-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Stocks Jump On Apparent De-Escalation

EXECUTIVE SUMMARY:

- RUSSIA RETURNING SOME TROOPS TO BASES AFTER DRILLS: INTERFAX

- LAVROV SAYS SECURITY AGREEMENT POSSIBLE WITH U.S.

- EU'S BORRELL: IF RUSSIA-UKRAINE WAR, NORDSTREAM 2 CANNOT OPERATE

- UK Q4 EMPLOYMENT DOWN; REAL EARNINGS NEGATIVE

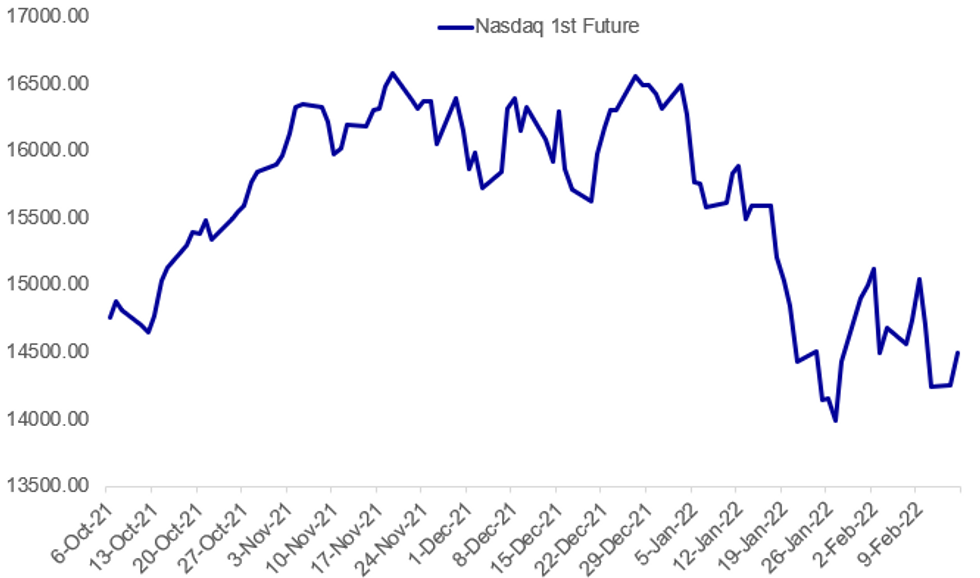

Fig. 1: Geopolitical Relief Rally

Source: BBG, MNI

Source: BBG, MNI

NEWS:

RUSSIA (BBG/INTERFAX): Russia’s Defense Ministry announced the start of a pullback of some forces after drills that raised U.S. and European alarm about a possible military assault on Ukraine. The Kremlin has consistently denied it plans an attack. Units of the Western and Southern military districts on Tuesday will begin returning to permanent bases after completing exercises, the Interfax news service reported, citing the Defense Ministry in Moscow.

RUSSIA (RTRS): Interfax cited the district command as saying that some of the troops were moving to bases in Russia's southern regions of Dagestan and North Ossetia. Russia annexed Crimea in 2014.

RUSSIA/EUROPE (WASH POST): Eleventh-hour diplomatic efforts are continuing, with German Chancellor Olaf Scholz in Moscow for talks with the Russian president. Italy's foreign minister is due in Kyiv on Tuesday and Poland's top diplomat is set to meet with his Russian counterpart in Moscow the same day.

RUSSIA-EUROPE-ENERGY: Wires and social media carrying comments from EU High Representative for Foreign Affairs and Security Josep Borrell stating that the EU is ready to discuss Russian security concerns with Moscow.

- Borrell says that if there is war between Russia and Ukraine then the Nord Stream II gas pipeline will not become operational. Could spark major backlash from Germany, which has refused to rule out the project going ahead even if there is a Russian invasion.

- Says that in the event of an invasion, sanctions will affect Russia 'from every viewpoint'.

RUSSIA/ENERGY (BBG): Oil retreated from the highest since 2014 as traders weighed a possible cooling in the Ukrainian crisis.Brent futures fell as much as 2.1% to trade below $95 a barrel while futures in New York also slumped. Some Russian military units will start returning to their permanent bases on Tuesday after completing drills, Interfax reported, citing the Defense Ministry.

RUSSIA-UKRAINE (BBG): The lower house of Russia’s parliament voted to appeal to President Vladimir Putin to recognize separatist entities in eastern Ukraine, potentially raising tensions in the region.Duma Speaker Vyacheslav Volodin said the resolution will be sent to the president “immediately.” The Kremlin so far hasn’t publicly stated its position on the proposal. The Duma rejected a draft proposed by the ruling United Russia party to send the resolution to the Foreign Ministry for consideration.

GERMANY/COVID (BBG): Germany will start easing pandemic restrictions this week under a three-stage plan that would see most curbs gone by March 20, according to draft proposals published in local media.Chancellor Olaf Scholz will hold a latest round of strategy talks with regional leaders on Wednesday. The draft prepared for the meeting includes immediately removing the requirement for people to be vaccinated or recovered to enter non-essential stores and allowing private gatherings of as many as 20 people, German public broadcaster ARD and other media reported.

EUROZONE: Soaring natural gas prices are currently the main driver of low growth in the euro area, a study published as part of the latest ECB Economic Bulletin concludes, with the combined effect of surging oil and gas costs potentially reducing euro area output by 0.2% by the end of this year. The direct and indirect effect of a 10% gas rationing shock on the corporate sector could cut euro area gross value added by about 0.7%, while a permanent one standard deviation increase in gas prices from the first quarter of 2021 would cut euro area GDP by around 0.2% over a three-year projection horizon

EUROZONE: Next Generation EU and RRF funds are expected to raise euro area real GDP by around 0.5% in 2022 and 2023, according to an ECB Economic Bulletin study published Tuesday, with the greatest positive impacts for those member states with a lower GDP per capita in 2019. NextGenEU-related growth will “largely” persist until the programme ends in 2026, the authors found, and its macroeconomic effects even be higher than currently estimated on account of confidence effects and structural reforms. However doubts remain over how effectively a one-off initiative can promote such reforms over the longer term.

DATA:

UK PAYROLLS +108,000 IN JAN

MNI: UK ILO DEC UNEMPLOYMENT RATE 4.1%

MNI DATA BRIEF: UK Q4 Employment Down; Real Earnings Negative

UK employment declined by 38,000 in the fourth quarter, according to the LFS survey, the first fall since the three months to February 2021, the Office for National Statistics said Tuesday. The decline accompanied a sharp fall in real earnings, with inflation-adjusted total earnings declining by an annual rate of 0.1%, while real regular earnings slumped by 0.8%, the first declines since the third quarter of 2020.

Nominal earnings actually rose in the fourth quarter, defying analysts’ expectations of a decline. Total earnings rose to an annual rate of 4.3%, while ex-bonus wages slipped to 3.7% from 3.8% previously.

Payroll employment rose by 108,000 in January to stand 436,000 above pre-pandemic levels. The December outturn was revised downward to an increase of 130,000 from the originally-reported 184,000 increase. The employment rate steadied at 75.5%, matching the level recorded in the three months to November, while the unemployment rate was unchanged at 4.1%. The fall in LFS employment was largely due to a drop in employment amongst the over-65’s, according to an ONS official.

Spanish Inflation Mixed; Jan CPI Softer than Flash, HICP revised higher

FINAL HICP JAN -0.8%r M/M, +6.2%r Y/Y; DEC +6.6% Y/Y

SPAIN FINAL CPI JAN -0.4%r M/M, +6.1%r Y/Y; DEC +6.5% Y/Y

- The final inflation print for January CPI confirmed that Spanish headline inflation has eased a touch, slipping to +6.1%r y/y, down from +6.5% y/y in December following ten months of growth.

- Headline CPI numbers were weaker than flash estimates and the consensus forecasts by 0.1% on both month on month and annualised readings.

- On the month HICP weakened by -0.8%r m/m, just below the -0.9% m/m preliminary reading, whilst HICP fell to an upwardly revised +6.2%r y/y (flash +6.1% y/y) from +6.6% y/y in December.

- Housing prices (including utilities) were a downwards driver, moderating 0.5% to +18.1% y/y due to lower electricity prices. Food costs also softened 0.2% to +4.8% y/y, as well as leisure services down by 0.5% to +1.2% due to cuts in tourism prices.

- However, transport costs continued to rise, up 0.4% to +11.3% y/y due to the jump in fuel prices.

- January prints are based on the adjusted 2021 basket weights.

Source: INE

GERMANY FEB ZEW CURRENT CONDITIONS -8.1

*MNI: GERMANY FEB ECONOMIC SENTIMENT INDEX 54.3

MNI: EZ FLASH Q4 GDP +0.3% Q/Q, +4.6% Y/Y

MNI: EZ FLASH Q4 EMPLOYMENT +0.5% Q/Q; Q3 +1.0% Q/Q

FIXED INCOME: Risk recoveries see core FI under pressure

Reports that Russia have been pulling back troops from the Ukrainian border has helped risk appetite through the European morning session with equities moving higher and core fixed income selling off (although there has been some pause in the FI moves lower following further headlines).

- Treasuries have seen the biggest moves, with the curve bear steepening and 10-year yields up 4.7bp on the day at writing.

- Gilts have been the exception. After decent labour market data this morning, we initially saw the whole SONIA futures curve move lower and gilts move lower on the open. However, we have now seen a decent reversal based on little new news - possibly positioning ahead of tomorrow's inflation data with the market looking overstretched and due for a bit of a move higher.

- Peripheral spreads (other than Greek) are generally a bit tigther today.

- TY1 futures are down -0-8+ today at 125-23 with 10y UST yields up 4.7bp at 2.036% and 2y yields up 1.2bp at 1.589%.

- Bund futures are down -0.44 today at 164.79 with 10y Bund yields up 1.5bp at 0.296% and Schatz yields up 0.8bp at -0.361%.

- Gilt futures are up 0.04 today at 119.68 with 10y yields down -1.8bp at 1.570% and 2y yields up 0.8bp at 1.512%.

FOREX: Markets Reverse Risk-Off Poise as Russian Troops Demobilize

- Markets are reversing the risk-off posture seen since the beginning of the week, with signs that Russia are pulling back troops from both the eastern and southern Ukrainian borders the latest catalyst for a risk-on rally. As a result, the currencies that were hardest hit yesterday (namely SEK, AUD and EUR) are among the strongest performers so far.

- Equities have rallied sharply, with US futures pointing to a solidly positive open of 1.5-2.0% later today. Markets clearly have some way to go before retracing the Russia-inspired sell-off, with EUR/JPY still much closer to recent lows relative to recent highs. 131.39 marks first resistance for the cross ahead of 131.60 and the 132 handle.

- UK jobs data came in largely inline with expectations, leaving little reason for the MPC to change tack on their current tightening path. Sell side consensus continues to shift toward a protracted tightening cycle in the UK, with both HSBC and Goldman Sachs steepening their BoE rate path assumptions in the past few days.

- Focus turns to the US PPI release for January, with markets expecting headline final demand PPI to moderate to 9.1% from 9.7% on a Y/Y basis. There are few central speakers of note, with just ECB's Villeroy on the docket.

EQUITIES: Stocks Reverse Higher On Calmer Geopolitics

- Asian equities closed mixed: Japan's NIKKEI closed down 214.4 pts or -0.79% at 26865.19 and the TOPIX ended 15.95 pts lower or -0.83% at 1914.7. China's SHANGHAI closed up 17.206 pts or +0.5% at 3446.088 and the HANG SENG ended 200.86 pts lower or -0.82% at 24355.71

- European equities have rebounded sharply from earlier losses, with the German Dax up 200.79 pts or +1.33% at 15325.08, FTSE 100 up 56.24 pts or +0.75% at 7590.67, CAC 40 up 84.24 pts or +1.23% at 6941 and Euro Stoxx 50 up 51.81 pts or +1.27% at 4118.17.

- U.S. futures are also gaining, led by tech, with the Dow Jones mini up 305 pts or +0.88% at 34776, S&P 500 mini up 53.75 pts or +1.22% at 4447.75, NASDAQ mini up 247 pts or +1.73% at 14500.

COMMODITIES: Oil And Precious Metals Lower On Ukraine/Russia De-Escalation

- WTI Crude down $2.46 or -2.58% at $92.7

- Natural Gas up $0.22 or +5.15% at $4.413

- Gold spot down $13.53 or -0.72% at $1858.59

- Copper up $2.1 or +0.47% at $452.8

- Silver down $0.39 or -1.64% at $23.4658

- Platinum down $3.79 or -0.37% at $1028.15

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/02/2022 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 15/02/2022 | 1330/0830 | *** |  | US | PPI |

| 15/02/2022 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/02/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 15/02/2022 | 1400/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

| 15/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 15/02/2022 | 1915/1415 |  | US | Senate Banking Committee votes on Federal Reserve nominees | |

| 15/02/2022 | 2100/1600 | ** |  | US | TICS |

| 16/02/2022 | 0130/0930 | *** |  | CN | CPI |

| 16/02/2022 | 0130/0930 | *** |  | CN | Producer Price Index |

| 16/02/2022 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 16/02/2022 | 0700/0700 | *** |  | UK | Producer Prices |

| 16/02/2022 | 0700/0800 | ** |  | NO | Norway GDP |

| 16/02/2022 | 0930/0930 | * |  | UK | ONS House Price Index |

| 16/02/2022 | 1000/1100 | ** |  | EU | industrial production |

| 16/02/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 16/02/2022 | 1330/0830 | *** |  | US | Retail Sales |

| 16/02/2022 | 1330/0830 | ** |  | US | import/export price index |

| 16/02/2022 | 1330/0830 | *** |  | CA | CPI |

| 16/02/2022 | 1330/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 16/02/2022 | 1330/0830 | ** |  | CA | Wholesale Trade |

| 16/02/2022 | 1415/0915 | *** |  | US | Industrial Production |

| 16/02/2022 | 1500/1000 | * |  | US | business inventories |

| 16/02/2022 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 16/02/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 16/02/2022 | 1600/1100 |  | US | Minneapolis Fed's Neel Kashkari | |

| 16/02/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 16/02/2022 | 1830/1330 |  | CA | BOC Deputy Lane speech | |

| 16/02/2022 | 1900/1400 | * |  | US | FOMC Minutes |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.