-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Tsys Through First Support

MNI US OPEN - RBA Holds, Communication Turns Slightly Dovish

MNI US OPEN - Focus On Jobless Claims & Fed Speakers

MNI US OPEN - Focus On Jobless Claims & Fed Speakers

EXECUTIVE SUMMARY:

- USTs and EGBs have diverged this morning with the latter firming and the former trading weaker

- Equities and FX have been generally mixed.

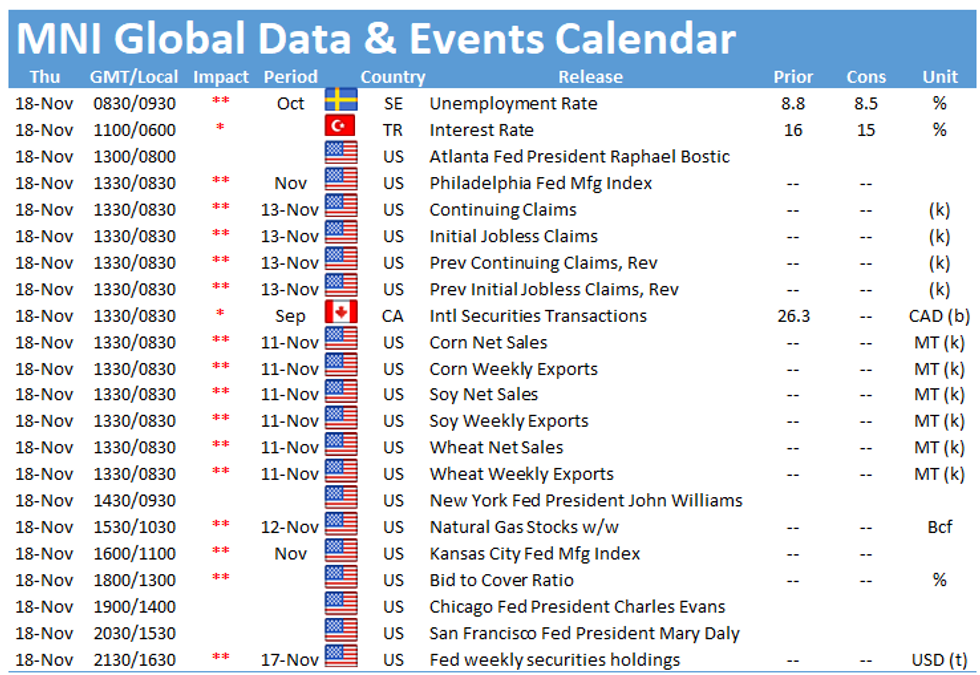

- Beyond US jobless claims and the Philly Fed index, the data slate is light

- The Fed's Bostic, Williams, Evans and Daly will speak later today.

NEWS

RUSSIA (REUTERS): Russia said on Wednesday it would deploy a new paratroop regiment on annexed Crimea by the beginning of December and complained about a British deal to boost Ukraine's navy which it said showed British military activities were expanding near its borders.

UK (BLOOMBERG): In a private meeting on Wednesday evening, the prime minister told rank-and-file Tories that after their successful party conference in October he'd taken his eye off the road and effectively driven the car into a ditch, according to two members of Parliament present who asked not to be named. "He got a very good reception," said Geoffrey Clifton-Brown, another Tory MP who was in the meeting. Johnson had triggered the crisis with a misjudged attempt to save a disgraced ally, the former minister Owen Paterson, who was found to have broken lobbying rules. The backlash forced the prime minister to abandon his plan and Paterson to quit politics, unleashing weeks of negative headlines as the media trained its focus on the second jobs that many MPs use to supplement their regular salaries of about 80,000 pounds ($110,000).

FRANCE (REUTERS): France registered more than 20,000 new confirmed coronavirus infections on Wednesday for the first time since Aug. 25 as the fifth wave of the epidemic picked up speed.

TURKEY (FT): Turkey's lira suffered another bout of severe volatility as traders braced for a central bank decision that will test policymakers' willingness to act against blistering inflation and mounting risks of a currency crisis. The lira fell as much as 3.4 per cent early in the Asian trading day on Thursday to a historic low of TL10.9785 against the US dollar. The currency steadied to TL10.7 when trading began in London, but it remains down 10 per cent over the past three weeks alone. Turkey's central bank faces a "moment of reckoning" when it reveals its latest policy decision at 11am UK time, said Cristian Maggio, head of portfolio strategy at TD Securities in London. Markets are expecting the central bank to reduce its main interest rate by 1 percentage point to 15 per cent, extending a cutting cycle that has brought interest rates down from 19 per cent in March, according to a survey of economists by Bloomberg.

EUROPEAN ISSUANCE UPDATE

FRANCE AUCTION RESULTS: MT OATs

| 0% Feb-24 OAT | 0% Feb-27 OAT | 2.75% Oct-27 OAT | |

| ISIN | FR0014001N46 | FR0014003513 | FR0011317783 |

| Amount | E3.047bln | E2.598bln | E1.849bln |

| Previous | E4.457bln | E3.208bln | E1.82bln |

| Avg yield | -0.69% | -0.37% | -0.37% |

| Previous | -0.63% | -0.42% | -0.42% |

| Bid-to-cover | 2.86x | 2.56x | 2.92x |

| Previous | 2.31x | 2.51x | 2.39x |

| Price | 101.58 | 101.97 | 118.7300 |

| Previous | 101.65 | 102.34 | 120.1500 |

| Pre-auction mid | 101.541 | 101.902 | 118.639 |

| Previous | 101.633 | 102.281 | 120.088 |

| Previous date | 15-Jul-21 | 16-Sep-21 | 15-Jul-21 |

SPAIN AUCTION RESULTS: 5y Bono / 8/10-year Oblis

| 0% Jan-27 Bono | 0.60% Oct-29 Obli | 0.50% Oct-31 Obli | |

| ISIN | ES0000012J15 | ES0000012F43 | ES0000012I32 |

| Amount | E1.489bln | E865mln | E1.761bln |

| Previous | E3.37bln | E921mln | E1.324bln |

| Avg yield | -0.1140% | 0.1780% | 0.4650% |

| Previous | -0.0890% | 0.2720% | 0.4830% |

| Bid-to-cover | 1.62x | 2.32x | 1.40x |

| Previous | 1.35x | 2.69x | 1.32x |

| Price | 100.60 | 103.32 | 100.3330 |

| Previous | 100.48 | 103.00 | 100.1600 |

| Pre-auction mid | 100.556 | 103.189 | 100.265 |

| Previous | 100.074 | ||

| Previous date | 21-Oct-21 | 16-Jul-20 | 04-Nov-21 |

IRELAND AUCTION RESULTS: 5-month IRTBs

| Type | 5-month IRTB |

| Maturity | Apr 25, 2022 |

| Amount | E750mln |

| Target | E750mln |

| Previous | E750mln |

| Avg yield | -0.70% |

| Previous | -0.64% |

| Bid-to-cover | 2.4x |

| Previous | 2.45x |

| Previous date | Oct 21, 2021 |

FIXED INCOME: US/German divergence while gilts play to their own drumbeat

- The main theme for core bond markets has been divergence between USTs and Bunds this morning while gilts have been playing the drum to their own beat.

- UST and Schatz yields are both up a little on the day, but the divergence has been further out the curve: 10-year UST yields are up 0.8bp on the day and 10-year Bund yields down 2.4bp. These divergences have all been driven by inflation expectations this morning, with 10-year breakevens moving higher in the US and lower in Europe. This has translated to a flatter curve in Germany, but steeper in the US today. This largely reflects reactions to some of the Nord Stream 2 headlines seen earlier this week and the market continuing to digest these for the medium-term inflation outlook.

- With a number of Fed speakers but the only notable data being jobless claims, commodity prices are likely to be watched closely by markets through the day.

- Gilts have seen a more parallel curve shift, with yields down over 2.0bp across most of the curve. Part of this is reversing the optimism on rate hikes priced in following this week's labour market and inflation data (short sterling has outperformed today too see earlier bullet here). EU-UK negotiator Frost is due to give an update to the Lords at 11:30GMT following on from earlier negative trade headlines.

- TY1 futures are up 0-1 today at 130-15+ with 10y UST yields up 0.8bp at 1.598% and 2y yields up 0.1bp at 0.502%.

- Bund futures are up 0.19 today at 170.96 with 10y Bund yields down -0.8bp at -0.256% and Schatz yields unch at -0.828%.

- Gilt futures are up 0.31 today at 126.12 with 10y yields down -2.2bp at 0.939% and 2y yields down -2.1bp at 0.534%.

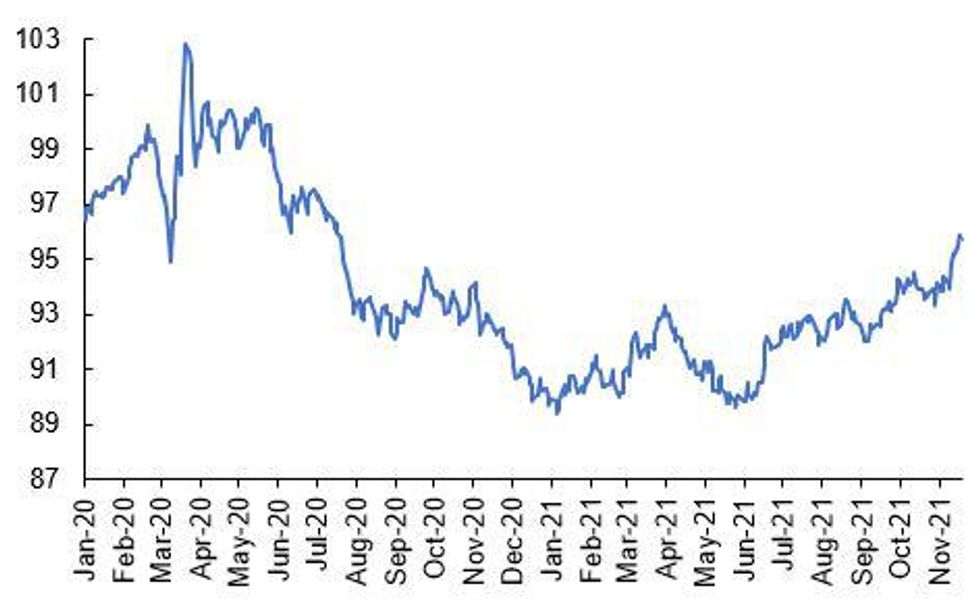

FOREX: Markets Testing SNB Tolerance

- JPY is the poorest performer on the day, but the pullback pales in comparison to the strength seen into the Wednesday close. USD/JPY looks to the 114.00 handle as a near-term anchor, with markets needing to retake 114.97 to reignite the upside argument, while a break below 113.76 would prove bearish.

- EUR/CHF remains a focus, with markets watching the cross testing the key support seen ahead of the 1.05 handle. 1.0503 remains the low print so far, with traders looking to gauge the SNB's implied tolerance level for the cross.

- NZD is the strongest currency in G10, with the currency taking the lead from 2yr inflation expectation data released overnight, which surged to 2.96% from 2.27% previously - the highest rate since 2011. NZD/USD rallied to narrow the gap with the 50-dma of 0.7056. A break above here would see the short-term outlook improve toward 0.71 and the 200-dma.

- Data in focus later today includes weekly US jobless claims, with markets expecting a modest improvement in claims, seen dropping to 260k. Fed speakers remain plentiful, with Fed's Williams likely the focus - he speaks on transatlantic responses to the pandemic. Others include Evans, Bostic and Daly, but don't appear policy-oriented.

FX OPTION EXPIRY

FX OPTION EXPIRY (Closest ones)

Of note:

USDJPY 2.75bn between 113.90/114.25

EURGBP 1.13bn at 0.8400

USCNY 1.6bn at 6.3800/6.3830- EURUSD; 1.1290 (552mln), 1.1330 (461mln), 1.1350 (246mln), 1.1375 (299mln), 1.1400 )415mln).

- GBPUSD: 1.3500 (344mln), 1.3550 (407mln)

- USDJPY: 113.50 (427mln), 113.90 (605mln), 113.95 (517mln), 114.00 (235mln), 114.20 (630mln), 114.25 (758mln), 114.50 (531mln)

- USDCAD: 1.2500 (1.04bn), 1.2630 (200mln), 1.2640 (368mln)

- EURGBP: 0.8400 (1.13bn) 0.8450 (619mln), 0.8460 (481mln)

- AUDUSD: 0.7250 (575mln), 0.7305 (220mln), 0.7330 (233mln)

- USDCNY: 6.38 (600mln), 6.3830 (1bn)

EQUITIES: Another mixed day for stocks

- Japan's NIKKEI down 89.67 pts or -0.3% at 29598.66 and the TOPIX down 2.82 pts or -0.14% at 2035.52

- China's SHANGHAI closed down 16.655 pts or -0.47% at 3520.711 and the HANG SENG ended 330.36 pts lower or -1.29% at 25319.72

- German Dax down 11.17 pts or -0.07% at 16240.92, FTSE 100 down 9.29 pts or -0.13% at 7282.27, CAC 40 up 11.04 pts or +0.15% at 7168.87 and Euro Stoxx 50 up 4.98 pts or +0.11% at 4406.18.

- Dow Jones mini up 36 pts or +0.1% at 35905, S&P 500 mini up 12.75 pts or +0.27% at 4699.5, NASDAQ mini up 77.75 pts or +0.48% at 16389.5.

COMMODITIES: Natgas and platinum higher, while most commods lower

- WTI Crude down $0.55 or -0.7% at $77.80

- Natural Gas up $0.14 or +2.87% at $4.954

- Gold spot down $4.39 or -0.24% at $1863.47

- Copper down $2.4 or -0.56% at $424.8

- Silver down $0.05 or -0.19% at $25.0448

- Platinum up $2.48 or +0.23% at $1064.91

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.