-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Diplomacy Mostly Prevailing

EXECUTIVE SUMMARY:

- KREMLIN: NATO WRONG ON NO WITHDRAWAL, PUTIN SHOWING DESIRE TO TALK

- UK INFLATION HITS FRESH 30-YR HIGH IN JANUARY

- TOP EUROPEAN COURT RULES E.U. CAN FREEZE AID TO POLAND AND HUNGARY

- BIDEN ADMINISTRATION SAYS CHINA FAILED TRADE COMMITMENTS ON MULTIPLE FRONTS

- PBOC RRR CUT IN VIEW AS FED NARROWS POLICY WINDOW-ADVISORS (MNI EXCLUSIVE)

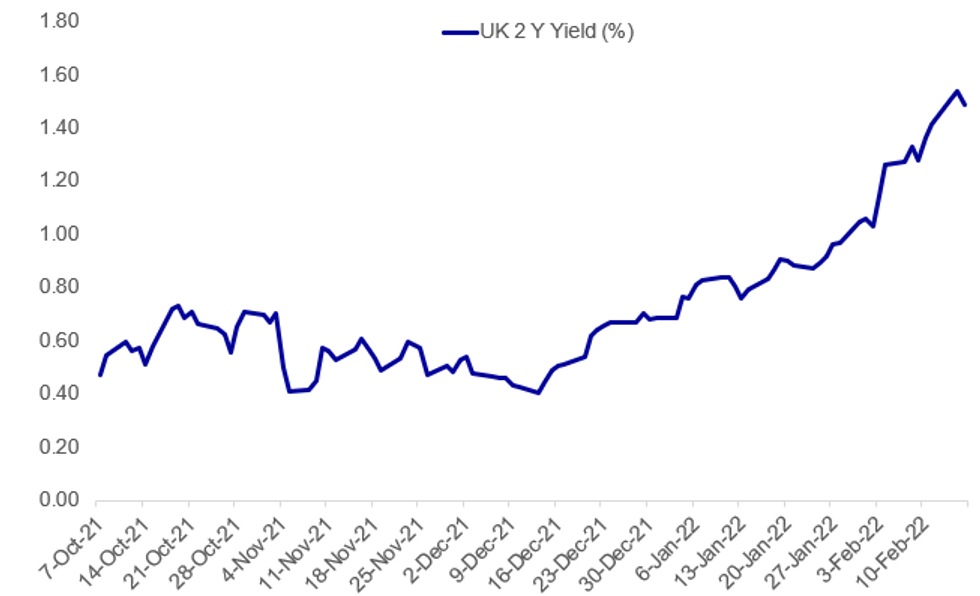

Fig. 1: UK Inflation Higher Than Expected, But Yields Pull Back

Source:BBG, MNI

Source:BBG, MNI

NEWS:

RUSSIA-UKRAINE: A number of comments from the Kremlin hitting wires, seemingly seeking to double-down on previous comments hinting at a de-escalation of tensions on the Russian border.

- Overnight a number of Western nations have expressed scepticism of the shift in some Russian troops away from the Ukrainian border. This orning the Kremlin has stated that NATO is 'wrong' to suggest there is no evidence of a withdrawal.

- On the US' stance, Kremlin says that it is positive that President Joe Biden has expressed willingness to talk - with Kremlin also stating that Puting is 'stressing his desire to negotiate' - and that Russia welcomes fact that 'Biden is thinking about the Russian people'.

- Russia will seemingly not recognise the breakaway Ukrainian regions of Donetsk and Luhansk, stating that it woulnot be in line with the 'Minsk accords'.

- NATO, its members, and the Ukrainian gov't are still being extremely cautious with regards to the legitimacy of the Russian 'withdrawal', stating that there are still enough troops on the Ukrainian border to launch a major offensive at short notice.

E.U. (NY TIMES): Europe’s top court ruled on Wednesday that the European Union can withhold funding from member countries failing to uphold the rule of law, arming the bloc to step up its efforts to defend its core values. The ruling shoots down a lawsuit by Hungary and Poland, the two countries most directly and immediately affected, whose governments the European Union has been increasingly at odds with, and opens a new chapter in the dispute that could see the countries losing out on tens of billions of euros in aid. The European Court of Justice ruling, which is final, provides ample legal and political cover to the European Commission, the bloc’s executive, to flex its muscle and withhold vital aid to the two countries over what it has long seen as a pernicious and deliberate illiberal drift away from E.U. standards.

EU (MNI POLITICS): European Commission President Ursula von der Leyen is set to come under increasing pressure in the weeks and months ahead to impose financial and legal penalties on the gov'ts of Hungary and Poland for breaches of the EU's rule of law standards. MEPs from the centre and left of the political spectrum are likely to seek to pressure von der Leyen to hit both gov'ts with sizeable cuts to their structural funding budgets. However, there are concerns within some areas of EU leadership that hittingboth gov'ts hard could have the opposite effect from intended insofar as the sanctions pushing both countries further away from the EU rather than bringing them back in line with liberal democratic values.

US-CHINA (NY TIMES): The Biden administration criticized China in a new Wednesday morning for failing to uphold a wide range of trade commitments, including promises it had made when it joined the World Trade Organization in 2001 and others in a trade deal signed with the Trump administration in 2020.In its annual assessment of China’s compliance with its obligations to the W.T.O., the Office of the United States Trade Representative excoriated the Chinese government for flouting the global trade body’s rules and its transparent, market-oriented approach. Instead, China expanded its state-led approach to its economy and trade, causing serious harm to workers and businesses around the world, particularly in industries targeted by its industrial plans, Katherine Tai, the U.S. trade representative, said in a statement.

BOJ: Bank of Japan Governor Haruhiko Kuroda on Wednesday declined to rule out a possible wider the 10-year interest rate range - now around plus and minus 0.25% - although he reiterated there is no need to widen the range now. Kuroda told lawmakers that the BOJ does not intend to raise interest rates under its yield curve control policy and is aimed at forming :an appropriate yield curve. He did not elaborate on what "appropriate" meant, but added the BOJ has no plan to sharply steepen the yield curve.

PBOC (MNI EXCLUSIVE): The People's Bank of China may cut reserve requirement ratios before an expected Federal Reserve rate hike in March further crimps its policy space, and is likely to be increasingly cautious about pushing forward with an easing cycle as it watches to see whether credit demand improves in response to past stimulus, policy advisors and economists told MNI. For full article please contact sales@marketnews.com

OIL (BBG): The OPEC+ producers’ group needs to pump more oil to bridge a gap between supply and demand and to reduce price volatility that’s seen crude skyrocket towards $100 a barrel this year.Speaking by video link to a conference in Saudi Arabia, one of the leaders of the alliance, International Energy Agency Executive Director Fatih Birol told the group that it’s lagging in meeting output targets and needs to catch up. Prince Abdulaziz bin Salman Al Saud, the Saudi energy minister, is set to speak at the same conference later today in a session that’s closed to media.

CHINA/HONG KONG (BBG): President Xi Jinping called for Hong Kong officials to take “all necessary measures” in getting the city’s virus outbreak under control, an unusually direct intervention that could pave the way for stricter measures and possibly a broader lockdown in the Asian financial hub.The Chinese leader said Chief Executive Carrie Lam’s government should make stabilizing the Covid-19 situation its top priority, the state-run Wen Wei Po and Ta Kung Pao newspapers reported Wednesday, without saying where they got the information.

ECB: Combining the Headline Consumer Price Index (HCPI) with the Owner-Occupied Housing Index (OOHPI) would have resulted added between 0.4 and 0.6 percentage points to the euro area average inflation rate in the second and third quarters of 2021, preliminary calculations published in the latest ECB Economic Bulletin show, compared with a maximum of 0.3% from 2012-2020.

GERMANY (BBG): German national railway operator Deutsche Bahn AG has taken the first concrete steps to prepare for a potential sale or listing of its DB Schenker logistics unit, which could be around 20 billion euros ($23 billion), people familiar with the matter said. The government-owned company is working with a consultant and legal advisers to ready the business for a possible transaction later this year, said the people, who asked not to be identified because discussions are private.

ERICSSON (BBG): Ericsson may have made payments to the ISIS terror organization to gain access to certain transport routes in Iraq, the company’s chief executive officer Borje Ekholm told newspaper Dagens Industri.Shares in the Stockholm-based company fell as much as 8.5% in early trading Wednesday, the most since July.In an interview with the business daily, the CEO said that Ericsson had identified “unusual expenses dating back to 2018” but the company hasn’t yet determined who the final recipient of the money was. “What we are seeing is that transport routes have been purchased through areas that have been controlled by terrorist organizations, including ISIS,” Ekholm added.

CRYPTO: Crypto-asset markets are fast evolving and could reach a point where they represent a threat to global financial stability due to their scale, structural vulnerabilities and increasing interconnectedness with the traditional financial system, the Financial Stability Board said in a report issued Wednesday.

DATA:

MNI: UK JAN CPI -0.1% M/M, +5.5% Y/Y

UK JAN CORE CPI -0.4% M/M, +4.4% Y/Y

MNI BRIEF: UK Jan Inflation At Fresh 30-Year High

UK CPI continued to rise in January, stretching to an annual rate of 5.5%, from 5.4% in the final month of 2021, matching analysts’ expectations. That’s the highest reading since March1992. Core inflation rose more steeply, hitting a record high of 4.4% from 4.2% in December.

The increase in broader inflation came despite a downward contribution from fuel prices, which subtracted 0.07 percentage points from the change in CPI. With petrol prices resuming their upward trajectory in February, inflation could accelerate in months to come. Many analysts’ believe CPI will peak above the Bank of England’s forecast of 7.25%. Clothing and footwear accounted for 0.19 percentage points of the rise in PPI, with prices falling by just 2.9% last month, the smallest decline since 1990. Clothing slumped by 4.9% in the same period a year earlier.

RPI accelerated more quickly, rising to an annual rate of 7.8% from 7.5% in December, while RPIX rose to 8.0% from 7.7% previously. Both readings are the highest since March 1991.

MNI: UK Jan OUTPUT PPI +1.2% M/M, +9.9% Y/Y

UK output price inflation accelerated to an annual rate of 9.9% in January, the fastest pace since September of 2009, from 9.3% in December. That’s far higher than the 9.1% pace forecast by City analysts. Core output PPI also picked up steam, rising to a record-high 9.3% from 8.6% in December.

Other manufactured products provided the biggest lift to output PPI, particularly timber used in construction. Input PPI eased modestly from elevated levels, slipping to an annual rate of 13.6% from 13.8%.

UK: ONS To Reweight Inflation On Pandemic-Era Spending

The Office for National Statistics has reweighted its CPI and CPIH baskets for 2022, to further reflect pandemic era spending adjustments, consistent with international standards. The ONS said it will be publishing fuller details alongside the February inflation data due for release in March.

Martin Weale, a former BOE MPC member and an economic advisor to the ONS recently expressed some concern over this method, suggesting a closer alignment with pre-pandemic spending should be used. (MNI:Weightings May Distort 2022 UK Inflation Data- ONS Advisor)

FIXED INCOME: UK short-end biggest mover of the day

- The short-end of the UK curve has been the biggest mover this morning with 2-year gilt yields down 5.1bp on the day. The SONIA strip has also moved higher. This follows inflation data released in the UK this morning that was actually a tenth higher than consensus expectations, but the surprise primarily driven by clothing prices which may reverse in next month's print. With so much priced in, the market feels like it needed a higher than consensus print in order to keep the downside momentum on the short-end. 10-year gilts have moved more in line with Treasuries and Bunds.

- After some divergence in Bunds and Treasuries this morning, 10-year yields for both are now down 0.6bp on the day. This seems to be more markets finding a level following the Ukraine headlines yesterday rather than any new headline driven moves today.

- US retail sales, industrial production, the FOMC Minutes and Canadian inflation are all due for release today.

- TY1 futures are up 0-2 today at 125-25+ with 10y UST yields down -0.6bp at 2.039% and 2y yields down -1.4bp at 1.565%.

- Bund futures are up 0.27 today at 164.81 with 10y Bund yields down -0.7bp at 0.299% and Schatz yields down -0.8bp at -0.361%.

- Gilt futures are up 0.05 today at 119.65 with 10y yields down -0.7bp at 1.573% and 2y yields down -5.1bp at 1.478%.

FOREX: Bounce Extends as Signs Point to More Likely Diplomatic Ukraine Solution

- Markets are extending the move initiated on Tuesday, by pressuring haven currencies and boosting growth proxies as a diplomatic solution to the Ukraine crisis looks to be becoming more likely. While Western authorities continue to insist there are few signs of a Russian military withdrawal from Ukrainian borders, Russian news agencies continue to report the pullback of military columns from Crimea and territories bordering eastern Ukraine.

- AUD/JPY is the strongest cross headed into the NY crossover, although early gains have faded as markets failed to hold above the 93.00 handle. The 100-dma undercuts as support at 82.69.

- UK inflation data came in modestly ahead of expectations, with the ONS flagging the influence of clothing and footwear prices - which often fall in January - fell by the smallest margin since the series began in 2005. The data was sufficiently close to analyst expectations to leave market pricing relatively unchanged, with UK markets continue to see a persistent tightening cycle across 2022.

- US retail sales for January cross later today, with markets expecting sales to have risen 2.0% across the month. Canadian CPI is also due, as well as CB speakers including BoC's Lane, Fed's Kashkari and the FOMC minutes.

EQUITIES: Materials, Energy Lead Early Gains

- Asian markets closed higher: Japan's NIKKEI closed up 595.21 pts or +2.22% at 27460.4 and the TOPIX ended 31.93 pts higher or +1.67% at 1946.63. China's SHANGHAI closed up 19.743 pts or +0.57% at 3465.831 and the HANG SENG ended 363.19 pts higher or +1.49% at 24718.9.

- European equities are a little higher, with the German Dax up 35.44 pts or +0.23% at 15450.28, FTSE 100 up 4.48 pts or +0.06% at 7612.65, CAC 40 up 24.87 pts or +0.36% at 7004.76 and Euro Stoxx 50 up 15.58 pts or +0.38% at 4160.04.

- U.S. futures are flat, with the Dow Jones mini up 21 pts or +0.06% at 34925, S&P 500 mini up 1.25 pts or +0.03% at 4465.75, NASDAQ mini up 2 pts or +0.01% at 14611.5.

COMMODITIES: Energy Leads Broad Gains

- WTI Crude up $0.83 or +0.9% at $92.85

- Natural Gas up $0.19 or +4.51% at $4.504

- Gold spot up $4.4 or +0.24% at $1857.43

- Copper up $3.35 or +0.74% at $457

- Silver up $0.17 or +0.71% at $23.5244

- Platinum up $9.06 or +0.88% at $1035.57

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/02/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 16/02/2022 | 1330/0830 | *** |  | US | Retail Sales |

| 16/02/2022 | 1330/0830 | ** |  | US | import/export price index |

| 16/02/2022 | 1330/0830 | *** |  | CA | CPI |

| 16/02/2022 | 1330/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 16/02/2022 | 1330/0830 | ** |  | CA | Wholesale Trade |

| 16/02/2022 | 1415/0915 | *** |  | US | Industrial Production |

| 16/02/2022 | 1500/1000 | * |  | US | business inventories |

| 16/02/2022 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 16/02/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 16/02/2022 | 1600/1100 |  | US | Minneapolis Fed's Neel Kashkari | |

| 16/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 16/02/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 16/02/2022 | 1830/1330 |  | CA | BOC Deputy Lane speech | |

| 16/02/2022 | 1900/1400 | * |  | US | FOMC Minutes |

| 17/02/2022 | 0030/1130 | *** |  | AU | Labor force survey |

| 17/02/2022 | 0700/0800 |  | EU | ECB Schnabel discussion with SPD | |

| 17/02/2022 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 17/02/2022 | - |  | EU | ECB Lagarde at G20 CB Governors Meeting | |

| 17/02/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 17/02/2022 | 1330/0830 | *** |  | US | housing starts |

| 17/02/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 17/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 17/02/2022 | 1400/1500 |  | EU | ECB Lane on MNI Webcast on ECB Policy | |

| 17/02/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 17/02/2022 | 1600/1100 |  | US | St. Louis Fed's James Bullard | |

| 17/02/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 17/02/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 17/02/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

| 17/02/2022 | 2200/1700 |  | US | Cleveland Fed's Loretta Mester | |

| 18/02/2022 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.