-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Short-End Yields, Oil, Stocks Head Lower

EXECUTIVE SUMMARY:

- UKRAINIAN PRESIDENTIAL ADVISER SAYS WAR IS AT A CROSSROADS

- ECB'S DE COS: KEY IS TO AVOID 2ND-ROUND EFFECTS AS COMMODITIES SURGE

- U.S. WARNS EUROPE THAT RUSSIA WANTS ARMED DRONES FROM CHINA

- INFLATION EATS INTO U.K. PAY RISES

- HK-LISTED CHINESE FIRMS TUMBLE TO 2008 LOWS

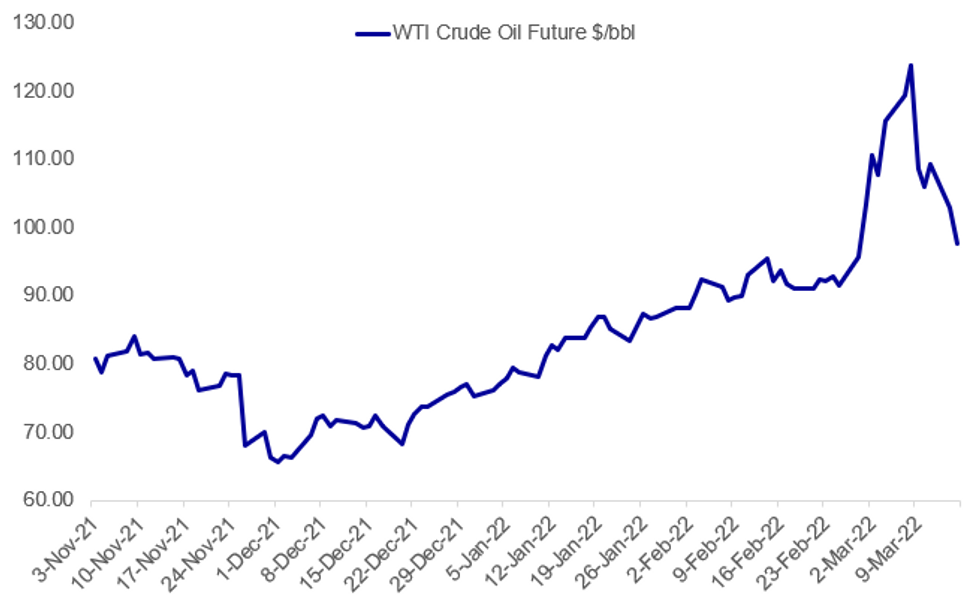

Fig. 1: WTI Oil Back Below $100

Source: BBG, MNI

Source: BBG, MNI

NEWS:

UKRAINE-RUSSIA (RTRS): An adviser to Ukrainian President Volodymr Zelenskiy said on Tuesday that the war in Ukraine was at a crossroads that could lead to an agreement at talks with Russia or a new Russian offensive. "We are at a crossroads. Either we will agree at the current talks or the Russians will make a second attempt (at an offensive) and then there will be talks again," adviser Oleksiy Arestovych said.

ECB (BBG): Europe’s gradual recovery from the pandemic will be negatively affected by the war in Ukraine and it’s essential that economic policies respond decisively to the fallout, according to European Central Bank Governing Council member Pablo Hernandez De Cos. ECB’s decision increases flexibility and optionality; officials are committed to taking measures necessary to achieve price stability, de Cos says.

US-RUSSIA-CHINA (BBG): The U.S. has warned European allies that Russia asked China for armed drones in late February as it was beginning its invasion of Ukraine, according to people familiar with the matter. The request has alarmed Biden administration officials seeking to prevent China -- Russia’s most powerful diplomatic partner -- from coming to President Vladimir Putin’s aid in the war, according to the people, who described the matter on the condition of anonymity. China is among the world’s largest exporters of armed unmanned aerial vehicles and has sold them to countries such as Saudi Arabia, Pakistan and the United Arab Emirates.

UKRAINE (RTRS): A curfew will be imposed on the Ukrainian capital Kyiv from 8 p.m. (1800 GMT) on Tuesday to 7 a.m. (0500 GMT) on Thursday after several apartment blocks were struck by Russian forces based outside the city, Mayor Vitaliy Klitschko announced. Two people were killed in the latest bloodshed, he said.

RUSSIA (RTRS): The Russian central bank said it will suspend the buying of gold from banks from Tuesday to meet increased demand for the precious metal from households. "Currently, households' demand for buying physical gold in bars has increased, driven, in particular, by the abolition of value-added tax on these operations," the central bank said in a statement.

EU-RUSSIA (RTRS): The European Union formally approved on Tuesday a new barrage of sanctions against Russia for its invasion of Ukraine, which include bans on investments in the Russian energy sector, luxury goods exports and imports of steel products from Russia. The sanctions, which come into effect after publication in the EU official journal later on Tuesday, also freeze the assets of more business leaders who support the Russian state, including Chelsea football club owner Roman Abramovich.

UK-RUSSIA (RTRS): Britain on Tuesday said it would ban the export of luxury goods to Russia and impose new tariffs on 900 million pounds ($1.2 billion) worth of Russian imports, including vodka. "Our new tariffs will further isolate the Russian economy from global trade, ensuring it does not benefit from the rules-based international system it does not respect," finance minister Rishi Sunak said in a statement.

HONG KONG / EQUITIES (RTRS): China stocks slumped to 21-month lows on Tuesday while mainland firms listed in Hong Kong plumbed their 2008 lows, as surging COVID-19 cases threatened the outlook for the world's second-largest economy and as the central bank dashed expectations for a cut in a key lending rate. The Ukraine crisis also weighed on sentiment, reviving worries about widening differences between Beijing and Washington as the United States raised concerns about China's alignment with Russia, and prompting global investors to dump Chinese offshore-listed stocks, analysts said.

DATA:

UK FEB PAYROLLS +275000 - ONS / HMRC

MNI: UK FEB CLAIMANT CHG -48100

MNI BRIEF: Inflation Eats Into UK Pay Rises

UK real regular earnings declined 1.0% in the three months to January, the biggest fall since the three months to July 2014, according to data released by the Office for National Statistics Tuesday. Excluding bonuses, real earnings rose by 0.1%. The fall in real earnings would have been worse if discounted by CPI, rather than CPIH. Using the CPI as a discount, real regular earnings plunged by 1.6% in the three months to January.

Total earnings -- before adjustment for inflation -- rose by 4.8%, exceeding analysts’ expectations, from 4.6% in the fourth quarter. Excluding bonuses, earnings rose to an annual rate of 3.8% from 3.7% in the December period. Payroll employment rose by a record 275,000 in February, HMRC data shows. Salaried employment stands 662,000 above the level of February 2020.

But LFS employment fall by 12,000, with older workers continuing to leave the work force, according to ONS officials. Despite the fall in employment, the jobless rate fell to 3.9% — below its pre-pandemic level — from 4.0% in the fourth quarter. The inactivity rate rose to 21.3% from 21.2% in the fourth quarter.

FIXED INCOME: Gilts underperform after better labour market data

Gilts are underperforming Treasuries and Bunds on the back of the better-than-expected UK labour market data. 10-year gilt yields have fallen around 3.5bp, around 1bp less than Bunds and 1.7bp less than USTs.

- Yesterday's pattern of the gilt curve seeing parallel moves while the Treasury curve sees a higher beta on 2s than 10s and the German curve sees a lower beta on 2s than 10s remains instact. This has meant we have seen a bull steepening of the UST curve and a bull flattening of the German curve.

- We have a relatively busy data calendar today with the German ZEW and US PPI the highlights. We also have Eurozone industrial production, US Empire manufacturing and US TIC flow data due today.

- TY1 futures are up 0-13 today at 125-07 with 10y UST yields down -4.7bp at 2.088% and 2y yields down -6.2bp at 1.801%.

- Bund futures are up 0.70 today at 161.91 with 10y Bund yields down -4.0bp at 0.325% and Schatz yields down -3.2bp at -0.387%.

- Gilt futures are up 0.44 today at 121.84 with 10y yields down -3.0bp at 1.562% and 2y yields down -3.1bp at 1.347%.

FOREX: GBP/USD Circling New Multiyear Low

- The single currency trades well early Tuesday, rising against all others in G10 as EUR/USD extends the recovery off last week's lows. EUR/USD is now either side of the 1.10 handle, but will need to make progress through 1.1121 to secure any progress toward the 1.1257 50-dma.

- Market focus remains on the Ukraine crisis, with markets watching for the re-convening of regular negotiations between Russian and Ukrainian representatives after the technical break in talks yesterday. Separately, the Polish, Slovenian, Czech leaders are headed to Kyiv to meet with the Ukrainian President - a move that could lessen the military incursion on the city from the Russian side, in order to avoid directly endangering the leaders of NATO nations.

- Elsewhere, UK jobs data fared better than expected, with average weekly earnings growing ahead of forecast, alongside a lower-than-forecast ILO Unemployment Rate. GBP initially saw some support, tilting GBP/USD up to 1.3051 before the support faded through the European morning. This keeps the pair well within range of the overnight cycle lows, printed at 1.3000 - GBP/USD last traded below that mark in late 2020.

- Focus turns to the upcoming US PPI release, with markets expecting a Y/Y rise of 10% for producer prices - another series high. Germany's ZEW survey also crosses, as well as Canada's existing home sales/manufacturing sales data. ECB's Lagarde speaks, appearing at the WELT Economic Summit.

EQUITIES: Hang Seng Drops Sharply Again

- Asian markets closed mixed, with Japan flat but Hong Kong stocks cratering again: Japan's NIKKEI closed up 38.63 pts or +0.15% at 25346.48 and the TOPIX ended 14.35 pts higher or +0.79% at 1826.63. China's SHANGHAI closed down 159.568 pts or -4.95% at 3063.965 and the HANG SENG ended 1116.58 pts lower or -5.72% at 18415.08

- European equities are sharply lower, with the German Dax down 326.24 pts or -2.34% at 13622.26, FTSE 100 down 114.3 pts or -1.59% at 7077.23, CAC 40 down 160.94 pts or -2.53% at 6224.23 and Euro Stoxx 50 down 94.44 pts or -2.52% at 3652.84.

- U.S. futures are weaker, with the Dow Jones mini down 220 pts or -0.67% at 32724, S&P 500 mini down 29 pts or -0.7% at 4143, NASDAQ mini down 84.75 pts or -0.65% at 12960.75.

COMMODITIES: WTI Back Below $100

- WTI Crude down $5.45 or -5.29% at $97.29

- Natural Gas down $0.09 or -1.85% at $4.582

- Gold spot down $19.38 or -0.99% at $1934.15

- Copper down $3.4 or -0.75% at $449.15

- Silver down $0.37 or -1.46% at $24.799

- Platinum down $14.05 or -1.36% at $1024.23

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/03/2022 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 15/03/2022 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 15/03/2022 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 15/03/2022 | 1000/1100 | ** |  | EU | industrial production |

| 15/03/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 15/03/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 15/03/2022 | 1230/0830 | *** |  | US | PPI |

| 15/03/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/03/2022 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/03/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 15/03/2022 | 1300/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

| 15/03/2022 | 1515/1615 |  | EU | ECB Lagarde Speaks at WELT Economic Summit | |

| 15/03/2022 | 2000/1600 | ** |  | US | TICS |

| 16/03/2022 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 16/03/2022 | 0900/1000 |  | EU | ECB Panetta at Italian Banking Association Meeting | |

| 16/03/2022 | 0930/1030 |  | EU | ECB Elderson Panels Asia High-level Meeting | |

| 16/03/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 16/03/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 16/03/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 16/03/2022 | 1230/0830 | *** |  | CA | CPI |

| 16/03/2022 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 16/03/2022 | 1400/1000 | * |  | US | Business Inventories |

| 16/03/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 16/03/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 16/03/2022 | 1800/1400 | *** |  | US | FOMC Statement |

| 17/03/2022 | 2145/1045 | *** |  | NZ | GDP |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.