-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: European Sovereign FI Weaker Post-FOMC

EXECUTIVE SUMMARY:

- European sovereign FI as traded weaker post the FOMC, while the UST curve has flattened

- German consumer confidence was steady in February

- The UK indicates it could bolster forces to act as a deterrent to Russia amid the escalating crisis over Ukraine

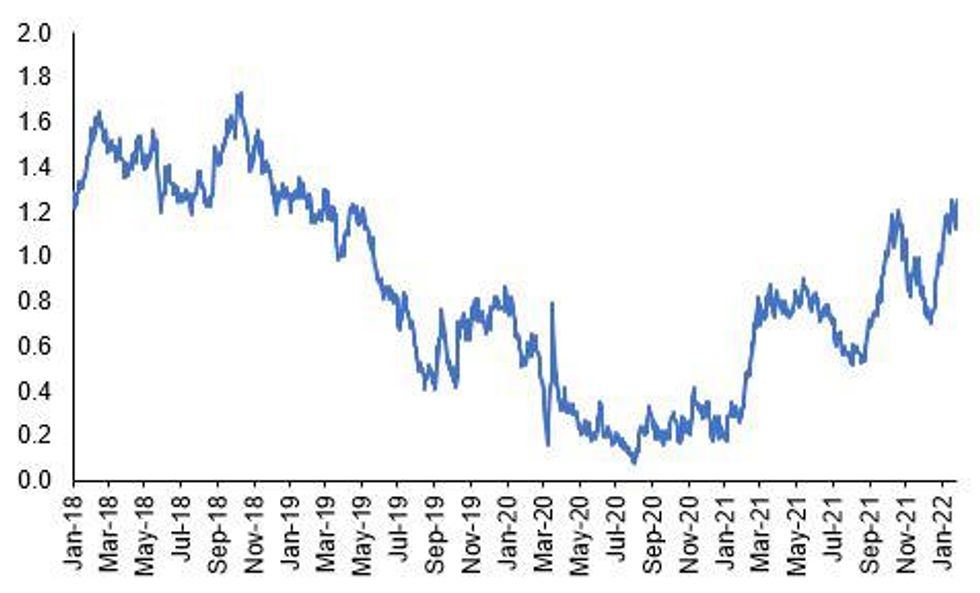

Fig. 1: UK 10-Year Gilt Yield, %

NEWS

RUSSIA-UKRAINE (BLOOMBERG) - Defense Secretary Ben Wallace said on Thursday that the U.K. could support NATO countries by increasing its forces to act as a deterrent to any further Russian aggression. This comes a day after the U.S. and NATO delivered written responses to Russia, broadly rejecting Moscow’s demands that the Western alliance redraw its borders, close its door to Ukraine’s potential future membership and roll back forces from former Soviet states.

RUSSIA-UKRAINE (REUTERS) - China has told the United States it wants to see all sides involved in Ukraine remain calm and avoid increasing tension while the United States stressed de-escalation and warned of the security and economic risks from Russian aggression. China's Foreign Minister Wang Yi and U.S. Secretary of State Antony Blinken spoke about Ukraine on a telephone call late on Wednesday. "We call on all parties to stay calm and refrain from doing things that agitate tensions and hype up the crisis," Wang told Blinken, China's foreign ministry said in a statement.

UK (GUARDIAN): A new raft of Conservative MPs are poised to send letters of no confidence in Boris Johnson when the long-awaited “partygate” report is published, as the prime minister was pressured by his supporters to oversee a complete clearout of No 10. The Guardian has learned that senior backbenchers are to move as a collective to force a no-confidence vote in Johnson once senior civil servant Sue Gray releases her findings, which on Tuesday helped trigger a criminal inquiry.

DATA

GERMANY FEB GFK CONSUMER CONFIDENCE -6.7; JAN -6.9r

German consumer confidence seen steadying in Feb - GfK

German consumer confidence looks set to steady in February, a flash release from Gfk shows, rising to 0.2 points to -6.7 from a revised January reading of -6.9.

- Despite higher inflation, "consumers are once again showing some optimism at the beginning of the year,” said Gfk'S Rolf Burkl.

- The full January report suggests Germans are more upbeat on income expectations, with an increase in 10 points on December to 16.9.

- According to the report, consumers are expecting price trends to ease to some degree this year, although hoping higher prices will also lead to corresponding wage increases.

FIXED INCOME: Big day for US data as markets continue to find equilibrium after the Fed

Core bond futures are all down since the close yesterday, but have retraced some of their losses since around 6:00GMT this morning. After European traders started to get in, we have seen bonds moves off their lows. Indeed, looking at moves in cash Treasuries markets 10-year yields are down 2.5bp on the day.

- However, despite the consolidation around the 10-year sector, the short-end has still seen yields drift higher on aggregate in the European morning session. The Eurodollar strip remains down up to 11 ticks lower in some White/Red contracts since yesterday's close.

- Looking ahead, on the US data calendar we have a first print of both December's durable goods and Q4 GDP. Both of which are less important than inflation and the labour market at this juncture, but still have potential to see decent market moves.

- TY1 futures are down -0-3 today at 127-13+ with 10y UST yields down -2.5bp at 1.841% and 2y yields up 2.9bp at 1.182%.

- Bund futures are down -0.34 today at 170.01 with 10y Bund yields up 2.9bp at -0.47% and Schatz yields up 3.1bp at -0.620%.

- Gilt futures are down -0.45 today at 122.44 with 10y yields up 5.3bp at 1.249% and 2y yields up 6.4bp at 0.975%.

FOREX: Dollar Remains Solid as Post-Fed Buying Persists Through Europe

- The greenback continues to trade from strength to strength, and is outstripping all others in G10 early Thursday as the Fed-induced wave of buying persisted across Asia-Pac hours. The USD Index trades within range of two key resistance levels (96.906 and 96.938) which, if broken, put the dollar at the best levels since mid-2020.

- The hawkish interpretation of the Fed press conference yesterday continues to underpin a tightening of financial conditions, with the front-end of the US yield curve pricing in much tighter policy front March onwards. STIR markets now price in close to 5 hikes across 2022.

- Outside of the greenback, the single currency is suffering, with the stark perceived policy divergence between the ECB and Fed driving EUR/USD to fresh 2022 lows. Similarly, EUR/GBP is under pressure and lower for a third session. This puts the cross on track to test key support of 0.8305 should weakness persist.

- The NOK trades well, second to just the USD as oil prices remain well elevated. Brent crude futures topped $90/bbl yesterday for the first time since 2014, with prices holding above that key psychological level at the NY crossover.

- Advance US Q4 GDP data takes focus going forward, with weekly jobless claims data also due as well as prelim December durables data.

FX OPTION EXPIRY

FX OPTION EXPIRY (closest ones)

Of note: a little far, but USDCNY 1.37bn at 6.35- EURUSD; 1.1150 (688mln), 1.1200 (360mln), 1.1205 (322mln), 1.1250 (677mln)

- USDJPY: 114.80 (981mln), 115 ( 255mln), 115.50 (775mln)

- USDCAD: 1.2700 (257mln)

- USDCNY: 6.35 (1.37bn)

EQUITIES: US equities pushing higher European equities more mixed

- Japan's NIKKEI down 841.03 pts or -3.11% at 26170.3 and the TOPIX down 49.41 pts or -2.61% at 1842.44

- China's SHANGHAI closed down 61.421 pts or -1.78% at 3394.247 and the HANG SENG ended 482.9 pts lower or -1.99% at 23807.

- German Dax down 52.81 pts or -0.34% at 15408.04, FTSE 100 up 5.23 pts or +0.07% at 7473.97, CAC 40 down 33.67 pts or -0.48% at 6952.58 and Euro Stoxx 50 down 8.7 pts or -0.21% at 4158.02.

- Dow Jones mini up 16 pts or +0.05% at 34040, S&P 500 mini up 7.75 pts or +0.18% at 4351.25, NASDAQ mini up 62.75 pts or +0.44% at 14226.5.

COMMODITIES: Mixed moves as the USD strengthens

- WTI Crude down $0.06 or -0.07% at $87.19

- Natural Gas (NYM) up $0.09 or +2.17% at $4.37

- Natural Gas (ICE Dutch TTF) up $0.73 or +0.79% at $93

- Gold spot down $3.54 or -0.19% at $1815.98

- Copper down $3.35 or -0.74% at $447.7

- Silver down $0.2 or -0.85% at $23.3419

- Platinum up $0.64 or +0.06% at $1036.33

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/01/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 27/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 27/01/2022 | 1330/0830 | ** |  | US | durable goods new orders |

| 27/01/2022 | 1330/0830 | *** |  | US | GDP (adv) |

| 27/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 27/01/2022 | 1330/0830 | * |  | CA | Payroll employment |

| 27/01/2022 | 1500/1000 | ** |  | US | NAR pending home sales |

| 27/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 27/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 27/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 27/01/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 28/01/2022 | 0630/0730 | ** |  | FR | Consumer Spending |

| 28/01/2022 | 0630/0730 | *** |  | FR | GDP (p) |

| 28/01/2022 | 0700/0800 | ** |  | SE | Unemployment |

| 28/01/2022 | 0700/0800 | ** |  | SE | Retail Sales |

| 28/01/2022 | 0700/0800 | *** |  | SE | GDP |

| 28/01/2022 | 0700/0800 | * |  | NO | Norway Unemployment Rate |

| 28/01/2022 | 0700/0800 | ** |  | DE | Import/Export Prices |

| 28/01/2022 | 0745/0845 | ** |  | FR | PPI |

| 28/01/2022 | 0800/0900 | *** |  | ES | GDP (p) |

| 28/01/2022 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 28/01/2022 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 28/01/2022 | 0900/1000 | *** |  | DE | GDP (p) |

| 28/01/2022 | 1000/1100 | ** |  | EU | Economic Sentiment Indicator |

| 28/01/2022 | 1000/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 28/01/2022 | 1000/1100 | * |  | EU | Business Climate Indicator |

| 28/01/2022 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 28/01/2022 | 1330/0830 | ** |  | US | Employment Cost Index |

| 28/01/2022 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 28/01/2022 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.