-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Russia-Ukraine Tensions Ease Somewhat

EXECUTIVE SUMMARY:

- RUSSIA'S FOREIGN MINISTRY: RECOGNISES BREAKAWAY UKRAINIAN REPUBLICS WITHIN BORDERS THEY CURRENTLY CONTROL

- RUSSIA'S LAVROV SAYS UKRAINE DOES NOT HAVE A RIGHT TO SOVEREIGNTY - IFAX

- EU FOREIGN MINISTERS TO DECIDE ON RUSSIA SANCTIONS TUESDAY

- GERMAN IFO INDEX SEES STRONG RECOVERY IN FEB

- MNI: ECB LIKELY TO LOOK THROUGH ANY UKRAINE INFLATION SPIKE

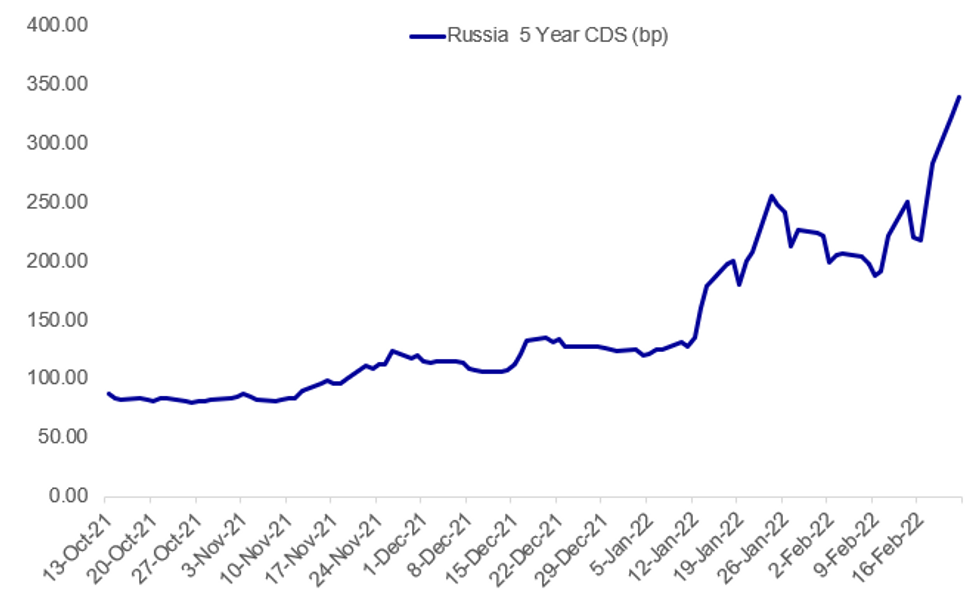

Fig. 1: Escalation In Russian Credit Default Protection

Source: BBG, MNI

Source: BBG, MNI

NEWS:

RUSSIA-UKRAINE - As we published the US Open, this headline caused a risk-on move: [RTRS] RUSSIA'S FOREIGN MINISTRY SAYS RUSSIA RECOGNISES BREAKAWAY UKRAINIAN REPUBLICS WITHIN BORDERS THAT THEY CURRENTLY CONTROL - IFAX

Recall that a major point of interest was whether Russia limit themselves to the current separatist-held territories or recognize the 2/3 of the oblasts held by Ukraine – This looks like the former.

RUSSIA-UKRAINE (RTRS): Russia's Foreign Minister Sergei Lavrov on Tuesday questioned whether Ukraine had a right to sovereignty because he said the government in Kyiv did not represent the country's constituent parts, the Interfax news agency reported. "If we talk about the principle of sovereignty and territorial integrity, one of the key documents ... is the Declaration on Principles of International Law concerning Friendly Relations among Peoples," he was quoted as saying. He accused Ukraine of being out of line with that since 2014 when a Moscow-backed president was overthrown in Kyiv and replaced by a pro-Western leader, prompting Russia to annex Ukraine's peninsula of Crimea and back an insurgency in its eastern regions.

EU-RUSSIA: EU foreign ministers would hold an emergency meeting later Tuesday to decide on a European response to the Russian actions in Ukraine, High Representative Josep Borrell said. Borrell, speaking in Paris, refused to comment on what the details of the package might be, but earlier on social media the EU’s French Presidency said that the sanctions would be ‘targeted’, while Borrell and EU Commission President Ursula von der Leyen stated Monday evening that sanctions would target those Russian officials who are responsible.

US-EU-RUSSIA (RTRS): Russian Foreign Minister Sergei Lavrov brushed off the threat of sanctions on Tuesday, saying the West would impose them regardless of events and describing the response to Russia's recognition of two breakaway Ukrainian regions as predictable. "Our European, American, British colleagues will not stop and will not calm down until they have exhausted all their possibilities for the so-called ‘punishment of Russia’. They are already threatening us with all manner of sanctions or, as they say now, 'the mother of all sanctions'," Lavrov said. "Well, we're used to it. We know that sanctions will be imposed anyway, in any case. With or without reason."

TURKEY-RUSSIA (RTRS): Turkish President Tayyip Erdogan said Russia's recognition of two breakaway regions in eastern Ukraine was "unacceptable" and he called on all parties to respect international laws, broadcaster NTV and others reported on Tuesday. NATO member Turkey is a maritime neighbour with Ukraine and Russia in the Black Sea and has good ties with both. Erdogan has offered to mediate in the conflict, warned Russia against invading Ukraine, and criticised the West's handling of the crisis. "We see this decision by Russia as unacceptable. We repeat our call for common sense and respect for international law by all sides," Erdogan told reporters on a flight in Africa, adding Ankara had prepared "precaution packages" as a regional country.

CHINA/RUSSIA/US: China calls on all parties concerning the Russia-Ukraine conflict to continue dialogues and encourages all efforts to promote a diplomatic solution, Zhang Jun, Permanent Representative of China to the United Nations, said at the UN Security Council’s emergency meeting on Ukraine situation, CCTV News reported. On the same day, China’s Foreign Minister Wang Yi talked to U.S. Secretary of State Antony Blinken by phone. Wang called on all parties to exercise restraint and ease the deteriorating situation through negotiations, according to a statement on the ministry's website. “China will continue to make contact with all parties based on the merits of the matter,” said Wang, noting that the legitimate security concerns of any country should be respected.

ECB-UKRAINE (MNI): The European Central Bank would be likely to look through any spike in inflation prompted by higher energy prices as a result of a conflict in Ukraine, and if markets deteriorate would step in to provide liquidity, though there are no signs of significant stress for the moment, Eurosystem sources told MNI. On MNI Policy MainWire now, for more details please contact sales@marketnews.com

ECB (RTRS): The European Central Bank may need to end its bond buys sooner than earlier thought given mounting inflation risks, ECB policymaker Gaston Reinesch said, joining a growing number of rates-setters now openly discussing a curb in stimulus. With euro zone inflation rising to record highs in recent months, the ECB has given up on a pledge not to raise rates this year and several policymakers are openly advocating an end to bond purchases this year, a prerequisite for any rate hike. Reinesch, one of the longest serving members of the ECB's Governing Council, argued that current price pressures could boost wages while the economy could return to full capacity quicker than forecast, both potentially adding to inflation pressures.

EU-UK-N IRELAND: Key sticking points in EU-UK talks aimed at resolving difficulties around the implementation of the Northern Ireland Protocol remain challenging as assembly elections loom in the province, EU officials say. While EU Commission Vice President Maros Sefcovic called for a strong partnership between the UK and EU to help face off Russian aggression against Ukraine, EU officials indicated that such wider considerations would not make them turn a blind eye to their ongoing concerns over trade flows between the UK and Northern Ireland.

DATA:

German Ifo Index Sees Strong Recovery in Feb

IFO BIZ CLIMATE INDEX FEB 98.9; JAN 96.0r

CURRENT ASSESSMENT FEB 98.6; JAN 96.2r

EXPECTATIONS FEB 99.2; JAN 95.8r

- Economic sentiment in Germany beat consensus forecasts this morning, increasing for the second consecutive month to 98.9 in February and improving 2.9 points on the upwards revised January reading. Expectations were outpaced by 2.5 points.

- The current assessment of economic conditions rebounded to 98.6, up 2.4 points from upwardly revised January and coming in significantly stronger than the projected moderate improvement to 96.5.

- Future expectations once again improved, jumping three points above the forecast to 99.2 and strengthening 3.4 points from the upwardly revised January print of 95.8.

- The upswing was predominantly due to considerable rebounds in manufacturing and services, with strong improvements across all service sectors and manufacturing seeing order books grow despite persistent material shortages remaining.

MNI: UK JAN PSNCR GBP-21.98 BN

UK Govt Finances Sees Small Jan Surplus

UK JAN CGNCR -GBP23.32 BN

MNI: UK JAN PSNCR -GBP21.98 BN

UK JAN PSNB-X -GBP2.89 BN

UK JAN PSNB -GBP3.65 BN

UK Govt's Debt Costs Soar In January

- UK government debt interest payments were GBP6.1 billion in January 2022, the highest for any January since records begin in 1997, the Office for National Statistics said Tuesday.

- Payments were GBP4.5 billion more than in January 2021, but lower than in June 2021 when interest payments were GBP9.0 billion.

- The recent high levels of debt interest payments "are largely a result of movements in the Retail Prices Index (RPI) to which index-linked gilts are pegged," the ONS said.

- In January 2022, the RPI uplift on index-linked gilts was GBP3.4 billion over and above the accrued coupon payments and other components of debt interest.

FIXED INCOME: Risk on drives cross assets

- Bonds were initially trading higher on the back of risk off, on Russia tension, but market reversed course after some report that Russian Legislator backs off wider separatist recognition claim.

- It's another big trading session for Bund, way above averages, with most of the bulk of the volumes happening during the morning European session.

- This has been the trend for the past 2 weeks.

- Peripheral spreads are mostly flat, but Greek/Bund edges wider, by 1.6bps.Immediate resistance is at the February high (widest) 235.9306, which was the highest level since May 2020.N

- onetheless, better is seen at the 240bps area..

- Gilts have traded inline with Bund, and this can be seen via the flat Gilt/Bund spread.

- Looking ahead, focus remains squarely on Russia.

- On the data front, out of the US, sees PMIs.

- Speakers, Include BoE Ramsden and Fed Bpstic

FOREX: Markets Await Western Response to Russian Actions

- Global equity markets are recovering off lows ahead of the NY crossover, with the e-mini S&P rallying back above the Monday close to look more settled after a shakier overnight session. For currency markets, this has translated to weaker haven currencies, resulting in the CHF and JPY being among the session's worst performers in contrast with the Monday session.

- The proto risk-on sentiment seen across assets seems counter-intuitive as the Russian Parliament formally adopt the 'Friendship Treaty' with the separatist states in Donetsk and Luhansk, sending military supplies and aid to the disputed territories. Nonetheless, there are indications of a cautious stabilization and stalemate for now that lowers the risk of a near-term armed conflict. The separatist territories have talked down the requirement of military assets, while Western leaders appear to be favouring a step-by-step approach to sanctions for now. This suggests a fragile de-escalation is the most likely path forward for now.

- Commodity-tied currencies are leading gains, with NOK outstripping all others as oil prices surge further still. Brent crude futures touched $99.50/bbl, the highest level since 2014 - with the Russia - Europe Nordstream 2 gas pipeline expected to be a victim of any sanctions response on the continent. As a result, USD/NOK has reversed well back below the 9.00 handle.

- Data due Tuesday includes prelim US PMI data for February and the conference board consumer confidence release. Central bank speakers include BoE's Ramsden and Fed's Bostic.

EQUITIES: Off Overnight Lows

- Asian markets closed weaker: Japan's NIKKEI closed down 461.26 pts or -1.71% at 26449.61 and the TOPIX ended 29.6 pts lower or -1.55% at 1881.08. China's SHANGHAI closed down 33.466 pts or -0.96% at 3457.146 and the HANG SENG ended 650.07 pts lower or -2.69% at 23520

- European equities are weaker, with the German Dax down 193.23 pts or -1.31% at 14731.12, FTSE 100 down 33.05 pts or -0.44% at 7484.33, CAC 40 down 60.38 pts or -0.89% at 6788.34 and Euro Stoxx 50 down 44.48 pts or -1.12% at 3985.71.

- U.S. futures are also sharply lower, with the Dow Jones mini down 351 pts or -1.03% at 33657, S&P 500 mini down 50.75 pts or -1.17% at 4293, NASDAQ mini down 269.25 pts or -1.92% at 13727.

COMMODITIES: WTI Hits New 7+ Year High On Russia-Ukraine

- WTI Crude up $4.4 or +4.83% at $95.47

- Natural Gas up $0.11 or +2.57% at $4.545

- Gold spot down $5.86 or -0.31% at $1910.09

- Copper down $1.85 or -0.41% at $450.75

- Silver up $0.2 or +0.84% at $24.0986

- Platinum up $4.46 or +0.41% at $1083.3

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/02/2022 | 1045/1045 |  | UK | BOE Ramsden speech at National Farmers Union | |

| 22/02/2022 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 22/02/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 22/02/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/02/2022 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 22/02/2022 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 22/02/2022 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 22/02/2022 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 22/02/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 22/02/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 22/02/2022 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 22/02/2022 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 22/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 22/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 22/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 22/02/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 22/02/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 22/02/2022 | 2030/1530 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.