-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - EUR On Top as CPI Hits Record High

Highlights:

- Eurozone CPI hits new alltime highs - markets bring forward ECB hike expectations

- German 5s30s curve at flattest since 2008

- ADP employment change watched for NFP clues

US TSYS SUMMARY: Minor Twist Flattening Ahead Of Refunding, ADP

- Cash Tsys have modestly twist flattened this morning ahead of Treasury Refunding and ADP employment.

- 2Y yields +0.4bps at 1.169%, 5Y +0.2bps at 1.619%, 10Y unch at 1.788% and 30Y -0.7bps at 2.102%.

- TYH2 is currently back where it spent much of the Asian session at 127-29+, the low end of yesterday’s range on low volumes and with some gap to both resistance and support levels.

- Data: ADP employment for Jan (0815ET_ has consensus for a pullback to +184k but it’s caveated by last month having one of the largest gaps with private payrolls on record.

- Treasury Refunding announcement (0830ET) followed by the press conf webcast (1000ET).

- Bill issuance: US Tsy $40B 119D bill CMB auction (1130ET).

- No Fedspeak currently scheduled for today before the Senate confirmation hearings for Raskin, Cook & Jefferson tomorrow.

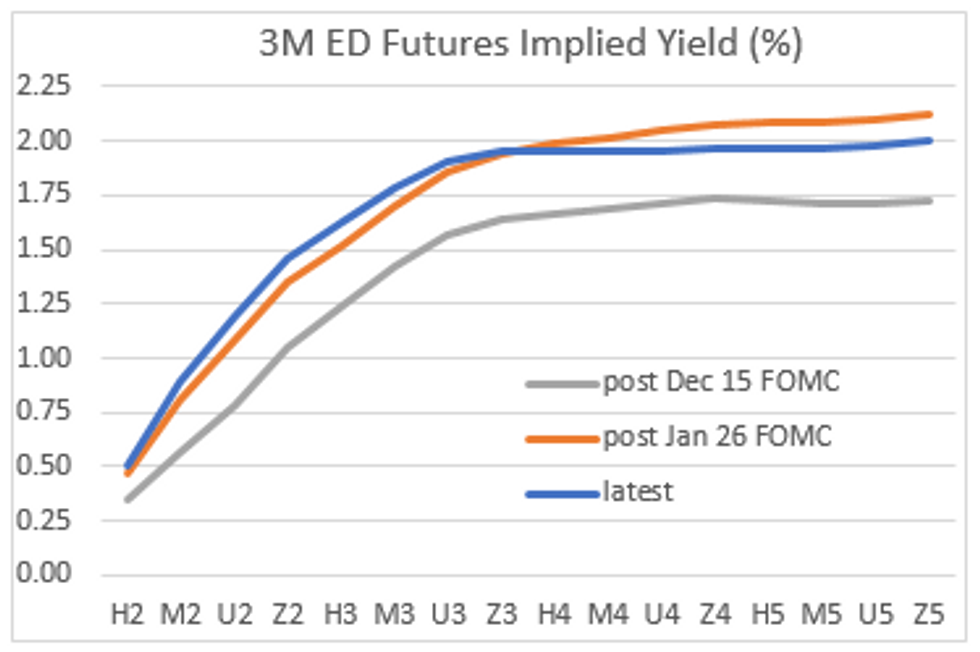

STIRS: US Implied Hikes At Low End For Week

- Implied hikes in Fed Funds futures are at the low end for the week, with 29bps priced for March and 120bps following the Dec meeting.

- Eurodollar reds lead the way down between 0.5-1.5 ticks on the day with whites unchanged, as implied yields remain steeper than immediately after last week’s FOMC out to Dec'23 after which they plateau at a lower rate.

- Bullard said yesterday that market pricing for five rate hikes this year is not a bad bet but a lot is going to depend on how inflation develops. A 50bp move doesn’t help because “we can get a disciplined approach to raising the policy rate and the expectations are already in markets”, adding potential for “getting the balance sheet runoff going in the second quarter. That would be my preference”.

Source: Bloomberg, MNI

Source: Bloomberg, MNI

EGB/GILT SUMMARY: Eurozone Inflation Continues To Push Higher

European sovereign bonds started the session on a firm footing but traded weaker through the morning with performance now mixed on the day. Equities continue to push higher while recent dollar weakness persists.

- Gilts have traded weaker through the morning and are now close to flat on the day.

- The leadership of the UK's PM Boris Johnson continues to hang in the balance amid further revelations about parties held during lockdown. Former minister Tobias Ellwood is reportedly the latest to submit a letter of no confidence.

- Bunds have given back early gains and now trade below yesterday's close with cash yields 1-2bp higher on the day across much of the curve.

- The OAT curve has twist flattened with the 2s30s spread narrowing 2bp.

- The BTP curve has bear flattened with yields at the short-end/belly up 1-2bp.

- Eurozone inflation continued to push higher in January, coming in at 5.1%, up from 5.0% and defying expectations for a sharp slowdown to 4.0.%. Similarly, preliminary January CPI data for Italy came in stronger than expected (5.3% Y/Y vs 4.0% consensus).

- Supply this morning came from Greece (GTBs, EUR625mn). Italy is also selling a 10-year BTPei via syndication with a coupon of 0.4% and book size last seen above EUR18bn.

EUROZONE OPTION FLOW SUMMARY

Eurozone:

RXH2 167.5 put sold at 38 in 3k

RXH2 168 put sold at 47 in 3k

RXH2 172 call bought for 13/14/15/16 in 20.5k (hearing short cover)

RXH2 167/170.5 strangle sold at 60 in 1.7k

OEJ2 131.75/130.75 1X1.5 put spread bought for 17 in 4k

EUROPE ISSUANCE UPDATE

ITALY SYNDICATION: 10-year BTPei

- Spread set at 0.40% May-30 BTPei RY + 34bps (Guidance was + 36bps area)

- Books over E18bln incl. JLM interest of 1.5bn

- Books to close 11:00GMT / 12:00CET

- MNI expects a transaction size of E4-5bln

FOREX: EUR Corrects Higher on Hot EZ CPI Release

- Eurozone CPI came in well ahead of expectations, with the prelim January release hitting new record highs of 5.1% thanks to a particularly hot Italian inflation release (topping forecast by 1.3ppts). The EUR rallied to touch fresh session highs against the USD at 1.1305, while Bund futures briefly dipped to new daily lows.

- EUR/USD now trades just shy of first resistance at the 1.1309 50-dma, with strength following the 3-day morning star reversal pattern printed at the Monday close. Nonetheless, gains for now are considered corrective, with the more medium-term trend view still pointed lower.

- The greenback sits at the bottom of the G10 pile ahead of the Wednesday crossover, putting the USD Index on the backfoot for a third consecutive session, and through first support at the 96.10 50-dma. Dollar weakness comes alongside a further flattening in the US yield curve, with 10y yields a touch lower pre-NY hours.

- ADP employment change data takes focus going forward, with markets expecting 184k jobs added - a material slowdown from December's 807k and supporting expectations for Friday's NFP release to come in below the prior month.

FX OPTIONS: Expiries for Feb02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1200(E520mln), $1.1240(E589mln)

- USD/JPY: Y113.25($600mln), Y114.35-50($840mln), Y115.00($793mln), Y115.50($761mln), Y116.00($1.2bln)

- GBP/USD: $1.3545-50(Gbp504mln)

- AUD/USD: $0.7050(A$506mln), $0.7250(A$563mln)

- USD/CAD: C$1.2500($711mln)

Price Signal Summary - FI Futures Remain Vulnerable

- In the equity space, S&P E-minis continue to climb and the contract is approaching a key resistance area at the 50-day EMA. The average intersects at 4576.53. A clear breach of this average is required to improve bullish conditions and would highlight potential for a climb towards 4671.75, the Jan 18 high. For now, gains are still considered corrective. A resumption of weakness would refocus attention on 4121.75, the Jan 24 low. EUROSTOXX 50 futures are trading higher and price has breached the 50-day EMA at 4211.80. This average marks a key resistance area and a clear break of it would suggest scope for stronger recovery. This would open 4324.50, the Jan 13 high. Gains are, for now at least, still considered corrective. A reversal lower would refocus attention on 3990.50, the Jan 24 low.

- In FX, EURUSD continues to strengthen, having recovered from 1.1121, the Jan 28 low. Attention is on the recent 3-day Japanese candle reversal known as a morning star. This suggests scope for a stronger short-term corrective bounce. Price has breached the 20-day EMA and attention turns to the 50-day EMA at 1.1339. Key support and the bear trigger is 1.1121. GBPUSD is firmer too as the pair extends the recovery from last week’s 1.3358 low on Jan 27. Resistance at 1.3525, the Jan 26 high, has been breached. This opens 1.3566 next, Jan 24 high. A turn lower would open 1.3358, Jan 27 low and the short-term bear trigger. USDJPY has continued to retrace, having pulled back from 115.68, the Jan 28 high. Key short-term support has been defined at 113.47, the Jan 24 low. While this level holds, the outlook remains bullish and a reversal higher would refocus attention on 116.35, the Jan 4 high.

- On the commodity front, Gold remains vulnerable following the recent break of its bull channel base drawn off the Aug 9 low. The clear breach signals potential for a move lower towards $1753.6, the Dec 15 low. Resistance to watch is $1822.2, the Jan 27 high. WTI futures remain in an uptrend. The contract has cleared $87.10, the Jan 20 high and attention is on the psychological $90.00 handle.

- In the FI space, Bund futures remains in a downtrend. The contract resumed the downtrend Monday following the breach of support at 168.95, Jan 19 low. This maintains the bearish sequence of lower lows and lower highs. The focus is on 168.46, 4.00 projection of the Dec 8 - Dec 20 price swing. Gilts Monday traded through support 121.93, Jan 19 low. This confirms a resumption of the downtrend and opens 121.61 next, the Nov 13 2018 low.

EQUITIES: NASDAQ Futs on Top as Alphabet Shares Set for New Record Highs

- US equity futures sit higher ahead of the Wednesday open, indicating a positive start at the opening bell, with NASDAQ futures leading early gains. A solid set of earnings after-market Tuesday have set up markets well, with both Meta (Facebook) and Alphabet (Google) sharply higher pre-market.

- Strength across US futures put the e-mini S&P at 4575 overnight and above the 100-dma of 4563.00, which marks a fourth consecutive session of strength for the index. Gains though are still considered corrective. Price action in January resulted in a reversal of the moving average condition to bearish. This suggests that short-term gains are corrective.

- Two important resistance levels to watch are; 4522.38 (breached), the 20-day EMA and the more important 4576.53 level, the 50-day EMA. A decisive break of this resistance zone would suggest scope for a stronger reversal.

COMMODITIES: Soybean Futures Spike As S. America’s Drought Diminishes Harvests

- Soybean futures rose 2.6% to settle at $15.285 a bushel, after peaking at $15.39, the highest for a most-active contract since May 28 as South America’s harvest continues to wane amid adverse weather conditions.

- Rising petroleum prices are an additional tailwind for crop markets, since biofuels made from corn and soybeans are blended into gasoline.

- StoneX cut its estimate for top producer Brazil by 5.6% to 126.5 million metric tons, citing drought. That compares to last year’s crop totaling 145.1 million tons, and follows other expectations of declining prospects, dashing hopes of a supply recovery and relief from food inflation. (Bloomberg)

- The Soybeans extension maintains the bullish price sequence of higher highs and higher lows that defines an uptrend. Furthermore, moving average conditions also remain in bull mode, highlighting the current sentiment.

- The next level of technical resistance comes in at $1546.00 - 3.00 proj of the Nov 9 - 17 - Dec 1 price swing.

COMMODITIES: Gains Amid Broader Risk Rally

- WTI Crude up $0.36 or +0.41% at $88.51

- Natural Gas up $0.2 or +4.19% at $4.974

- Gold spot up $0.84 or +0.05% at $1795.04

- Copper up $3.25 or +0.73% at $444.3

- Silver up $0.14 or +0.63% at $22.6222

- Platinum up $10.17 or +0.99% at $1027.24

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/02/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 02/02/2022 | 1315/0815 | *** |  | US | ADP Employment Report |

| 02/02/2022 | 1330/0830 | * |  | CA | Building Permits |

| 02/02/2022 | 1500/1000 | ** |  | US | housing vacancies |

| 02/02/2022 | 1500/1000 |  | CA | BOC Deputy Gravelle speaks on swaps panel | |

| 02/02/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 02/02/2022 | 2000/1500 |  | CA | BOC Gov Macklem testifies at parliamentary committee | |

| 03/02/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 03/02/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 03/02/2022 | 0030/1130 | ** |  | AU | Trade Balance |

| 03/02/2022 | 0030/1130 | * |  | AU | Building Approvals |

| 03/02/2022 | 0700/0200 | * |  | TR | Turkey CPI |

| 03/02/2022 | 0815/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 03/02/2022 | 0845/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 03/02/2022 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/02/2022 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/02/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/02/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 03/02/2022 | 1000/1100 | ** |  | EU | PPI |

| 03/02/2022 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 03/02/2022 | 1200/1200 | *** |  | UK | Bank Of England Quantitative Easing |

| 03/02/2022 | 1245/1345 | *** |  | EU | ECB Deposit Rate |

| 03/02/2022 | 1245/1345 | *** |  | EU | ECB Main Refi Rate |

| 03/02/2022 | 1245/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 03/02/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 03/02/2022 | 1330/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 03/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 03/02/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/02/2022 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/02/2022 | 1500/1000 | ** |  | US | factory new orders |

| 03/02/2022 | 1500/1000 |  | US | Senate hearing on Federal Reserve nominees | |

| 03/02/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.