-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Post-FOMC Minutes Bond Weakness Continues

EXECUTIVE SUMMARY:

- GERMAN FACTORY ORDERS RISE ON FOREIGN ORDERS

- EUROZONE PRODUCER PRICE INFLATION RISES MORE THAN EXPECTED

- BOJ TO UPGRADE INFLATION VIEW; CHECK RISK BALANCE (MNI INSIGHT)

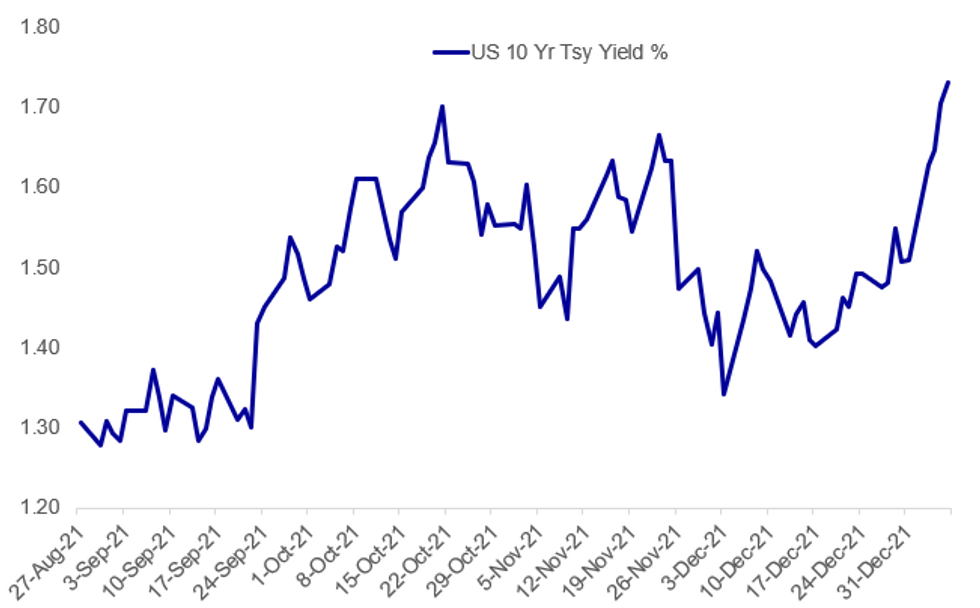

Fig. 1: 10Yr Tsy Yields Near March 2021 High

Source: BBG, MNI

Source: BBG, MNI

NEWS:

GERMAN DATA (BBG): German factory orders rose in November, giving the economy cause for optimism after another quarter that was characterized by record numbers of Covid-19 infections. Demand increased 3.7% after declining a revised 5.8% in the previous month. Orders from abroad helped drive that increase, while domestic demand fell.

BOJ (MNI INSIGHT): The Bank of Japan board's median forecast for inflation in fiscal 2022 could be upgraded above 1% from +0.9% in October in the wake of firmer corporate price-setting behaviour, MNI understands. For full article contact sales@marketnews.com

BOE: The Bank of England's December Decision Marker Panel survey found that businesses expected the latest Omicron-driven Covid wave to hit investment and that firms also reported high levels of difficulty recruiting staff. The latest survey of firms highlighted the point that Covid has delivered a hefty supply side shock. In the Dec survey firms estimated that Q4 2021 sales would be 7% lower than they would have been absent Covid, while investment was estimated at 11% lower and employment 5% lower.

EUROPE ENERGY (BBG): European natural gas rose for a fourth day as top supplier Russia continued to curb deliveries to the region.Prices have resumed their rally this year after more than tripling in 2021. The escalating cost of energy has hit households, sending bills rocketing, and forced multiple industries to curtail output.

NORDSTREAM 2 / U.S.: The Senate will vote next week on legislation proposed by Senator Ted Cruz (R-TX) to impose sanctions on the Nordstream 2 pipeline.While previously sanctions on the pipeline had support from both sides of the aisle it now appears that Democrats are falling in line behind President Joe Biden’s reluctant approval of the project. Biden waived sanctions on Nordstream 2 in 2021 and is currently navigating the complex diplomatic crisis on the Ukrainian border.

CRYPTO (BBG): Bitcoin slumped to the lowest level since its December flash crash as growing expectations of rising borrowing rates weigh on some of the best-performing assets of the past few years.The largest cryptocurrency by market value dropped as low as $42,505 in early Asia trading Thursday. That pushed the price to the weakest since it touched $42,296 during a weekend crash at the start of last month. It rallied back to around $43,200 as of 7:30 a.m. in London. Bitcoin has surged by about 500% since the end of 2019 in the wake of stimulus measures put in place during the Covid-19 pandemic.

CHINA (BBG): A unit of Shimao Group Holdings Ltd. defaulted on a yuan loan after a demand for early repayment, according to a notice sent to investors by the trust company involved and seen by Bloomberg.China Credit Trust Co. said in the notice that the developer’s unit has defaulted on the trust product with 645 million yuan ($101 million) of overdue payment. The trust firm raised funds for the developer by selling the high-yielding investment product to investors. It also oversees payments from the borrower.

TECH (BBG): Alphabet Inc.’s Google was slapped with a record French fine of 150 million euros ($170 million) by the nation’s privacy watchdog, together with a 60 million-euro fine for Meta Platforms Inc.’s Facebook, over the way the companies manage cookies. CNIL, France’s data protection authority, on Thursday issued the companies with a three-month ultimatum “to provide internet users located in France with a means of refusing cookies as simple as the existing means of accepting them, in order to guarantee their freedom of consent.”

SWITZERLAND (BBG): A proposal to get Switzerland’s central bank to give out 53 billion francs ($58 billion) in “helicopter money” has stalled.The measure envisioned giving tax-free 7,500 francs to all citizens from SNBcoffers but the initiative appears unlikely to get enough signatures to move it forward for a national vote.Swiss newspaper Blick reported that only about half of the necessary 100,000 signatures had been collected with an end of April deadline looming.

DATA:

MNI: EZ NOV PPI +1.8% M/M, +23.7% Y/Y; OCT +21.9% Y/Y

EZ November PPI pace slows, record annual highs continue

EUROZONE PPI for November +1.8% m/m, +23.7% y/y (previous 5.4% m/m; 21.9% y/y)

- Eurozone factory gate inflation continued to soar in November, albeit at a significantly reduced pace on the month.

- Energy prices jumped by 3.5%, intermediate goods by 1.5%, durable and non-durable consumer goods by 0.5% and 0.6% from October to November 2021.

- Energy prices continue to be a key driver of inflationary pressure, rising an impressive 66.0% in November 2021 compared to the previous year.

- Monthly core PPI came in at +0.9%.

- Ireland saw the strongest annual factory gate inflation jump in the Eurozone, hitting +87.9% in November 2021.

FIXED INCOME: Follow through from hawkish Fed and higher German inflation weigh on FI

After yesterday's more hawkish FOMC Minutes (both in terms of the potential for a near-term hike and the potential for faster balance sheet unwind) core fixed income markets are coming under some pressure this morning.

- German state CPI data has come in higher than generally expected with M/M prints ranging from 0.5-0.7% so far. The comparable national print was expected to increase 0.4%M/M while HICP is expected to rise 0.2%M/M. Eurozone PPI data was also stronger than expected.

- The higher inflation prints are likely to be spooking the market ahead of tomorrow's Eurozone CPI print with EGB spreads widening, notably in France, Ireland, Spain and Italy.

- TY1 futures are down -0-8+ today at 128-18+ with 10y UST yields up 2.4bp at 1.731% and 2y yields up 3.1bp at 0.860%.

- Bund futures are down -0.53 today at 170.22 with 10y Bund yields up 3.1bp at -0.96% and Schatz yields up 1.5bp at -0.611%.

- Gilt futures are down -0.53 today at 123.39 with 10y yields up 4.8bp at 1.134% and 2y yields up 3.3bp at 0.786%.

FOREX: Greenback Extending Gains Post-Minutes

- The greenback trades firmer this morning, extending the move post-FOMC minutes, which the markets interpreted hawkishly after the Fed strongly suggested the removal of stimulus could accelerate in the coming months. The USD's gains are more notable against growth proxy and commodity tied currencies, with AUD and NZD at the bottom-end of the G10 table.

- AUD/USD's downtick Thursday puts the pair short of a firm break above the 50-dma - and the rejection could mark the beginning of a bearish reversal that initially targets 0.7082 ahead of 0.6993. NZD is trading similarly poorly, but NZD/USD holds clear of key support at 0.6703 for now.

- Equity markets remain the focus for risk sentiment. There's been very little bounce for the in focus tech sector pre-market, with the NASDAQ future indicating another negative open on Wall Street later today. The e-mini S&P and DJIA futures are faring slightly better, but all still remain well shy of yesterday's best levels.

- ISM Services Index takes focus going forward, with markets on watch for the prices subcomponent after the manufacturing ISM data earlier in the week dropped sharply. Final German CPI numbers also cross as well as weekly jobless claims. Fed's Daly and Bullard make up the speaker slate.

EQUITIES: Tech Stocks Continue To Lead Way Lower

- Asian markets closed mixed: Japan's NIKKEI closed down 844.29 pts or -2.88% at 28487.87 and the TOPIX ended 42.26 pts lower or -2.07% at 1997.01. China's SHANGHAI closed down 9.097 pts or -0.25% at 3586.079 and the HANG SENG ended 165.61 pts higher or +0.72% at 23072.86

- European stocks are under a bit of pressure, with the German Dax down 158.37 pts or -0.97% at 16271.75, FTSE 100 down 55.24 pts or -0.73% at 7516.87, CAC 40 down 84.88 pts or -1.15% at 7376.37 and Euro Stoxx 50 down 51.93 pts or -1.18% at 4392.15.

- U.S. futures are mixed, with tech underperforming: Dow Jones mini up 45 pts or +0.12% at 36336, S&P 500 mini up 1.75 pts or +0.04% at 4694.25, NASDAQ mini down 21.75 pts or -0.14% at 15744.75.

COMMODITIES: Precious Metals Dive After Fed Seen Hawkish

- WTI Crude up $0.41 or +0.53% at $78.1

- Natural Gas down $0.03 or -0.72% at $3.841

- Gold spot down $16.15 or -0.89% at $1800.17

- Copper down $6.7 or -1.52% at $433.6

- Silver down $0.59 or -2.59% at $22.2078

- Platinum down $12.3 or -1.25% at $972.58

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/01/2022 | 1300/1400 | *** |  | DE | HICP (p) |

| 06/01/2022 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 06/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 06/01/2022 | 1330/0830 | ** |  | US | trade balance |

| 06/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 06/01/2022 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 06/01/2022 | 1500/1000 | ** |  | US | factory new orders |

| 06/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 06/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 06/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 06/01/2022 | 1630/1130 |  | US | San Francisco Fed's Mary Daly | |

| 06/01/2022 | 1815/1315 |  | US | St. Louis Fed's James Bullard | |

| 07/01/2022 | 0645/0745 | ** |  | CH | unemployment |

| 07/01/2022 | 0700/0800 | ** |  | DE | industrial production |

| 07/01/2022 | 0700/0800 | ** |  | DE | trade balance |

| 07/01/2022 | 0700/0700 | * |  | UK | Halifax House Price Index |

| 07/01/2022 | 0730/0830 | ** |  | CH | retail sales |

| 07/01/2022 | 0745/0845 | ** |  | FR | Consumer Spending |

| 07/01/2022 | 0745/0845 | * |  | FR | industrial production |

| 07/01/2022 | 0745/0845 | * |  | FR | foreign trade |

| 07/01/2022 | 0745/0845 | * |  | FR | current account |

| 07/01/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 07/01/2022 | 1000/1100 | ** |  | EU | Economic Sentiment Indicator |

| 07/01/2022 | 1000/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 07/01/2022 | 1000/1100 | * |  | EU | Business Climate Indicator |

| 07/01/2022 | 1000/1100 | *** |  | EU | HICP (p) |

| 07/01/2022 | 1000/1100 | ** |  | EU | retail sales |

| 07/01/2022 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 07/01/2022 | 1330/0830 | *** |  | US | Employment Report |

| 07/01/2022 | 1500/1000 | * |  | CA | Ivey PMI |

| 07/01/2022 | 1500/1000 |  | US | San Francisco Fed's Mary Daly | |

| 07/01/2022 | 1600/1600 |  | UK | BOE Mann at CFR meeting | |

| 07/01/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 07/01/2022 | 1715/1715 |  | UK | BOE Mann on panel at AEA | |

| 07/01/2022 | 1715/1215 |  | US | Atlanta Fed's Raphael Bostic | |

| 07/01/2022 | 2000/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.