-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Eurozone Inflation Hits Another Record High

EXECUTIVE SUMMARY:

- EUROZONE JANUARY INFLATION SMASHES EXPECTATIONS TO HIT NEW HIGH

- ITALY JAN INFLATION BIGGEST RISE SINCE APRIL 1966

- NASDAQ FUTURES SIGNAL GAINS FOR TECH AFTER ALPHABET EARNINGS

- MNI BOE PREVIEW: HIKE NOW, POSSIBLY MARCH, PUSHBACK M-T

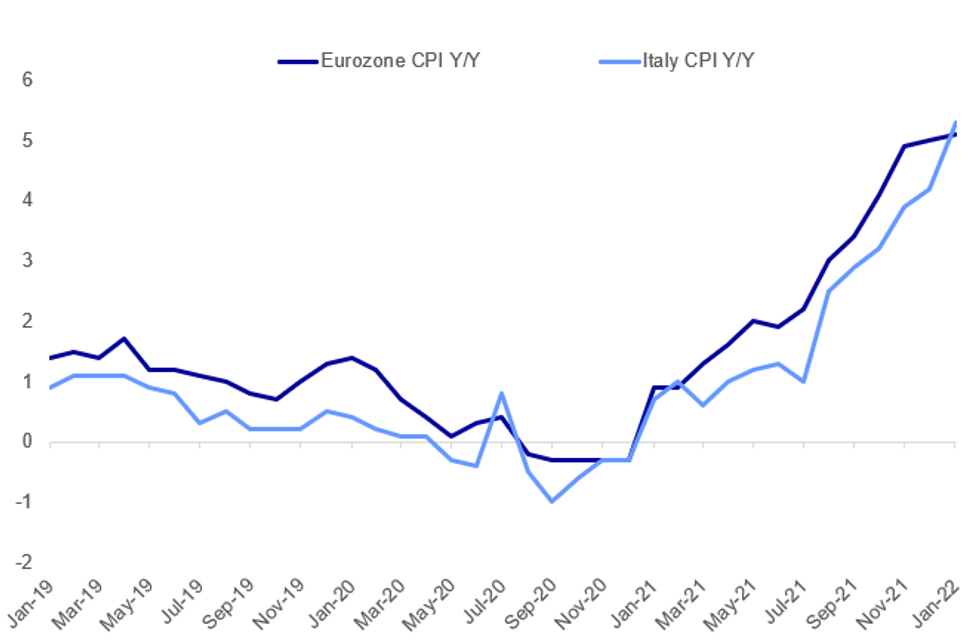

Fig. 1: Jan European Inflation Surpasses Expectations

Source: Eurostat, Istat, MNI

Source: Eurostat, Istat, MNI

NEWS:

US EQUITIES (BBG): Futures tracking the Nasdaq 100 Index signaled further gains for recently-battered tech stocks on Wednesday, as Alphabet Inc.’s forecast-beating earnings and stock split boosted sentiment. March futures tracking the index were up 1.2% at 07:55 a.m. in London, with the expected surge in Alphabet shares representing more than half the gains in the contract, according to Bloomberg calculations. Futures on the S&P 500 advanced 0.5%, while those on the Dow Jones were little changed.Google parent Alphabet posted quarterly sales and profit that topped analysts’ projections, signaling resilience of its advertising business in the face of major economic upheaval as the pandemic persists. The shares surged in late trading.

BANK OF ENGLAND (MNI MARKETS PREVIEW): The MNI Markets team expects a 25bp hike this week, along with the 26 sell-side analysts in our survey. Assuming a hike, the gilt maturing in March will almost certainly not be reinvested. Markets are fully pricing 50bp of hikes by March, but only 1/26 analysts in our survey sees that as their base case. We think markets shouldn't fully price a rate hike but that analysts are underestimating the probability. We talk through the potential rationale for a March hike. We would prefer to stay away from trading near-term meetings and instead think there is more scope to seeing Red SONIA futures move higher.For the full document including summaries of 26 sell-side analyst views and the questions for MNI Instant Answers, click here.

NATO-RUSSIA: Spain's El Pais has published the two letters submitted by the United States and NATO to Russia on the latter's demands on security guarantees. The letters offer Russia continued top-level talks on a number of issues, but hold firm on NATO's ability to expand further based on request.

(BBG): U.K. retailers raised their prices at the fastest pace in more than nine years in January, a survey showed, passing on soaring costs to consumers already grappling with a cost-of-living squeeze.The report by the British Retail Consortium suggests inflation is spreading well beyond energy prices, with goods from food to furniture seeing prices driven higher in a month when stores traditionally offer new year discounts.

GERMANY (MNI BRIEF): Germany's retailers saw a 'considerable easing' of supply chain issues in January, although more than half still saw delays in goods ordered, a survey published Wednesday by the Munich-based Ifo Institute showed. "With the end of the Christmas season, the pressure has abated somewhat," Klaus Wohlrabe, Head of Surveys at ifo, said, although he acknowledged ongoing shortages. Although easing, 57.1% of retailers said not all orders for the month were delivered. That was down sharply on the 81.6% who reported significant delays in December. goods they ordered. In December, the figure was 81.6 percent. The situation in supermarkets has perhaps seen the best improvement, with only 18.4% reporting bottlenecks, down from 64.4% in December.

BOJ (MNI INTERVIEW): The Bank of Japan should not "frantically" curb 10-year Japanese Government Bond (JGB) yields to avoid a weaker yen and instead fine tune policy ahead of expected financial market volatility this year caused by likely Fed rate hikes, a former central bank executive director told MNI. For full interview contact sales@marketnews.com

DATA:

MNI: EUROZONE FLASH HICP JAN +0.3% M/M, +5.1% Y/Y; DEC +5.0% Y/Y

EZ Jan Inflation Smashes Expectations To Hit New High

- Eurozone inflation blew through expectations in January, rising by 0.3% over December, taking the annual rate to a new euro-era high of stretching to an annual rate of 5.1%, according to data released by Eurostat on Wednesday.

- Analysts had expected a retreat to 4.5% from 5.0% in December.

- Energy prices continued to distort the inflation reading, rising by 6.0% between December and January for a 28.6% surge over the same period of last year.

- Excluding food, energy, alcohol and tobacco, core inflation declined by 0.8% in January, taking the annual rate down to 2.3%, the smallest increase since October, from 2.6% in December.

- Prices for non-energy industrial goods declined to an annual rate of 2.3% from 2.9% in December, while service sector inflation was unchanged at 2.4%.

ITALY JAN PRELIMINARY HICP +0.2 % M/M, +5.3 Y/Y (DEC +4.2%)

Italy Jan Inflation Biggest Rise Since April 1966

ITALY JAN PRELIMINARY HICP +0.2 % M/M, +5.3 Y/Y (DEC +4.2%)

ITALY JAN PREL 'NIC' CPI +1.6% M/M, +4.8% Y/Y (DEC +3.9%)

- Italian HICP rose by 0.2% in January, taking the annual pace to 5.3% from 4.2% in December.

- NIC inflation rose by 1.6% last month for a annual change for 4.8% — the biggest rise since April of 1996 — from 3.9% in December.

- Core inflation was flat in January, leaving the annual rate unchanged at 1.5%.

Graph source: ISTAT

FIXED INCOME: Becoming desensitized to European inflation surprises

Relative to recent sessions, the European morning session has been rather subdued. The highlight came at 10:00GMT / 5:00ET when Eurozone and Italian HICP were released. Eurozone HICP surprised 7 tenths to the upside (core 4 tenths), although this was compared to a stale consensus that had updated after the Spanish, German or French surprises recently. Italian HICP came in 13 tenths above consensus expectations with the national NIC inflation seeing the biggest annual rise since April 1996.

- The Euribor strip saw little reaction and is largely unch on the day while Bunds saw a kneejerk fall of about 20 ticks that was almost instantly retraced.

- Looking ahead we have ADP employment this afternoon but markets are already looking ahead to tomorrow's ECB and BOE meetings.

- TY1 futures are up 0-3+ today at 127-31+ with 10y UST yields down -0.4bp at 1.785% and 2y yields up 0.7bp at 1.173%.

- Bund futures are up 0.10 today at 168.86 with 10y Bund yields down -0.9bp at 0.025% and Schatz yields down -0.1bp at -0.481%.

- Gilt futures are up 0.16 today at 122.10 with 10y yields down -1.0bp at 1.288% and 2y yields down -0.2bp at 1.052%.

FOREX: EUR Corrects Higher on Hot EZ CPI Release

- Eurozone CPI came in well ahead of expectations, with the prelim January release hitting new record highs of 5.1% thanks to a particularly hot Italian inflation release (topping forecast by 1.3ppts). The EUR rallied to touch fresh session highs against the USD at 1.1305, while Bund futures briefly dipped to new daily lows.

- EUR/USD now trades just shy of first resistance at the 1.1309 50-dma, with strength following the 3-day morning star reversal pattern printed at the Monday close. Nonetheless, gains for now are considered corrective, with the more medium-term trend view still pointed lower.

- The greenback sits at the bottom of the G10 pile ahead of the Wednesday crossover, putting the USD Index on the backfoot for a third consecutive session, and through first support at the 96.10 50-dma. Dollar weakness comes alongside a further flattening in the US yield curve, with 10y yields a touch lower pre-NY hours.

- ADP employment change data takes focus going forward, with markets expecting 184k jobs added - a material slowdown from December's 807k and supporting expectations for Friday's NFP release to come in below the prior month.

EQUITIES: Tech Leads Gains After Strong Earnings

- Asian stocks closed stronger: Japan's NIKKEI closed up 455.12 pts or +1.68% at 27533.6 and the TOPIX ended 40.5 pts higher or +2.14% at 1936.56.

- European equities are gaining, with the German Dax up 90.43 pts or +0.58% at 15619.39, FTSE 100 up 55.67 pts or +0.74% at 7535.78, CAC 40 up 43.12 pts or +0.61% at 7099.49 and Euro Stoxx 50 up 30.5 pts or +0.72% at 4224.45.

- U.S. futures are again higher led by tech, with the Dow Jones mini up 50 pts or +0.14% at 35324, S&P 500 mini up 37.5 pts or +0.83% at 4572.5, NASDAQ mini up 244.75 pts or +1.63% at 15239.5.

COMMODITIES: Gains Amid Broader Risk Rally

- WTI Crude up $0.36 or +0.41% at $88.51

- Natural Gas up $0.2 or +4.19% at $4.974

- Gold spot up $0.84 or +0.05% at $1795.04

- Copper up $3.25 or +0.73% at $444.3

- Silver up $0.14 or +0.63% at $22.6222

- Platinum up $10.17 or +0.99% at $1027.24

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/02/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 02/02/2022 | 1315/0815 | *** |  | US | ADP Employment Report |

| 02/02/2022 | 1330/0830 | * |  | CA | Building Permits |

| 02/02/2022 | 1500/1000 | ** |  | US | housing vacancies |

| 02/02/2022 | 1500/1000 |  | CA | BOC Deputy Gravelle speaks on swaps panel | |

| 02/02/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 02/02/2022 | 2000/1500 |  | CA | BOC Gov Macklem testifies at parliamentary committee | |

| 03/02/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 03/02/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 03/02/2022 | 0030/1130 | ** |  | AU | Trade Balance |

| 03/02/2022 | 0030/1130 | * |  | AU | Building Approvals |

| 03/02/2022 | 0700/0200 | * |  | TR | Turkey CPI |

| 03/02/2022 | 0815/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 03/02/2022 | 0845/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 03/02/2022 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/02/2022 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/02/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/02/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 03/02/2022 | 1000/1100 | ** |  | EU | PPI |

| 03/02/2022 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 03/02/2022 | 1200/1200 | *** |  | UK | Bank Of England Quantitative Easing |

| 03/02/2022 | 1245/1345 | *** |  | EU | ECB Deposit Rate |

| 03/02/2022 | 1245/1345 | *** |  | EU | ECB Main Refi Rate |

| 03/02/2022 | 1245/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 03/02/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 03/02/2022 | 1330/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 03/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 03/02/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/02/2022 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/02/2022 | 1500/1000 | ** |  | US | factory new orders |

| 03/02/2022 | 1500/1000 |  | US | Senate hearing on Federal Reserve nominees | |

| 03/02/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.