-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI US Open: European FI Heads Lower

MNI US Open: European FI Heads Lower

EXECUTIVE SUMMARY:

- Following a firm start, European government bonds have traded weaker through the morning

- The dollar has held firm against DM FX, while equity performance has been mixed.

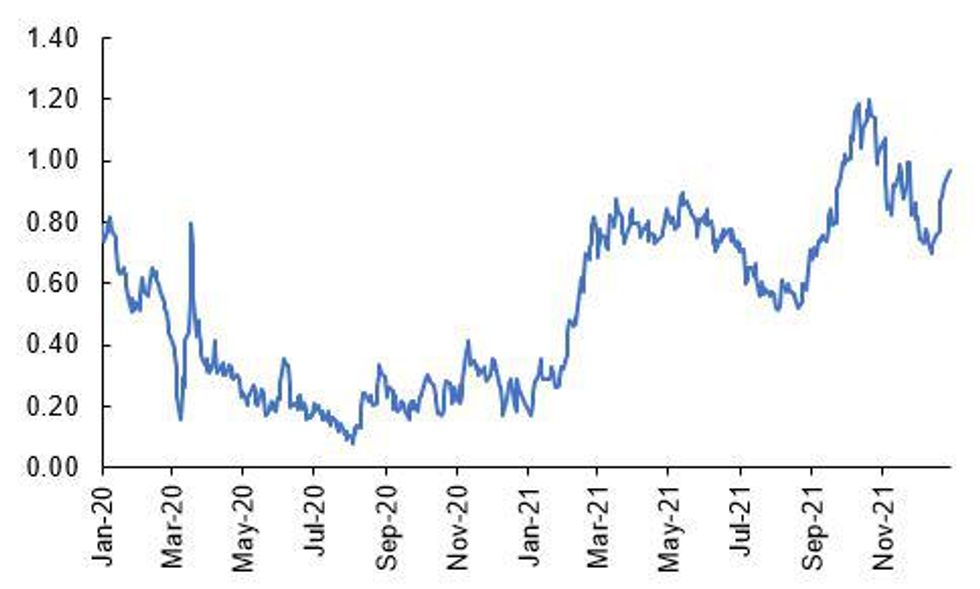

Source: MNI, Bloomberg

NEWS

US-COVID (FT): US health officials have sharply cut their estimates for how much of the country’s Covid-19 wave has been caused by the Omicron coronavirus variant, underlining the uncertainties about the pandemic response. The US Centers for Disease Control and Prevention on Tuesday said they believed the highly transmissible strain was responsible for just over half of the country’s Covid infections, rather than three-quarters, as estimated a week ago. The change to CDC’s estimates came after the agency received more sampling information from previous weeks, officials said. But they also highlighted the difficulties federal health officials have faced in trying to gain an accurate picture of the pandemic in the US given that so much health data is held at local and state levels.

COVID (BBC): The US and several European countries have reported their highest daily rises in Covid cases since the pandemic began, as the Omicron variant spreads. More than 440,000 new cases were recorded in the US on Monday, health officials said.France, Italy, Greece, Portugal and England have also reported record numbers of daily infections. Officials have said the high figures could be due in part to reporting delays over the Christmas period. Studies suggest that Omicron is milder than the previously dominant Delta variant, but fears remain that the sheer number of cases stemming from the highly infectious Omicron could overwhelm hospitals. The World Health Organization (WHO) has warned that the risk posed by Omicron "remains very high".

HONG KONG (Reuters): Hundreds of Hong Kong national security police raided the office of online pro-democracy media outlet Stand News on Wednesday and arrested six people for suspected "seditious publications" offences, the latest in a series of crackdowns on the media. Stand News, set up in 2014 as a non-profit, is the most prominent remaining pro-democracy publication in Hong Kong after a national security investigation this year led to the closure of jailed tycoon Jimmy Lai's Apple Daily tabloid. The raid raises more concerns about press freedom in the former British colony, which returned to Chinese rule in 1997 with the promise that a wide range of individual rights would be protected, media advocacy groups said.

UK (FT): A growing number of smaller UK companies are seeking to tap demand from US retail investors prepared to back fast-growing and sometimes riskier businesses. Almost 30 companies with either a headquarters or stock market listing in the UK have signed up to two major “over the counter” markets run by OTC Markets Group, a move that allows US investors to buy their shares. The total is more than double the number of UK companies that signed up to the premium OTCQX and venture-focused OTCQB markets, two similar US trading venues, last year and just two that made the move in 2019. The allure of US markets for some UK companies has grown as retail investors have emerged as a powerful force in equity markets, throwing their weight behind stocks like Tesla.

FIXED INCOME: FI Markets Potentially Reflecting Less Malign Omicron Scenario

Having initially firmed around the open, EGBs soon sold off alongside a sharp move lower in gilts.

- Catalysts for price action are thin on the ground given the lack of tier one economic data, European supply and an absence of central bank speakers.

- Covid headlines remain a key driver for markets. While the US and some European countries have recorded record high daily cases, the scientific consensus seems to be converging on the prospect of the Omicron variant being less deadly than initially feared. Fixed income markets are arguably reflecting an improvement in risk sentiment at the margin.

- Gilts are underperforming EGBs with cash yields 4-5bp higher on the day.

- The bund curve has bear steepened with the 2s30s spread widening 3bp.

- The OAT curve has steepened more sharply on the back of the very short-end trading bid and longer-end yields pushing higher. The 2s30s spread has traded up 6bp.

- BTP yields are almost uniformly 3bp higher across the curve.

FOREX: Dollar Holds Firm

While the USD has gained across the board against DM FX, price action has been relatively contained during the European morning session.

- Dollar gains come amid a mixed performance in equities and a sell-off in European government bonds, with the latter potentially reflecting a shift in sentiment with respect to the Omicron variant, which now appears less deadly than initially feared despite surging case volumes.

- Scandinavian currencies have marginally underperformed, while USDCAD is close to flat on the day.

- In the EM space, TRY remains under pressure and off 5% against the dollar. The most recent weekly FX reserve data showing that the CBRT has been drawing down foreign currency holdings through the end of November and into December.

Eurozone Timeline of key events (Times GMT)

| Date | Time | Country | Event |

| 29-Dec | 0900 | EU | M3 |

| 30-Dec | 0800 | ES | HICP (p) |

| 03-Jan | 0815 | ES | IHS Markit Manufacturing PMI |

| 03-Jan | 0845 | IT | IHS Markit Manufacturing PMI |

| 03-Jan | 0850 | FR | IHS Markit Manufacturing PMI |

| 03-Jan | 0855 | DE | IHS Markit Manufacturing PMI |

| 03-Jan | 0900 | EU | IHS Markit Manufacturing PMI |

| 04-Jan | 0745 | FR | HICP (p) |

| 04-Jan | 0855 | DE | Unemployment |

| 05-Jan | 0745 | FR | Consumer Sentiment |

| 05-Jan | 0815 | ES | IHS Markit Services PMI |

| 05-Jan | 0845 | IT | IHS Markit Services PMI |

| 05-Jan | 0850 | FR | IHS Markit Services PMI |

UK Timeline of key events (Times GMT)

| Date | Time | Period | Event |

| 04-Jan | 0001 | Dec | BRC Monthly Shop Price Index |

| 04-Jan | 0930 | Nov | M4 Money Supply |

| 04-Jan | 0930 | Dec | IHS Markit/CIPS Manufacturing PMI (f) |

| 06-Jan | 0930 | Dec | IHS Markit/CIPS Services / Composite PMI (f) |

| 07-Jan | 0930 | Dec | IHS Markit/CIPS Construction PMI |

| 07-Jan | 1715 | ---- | BOE Mann on panel at AEA on US growth |

| 08-Jan | 1500 | ---- | BOE Mann on panel at AEA on Covid and Inequality |

| 08-Jan | 1715 | ---- | BOE Mann on panel at AEA on World Econ post-Covid |

| 11-Jan | 0001 | Dec | BRC-KPMG Shop Sales Monitor |

| 14-Jan | 0700 | Nov | GDP / Manufacturing / IP/ Construction / Services / Trade |

| 18-Jan | 0700 | Nov/Dec | Labour Market Survey |

| 18-Jan | 1100 | Jan | CBI Industrial Trends |

| 19-Jan | 0700 | Dec | PPI / CPI / Retail Price Index |

| 19-Jan | 0930 | Nov | ONS House Price Index |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.