-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI US Open: Coalition Negotiations Ahead To Form Germany Government

MNI US Open: Coalition Negotiations Ahead To Form Germany Government

EXECUTIVE SUMMARY

- Sovereign bonds have sold off and equities have pushed higher this morning.

- Following a narrowly fought election, Germany now faces weeks of coalition negotiations.

- The fuel crisis in the UK continues to deepen with the government reportedly considering drafting in the army

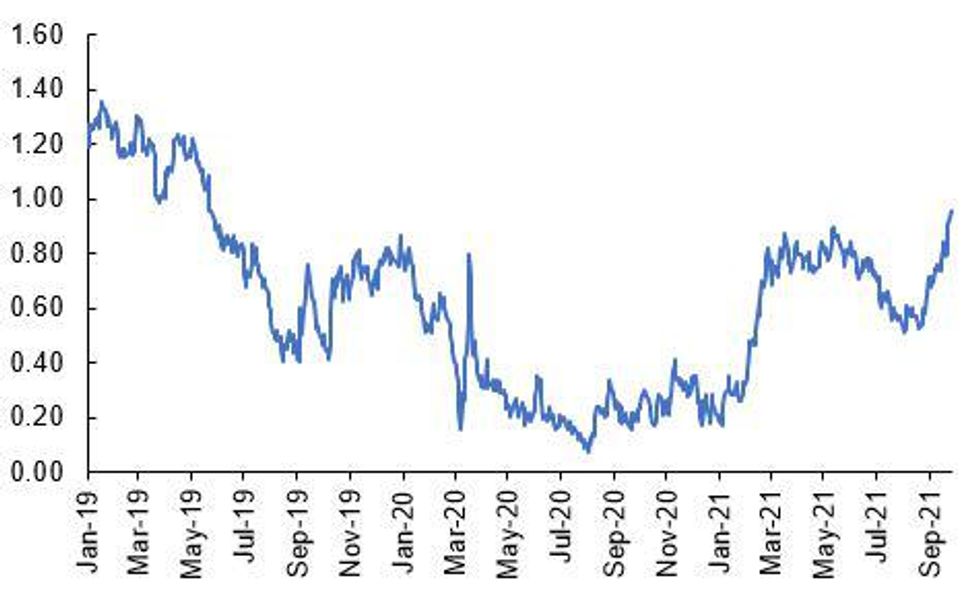

Source: MNI/Bloomberg

NEWS

GERMANY (GUARDIAN): Germany is set for weeks or even months of protracted coalition talks after the race to succeed Angela Merkel after 16 years in power failed to produce a clear winner, with the centre-left Social Democrats just ahead of the centre-right conservative alliance according to official returns. Preliminary results released on the election commission's website showed that the Social Democrats (SPD) led by Olaf Scholz had won the largest share of the vote at 25.7%. The centre-right CDU-CSU bloc led for so long by the outgoing chancellor garnered 24.1%, its worst showing in its seven-decade history. The Green party, in jubilant mood after winning 14.8% in its best result in a national poll, despite having lost the lead it held early on and dropping about 13 points since April, was confident of becoming a kingmaker in the upcoming coalition talks.

UK (BBC): The government is to suspend competition law to allow oil firms to target fuel deliveries at petrol stations following recent panic buying. Officials said the move would make it easier for companies to share information and prioritise parts of the country most at need. It follows days of long queues at the pumps, after fears of disruption to the fuel supply sparked panic buying. Ministers are also considering deploying the Army to deliver fuel. The Petrol Retailers Association has warned that as many as two-thirds of its membership of nearly 5,500 independent outlets are out of fuel, with the rest of them "partly dry and running out soon". The UK has a total of more than 8,000 filling stations.

CHINA (REUTERS): Widening power shortages in China have halted production at numerous factories including many supplying Apple and Tesla, while some shops in the northeast operated by candlelight and malls shut earlier as the economic toll of the squeeze mounted.

FIXED INCOME: Moving Lower to Key Levels

it has been a busy day in fixed income markets with 2-year Treasury yields and 10-year gilt yields hitting their highest levels since March 2020. The moves have come amid a positive outlook for risky assets with European and US equity index futures higher.

- The German election was held at the weekend and our political analysis team note that with the R2G coalition having failed to win a majority, the remaining possibilities for coalitions sit around the political mainstream, with little impact of a major change in policy stance towards Germany's fiscal outlook, stance on the eurozone, or foreign policy from any of these coalition combinations.

- The biggest event later today will be a speech from Bank of England Governor Andrew Bailey. It will be watched closely to see whether his comments push back on or endorse market pricing. Last week's MPC Minutes had a statement indicating that some members could be ready to vote for a hike in Bank Rate ahead of the end of the APF scheme (which is scheduled to end mid-December). The market continues to discuss whether this was a hawkish jolt from the MPC or was intended to merely reinforce the sequencing review and note that the MPC would not end QE early.

- Also later today we have the preliminary print of US durable goods orders and are due to hear from the ECB's Lagarde and de Cos as well as the Fed's Evans, Williams and Brainard.

- TY1 futures are down -0-6 today at 131-26+ with 10y UST yields up 3.0bp at 1.483% and 2y yields up 1.4bp at 0.285%.

- Bund futures are down -0.30 today at 170.00 with 10y Bund yields up 1.7bp at -0.212% and Schatz yields up 0.3bp at -0.700%.

- Gilt futures are down -0.32 today at 125.84 with 10y yields up 4.0bp at 0.964% and 2y yields up 2.5bp at 0.402%.

FOREX: EUR Inching Lower in Wake of German Election Results

- EUR trades on the back foot, with EUR/USD edging back below the 1.17 mark as EGB yields creep higher in tandem. The moves follow the outcome of the German election, which showed a very marginal victory for the Social Democrats, setting up weeks of negotiations and discussions in an attempt to form a governing coalition.

- GBP trades well, with the currency higher against all others in G10 as the UK curve continues to steepen after last week's BoE decision. Progress through last week's 1.3751 opens the 50-dma at 1.3789.

- SEK, CHF and EUR are among the poorest performers, while GBP, AUD trade most favourably.

- Monday's data slate focuses on August US durable goods orders, with Dallas Fed Manufacturing Activity also on the docket. The central bank speaker slate could be of more interest - with Lagarde, Visco & de Cos of the ECB, Evans, Williams & Brainard of the Fed and lastly BoE's Bailey.

EQUITIES: Moving on up (in US and Europe)

- Japan's NIKKEI down 8.75 pts or -0.03% at 30240.06 and the TOPIX down 3.01 pts or -0.14% at 2087.74

- China's SHANGHAI closed down 30.236 pts or -0.84% at 3582.831 and the HANG SENG ended 16.62 pts higher or +0.07% at 24208.78

- German Dax up 148.24 pts or +0.95% at 15679.86, FTSE 100 up 26 pts or +0.37% at 7077.57, CAC 40 up 45.98 pts or +0.69% at 6684.44 and Euro Stoxx 50 up 30.59 pts or +0.74% at 4189.1.

- Dow Jones mini up 162 pts or +0.47% at 34835, S&P 500 mini up 15 pts or +0.34% at 4460.75, NASDAQ mini up 15 pts or +0.1% at 15334.

COMMODITIES: Natgas jumps another 4%

- WTI Crude up $1.02 or +1.38% at $75.01

- Natural Gas up $0.21 or +4.09% at $5.343

- Gold spot up $1.46 or +0.08% at $1752.2

- Copper down $0.35 or -0.08% at $428.35

- Silver up $0.14 or +0.61% at $22.5631

- Platinum up $3.79 or +0.38% at $989.32

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.