-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Periphery EGB Spreads Continue To Widen

EXECUTIVE SUMMARY:

- MAJOR MEETINGS TODAY AS MACRON VISITS PUTIN, SCHOLZ SEES BIDEN

- NO LET UP YET IN GERMAN PRICE INCREASES: IFO

- CONSTRUCTION LEADS GERMAN I.P. SLUMP

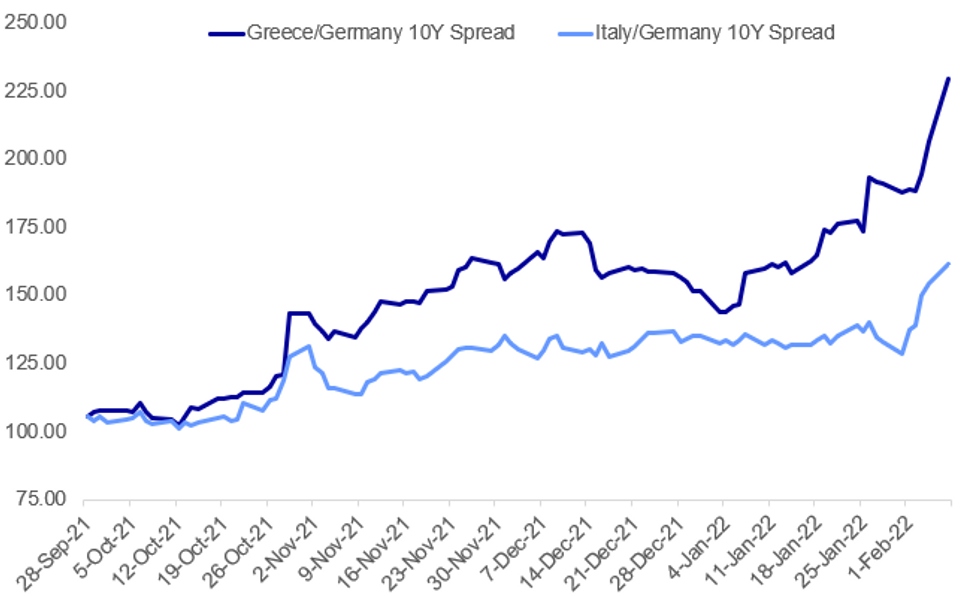

Fig. 1: Periphery EGB Spreads Continue To Widen Post-ECB

Source: Bloomberg, MNI

Source: Bloomberg, MNI

NEWS:

GEOPOLITICS (MNI POLITICS): Significant day of top-level geopolitical summits taking place today, with French President Emmanuel Macron travelling to Moscow for talks with his Russian counterpart Vladimir Putin. Meanwhile, German Chancellor Olaf Scholz meets with US President Joe Biden in Washington, D.C.

MNI ECB Review: While the February policy outcomes were in line with expectations (no change on all fronts), the press conference indicated a notably hawkish shift within the Governing Council. Such a marked split between the initial policy announcement and the follow-up presser is quite rare and likely reflects the difficulty facing the ECB as it tries to address concerns about inflation risks, while still clinging on to its baseline assumption that the recent inflation surge will ultimately prove transitory. For the full review click here

ECB (MT NEWSWIRES - OVERNIGHT): Dutch Central Bank Governor Klaas Knot is asking the European Central Bank to increase interest rates in the fourth quarter and end net bond purchases as soon as possible, London's Financial Times reported Feb. 6. Knot, who is also a member of the ECB governing council, added that inflation in the euro area could remain at 4% for most of 2022. The eurozone inflation is expected to reach a record-high of 5.1% in January, higher than the market estimate of 4.4%.

PELOTON / US EQUITIES (BBG): Peloton Interactive Inc. soared in premarket trading after reports that it’s exploring takeover options. The New York-based company is working with an adviser after a plunge in the shares made it a takeover target, according to people familiar with the matter, who asked not to be identified because discussions are private. The takeover interest is exploratory and may not lead to a transaction, they said. The stock rose 27% in early premarket trading in New York.

UK DATA (BBG): U.K. house prices rose at the slowest pace in more than six months in January after a bumper end to 2021 left the average value of a home at a record high.Prices rose just 0.3% following four months of gains above 1%, mortgage lender Halifax said Monday. In a sign of a more normal market, the number of transactions fell toward pre-Covid levels, it said.

DATA:

MNI BRIEF: No Let Up Yet In Germany Price Increases: Ifo

Germany's corporate sector is expected to raise prices to customers further in coming months, with the steepest increases expected in the service sector, but remain elevated across the economy, a survey for the Munich-based Ifo Institute published Monday shows.

According to Timo Wollmershauser, Ifo's head of forecasting, those pricing expectations will likely filter down into consumer prices, meaning 'inflation will remain above 4% for a while.'

The European Central Bank is growing increasingly concerned about the near-term outlook for inflation, with President Christine Lagarde saying on Feb 3 that risks in coming months were to the upside.

MNI: GERMANY DEC IP -0.3% M/M, -4.1% Y/Y; NOV +0.3r% M/M

Construction leads the slump in German IP

DEC IP -0.3% M/M, -4.1% Y/Y; NOV +0.3r% M/M

- Germany's industrial production disappointed again today, with both monthly and annual readings coming in below expectations.

- IP edged further downwards by -0.3% m/m, one point lower than upwardly-revised November and 0.8% m/m lower than the forecast which saw an increase of 0.5% m/m.

- On the year, IP also disappointed, dipping a further 1.9 points to -4.1% y/y in December, despite the consensus expecting a softer 3.6% decline. Capital goods and intermediate production rose by 2.5% and 0.6% respectively, however consumer goods production dampened by 0.5%. Construction led the decline at -7.3%.

- Compared to the pre-pandemic level, German IP was 6.9% lower in December.

FIXED INCOME: Lagarde in focus later as European peripherals under huge pressure

- Bunds and to an even greater extent, European peripheral bonds are under pressure this morning following weekend comments from DNB President Knot over the weekend that a 25bp hike would be appropriate in Q4-22 following by another 25bp hike to bring the Deposit Rate to 0% in Q1-23. 10-year GGB spreads to Bunds are over 20bp wider on the day, 10-year BTP spreads 8.7bp wider at typing, while even core spreads are widening such as 10-year OAT spreads 1.7bp wider on the day. President Lagarde is due to give an introductory statement ahead of the European Parliament's Economic and Monetary Affairs Committee at 15:45GMT / 10:45ET. Her comments would have been in focus anyway, but with the huge moves in EGBs there is even more focus.

- Moves in gilts and Treasuries have been more subdued with 10-year UST yields unch but shorter yields lower as the curve bull steepens. Gilt have seen short end yields higher, but little change in 10-year as the curve bear flattens.

- TY1 futures are up 0-3+ today at 126-28 with 10y UST yields unch at 1.911% and 2y yields down -1.5bp at 1.298%.

- Bund futures are down -0.36 today at 165.66 with 10y Bund yields up 2.5bp at 0.228% and Schatz yields up 1.3bp at -0.243%.

- Gilt futures are up 0.02 today at 120.99 with 10y yields up 0.3bp at 1.412% and 2y yields up 1.5bp at 1.270%.

FOREX: Subdued, With All Focus on CPI

- Markets have started the week in subdued fashion, with most major pairs trading inside their recent ranges, although a modest risk-off tone continues to hang over price action.

- JPY is the best performing currency in G10, with USD/JPY briefly edging below the Y115.00 handle, albeit still trades clear of the Friday low of 114.77.

- One standout currency is the NOK, falling against all others in G10 as USD/NOK bounces further off the 200-dma at 8.681. Next upside target rests at the 50-dma of 8.8989, which remains within range should crude oil prices roll further off their recent highs.

- ECB's Lagarde is due to speak later today (1545GMT/1045ET) and markets will be on watch for any reinterpretation of last week's hawkish ECB meeting. Markets continue to price in around 50bps of tightening by year-end, a marked shift that continues to widen Italian/Spanish spreads against Germany - a correlation that has historically been negative for the EUR.

- Focus remains on US CPI data later in the week, with markets expecting Y/Y CPI to rise to 7.3% - a new multi-decade high. Sentiment leading into the release will likely drive sentiment over the coming days, particularly through the lens of US monetary policy.

EQUITIES: Shanghai Stocks Catch Up Post Holiday

- Japanese markets closed weaker, while China markets rose on the post-holiday re-open: Japan's NIKKEI closed down 191.12 pts or -0.7% at 27248.87 and the TOPIX ended 4.57 pts lower or -0.24% at 1925.99. China's SHANGHAI closed up 68.141 pts or +2.03% at 3429.581 and the HANG SENG ended 6.26 pts higher or +0.03% at 24579.55.

- European equities are fairly flat, with the German Dax up 2.21 pts or +0.01% at 15111.04, FTSE 100 up 17.56 pts or +0.23% at 7534.16, CAC 40 up 4.81 pts or +0.07% at 6957.54 and Euro Stoxx 50 down 4.73 pts or -0.12% at 4084.02.

- U.S. futures are weaker, with the Dow Jones mini down 127 pts or -0.36% at 34851, S&P 500 mini down 14.25 pts or -0.32% at 4478.25, NASDAQ mini down 45 pts or -0.31% at 14640.5.

COMMODITIES: Industrials Lower; Precious Gains

- WTI Crude down $1.5 or -1.63% at $90.8

- Natural Gas down $0.16 or -3.41% at $4.419

- Gold spot up $3.46 or +0.19% at $1811.79

- Copper down $4.3 or -0.96% at $444.8

- Silver up $0.22 or +0.98% at $22.7435

- Platinum down $13.08 or -1.27% at $1015.27

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/02/2022 | 1545/1645 |  | EU | ECB Lagarde Intro at ECON EU Parliament | |

| 07/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 07/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 07/02/2022 | 2000/1500 | * |  | US | Consumer Credit |

| 08/02/2022 | 0700/0800 | ** |  | SE | Private Sector Production |

| 08/02/2022 | 0745/0845 | * |  | FR | current account |

| 08/02/2022 | 0745/0845 | * |  | FR | foreign trade |

| 08/02/2022 | 0800/0900 | ** |  | ES | industrial production |

| 08/02/2022 | 0900/1000 | * |  | IT | retail sales |

| 08/02/2022 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 08/02/2022 | 1330/0830 | ** |  | US | trade balance |

| 08/02/2022 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 08/02/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 08/02/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 08/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 08/02/2022 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.