-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Yen On The Edge, Intervention In Focus

EXECUTIVE SUMMARY:

- JAPANESE YEN WEAKENS AS BOJ INTERVENES IN BOND MARKET

- BOJ TO BUY 10Y JGBS FOR THREE CONSECUTIVE SESSIONS FOR FIRST TIME

- SHANGHAI LOCKS DOWN HALF OF CITY TO FIGHT COVID OUTBREAK

- PUTIN-ZELENSKIY MEETING NEEDED ONCE SIDES CLOSER ON KEY ISSUES: RUSSIA'S LAVROV

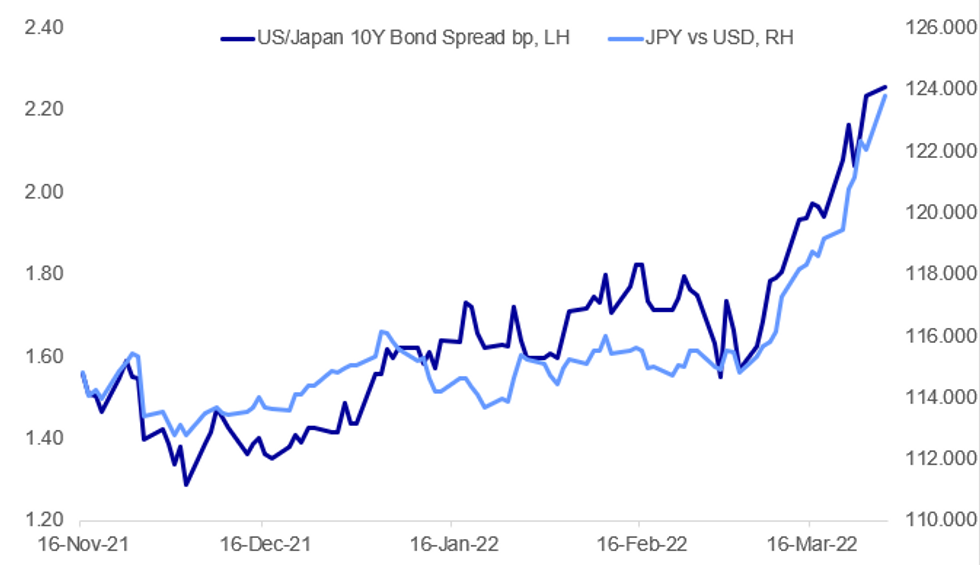

Fig. 1: Rising US-Japan Yield Differential Puts Pressure On Yen

Source: BBG, MNI

Source: BBG, MNI

NEWS:

BOJ (BBG): The Bank of Japan underscored its strong commitment to ultra loose monetary policy by offering for the first time to buy an unlimited amount of bonds for three straight days amid a global debt selloff. Monday’s announcement that it would buy 10-year notes on March 29, 30 and 31 came after two offers earlier in the day that failed to lower yields. They touched the defending line of 0.25% for the first time since the bank made the level of its ceiling clear in March last year. The yen, already at its weakest since December 2015, extended losses.

CHINA (BBG - Reported overinght): Shanghai will lock down the city in two phases to conduct a mass testing blitz for Covid-19, as authorities scramble to staunch a spiraling outbreak that’s challenging China’s zero-tolerance approach to the virus like never before. At 5am on Monday, the city of 25 million people locked down areas east of the Huangpu River, which includes its financial district and industrial parks, for four days. The lockdown then shifts to the other half of the city, in the west, for another four days, according to a statement Sunday from the local government. Residents will be barred from leaving their homes, while public transport and car-hailing services will be suspended. Private cars will not be allowed on the roads unless necessary. Tesla Inc. is extending the production pause at its Shanghai plant to Thursday, people familiar with the matter said. Some financial companies rushed to call staff into offices before the lockdown and told workers to prepare to sleep there.

CHINA (BBG): Companies including China’s biggest chip producer and an Apple Inc. supplier are continuing to operate factories in Shanghai during the city’s lockdown by isolating workers and running a closed-off procedure authorized by local authorities, according to people familiar with the matter.The Shanghai government is allowing some manufacturers to run so-called closed loop systems where employees are able to keep working as long as they’re confined to the factory campus and adhere to certain Covid and testing protocols, the people said, asking not to be named discussing internal procedures. Production capacity, however, may still be affected to some degree due to disruptions to logistics and supply chains.

RUSSIA/UKRAINE (RTRS): Russian Foreign Minister Sergei Lavrov said on Monday that a meeting between President Vladimir Putin and his Ukrainian counterpart Volodymyr Zelenskiy should happen once the two sides are closer to agreeing on key issues. Speaking to Serbian media outlets, Lavrov added that any meeting between Putin and Zelenskiy to exchange views on the conflict right now would be counter-productive.

CHINA/RUSSIA (BBG): China rejected speculation it might try to circumvent international sanctions against Russia, while complaining that the measures have damaged normal trade relations with its key diplomatic partner. Foreign Ministry spokesman Wang Wenbin made the remarks Monday in response to a question about a Bloomberg News report that Chinese diplomats are seeking details about complying with sanctions. Wang reiterated that China would take necessary measures to safeguard what it see as its legitimate rights and interests.

UK (BBG): Guidance issued to public sector buying team recommends that public bodies, including Government departments and hospitals, “immediately seek to identify any contracts with Russian and Belarusian companies and, if possible to switch suppliers with minimal disruption, pursue legal routes of cancelling them,” according to a government statement.

UK (BBG): A “stronger surge” in inflation, which is coming down hard on household spending, will slow U.K. growth to 3.5% for 2022, S&P Global Ratings said in a statement. GDP forecast compares with 4.6% that S&P Global Ratings forecast in December

TESLA (BBG): Tesla Inc.’s Elon Musk said in a tweet he has Covid-19 again and is experiencing “almost no symptoms.”The chief executive officer of the electric-car maker and rocket company Space Exploration Technologies Corp. kept his Twitter followers apprised of his first bout with Covid in November 2020. The billionaire missed out on attending SpaceX’s first launch of astronauts to the International Space Station that month.

DATA:

No key data released in the European morning session.

FIXED INCOME: Big downside moves

Core fixed income coming under pressure this morning with gilts underperforming at the 10-year sector of the curve, but Treasuries seeing larger moves in 2-years (with 2-year UTS yields up 10.4bp on the day at writing). The moves seem more driven by momentum rather than any specific headlines today with the BoJ having intervened at least twice to keep 10-year yields in the +/-0.25% target range. This has led to big moves in USDJPY which briefly touched 125 this morning.

- Biggest event of the day will be a speech by BOE Governor Bailey. He is due to speak with Guntram Wolff, Bruegel with the topic 'Macroeconomic and financial stability inchanging times'. The event is scheduled for 12:00GMT / 7:00ET.

- Elsewhere we have US advance trade and inventory data but the calendar remains fairly light with focus remaining on the big market moves.

- TY1 futures are down -0-10 today at 121-07+ with 10y UST yields up 2.2bp at 2.499% and 2y yields up 10.4bp at 2.377%.

- Bund futures are down -0.63 today at 158.02 with 10y Bund yields up 1.8bp at 0.602% and Schatz yields up 4.5bp at -0.99%.

- Gilt futures are down -0.60 today at 120.04 with 10y yields up 4.0bp at 1.734% and 2y yields up 7.7bp at 1.483%.

FOREX: JPY Plummets as Markets Opens Door to Y130

- JPY weakness was evident throughout the Asia-Pac session as well as the early European morning, but gains for USD/JPY and EUR/JPY really accelerated following the publication of an interview with former top currency chief Sakakibara (also known as Mr Yen), who stated that Japanese authorities do not need to take any action against current FX weakness, but should begin to intervene should USD/JPY cross Y130.00. This is considerably higher than the market's perceived tolerance band of Y125.00 for the pair, and helped spur fast money sales of the JPY vs. both the USD and EUR.

- The market moves open the door to the next key psychological level at Y130.00 - a level last crossed in 2002. Technical signals all point to a slowdown in gains for the pair in the near-term, with the RSI indicator now flashing at its most overbought level since 2001.

- As such, no surprise to see JPY at the bottom end of the G10 pile, with the greenback and EUR among the strongest. Markets continue to reshuffle monetary policy expectations, with Eurozone money markets now pricing over 50bps of rate hikes from the ECB by the December rate decision.

- Focus turns to US wholesale and retail inventories data as well as an appearance from the BoE governor Bailey, who speaks on the economy just a few hours after S&P downgraded their UK growth view, with accelerating inflation crimping on disposable income.

EQUITIES: Europe Higher, With Financials Leading And Tech Lagging

- Asian markets closed mixed: Japan's NIKKEI closed down 205.95 pts or -0.73% at 27943.89 and the TOPIX ended 8.1 pts lower or -0.41% at 1973.37. China's SHANGHAI closed up 2.263 pts or +0.07% at 3214.503 and the HANG SENG ended 280.09 pts higher or +1.31% at 21684.97.

- European stocks are higher, with the German Dax up 212.98 pts or +1.49% at 14515.15, FTSE 100 up 23.77 pts or +0.32% at 7506.26, CAC 40 up 71.84 pts or +1.1% at 6624.58 and Euro Stoxx 50 up 55.06 pts or +1.42% at 3922.13.

- U.S. futures are flat/lower, with the Dow Jones mini up 26 pts or +0.07% at 34785, S&P 500 mini down 0.5 pts or -0.01% at 4536, NASDAQ mini down 30.75 pts or -0.21% at 14725.75.

COMMODITIES: Oil Falls Sharply Amid Shanghai Lockdown

- WTI Crude down $4.55 or -3.99% at $109.36

- Natural Gas up $0.02 or +0.32% at $5.589

- Gold spot down $28.49 or -1.45% at $1930.52

- Copper down $0.65 or -0.14% at $469.3

- Silver down $0.47 or -1.84% at $25.0643

- Platinum down $8.92 or -0.89% at $996.51

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/03/2022 | 1100/1200 |  | UK | BOE Bailey in Conversation w. Guntram Wolff | |

| 28/03/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/03/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 28/03/2022 | 1430/1530 |  | UK | DMO Consultation Gilt Issuance 2022/23 | |

| 28/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 28/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 28/03/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 28/03/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 29/03/2022 | 0030/1130 | ** |  | AU | Retail Trade |

| 29/03/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 29/03/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 29/03/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 29/03/2022 | 0700/0900 |  | ES | Spain Retail Sales | |

| 29/03/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/03/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/03/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 29/03/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 29/03/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 29/03/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 29/03/2022 | 1300/0900 |  | US | New York Fed's John Williams | |

| 29/03/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 29/03/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 29/03/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 29/03/2022 | 1445/1045 |  | US | Philadelphia Fed's Patrick Harker | |

| 29/03/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.