-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Cautious Optimism Ahead Of Another Busy Week

EXECUTIVE SUMMARY:

- SPANISH AND GERMAN STATE INFLATION HIGHER THAN EXPECTED

- EUROZONE Q4 GDP SLOWS, SLIGHTLY BELOW FORECASTS

- KREMLIN SAYS NO DATE SET FOR RESPONSE TO U.S., NATO PROPOSALS

- UK'S JOHNSON PLANS CHANGES TO TOP TEAM (MIRROR)

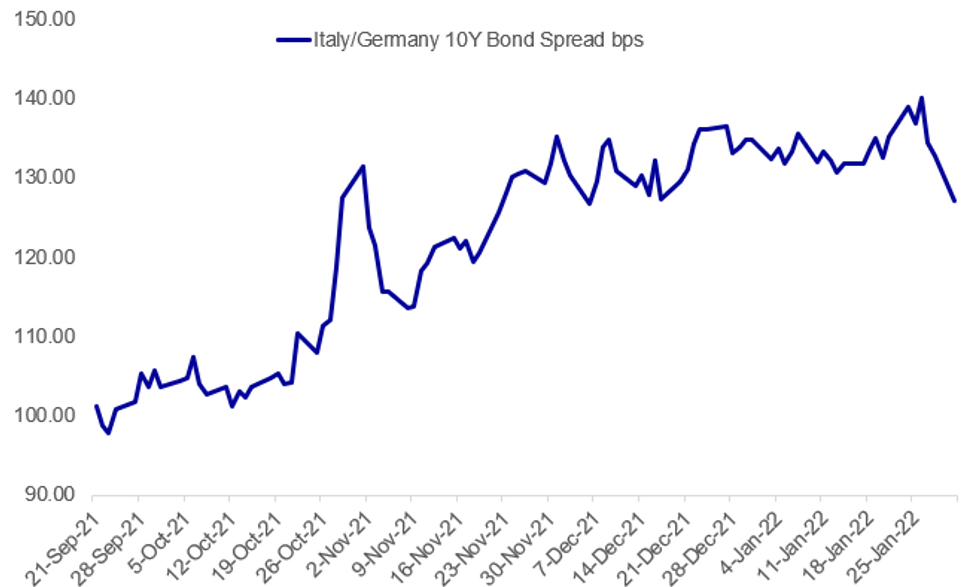

Fig.1: Italian Spreads Narrow After Mattarella Re-Elected President

Source: BBG, MNI

Source: BBG, MNI

NEWS:

RUSSIA-US-NATO (RTRS): Russian President Vladimir Putin will respond to proposals from the United States and NATO "when he considers it necessary", with no date set for now, the Kremlin said on Monday. Washington and Brussels replied last week to Moscow's demands for legally binding security guarantees amid a standoff over Ukraine's aspirations to join NATO. Putin said last Friday they had not addressed Moscow's main security demands but Russia was ready to keep talking.

RUSSIA-UK (RTRS): British Prime Minister Boris Johnson said on Monday he would tell Russian President Vladimir Putin to step back from the brink over Ukraine when the two leaders speak this week. "What I will say to President Putin, as I've said before, is that I think we really all need to step back from the brink, and I think Russia needs to step back from the brink," Johnson told reporters.

UK POLITICS (MIRROR VIA TWITTER): Boris Johnson is planning to then give a statement to Commons, in which I'm told he will apologise repeatedly and say he accepts her redacted findings in full.Sources say he will tell MPs the Govt will "learn lessons" from row before announcing changes to his top team in No10.

UK POLITICS (BBG): U.K. Chancellor of the Exchequer Rishi Sunak is working on a package of measures to alleviate the impact of rising energy costs, Prime Minister Boris Johnson said on Monday, as his government grapples with a growing squeeze on the cost of living for ordinary Britons.“We all understand the pressures that the cost-of-living crunch is putting on people and it is being driven by the inflation you are seeing around the world, particularly in energy costs,” the prime minister told reporters in Essex on Monday. “I know the chancellor is looking at a package of things to abate energy costs.”

ITALY (MNI POLITICS): Over the weekend, incumbent President Sergio Mattarella won re-election to a second seven-year term in office after one of the longest presidential election processes in Italian history. Despite having strongly objected to the prospect of a second term, Mattarella became the only acceptable compromise candidate for the parties involved in the broad coalition gov't of PM Mario Draghi. As has been noted by a number of outlets, Mattarella's re-election is the most positive outcome with regards to political stability over the medium term and for promoting market-supportive reforms from the gov't of PM Mario Draghi.Mattarella - the second president to be elected to a second term - is only likely to serve a portion of his term. The mid-2023 general election would seem the logical end-point for his tenure. Draghi would be the top contender to take over from Mattarella, with the election serving as a natural end-point to the PM's technocratic administration.

U.S. NATGAS (BBG): U.S. natural gas prices rallied after a blizzard swept across the Northeast over the weekend, boosting demand for the heating and power plant fuel.Boston tied a daily snow record, and the storm dumped more than 8 inches (20 centimeters) in Central Park. Natural gas futures jumped as much as 9% as the week’s trading started Monday in Asia, the seventh day of gains for the March contract.Fears of a lingering supply crunch has kept fuel prices elevated from New England to the Netherlands, boosting global competition for a finite amount of gas. Colder-than-normal weather is expected across most of the Central and Eastern U.S. through the first week of February, according to the National Oceanic and Atmospheric Administration.

DATA:

MNI: BAVARIA JAN CPI +0.4% M/M, +4.8% Y/Y; DEC +5.4% Y/Y

German National inflation likely to surprise to the upside

- We have now received six State CPI prints from Germany. These have come in at +0.1%, +0.2%, two prints of +0.4%, +0.7% and +0.8%.

- Note that consensus is looking for the national German CPI print to be -0.2%M/M, so it looks as though we will see an upside surprise of at least 3-4 tenths.

- Just a caveat that this does not always translate into a surprise for the HICP print.

- Note that Spanish HICP surprised to the upside by six tenths earlier this morning.

- Bunds the underperformers in core FI this morning while the Euribor strip continues to underperform the SONIA and Eurodollar strips.

MNI: SPAIN FLASH HICP JAN -0.9% M/M, +6.1% Y/Y; DEC +6.6% Y/Y

MNI: EZ FLASH Q4 GDP +0.3% Q/Q, +4.6% Y/Y

EZ Q4 GDP Slows, Slightly Below Forecasts

- Eurozone GDP growth slowed to 0.3% in the fourth quarter, slightly below analysts’ forecasts of 0.4%, according to data released by Eurostat on Monday. That’s below the 2.3% pace recorded in the previous three months.

- Annual growth of 4.6% matched economists’ predictions, against an unrevised 3.9% pace in the third quarter.

- That’s well below the 1.7% growth posted by the U.S. in data released last week.

- The Spanish economy expanded by 2.0%, outpacing the EU nations that have reported Q4 data. The regional powerhouse, Germany, suffered a 0.7% contraction in the closing months of the year, according to data released last week, while Austrian output slumped by a quarterly rate of 2.2%.

MNI: ITALY PREL. 4Q21 REAL SA WDA GDP +0.6% Q/Q; +6.4% Y/Y

FIXED INCOME: Politics and inflation pushing European yields higher

Bunds are leading fixed income lower today with the most market-positive plausible election results in both Italy and Portugal seen over the weekend. This has been followed up by Spanish CPI coming in six tenths higher than expected and German state CPI also coming in at fairly lofty levels, pointing to an upward surprise of at least 3-4 tenths for the national print due later.

- 10-year Bund yields up 3.9bp on the day with Schatz yields up 4.4bp. Peripheral spreads all tighter, too, led by 10-year BTP-Bund spread 5.3bp tighter on the day (although it was over 10bp tighter earlier). ECB meeting scheduled for Thursday.

- In the UK, focus on politics. Energy price measures (to mitigate the costs to poorer households) were expected to be announced as soon as today. However, multiple media sources now expect the Gray report to be handed to Number 10 today, with a statement likely from PM Johnson this afternoon (which could include a change in Johnson's team). Not moving gilts too much at present which are trading at a lower beta than Bunds to the European news today.

- In the US we look to the MNI Chicago Business Barometer and Dallas Fed to set the tone.

- TY1 futures are down -0-2 today at 127-28+ with 10y UST yields up 1.4bp at 1.786% and 2y yields up 4.2bp at 1.206%.

- Bund futures are down -0.63 today at 169.39 with 10y Bund yields up 3.9bp at -0.8% and Schatz yields up 4.4bp at -0.570%.

- Gilt futures are down -0.24 today at 122.29 with 10y yields up 2.4bp at 1.266% and 2y yields up 2.9bp at 0.992%.

FOREX: USD Mixed-to-Lower Despite Solid Buy Signal Into Month-End

- The dollar trades mixed-to-lower early Monday, running against the bulk of sell-side models for month-end, which continue to signal a strong USD buying need into the January close. This suggests that markets will be on watch for USD rallies through the NY crossover - or alternatively, much of that month-end flow has already worked its way through markets across last week's volatile trade.

- AUD is comfortably the outperformer Monday, with AUD/USD recovering close to 100 pips off the Friday lows. The moves come ahead of Tuesday's rate decision at which the RBA are seen weighing a conclusion to bond purchases, The internal debate at the bank is seen switching to rate hikes, as markets price four full rate hikes by year-end.

- Haven currencies are offered, with JPY and CHF among the poorest performers so far today. Equities sit somewhat stronger, with US futures holding the bulk of the late Friday rally, but indicating a more mixed cash open.

- German national CPI readings for January take focus going forward, with regional turnouts suggesting we may see a higher-than-expected nationwide release later today. The MNI Chicago Business Barometer is also due, with markets expecting activity to decelerate to 61.8 from 63.1 previously.

EQUITIES: S&P Futures Holding On To Late Friday Gains

- Chinese markets are closed for holidays, elsewhere Asian markets finished higher:Japan's NIKKEI up 284.64 pts or +1.07% at 27001.98 and the TOPIX up 19.04 pts or +1.01% at 1895.93. The HANG SENG ended 252.18 pts higher or +1.07% at 23802.26

- European equities are stronger, with the German Dax up 155 pts or +1.01% at 15493.23, FTSE 100 up 2.57 pts or +0.03% at 7466.07, CAC 40 up 42.56 pts or +0.61% at 6965.88 and Euro Stoxx 50 up 36.86 pts or +0.89% at 4183.13.

- U.S. futures are mixed, holding on to late Friday gains, with tech outperforming: Dow Jones mini down 70 pts or -0.2% at 34525, S&P 500 mini up 0.75 pts or +0.02% at 4424, NASDAQ mini up 68.75 pts or +0.48% at 14501.75.

COMMODITIES: US NatGas Jumps On Northeast Blizzard

- WTI Crude up $0.54 or +0.62% at $87.8

- Natural Gas up $0.26 or +5.54% at $4.943

- Gold spot down $2.34 or -0.13% at $1789.23

- Copper up $2.85 or +0.66% at $431.4

- Silver up $0.05 or +0.22% at $22.4286

- Platinum up $0.62 or +0.06% at $1015.78

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/01/2022 | 1000/1100 | *** |  | EU | GDP preliminary flash est. |

| 31/01/2022 | 1300/1400 | *** |  | DE | HICP (p) |

| 31/01/2022 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 31/01/2022 | 1445/0945 | ** |  | US | MNI Chicago PMI |

| 31/01/2022 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 31/01/2022 | 1630/1130 |  | US | San Francisco Fed's Mary Daly | |

| 31/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 31/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 31/01/2022 | 1740/1240 |  | US | Kansas City Fed's Esther George | |

| 01/02/2022 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0030/1130 | ** |  | AU | Retail Trade |

| 01/02/2022 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 01/02/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/02/2022 | 0330/1430 | *** |  | AU | RBA Rate Decision |

| 01/02/2022 | 0700/0700 | * |  | UK | Nationwide House Price Index |

| 01/02/2022 | 0730/0830 | ** |  | SE | Manufacturing PMI |

| 01/02/2022 | 0730/0830 | ** |  | SE | Services PMI |

| 01/02/2022 | 0730/0830 | ** |  | CH | retail sales |

| 01/02/2022 | 0730/0830 | *** |  | FR | HICP (p) |

| 01/02/2022 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0845/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0855/0955 | ** |  | DE | unemployment |

| 01/02/2022 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0930/0930 | ** |  | UK | BOE M4 |

| 01/02/2022 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 01/02/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/02/2022 | 1000/1100 | ** |  | EU | unemployment |

| 01/02/2022 | - | *** |  | US | domestic made vehicle sales |

| 01/02/2022 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 01/02/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 01/02/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/02/2022 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/02/2022 | 1500/1000 | * |  | US | construction spending |

| 01/02/2022 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 01/02/2022 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 01/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.