-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Dollar Slips To Multi-Month Lows

EXECUTIVE SUMMARY:

- BOE'S MANN: 2022 WILL BRING DIVERGENCE ON INFLATION ACTION

- EUROPEAN GAS PRICES FALL FOR FIFTH SESSION

- KREMLIN: U.S. SANCTIONS ON PUTIN WOULD MEAN BREACH IN RELATIONS

- FRANCE EASES U.K. BORDER RESTRICTIONS FOR VACCINATED PEOPLE

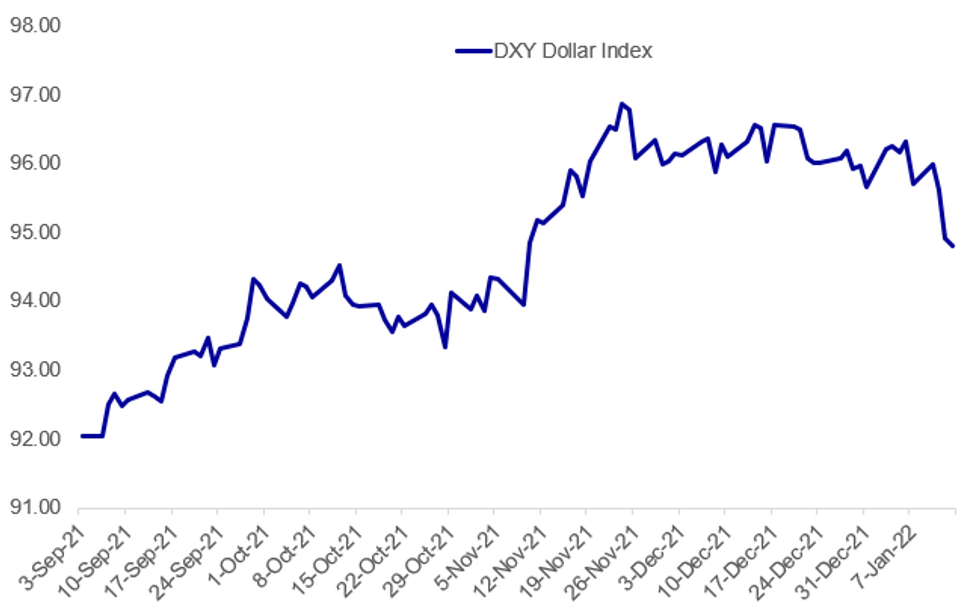

Fig. 1: Dollar Continues To Sag

Source: BBG, MNI

Source: BBG, MNI

NEWS:

BOE (BBG): Global central banks will diverge on the way they respond to inflation this year, creating risks to economies everywhere, Bank of England policy maker Catherine Mann said. Inflation is clearly above target in the U.S. and U.K., but not yet in the euro area, Mann said. “Central banks are facing different requirements with regard to responding to surge. Those differences in strategies responding to the inflationary surge is going to generate its own global spillovers. And this is going to be particularly important feature of the 2022 economic experience, not just for the countries that you see here”.

EUROPE ENERGY (BBG): European natural gas prices fell for a fifth session, nearly erasing gains from the start of the year, as ample flows of liquefied fuel and a milder weather outlook provide some relief to the continent’s supply crunch.The regional benchmark slipped as much as 8.2%. A total of 16 U.S. LNG cargoes have confirmed destinations for northwest Europe, with nine of them due in the U.K., over a two-week period, according to ship-tracking data compiled by Bloomberg.

ITALY POLITICS (RTRS): Italy's centre-right bloc will support former Prime Minister Silvio Berlusconi's bid to become the next president of the Republic, rightist League party leader Matteo Salvini said on Thursday. "The centre-right is firm and unanimous in its support for Berlusconi, we will not accept ideological vetoes from the left," he said in a statement. The Italian parliament will convene on Jan. 24 to begin voting for a new head of state to replace the outgoing Sergio Mattarella. Centre-right leaders are expected to discuss the situation at a meeting set for Friday.

RUSSIA-US (AFP): The Kremlin said Thursday that any US sanctions targeting Russian President Vladimir Putin personally would be "crossing a line" and could see relations between the countries severed."Introducing sanctions against a head of state is crossing a line and comparable to a rupture of ties," Kremlin spokesman Dmitry Peskov told reporters.

FRANCE-UK (BBG): U.K. travelers will no longer need an essential reason to enter France from Friday as long as they are vaccinated, the French government said. France is also lifting the requirement to self-isolate for people who have had the Covid vaccine, according to a statement from Prime Minister Jean Castex’s office on Thursday. All travelers will need a negative test less than 24 hours old.

UK-US: Emilio Cassalicchio at Politico tweets: "Biden snubs Global Britain. Washington REJECTS the offer from [UK Trade Minister Anne-Marie Trevelyan] for negotiations on steel tariffs in Jan. U.S. Commerce spokesperson: "While Secretary Raimondo appreciates the kind invitation, she's not in a position to travel to London in-person at this time"." The snub comes a day after US Trade Representative Katherine Tai, speaking tothe Institute of International and European Affairs, an Irish think tank,stated that UK-US steel tariff talks would begin "when the time is right."

UK-EU (BBG): U.K. Foreign Secretary Liz Truss enters the latest round of post-Brexit negotiations over Northern Ireland, facing a choice between picking a fight with the European Union that would curry favor with her Conservative Party faithful or cutting a deal to avert a trade war.Truss, who took responsibility for the talks following the resignation of former Brexit chief David Frost in December, will meet European Commission Vice President Maros Sefcovic at the foreign secretary’s country residence, Chevening House, on Thursday, according to a government statement. It is their first face-to-face meeting, and talks will go on into Friday.

UK (BBG): Boris Johnson has canceled a visit to a vaccination center in Burnley after a family member tested positive for Covid-19, ITV’s Daniel Hewitt reports in a tweet, citing Downing Street. The Prime Minister won’t have to isolate but is taking advice not to travel

DATA:

ITALY NOV SA IND OUTPUT +1.9% M/M (OCT -0.5%r MM); WDA +6.3%YY

- NOV SA MM IND OUTPUT BEAT 2/20 PRE-COVID LEVEL BY 3.1%--ISTAT

FOREX: Dollar Weakness Extends, With DXY Approaching Key Support

- The greenback trades softer early Thursday, slipping against most others and helping extend the rise in both EUR/USD and GBP/USD to fresh yearly highs as both pairs narrow in on key levels of resistance.

- This morning's move in the USD is an extension of the post-CPI move, with markets initially being primed for a hotter-than-expected figure given recent strength in various price measures in economic surveys. This has translated to the USD Index falling to new multi-month lows through the 95.00 handle, exposing first key support at the 100-dma of 94.65. The Index last broke below this level in April last year, and presaged a further 1.6% decline.

- Equities trade relatively horizontally, but growth-tied and proxy currencies continue to benefit, pushing AUD and NZD to the top end of the G10 pile ahead of the NY crossover. AUD/USD cleared the 100-dma of 0.7287 at today's open, opening gains toward 0.7341 (the 61.8% retracement of the October-November downleg) and - more importantly - the 200-dma at 0.7427.

- Thursday brings US PPI data as well as weekly jobless claims as well as speeches from ECB's de Guindos & Elderson as well as Fed's Barkin and Evans.

FIXED INCOME: Gilts outperform again

- Gilts are the outperformers in core fixed income, the only futures contract to move higher on the day. Having said that, all moves in core fixed income are rather subdued today and all sitting within yesterday's range.

- Looking ahead US PPI will be the focus, as will Brainard's testimony. We also have speeches from Fed's Barkin, Evans and ECB' s de Guindos and Elderson.

- TY1 futures are down -0-5+ today at 128-13 with 10y UST yields up 0.2bp at 1.747% and 2y yields down -0.5bp at 0.916%.

- Bund futures are down -0.08 today at 170.14 with 10y Bund yields up 0.4bp at -0.94% and Schatz yields up 0.5bp at -0.591%.

- Gilt futures are up 0.04 today at 123.39 with 10y yields unch at 1.137% and 2y yields down -0.8bp at 0.790%.

EQUITIES: Holding Pattern Overnight

- Asian markets closed mostly weaker: Japan's NIKKEI closed down 276.53 pts or -0.96% at 28489.13 and the TOPIX ended 13.78 pts lower or -0.68% at 2005.58. China's SHANGHAI closed down 42.173 pts or -1.17% at 3555.259 and the HANG SENG ended 27.6 pts higher or +0.11% at 24429.77.

- European stocks are a little lower, with the German Dax down 14.08 pts or -0.09% at 15970.35, FTSE 100 down 3.85 pts or -0.05% at 7538.63, CAC 40 down 29.05 pts or -0.4% at 7202.97 and Euro Stoxx 50 down 0.31 pts or -0.01% at 4313.79.

- I/S futures are flat/mixed, with the Dow Jones mini down 2 pts or -0.01% at 36158, S&P 500 mini up 1.25 pts or +0.03% at 4717.5, NASDAQ mini up 10 pts or +0.06% at 15897.25.

COMMODITIES: Gold Struggling Despite Weaker Dollar

- WTI Crude up $0.17 or +0.21% at $82.47

- Natural Gas down $0.11 or -2.31% at $4.704

- Gold spot down $3.93 or -0.22% at $1826.3

- Copper down $3.8 or -0.83% at $454.25

- Silver up $0 or +0% at $23.179

- Platinum down $5.99 or -0.61% at $978.68

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/01/2022 | 1030/1130 |  | EU | ECB de Guindos at UBS Q&A | |

| 13/01/2022 | 1300/0800 |  | US | Philadelphia Fed's Patrick Harker | |

| 13/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 13/01/2022 | 1330/0830 | *** |  | US | PPI |

| 13/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 13/01/2022 | 1430/1530 |  | EU | ECB Elderson at Climate Change Seminar | |

| 13/01/2022 | 1500/1000 |  | US | Fed Brainard's Senate Nomination Hearing | |

| 13/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 13/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 13/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 13/01/2022 | 1700/1200 |  | US | Richmond Fed's Tom Barkin | |

| 13/01/2022 | 1800/1300 |  | US | Chicago Fed's Charles Evans | |

| 13/01/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 14/01/2022 | 0130/1230 | ** |  | AU | Lending Finance Details |

| 14/01/2022 | 0700/0700 | *** |  | UK | Index of Production |

| 14/01/2022 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 14/01/2022 | 0700/0700 | ** |  | UK | Index of Services |

| 14/01/2022 | 0700/0700 | ** |  | UK | Trade Balance |

| 14/01/2022 | 0745/0845 | *** |  | FR | HICP (f) |

| 14/01/2022 | 0800/0900 | *** |  | ES | HICP (f) |

| 14/01/2022 | 0830/0930 | *** |  | SE | Inflation report |

| 14/01/2022 | 1000/1100 | * |  | EU | trade balance |

| 14/01/2022 | 1315/1415 |  | EU | ECB Lagarde speech at COSAC | |

| 14/01/2022 | 1330/0830 | *** |  | US | Retail Sales |

| 14/01/2022 | 1330/0830 | ** |  | US | import/export price index |

| 14/01/2022 | 1415/0915 | *** |  | US | Industrial Production |

| 14/01/2022 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 14/01/2022 | 1500/1000 | * |  | US | business inventories |

| 14/01/2022 | 1500/1000 |  | US | Philadelphia Fed's Patrick Harker | |

| 14/01/2022 | 1600/1100 |  | US | New York Fed's John Williams | |

| 14/01/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 14/01/2022 | 1700/1200 |  | CA | BOC releases climate risk paper |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.