 2079.61

- China's SHANGHAI closed down 1.4 pts or -0.04% at 3675.187 and the HANG SENG ended 32.7 pts lower or -0.12% at 26320.93

- German Dax down 225.1 pts or -1.42% at 15618.11, FTSE 100 down 82.93 pts or -1.16% at 7065.9, CAC 40 down 85.32 pts or -1.27% at 6640.66 and Euro Stoxx 50 down 53.63 pts or -1.27% at 4171.55.

- Dow Jones mini down 142 pts or -0.4% at 34951, S&P 500 mini down 14 pts or -0.31% at 4505.25, NASDAQ mini down 34.5 pts or -0.22% at 15639.5.

COMMODITIES: Higher despite USD strength (except copper)

- WTI Crude up $0.28 or +0.41% at $68.57

- Natural Gas up $0.05 or +1.09% at $4.617

- Gold spot up $3.35 or +0.19% at $1798.2

- Copper down $6.2 or -1.45% at $421.95

- Silver up $0.02 or +0.09% at $24.3466

- Platinum up $0.13 or +0.01% at $1002.42

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.