-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI US OPEN: Equity Rebound Faltering As USD Gains

EXECUTIVE SUMMARY:

- KREMLIN SAYS WATCHING US ACTIONS OVER UKRAINE WITH GREAT CONCERN

- U.K. POLICE TO PROBE GOV'T PARTIES DURING LOCKDOWN

- GERMAN IFO SURVEY: BUSINESS MORALE BRIGHTENS IN JANUARY

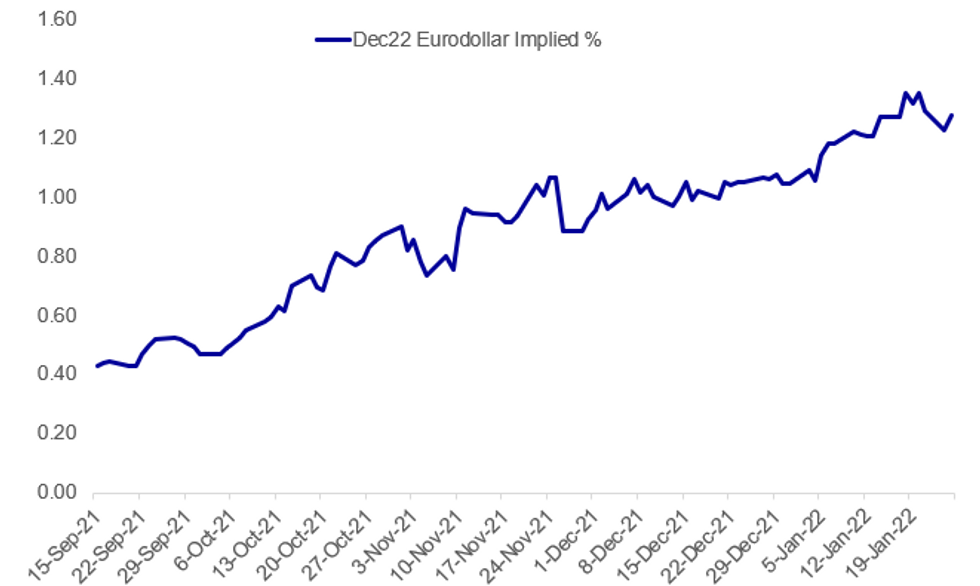

Fig.1: Implied Rate Hikes Pick Up From Monday's Lows Ahead Of Fed

Source: BBG, MNI

Source: BBG, MNI

NEWS:

US-RUSSIA-UKRAINE (RTRS): Russia said on Tuesday it was watching with great concern after the United States put 8,500 troops on alert to be ready to deploy to Europe in case of an escalation in the Ukraine crisis. Kremlin spokesman Dmitry Peskov accused Washington of fuelling tensions over Ukraine - repeating Moscow's line that the crisis is being driven by U.S. and NATO actions rather than by its own build-up of tens of thousands of troops near the Ukrainian border.

UK (BBG): The Metropolitan Police is now investigating events that took place at Downing Street, London’s Met police commissioner Cressida Dick said in a hearing Tuesday. Boris Johnson is facing further allegations of rule-breaking parties during the pandemic, after his office confirmed staff had gathered in Downing Street to celebrate his birthday during the first lockdown in 2020.

GERMAN DATA (RTRS): German business morale improved in January for the first time in seven months as easing supply bottlenecks helped to lift factory output in Europe's largest economy, a survey showed on Tuesday. The Ifo institute said its business climate index rose to 95.7 from an upwardly revised 94.8 in December. A Reuters poll of analysts had pointed to a December reading of 94.7.

EUROPE ENERGY (BBG): Natural gas prices in Europe declined as Russia’s shipments increased and weather forecasts pointed to milder temperatures in the region. Orders to send gas through Ukraine via Velke Kapusany, a major entry point in Slovakia, rose to the highest level since Jan. 1, according to data from operator Eustream. Shipments still remain below normal. Above-averagetemperatures are expected across most of mainland Europe next week, Maxar said in an emailed report.

ESMA (BBG): The European Securities and Markets Authority is worried about whether retail investors would be able to deal with any market correction, the regulator’s chair Verena Ross said.“What we’ve seen in financial markets in particular is very high valuations,” she says in a virtual conference.

ESRB (BBG): European Systemic Risk Board publishes policy recommendation to increase resilience of money market funds following market turmoil in 2020. “ESRB is now recommending policy reforms aimed at addressing the remaining sources of systemic risk, which will also reduce the need for central bank intervention in crisis situations”.

DATA:

MNI: GERMANY JAN IFO CURRENT CONDITIONS 96.1; DEC 96.9

GERMANY JAN IFO BUSINESS CLIMATE +95.7

MNI: SPAIN DEC PPI +3.8% M/M, +35.9% Y/Y, NOV +33.1% Y/Y

MNI: UK DEC CGNCR GBP17.56 BN

Public sector borrowing declined to GBP16.848 billion in December, falling short of the GBP18.5 forecast by City analysts, and down from GBP24.402 billion in year earlier, the Office for National Statistics said Tuesday. An unexpected surge in corporate tax payments kept borrowing in check, with corporates returning GBP5.5 billion to the Treasury, the highest for any month on record, despite the super-deduction in corporation tax announced in the April budget.

FIXED INCOME: Off the highs

As risk recovers somewhat and equities continue to move off their lows, core fixed income is also retreating from yesterday's highs. No real trigger for the moves other than market moves having been rather excessive.

- This morning's German IFO data was better than expected but not enough to warrant the moves seen in core FI.

- As we noted earlier, the Eurodollar strip in particular is very correlated with equity moves at present and is down 7 ticks from yesterday's close in the Reds.

- Markets continue to look ahead to tomorrow's FOMC meeting.

- TY1 futures are down -0-13+ today at 128-03 with 10y UST yields up 1.8bp at 1.790% and 2y yields up 1.1bp at 1.019%.

- Bund futures are down -0.40 today at 170.47 with 10y Bund yields up 3.0bp at -0.79% and Schatz yields up 1.4bp at -0.647%.

- Gilt futures are down -0.43 today at 123.15 with 10y yields up 4.7bp at 1.172% and 2y yields up 2.6bp at 0.890%.

FOREX: Equity Bounce Fades, Helps Tip USD Index to New High

- Equity markets remain the leading indicator for risk appetite following yesterday's late-in-the-day recovery rally. Prices have moderated slightly, with stock index futures in minor negative territory. As a result, the greenback and other haven FX including JPY are seen higher, helping the USD Index touch the best levels since Jan 10.

- Despite slight outperformance among haven currencies, CHF sits at the bottom of the G10 pile, helping EUR/CHF bounce off multi-year printed yesterday at 1.0300. The reversal of CHF strength today will raise questions about the SNB's involvement in FX levels at this point, with the bank still committed to intervening across currency markets to avoid disorderly price formations in CHF.

- Mimicking the price action across EUR/CHF, AUD and CAD are also bouncing, but both currencies remain well off the best levels of the week against the USD. This keeps a lid on AUD/USD at 0.7188 and USD/CAD at 1.2555.

- US conference board consumer confidence data takes focus Tuesday, with the Richmond Fed index also on the docket. There are no central bank speakers of note.

EQUITIES: Futures Holding On To Most Of Late Monday's Recovery

- Asian stocks closed lower: Japan's NIKKEI closed down 457.03 pts or -1.66% at 27131.34 and the TOPIX ended 33.25 pts lower or -1.72% at 1896.62. China's SHANGHAI closed down 91.044 pts or -2.58% at 3433.061 and the HANG SENG ended 412.85 pts lower or -1.67% at 24243.61

- European equities are bouncing a bit, with the German Dax up 152.97 pts or +1.02% at 15163.22, FTSE 100 up 64.49 pts or +0.88% at 7362.95, CAC 40 up 80.78 pts or +1.19% at 6871.02 and Euro Stoxx 50 up 45.26 pts or +1.12% at 4098.83.

- U.S. futures have held on to most of late Monday's recovery, with the Dow Jones mini down 99 pts or -0.29% at 34154, S&P 500 mini down 31.75 pts or -0.72% at 4372, NASDAQ mini down 163.5 pts or -1.13% at 14339.

COMMODITIES: Metals Fade As Dollar Gains

- WTI Crude up $0.92 or +1.1% at $84.2

- Natural Gas down $0.11 or -2.73% at $3.921

- Gold spot down $5.63 or -0.31% at $1837.42

- Copper up $0.7 or +0.16% at $441.85

- Silver down $0.24 or -1% at $23.7529

- Platinum down $9.79 or -0.95% at $1023.47

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/01/2022 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 25/01/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/01/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 25/01/2022 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/01/2022 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 25/01/2022 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 25/01/2022 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 25/01/2022 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 25/01/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 25/01/2022 | 1630/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 25/01/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 26/01/2022 | 0700/0800 | ** |  | SE | PPI |

| 26/01/2022 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 26/01/2022 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 26/01/2022 | 1200/0700 | ** |  | US | MBA weekly applications index |

| 26/01/2022 | 1330/0830 | ** |  | US | advance trade, advance business inventories |

| 26/01/2022 | 1500/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 26/01/2022 | 1500/1000 |  | CA | BOC Monetary Policy Report | |

| 26/01/2022 | 1500/1000 | *** |  | US | new home sales |

| 26/01/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 26/01/2022 | 1600/1100 |  | CA | BOC Governor press conference after rate decision | |

| 26/01/2022 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/01/2022 | 1900/1400 | *** |  | US | FOMC Statement SEP |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.