-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Lockdown Stock Drop Sets Negative Tone

EXECUTIVE SUMMARY:

- UK RETAIL SALES SLUMPED IN DECEMBER

- BLINKEN-LAVROV MEETING UNDERWAY IN VIENNA

- CHINA LOWERS STANDING LENDING FACILITY RATES BY 10BPS

- U.S. RAISES FEDERAL EMPLOYEE MINIMUM WAGE TO $15/HOUR: AXIOS

- ITALY'S RENZI:NO CHANCE OF SNAP ELECTIONS IN 2022

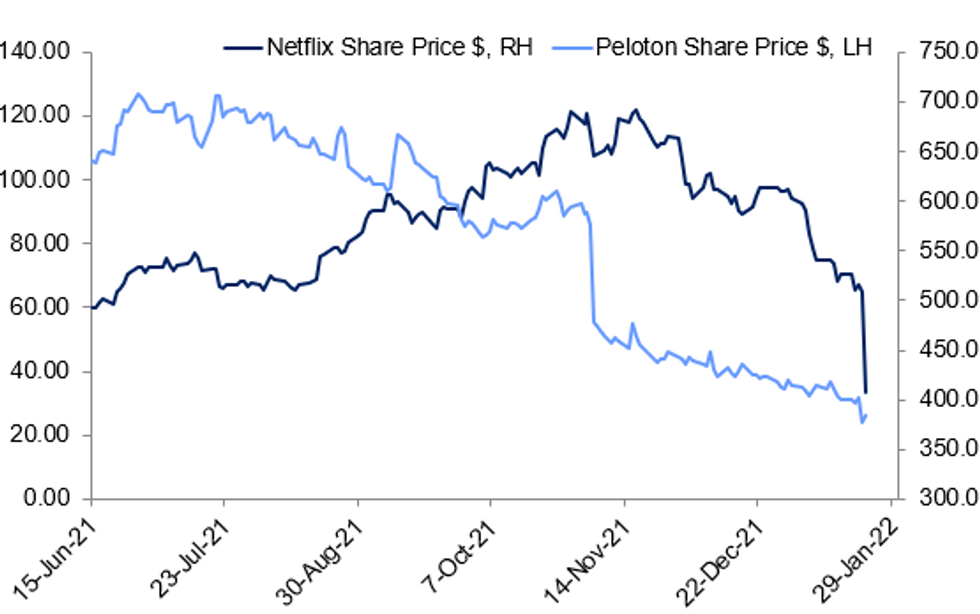

Fig. 1: Pandemic Stocks Set Negative Tone Overnight

Includes pre-market price today. Source: BBG, MNI

Includes pre-market price today. Source: BBG, MNI

NEWS:

US-RUSSIA: US Secretary of State Anthony Blinken and Russian Foreign Minister Sergei Lavrov are in Geneva today for the latest in a string of diplomatic talks to resolve the Ukrainian border crisis. The meeting is taking place at the Hotel President Wilson in Geneva and is expected to take two hours.

GERMANY-RUSSIA: Germany's Der Spiegel is reporting that Chancellor Olaf Scholz has turned down a late-notice invite for talks with US President Joe Biden on the escalating Ukraine crisis. According to the report, both sides are hoping to organise a meeting inmid-February. Comes as Scholz holds phone call with embattled UK PM Boris Johnson last night. Both said that Russia would pay a "considerable and serious price" for any incursion into Ukraine, mirroring rhetoric from other Western nations in recent days.

CHINA (BBG): Rates for overnight, seven-day and one-month standing lending facility were each lowered by 10 basis points to 2.95%, 3.10% and 3.45% respectively, effective from Jan. 17, according to PBOC.

U.S. (AXIOS): Federal agencies are being directed to raise the minimum wages for government employees to $15 an hour, according to new guidance from the Office of Personnel Management shared first with Axios. The guidance will impact almost 70,000 federal employees, most of which work at the Departments of Agriculture, Defense and Veterans Affairs. OMP is directing agencies to implement the new wage by Jan. 30.

ITALY POLITICS (BBG): Next Italian elections will be “for sure in 2023” as scheduled, Senator and leader of Italia Viva party Matteo Renzi said in a Bloomberg Television interview with Francine Lacqua. With either Mario Draghi as next president of the republic or remaining as premier “markets will be confident about Italy”. Former Prime Minister Silvio Berlusconi has “zero possibility” to become next president of the republic.

EQUITIES (BBG): The Covid-19 pandemic isn’t over yet, but the boom it helped create for stay-at-home stocks appears to be vanishing. Netflix Inc. and Peloton Interactive Inc., two of the highest-profile stars of the lockdown era, both plunged Thursday -- the latest sign that investors have moved on from the so-called pandemic trade. Netflix expects to add a paltry 2.5 million users in the current quarter, well short of estimates. Peloton, meanwhile, is slashing costs to cope with slowing demand for its stationary bikes.Netflix shares were down 21% in premarket on Friday, following a similar drop in late trade on Thursday. If the losses hold, it would be the stock’s biggest drop in almost a decade. Peloton shares were up 7% in premarket after sinking 24% on Thursday.

COMMODITIES: (BBG): Oil dropped alongside other financial assets and commodities as crude’s sizzling rally ran out of steam after hitting a seven-year high.Futures in New York slumped more than 3% before paring some losses to trade near $84 a barrel following a decline in stocks and raw materials including copper. Adding to bearish sentiment was U.S. government data pointing to the first gain in crude inventories in eight weeks and comments from the White House that it can work to accelerate the release of strategic oil reserves.

UK / DIGITAL CURRENCY (MNI INTERVIEW): A future UK central bank digital currency could undermine the financial sector and allow the Bank of England to expand its monetary policy powers without legislative sanction, a member of the House of Lords Economic Affairs Committee told MNI, highlighting disquiet among lawmakers about the lack of obvious benefits from the creation of a virtual pound. For full article contact sales@marketnews.com

DATA:

MNI: UK DEC RETAIL SALES -3.7% M/M, -0.9% Y/Y (NOV +4.3r% Y/Y)

MNI BRIEF: UK Dec Retail Sales Slump, Biggest Fall Since Jan

UK retail sales slumped by 3.7% in December, the Office for National Statistics said Friday, pushing the series into the red for the quarter. After November sales were revised to show a 1.0% gain -- below the originally-reported 1.4% rise -- sales over the closing three months of the year slipped by 0.2%, which could modestly dampen total economic growth.

The spread of the Omicrom variant kept shoppers from the stores, according to retailers. Non-food sales slumped by 7.1%, while supermarket sales slipped by 1.0%. Sales declined in all major categories of retailers. Sales declined by 0.9% over the same month of 2020, when most of the UK was in lockdown for part of the month.

Internet sales, measured by value, fell by 1.8% in December, taking the proportion of online transactions up slightly to 26.6% of the total from 26.3% in November. Over the course of 2021, total sales rose by 5.1%, the highest since 2004.

FIXED INCOME: Russia-US concerns drive core FI higher

Russia-US concerns over Ukraine have driven core fixed income higher today with the UK and German curves moving in lockstep higher while the Treasury curve has seen smaller moves (potentially less affected as it is further from Ukraine both geographically and economically).

- US Secretary of State Blinken and Russian Foreign Minister Lavrov have begun their meeting today but expectations of ay breakthrough agreements are low with Russia awaiting Biden and NATO's written responses to the security guarantees.

- The other big event of the day will be a speech by BOE's Mann at 13:00GMT / 8:00ET. With the exception of only limited comments from Bailey ahead of the TSC earlier this week, we have not really heard from any MPC members since the December hike. Despite this markets are pricing almost a 90% probability of a February hike. Her comments today will therefore be closely followed.

- TY1 futures are up 0-11+ today at 128-02 with 10y UST yields down -1.8bp at 1.788% and 2y yields down -0.4bp at 1.023%.

- Bund futures are up 0.44 today at 170.18 with 10y Bund yields down -3.2bp at -0.59% and Schatz yields down -2.2bp at -0.607%.

- Gilt futures are up 0.29 today at 122.95 with 10y yields down -3.0bp at 1.194% and 2y yields down -2.2bp at 0.867%.

FOREX: NZD/USD Nears Key Medium-Term Support

- The late Thursday sell-off across US equity markets continues to exert influence well into the Friday session, with a bias for risk-off seen across G10 FX ahead of the NY crossover. AUD, NZD and NOK are among the weakest currencies so far, with NZD/USD nearing a particularly notable level at the 0.6702 support. This level marks both the December 2021 low (lowest print since late 2020) as well as the 38.2% Fib retracement of the 2020-2021 upleg.

- GBP similarly underperforms, with EUR/GBP bouncing well off the 2022 low following a particularly disappointing read from December retail sales - which slipped nearly 4% on a M/M basis as non-food stores saw a distinct drop on footfall following the spread of the omicron COVID variant. GBP/USD eyes next support at the 1.3543 100-dma.

- Haven curencies are the notable outperformers, with CHF, JPY and the greenback all seen firmer this morning.

- Canadian retail sales data crosses later today, with Eurozone consumer confidence and US Leading Index shortly afterwards. There remains a very quiet central bank speakers slate, with the Fed remaining in their pre-meeting media blackout period. ECB's Lagarde is due to appear on a virtual panel, while BoE's Mann speaks on monetary policy at 1300GMT.

EQUITIES: Tech Under Pressure As Netflix Tumbles

- Asian markets closed mostly weaker: Japan's NIKKEI closed down 250.67 pts or -0.9% at 27522.26 and the TOPIX ended 11.35 pts lower or -0.59% at 1927.18. China's SHANGHAI closed down 32.495 pts or -0.91% at 3522.568 and the HANG SENG ended 13.2 pts higher or +0.05% at 24965.55

- European equities are broadly lower, with the German Dax down 229.59 pts or -1.44% at 15674.12, FTSE 100 down 60.51 pts or -0.8% at 7527.53, CAC 40 down 89.26 pts or -1.24% at 7117.85 and Euro Stoxx 50 down 53.21 pts or -1.24% at 4242.08.

- U.S. futures are flat/lower, led by tech, with the Dow Jones mini up 33 pts or +0.1% at 34649, S&P 500 mini down 3.25 pts or -0.07% at 4471.5, NASDAQ mini down 49 pts or -0.33% at 14791.75.

COMMODITIES: Oil Drop Reflects Broader Markets Pullback

- WTI Crude down $1.68 or -1.96% at $83.95

- Natural Gas up $0.13 or +3.31% at $3.927

- Gold spot down $5.1 or -0.28% at $1835.33

- Copper down $4.85 or -1.06% at $453.95

- Silver down $0.04 or -0.17% at $24.4458

- Platinum down $0.3 or -0.03% at $1045.77

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/01/2022 | 1230/1330 |  | EU | ECB Lagarde on Global Economic Outlook at WEF | |

| 21/01/2022 | 1300/1300 |  | UK | BOE Mann speaks at OMFIF | |

| 21/01/2022 | 1330/0830 | ** |  | CA | Retail Trade |

| 21/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 21/01/2022 | 1500/1600 | ** |  | EU | consumer confidence indicator (p) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.