-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Equity Drop Pauses For Breath

EXECUTIVE SUMMARY:

- UK INFLATION SOARS TO 30-YEAR HIGH

- BLINKEN URGES PUTIN TO CHOOSE "PEACEFUL PATH" ON UKRAINE

- BETTING MARKET ODDS OF 2022 UK PM JOHNSON DEPARTURE REACH 75%

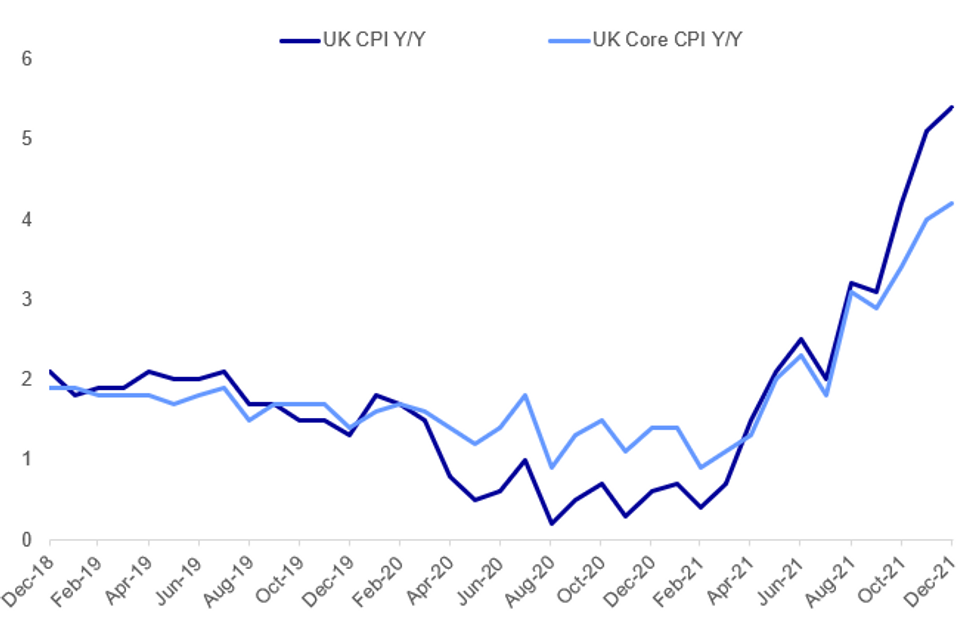

Fig. 1: UK CPI Highest Since 1992

Source: ONS,MNI

Source: ONS,MNI

NEWS:

OIL (BBG): Oil held gains above the highest close since 2014 as the International Energy Agency said the market looked tighter than previously thought, with demand proving resilient to omicron.The global supply surplus is shrinking and oil demand is on track to hit pre-pandemic levels, according to a report from the IEA. Futures in New York rallied above $87 a barrel earlier in the session after an explosion on Tuesday knocked out a key crude pipeline running from Iraq to Turkey. Prices pared some gains on news of its resumption Wednesday.

GAS (BBG): European natural gas slumped as a top LNG importer in China is preparing to flood the market with cargoes that could ease supply concerns in the continent. Benchmark futures fell as much as 8.9%, tracking weaker price sentiments in Asia. The trading arm of Sinopec is offering to sell dozens of spot cargoes this year, according to traders with knowledge of the matter, indicating the world’s biggest buyer is well stocked. The supply could help Europe tide over the winter as Russian flows remain capped and with inventories at record low levels for the time of year.

US-RUSSIA (AFP): US Secretary of State Antony Blinken on Wednesday urged Russian President Vladimir Putin to choose the "peaceful path" on Ukraine, as he visited Kyiv in a show of support ahead of crunch talks with Russia later this week.In Ukraine in advance of talks with European allies in Berlin and his Russian counterpart in Geneva on Friday, Blinken urged Putin to calm fears he is planning an invasion of his pro-Western neighbour."I strongly, strongly hope that we can keep this on a diplomatic and peaceful path, but ultimately, that's going to be President Putin's decision," Blinken said at the US embassy after he landed in the Ukrainian capital.

US-RUSSIA (BBG): Officials at the U.K. Foreign Office have been told to be ready to move into “crisis mode” at very short notice, highlighting the increased concern that Russia’s aggression toward Ukraine could escalate into conflict, according to a person familiar with the matter. Staff at the department were informed of the request this week, the person said. Triggering it would mean officials and diplomats are redeployed to work on Russia and Ukraine policy and to prioritize the U.K. response to any further spike in tensions, including deterrence and sanctions.

UK POLITICS: There is lots of media speculation this morning about whether 54 letters have already been sent (or will be sent today) from Conservative MPs to raise no confidence grievances with Prime Minister Boris Johnson. Under the Conservative Party rules, this would trigger a no confidence vote among Tory MPs, and it is not clear which way that would go at present.

UK POLITICS: The implied probability Johnson leaving office in the coming weeks reached new highs yesterday according to betting markets following revalations of a meeting of 2019GE intake Conservative MPs, where the future of Johnson's tenure was discussed. The so-called 'pork pie plot' (led by Rutland and Melton MP Alicia Kearns) involved 20 Conservative MPs primarily from the 'red wall' seats in northern England. A number of whom are said to have already submitted letters of no confidence in Johnson to the 1922 Committee, with others willing to do so. According to data from Smarkets, the implied probability of Johnson leaving office in Q122 rose to 43.1%, from 23.8% on 18 January. Meanwhile, the implied probability of the PM's tenure lasting into 2023 fell from 40.0% to 25.0% in the same timeframe.

US / 5G /AIRLINES (BBG): Airlines around the world are adjusting their schedules and aircraft deployments for flights to the U.S. over fears that a 5G rollout by AT&T Inc. and Verizon Communications Inc. near American airports could interfere with key safety systems. Dubai’s Emirates Airline said it will suspend flights to several U.S. cities, including Chicago, Newark and San Francisco, while Japan Airlines Co. and ANA Holdings Inc. said Tuesday they will drop some routes and won’t fly their 777 jets to and from the U.S. mainland after a warning from Boeing Co. British Airways cancelled a handful of services to the U.S. on Wednesday, and has also made some aircraft substitutions, a spokeswoman for the carrier said.

TURKEY (BBG): Turkey signed a $4.9 billion currency swap agreement with the United Arab Emirates, boosting dwindling foreign-exchange reserves depleted by the country’s financial turmoil. The three-year deal reflects a warming of ties that began last year after a decade of frosty relations that rippled across the Middle East. Turkey has already signed swap deals with Qatar, South Korea and China to prop up its reserves, which shrank more than 10% in December as the central bank intervened in the foreign-exchange market to stem the lira’s decline.

DATA:

MNI: UK DEC CPI +0.5% M/M, +5.4% Y/Y

UK NOV CORE CPI +0.5% M/M, +4.2% Y/Y

MNI BRIEF: UK Inflation Soars To 30-Year High

UK consumer price inflation burst through expectations in December, rising by an annual rate of 5.4%, the fastest pace since March 1992. Analysts had been looking for a more moderate rise to 5.2% from 5.1% in November.

Food and non-alcoholic beverage prices accounted for much of the increase, adding 0.18 percentage points to the change in CPI, with eight of the nine major categories exerting upward pressure on the index. Motor prices actually shaved 0.04 percentage points from the change in CPI, despite hovering near historically-high levels, as highlighted in the MNI morning briefing. But that didn’t prevent core CPI from stretching to a new record high of 4.2% in December from 4.0% in November.

RPI surged to an annual pace of 7.5%, the highest rate since March of 1991, from 7.1% in November.

MNI: UK Dec OUTPUT PPI +0.3% M/M, +9.3% Y/Y

MNI BRIEF: UK December Factory Gate Inflation Eases

UK pipeline inflation eased in December, with output PPI rising by 9.3%, down from an upwardly revised 9.4% in November, with petroleum products accounting for much of the decline. Input PPI also retreated, falling to13.5% from 15.2% in November.

But the decline from November’s 14-year highs is unlikely to bring much relief to policy makers, with narrow measures of intermediate inflation remaining stubbornly high. Core output PPI rose by a record-high 8.7%, up from 8.2% in November.

Services PPI also accelerated, rising by 3.6% in the fourth quarter, the highest since records began in 2003, from 3.4% in the previous three months.

FIXED INCOME: UK Inflation sets the tone for core FI

The tone was set for the European session by the release of UK inflation data that was two tenths higher than consensus expectations at 5.4%Y/Y (5.1% previously). This drove SONIA futures down on the open, which pulled Bund futures lower and eventually saw gilt futures open at their lowest level since November 2018.

- Soon after the open, however, core fixed income retraced much of its losses although the gilt curve still shows yields across the curve up by about 4.5bp. Bunds have been dragged lower by gilts with the German curve bear steepening while the Treasury curve has seen smaller moves.

- Looking ahead we have four FPC members testifying before the Treasury Select Committee on the Financial Stability Report. Bailey and Cunliffe sit on both the FPC as well as the MPC so their current view on monpol could potentially be discussed.

- TY1 futures are down -0-5+ today at 127-06+ with 10y UST yields up 1.2bp at 1.887% and 2y yields up 1.5bp at 1.060%.

- Bund futures are down -0.38 today at 169.19 with 10y Bund yields up 2.5bp at 0.005% and Schatz yields up 1.0bp at -0.569%.

- Gilt futures are down -0.49 today at 122.28 with 10y yields up 4.7bp at 1.263% and 2y yields up 4.6bp at 0.905%.

FOREX: Dollar Giving Back Small Part of Week's Rally

- The dollar is giving back a small part of the Tuesday rally ahead of Wednesday's NY open, with EUR/USD recovering to test the 1.1350 level. Similarly, GBP/USD is back comfortably above 1.36 as price action mimics that seen in stock markets. The e-mini S&P has stabilised, having bottomed out at the 4535.50 low in Asia hours, to sit in minor positive territory at the crossover.

- Outperformers so far Wednesday are commodity- and growth-tied currencies, with NOK bouncing ahead of tomorrow's Norges Bank decision (no change to rates expected) and CAD on the front foot ahead of today's CPI read. USD/CAD sits below the 200-dma, with bears eyeing the 2022 low of 1.2454 for direction.

- The Fed remain in their media blackout period, keeping the speaker schedule relatively light and keeping focus on US housing starts/building permits data as well as Canadian CPI. Bailey and Cunliffe of the Bank of England testify on financial stability, while ECB's Holzmann also makes an appearance.

EQUITIES: Bouncing From Overnight Lows

- Asian markets closed mostly weaker: Japan's NIKKEI closed down 790.02 pts or -2.8% at 27467.23 and the TOPIX ended 58.66 pts lower or -2.97% at 1919.72. China's SHANGHAI closed down 11.734 pts or -0.33% at 3558.18 and the HANG SENG ended 15.07 pts higher or +0.06% at 24127.85.

- European stocks are a little higher, with the German Dax up 27.82 pts or +0.18% at 15779.27, FTSE 100 up 1.01 pts or +0.01% at 7558.35, CAC 40 up 37.98 pts or +0.53% at 7152.78 and Euro Stoxx 50 up 22.49 pts or +0.53% at 4273.37.

- U.S. futures have bounced a little, with the Dow Jones mini up 35 pts or +0.1% at 35294, S&P 500 mini up 7.5 pts or +0.16% at 4578.75, NASDAQ mini up 44.25 pts or +0.29% at 15250.25.

COMMODITIES: Oil Continues To Outperform

- WTI Crude up $1.08 or +1.26% at $86.45

- Natural Gas down $0.02 or -0.56% at $4.246

- Gold spot up $3.42 or +0.19% at $1816.54

- Copper up $4.5 or +1.03% at $443.35

- Silver up $0.27 or +1.15% at $23.7394

- Platinum up $8.32 or +0.84% at $991.21

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/01/2022 | 1200/0700 | ** |  | US | MBA weekly applications index |

| 19/01/2022 | 1330/0830 | *** |  | CA | CPI |

| 19/01/2022 | 1330/0830 | ** |  | CA | Wholesale Trade |

| 19/01/2022 | 1330/0830 | *** |  | US | housing starts |

| 19/01/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 19/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 19/01/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 20/01/2022 | 0130/1230 | *** |  | AU | Labor force survey |

| 20/01/2022 | 0700/0800 | ** |  | DE | PPI |

| 20/01/2022 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 20/01/2022 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 20/01/2022 | 1000/1100 | *** |  | EU | HICP (f) |

| 20/01/2022 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 20/01/2022 | 1230/1330 |  | EU | ECB publishes Dec meet accounts | |

| 20/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 20/01/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 20/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/01/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 20/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 20/01/2022 | 1600/1100 | ** |  | US | DOE weekly crude oil stocks |

| 20/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 20/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 20/01/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 21/01/2022 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.