-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

MNI FOMC Hawk-Dove Spectrum

MNI US OPEN: Europe PMIs Show Inflation Up, Confidence Down

EXECUTIVE SUMMARY:

- RUSSIA SAYS "INTENSIVE" TALKS WITH UKRAINE CONTINUE

- EU'S VON DER LEYEN AND BORRELL TO MEET ZELENSKIY IN KYIV THIS WEEK

- U.S. ISN'T SEEKING `DIVORCE' FROM CHINA, TRADE CHIEF TAI SAYS

- EUROZONE SERVICES PMIS SEE STRONGER DEMAND, BUT EXPECTATIONS SLUMP

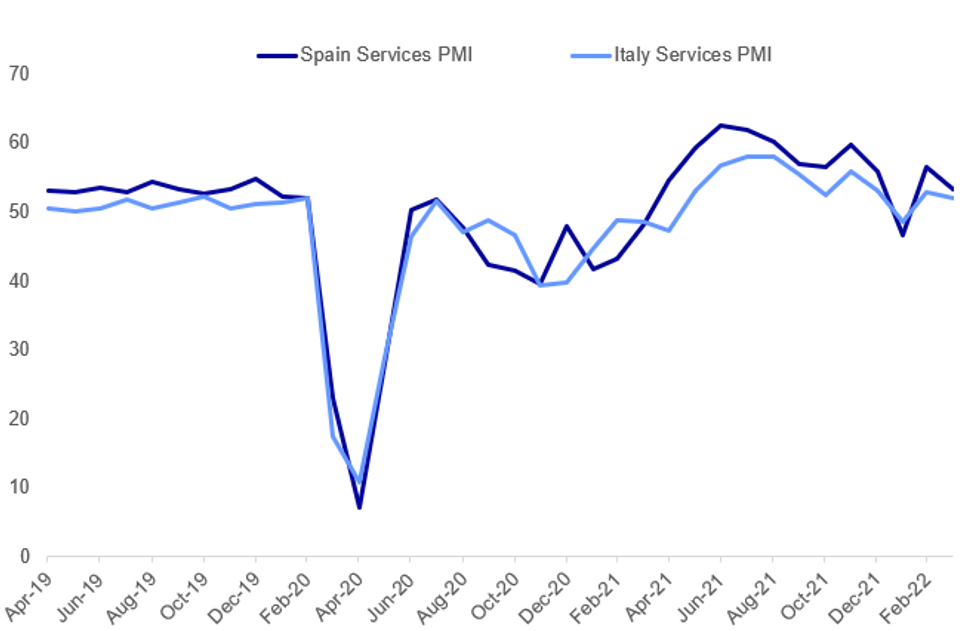

Fig. 1: Spanish And Italian Service Sector Growth Slowed In March

Source: S&P Global, MNI

Source: S&P Global, MNI

NEWS:

RUSSIA-UKRAINE (BBG): While talks between Russia and Ukraine continue by videolink, it’s premature to speak of any meeting between foreign ministers, Russian Deputy Foreign Minister Andrey Rudenko says on Tuesday, according to Interfax. Meeting is possible only after sides have agreed on the text on the final document.

EU-UKRAINE: A European Commission spokesman has confirmed that Commission President Ursula von der Leyen and EU High Representative for Foreign Affairs and Security Josep Borrell will both travel to Kyiv this week to hold talks with Ukrainian President Volodymyr Zelensky. Comes just days after European Parliament President Roberta Metsola also traveled to the Ukrainian capital for talks with the president. Zelensky will be hoping to convince the EU leaders to push member states to up provisions of lethal aid to Ukrainian forces and to cut off supplies of Russian hydrocarbons to the West. The latter request likely to fall on deaf ears given member state objections.

US-CHINA (BBG): The U.S. is seeking to realign its commercial ties with China rather than seek a “divorce” between the world’s biggest economies, trade chief Katherine Tai said on Tuesday. Asked in an interview whether U.S.-China tensions could lead to decoupling, Tai said the Biden administration’s policy was focused instead on “realignment in the global economy.” That includes addressing the lack of visibility, accountability and diversity in supply chains that has led to disruptions in recent years, she told Bloomberg Television’s Haslinda Amin in Singapore. “I would focus really on the kinds of changes that we’re trying to bring, which are really not about stopping trade or trade divorce,” Tai said. “They’re really about bringing reform and a more strategic approach to trade.”

UKRAINE-CHINA (BBG): A call between top diplomats from China and Ukraine sends a fresh signal that President Xi Jinping could soon speak with Volodymyr Zelenskiy for the first time since Russia’s invasion more than a month ago. Foreign Minster Wang Yi reiterated China’s desire for a cease-fire in talks Monday with Ukraine counterpart Dmytro Kuleba, their first such exchange since March 1, according to the official Xinhua News Agency. The conversation came days after European leaders urged Xi to make greater efforts to halt the attack initiated by his close diplomatic partner, Vladmir Putin.

CHINA/COVID (RTRS): Chinese authorities extended a lockdown in Shanghai to cover all of the financial centre's 26 million people on Tuesday after city-wide testing saw new COVID-19 cases surge to more than 13,000 amid growing public anger over quarantine rules. The lockdown now covers the entire city after restrictions in its western districts were extended until further notice, in what has become a major test of China's zero-tolerance strategy to eliminate the novel coronavirus. At least 38,000 personnel have been deployed to Shanghai from other regions in what state media has described as the biggest nationwide medical operation since the shutdown of the city of Wuhan in early 2020 after the first known coronavirus outbreak there.

DATA:

EUROZONE DATA: Services PMIs See Stronger Demand, Expectations Slump

SPAIN MAR SERVICES PMI 53.4 (FORCST 54.3); FEB 56.6

- Spanish services PMI fell by 3.2 points in the March print, a further 0.9 points below the forecasted decline (however substantially above the 50-point breakeven mark).

- Domestic transport strikes and the war in Ukraine saw confidence fall.

ITALY MAR SERVICES PMI 52.1 (FORCST 51.5); FEB 52.8

- Italian services saw a smaller decline in March, stepping down 0.7 points in March.

- Costs levied by firms rose at near-record high and business confidence slipped to a 16-month low.

FRANCE FINAL MAR SERVICES PMI 57.4 (UNCH FLASH); FEB 55.5

- France services PMI was confirmed at a four-month high, with activity growth continuing to expand on the back of easing Covid restrictions.

GERMANY FINAL MAR SERVICES PMI 56.1r (FLASH 55.0); FEB 55.8

- German services saw a surprise upward revision of +1.1 points on the flash estimate as business activity reached a 6-month high.

- Reduced Covid-restrictions coupled with strong job growth enabled this boost, however, business expectations dropped to a 17-month low.

EUROZONE FINAL MAR SERVICES PMI 55.6 (FLASH 54.8); FEB 55.5

- Across the eurozone, input costs and output prices reached new record highs. The surge in uncertainty surrounding the Ukraine invasions saw new exports fall.

- March saw service growth was boosted across the region as pandemic restrictions were lifted.

- Energy cost inflation has been worsened by the Ukraine war, which alongside persistent supply-chain disruptions continue to drag on confidence and growth.

- Chief Business Economist at S&P Global Chris Williamson commented "It certainly seems likely however that the solid expansion seen in March will prove hard to sustain and there is clearly a greater risk of the economy stalling or contracting during the second quarter"

UK PMI: Service Sector Rebounds, Beats Flash

UK FINAL MAR SERVICES PMI 62.6r (FLASH 61.0); FEB 60.5

FINAL MAR COMPOSITE PMI 60.9r (FLASH 59.7); FEB 59.9

SERVICES REVISED UP 1.6 POINTS, COMP UP 1.2 POINTS FROM FLASH

- Both UK services and composite PMIs both saw substantial upwards revisions from the flash estimates.

- Services grew by 2.1 points (1.6 more than flash) and the composite reading increased by 1 point (1.2 more than the flash which saw a small contraction.

- The strong service sector recovery was due to the largest increase in business activity since the lockdown recovery in May 2021, as pandemic restrictions eased and boosted consumer demand.

- The UK service sector saw the fastest acceleration in output prices since the survey began in 1996, following suit as the Eurozone prints this morning also highlighted new record highs.

- Business optimism slumped to a 17-month low largely due to economic uncertainty surrounding the Ukraine war.

FIXED INCOME: Retracing some of yesterday's gains

Core fixed inome is moving lower this morning with no real key drivers. Bunds and gilts are largely retracing some of yesterday's rally while Treasuries have hit their lowest level in a week. Gilts lead the way lower.

- Data this morning has been mixed with final PMI prints seeing small revisions. The highlight of the data calendar will be the release of the ISM services index later today.

- There has been decent supply in Europe with E6bln of Green EU bonds being sold via syndication, GBP3.25bln of 5-year gilts, E1.495bln of 10/25-year RAGBs and E600mln of ILBs, in addition to bill from three issuers.

- Fed's Brainard, Daly and Williams are the only notable speakers today.

- TY1 futures are down -0-9+ today at 121-25+ with 10y UST yields up 5.1bp at 2.449% and 2y yields up 3.5bp at 2.459%.

- Bund futures are down -0.39 today at 158.71 with 10y Bund yields up 4.3bp at 0.546% and Schatz yields up 2.1bp at -0.69%.

- Gilt futures are down -0.47 today at 121.41 with 10y yields up 6.3bp at 1.609% and 2y yields up 6.9bp at 1.425%.

FOREX: Hawkish RBA Hold Tips EUR/AUD to Fresh 5y Low

- The RBA provided a hawkish surprise in its monetary policy decision overnight. Despite keeping the cash rate unchanged this time, the Board dropped the reference to "patience" in its interest rate outlook, setting the scene for future tightening.

- The RBA's hawkish policy hold overnight continues to push AUD to the top of the G10 table, with AUD gains most notable against NOK, JPY and EUR so far today. The move puts EUR/AUD through horizontal support drawn off the mid-2017 lows at 1.4424, with prices now at the lowest levels since late April 2017 - narrowing the proximity with the 2017 cyclical low of 1.3627.

- The greenback is on the backfoot, partially reversing several sessions of strength after the USD Index recovered off last week's lows. This keeps the DXY either side of the 99.00 handle, as markets watch the stabilisation of pricing for Fed policy ahead of the next FOMC meeting in a month's time.

- PMI data revisions across the Eurozone this morning left little mark on markets, better final readings for Germany were countered by lower Spanish releases.

- US and Canadian trade balance numbers for February are the calendar highlights, with some attention also likely paid to speeches from Fed's Brainard on inflation, Daly & Williams on the economy.

EQUITIES: Mixed Early Trade, Financials Lagging

- Japanese markets closed mixed: Japan's NIKKEI closed up 51.51 pts or +0.19% at 27787.98 and the TOPIX ended 4.51 pts lower or -0.23% at 1949.12.

- European stocks are likewise trading mixed, with Utilities leading and Financials lagging: the German Dax up 43.57 pts or +0.3% at 14518.16, FTSE 100 down 14.77 pts or -0.2% at 7558.92, CAC 40 down 14.38 pts or -0.21% at 6731.37 and Euro Stoxx 50 up 2.85 pts or +0.07% at 3951.12.

- U.S. futures are flat, with the Dow Jones mini up 4 pts or +0.01% at 34833, S&P 500 mini up 0.5 pts or +0.01% at 4578.25, NASDAQ mini up 4.75 pts or +0.03% at 15169.

COMMODITIES: Oil And Gas Continue To Regain Ground

- WTI Crude up $1.07 or +1.04% at $105.06

- Natural Gas up $0.16 or +2.77% at $5.872

- Gold spot down $2.27 or -0.12% at $1933.01

- Copper up $6.25 or +1.31% at $484.1

- Silver up $0.15 or +0.63% at $24.6867

- Platinum down $1.57 or -0.16% at $989.07

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/04/2022 | - |  | EU | ECB's de Guindos attends Ecofin | |

| 05/04/2022 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 05/04/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 05/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 05/04/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/04/2022 | 1400/1000 |  | US | Minneapolis Fed's Neel Kashkari and Fed Governor Lael Brainard | |

| 05/04/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/04/2022 | 1630/1230 |  | US | San Francisco Fed's Mary Daly | |

| 05/04/2022 | 1800/1400 |  | US | New York Fed's John Williams | |

| 06/04/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 06/04/2022 | 0600/0800 | ** |  | DE | manufacturing orders |

| 06/04/2022 | 0700/0900 |  | EU | ECB VP de Guindos speaks | |

| 06/04/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/04/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/04/2022 | 0900/1100 | ** |  | EU | PPI |

| 06/04/2022 | 0900/1100 |  | EU | ECB Schnabel Panel Moderation at ECB/EC Conference | |

| 06/04/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 06/04/2022 | 1145/1345 |  | EU | ECB Philip Lane panel appearance | |

| 06/04/2022 | 1330/0930 |  | US | Philadelphia Fed's Patrick Harker | |

| 06/04/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 06/04/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 06/04/2022 | 1800/1400 | * |  | US | FOMC Minutes |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.