-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Beijing To Protect Firms From U.S. Bill - MOFCOM

MNI BRIEF: SNB Cuts Policy Rate By 50 BP To 0.5%

MNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI US OPEN: Ukraine-Russia Impasse Ahead Of ECB And CPI

EXECUTIVE SUMMARY:

- MNI U.S. FEB CPI PREVIEW: NON-CORE COMPONENTS TO RUN WILD

- MNI ECB PREVIEW: HAWKS STAND DOWN, FOR NOW

- UKRAINE: RUSSIA CONVEYED WILL CONTINUE ATTACK UNTIL DEMANDS MET

- UK SANCTIONS ABRAMOVICH, DERIPASKA IN RAMP-UP AGAINST RUSSIAN OLIGARCHS

- PBOC SEEN CUTTING DEPOSIT COST AS IT PUSHES BANKS TO LEND (MNI)

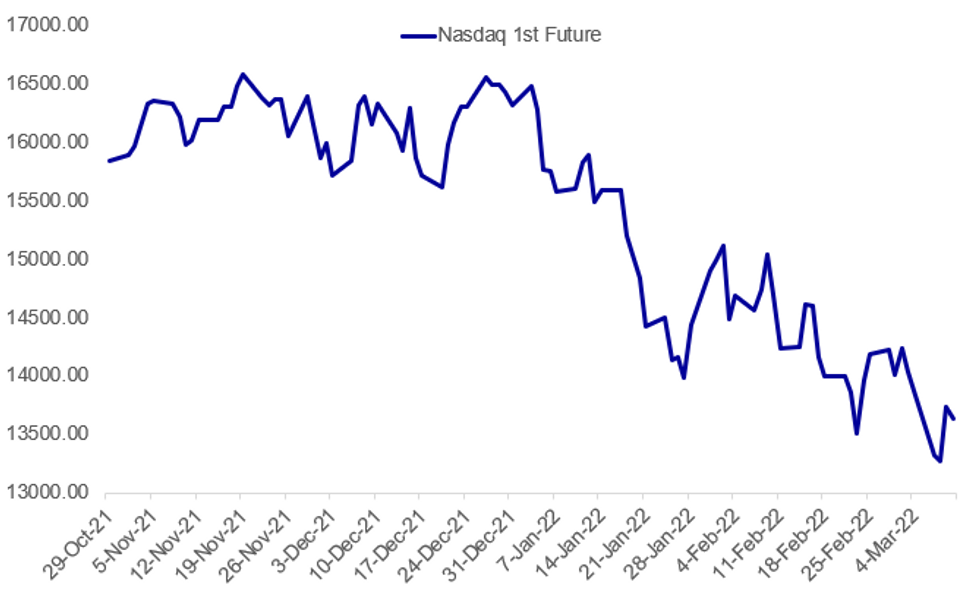

Fig. 1: Stocks Dip Ahead Of US CPI, ECB Decision

Source: BBG, MNI

Source: BBG, MNI

NEWS:

MNI US CPI PREVIEW: Consensus has headline CPI surging +0.8% M/M in Feb on energy and less so food prices, of which the largest effects aren’t likely to show until March. That would see year-on-year inflation rise from 7.5% to 7.8% Y/Y.

- Whilst normally looked through, non-core gains will add pressures to areas that consumers feel the most and carry the risk of a further drifting in survey-based inflation expectations.

- Core inflation is seen at +0.5% M/M from the +0.58% M/M in Jan on a possible dip in used car prices, but with reasonable strength in other categories. That sees year-ago inflation rise from 6.0% to 6.4% Y/Y, potentially the peak for the cycle.

- The full report including MNI analysis and previews of 12 sell-side analysts has been e-mailed to subscribers and can be found here.

MNI ECB PREVIEW: Having appeared to be gearing up to normalise monetary policy, the ECB’s calculus has now changed following the Russian invasion of Ukraine. For the time being, the direction of travel for monetary policy remains unchanged, but any momentum building behind a near-term tightening has subsided. The ECB will reconfirm the December policy calibration, but the narrative on the medium-term inflation outlook will now reflect the new two-way risks that have resulted from the Ukrainian crisis. For the full publication, see our website.

PBOC (MNI): The People's Bank of China is likely to push banks to reduce loan rates and support the property sector while keeping a lid on the cost of deposits as it loosens policy in support of the government's target for growth of about 5.5% this year, current and former PBOC officials told MNI in interviews on the sidelines of the National People's Congress. For full article contact sales@marketnews.com

UKRAINE - RUSSIA (BBG): Ukrainian Foreign Minister Dmytro Kuleba speaks in Turkey after meeting with his Russian counterpart Sergei Lavrov. Kuleba says Lavrov conveyed that Russia seeks Ukraine’s surrender. Ukraine will not surrender, Kuleba says. Kuleba says Ukraine is ready to meet in a format similar to today’s talks again. Kuleba says there was no progress made on a ceasefire at today’s talks.

UK - RUSSIA: The UK gov't has confirmed that Russian oligarchs including Chelsea FC owner Roman Abramovich and Oleg Deripaksa, who holds major stakes in En+ Group, have been hit with sanctions including asset freezes, travel bans, and transport sanctions.

- Full UK gov't statement here: https://www.gov.uk/government/news/abramovich-and-...

- As well as Abramovich and Deripaska, the following individuals have been hit by sanctions: Igor Sechin (Chief Exec of Rosneft), Andrey Kostin (Chairman of VTB), Alexei Miller (CEO of Gazprom), Nikolai Tokarev (president of Transneft), Dmitri Lebedev (Chairman of the Board of Bank Rossiya).

- Statement also gives details of the upcoming Economic Crime Bill, "coming into force next week [the bill] will also significantly simplify the process of imposing sanctions, allow the UK to more easily sanction individuals, stop oligarchs threatening the UK with multi-million pound lawsuits for damages at the taxpayer’s expense and also allow the UK to mirror allies’ designations."

- The impact of sanctions on Russian oligarchs around the world is being viewed closely, given the outsized influence many are seen to have on the Russian political leadership. Remains unclear whether any of the sanctioned individuals would have any personal influence on Putin's decision making.

CHINA-RUSSIA (RTRS): China has refused to supply Russian airlines with aircraft parts, the aviation authority Rosaviatsia spokesman was quoted by Interfax news agency as saying on Thursday. He said Russia would look for opportunities to source aircraft parts from other countries, including Turkey and India.

DATA:

MNI: NORWAY FEB CPI CPI +1.1% M/M, +3.7% Y/Y

MNI: NORWAY FEB CORE CPI +1.2% M/M, +2.1% Y/Y

FIXED INCOME: Outperforming on geopolitical headlines

- Gilts are outperforming Bunds a little at the 10-year point of the curve but see bigger outperformance at the short-end, given that more is priced in.

- The latest market moves have been driven by reports (via Reuters) that a Ukrainian presidential advisor has said that Ukraine will not conceded territory (in a sort of Crimea scenario). This makes it harder to see an imminent end to the conflict.

- There's little on the UK calendar until tomorrow's activity data for January (including the monthly GDP print). The UK has broadened its sanctions list today to include Abramovich, but this is unlikely to have any meaningful impact on UK markets.

- 2y gilt yields down -4.1bp today at 1.365%, 5y yields down -4.2bp today at 1.278%, 10y yields down -5.1bp today at 1.474%, 30y yields down -4.2bp today at 1.641%

- 2s10s down -0.9bp today at 11.0bp

- 10s30s up 0.9bp today at 16.7bp

FOREX: Markets Consolidate Wednesday Moves, Focus Turns to ECB

- Markets are largely unwinding the sharp moves seen across the Wednesday session, putting regional currencies lower (notably SEK and NOK) while haven FX regains some recent lost ground. The greenback trades firmer, with markets watching for the growing prospect of a Zelensky - Putin face to face meeting in the coming weeks.

- AUD remains the year's best performer by some margin, and is stronger again early Thursday, keeping the onus on the 0.7441 print from Mar 7.

- Focus has been on the meetings held between the Russian and Ukrainian foreign ministers in Turkey today - both sides showed very little sign of backing away from their recent demands, with Lavrov reasserting that Russia will continue their military incursion in the country. A Putin-Zelensky meeting was floated, but the Russian foreign minister stressed that substantive specifics would be needed before any meeting could take place.

- The ECB rate decision takes focus going forward, with the governing council seen opting to keep policy on hold, but note the building pressures to tighten policy into the second half of the year. US CPI also crosses, with markets expecting prices to have risen by 7.9% on a Y/Y basis, which would mark the hottest inflation read since the early 1980's.

EQUITIES: Stocks Dip Ahead Of US CPI, ECB Decision

- Asian stocks closed stronger: Japan's NIKKEI closed up 972.87 pts or +3.94% at 25690.4 and the TOPIX ended 71.14 pts higher or +4.04% at 1830.03. China's SHANGHAI closed up 39.704 pts or +1.22% at 3296.092 and the HANG SENG ended 262.55 pts higher or +1.27% at 20890.26

- European equities are weaker ahead of the ECB decision, with the German Dax down 299.83 pts or -2.17% at 13640.17, FTSE 100 down 82.1 pts or -1.14% at 7141.16, CAC 40 down 144.53 pts or -2.26% at 6297.75 and Euro Stoxx 50 down 84.64 pts or -2.25% at 3703.27.

- U.S. futures are lower pre-CPI data, with the Dow Jones mini down 259 pts or -0.78% at 33006, S&P 500 mini down 31 pts or -0.73% at 4244.25, NASDAQ mini down 126.75 pts or -0.92% at 13608.

COMMODITIES: Oil Bounces, But Well Off Week's Highs

- WTI Crude up $3.27 or +3.01% at $112.04

- Natural Gas up $0.1 or +2.21% at $4.626

- Gold spot down $9.82 or -0.49% at $1982.23

- Copper up $6.9 or +1.51% at $464.25

- Silver down $0.28 or -1.08% at $25.5023

- Platinum up $3.37 or +0.31% at $1086.85

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/03/2022 | 1245/1345 | *** |  | EU | ECB Deposit Rate |

| 10/03/2022 | 1245/1345 | *** |  | EU | ECB Main Refi Rate |

| 10/03/2022 | 1245/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 10/03/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 10/03/2022 | 1330/0830 | *** |  | US | CPI |

| 10/03/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 10/03/2022 | 1330/0830 | * |  | CA | Intl Investment Position |

| 10/03/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 10/03/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 10/03/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 10/03/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 10/03/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 10/03/2022 | 1900/1400 | ** |  | US | Treasury Budget |

| 11/03/2022 | 0700/0800 | *** |  | DE | HICP (f) |

| 11/03/2022 | 0700/0700 | ** |  | UK | UK monthly GDP |

| 11/03/2022 | 0700/0700 | ** |  | UK | Index of Services |

| 11/03/2022 | 0700/0700 | *** |  | UK | Index of Production |

| 11/03/2022 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 11/03/2022 | 0700/0700 | ** |  | UK | Trade Balance |

| 11/03/2022 | 0800/0900 | *** |  | ES | HICP (f) |

| 11/03/2022 | 1330/0830 | ** |  | CA | Capacity Utilization |

| 11/03/2022 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 11/03/2022 | 1330/0830 | * |  | CA | Household debt-to-disposable income |

| 11/03/2022 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 11/03/2022 | 1500/1000 | * |  | US | Services Revenues |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.