-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Commodity Weekly - Russian Flows Reshuffling

MNI US OPEN: Eurozone Posts Weak Growth, High Inflation

EXECUTIVE SUMMARY:

- EUROZONE CORE INFLATION SURPRISES TO THE UPSIDE

- GERMAN Q1 GDP SEES MODEST UPTICK; ITALY CONTRACTS; FRANCE AND SPAIN STAGNATE

- MNI INTERVIEW: NEW ZEALAND RISKS HARD LANDING: EX-RBNZ OFFICIAL

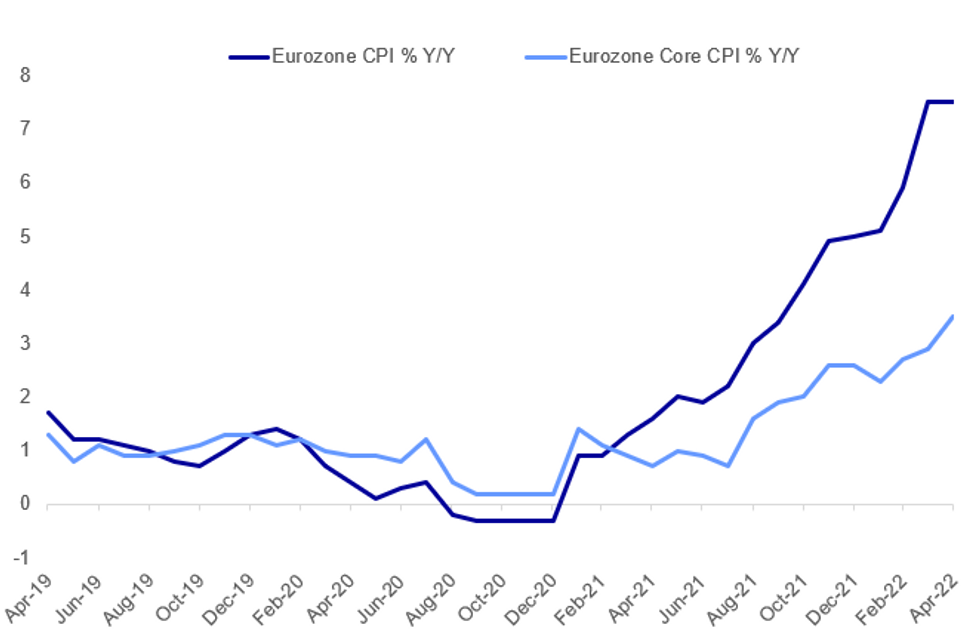

Fig. 1: Eurozone Core Inflation Continues To Accelerate

Source: Eurostat, MNI

Source: Eurostat, MNI

NEWS:

SPAIN (BBG): Spain’s government slashed its outlook for economic growth due to the impact from the war in Ukraine.Gross domestic product is set to expand 4.3% in 2022, down from a previous forecast of 7%, Economy Minister Nadia Calvino said in a press conference in Madrid Friday. The government sees the economy growing by 3.5% next year. The revised outlook was widely expected, with the economy already slowing. Earlier on Friday, the Spanish statistics-institute announced that GDP expanded less than predicted in the first quarter at 0.3%, as the country struggles with the fastest inflation in almost 40 years.

RBNZ (MNI INTERVIEW): A former senior Reserve Bank of New Zealand official has said he sees a "real risk" of a hard economic landing in NZ as a result of the central bank maintaining "negative rates" below the rate of inflation. For full article contact sales@marketnews.com

CHINA STOCKS (BBG): Technology stocks led a broad rally in Chinese equities on Friday as the nation’s top leaders vowed to boost economic stimulus and as speculation grew about a possible easing of the continued crackdown on internet firms.The Hang Seng Tech Index jumped 10% in Hong Kong, the most since March 16, led by names like Alibaba Group Holding Ltd. and JD.com Inc. The Communist Party’s Politburo said authorities will unveil specific measures to support the healthy and normal development of the platform economy.

CHINA: China will strengthen policy in a bid to help the economy grow in "a reasonable range" even though employment and inflation are all under new pressure after the latest outbreak of Covid-19 and the Ukraine crisis, a China Politburo meeting, chaired by President Xi Jinping, said on Friday.

US-CHINA (BBG): Americans’ negative views of China are rising as President Xi Jinping maintains close ties with Moscow during the war in Ukraine, a sign that the invasion and other issues are taking a toll on Beijing’s image. That’s according to the latest survey by the Pew Research Center, which found that 82% of respondents had “unfavorable opinions” of the Asian nation, up six percentage points from last year. It’s also the highest since 2020, when Pew began asking the question as part of a nationally representative survey that this year covered more than 3,500 people in late March.

CHINA-RUSSIA (BBG): China stepped up its rhetorical support for Russia, defying the U.S. and other nations who want Beijing to condemn Moscow for the war in Ukraine.“An important takeaway from the success of China-Russia relations is that the two sides rise above the model of military and political alliance in the Cold War era,” Foreign Ministry spokesman Zhao Lijian said, adding that they “commit themselves to developing a new model of international relations.”

DATA:

MNI: FRANCE Q1 2022 FLASH GDP 0.0% Q/Q; Q42021 +0.8%r Q/Q

MNI: FRANCE MAR CONS SPENDING -1.3% M/M, -2.4% Y/Y; FEB +0.9%r M/M

MNI: FRANCE FLASH APR HICP +0.5% M/M, +5.4% Y/Y; MAR +5.1% Y/Y

MNI: GERMANY Q1 2022 FLASH GDP +0.2% Q/Q SA; Q4 2021 -0.3% Q/Q

Q1 GDP Sees Modest Uptick

MNI: GERMANY Q1 2022 FLASH GDP +0.2% Q/Q SA; Q4 2021 -0.3% Q/Q

GERMANY Q1 22 PREL GDP +3.7% Y/Y WDA; +4.0% NSA

- German GDP data for Q1 was largely in line with flash estimates, 0.1pp higher than expected on the WDA print.

- German GDP ticked up a modest +0.2% q/q in Q1, following the -0.3% q/q decline seen in Q4 last year.

- The key upwards driver was higher capital formation, whilst net exports was a downwards driver.

- Effects of the Ukraine war have softened economic growth since late Feb. The German statistics office stresses that results are subject to large uncertainties due to the Ukraine war and Covid crisis.

MNI: SPAIN Q1 2022 FLASH GDP +0.3% Q/Q, Q4 2021 +2.2% Q/Q

MNI: ITALY FLASH Q1 2022 REAL SA WDA GDP -0.2% Q/Q; +5.8% Y/Y

MNI: EUROZONE FLASH APRIL HICP +0.6% M/M, +7.5% Y/Y; MAR +7.4% Y/Y

MNI BRIEF: EZ Inflation Higher, Core Prices Rising Faster

Eurozone inflation edged up to an annual rate of 7.5% in April, according to flash data released by Eurostat on Friday, an acceleration from the 7.4% pace recorded in March. However, prices rose by just 0.6% between March and April, a much slower increase than the 2.4% rise between February and March.

Core inflation, closely watched by the European Central Bank, accelerated more quickly than the headline number, rising by 1.1% in April for a 3.5% annual increase, up sharply from the 2.9% gain posted in March.

The jump in underlying inflation belies the repeated insistence by ECB President Christine Lagarde that energy prices are the main contributor to above-target inflation. Last weekend, Lagarde told America’s CBS News that a rise in interest rates would do nothing to alleviate high energy costs. Nonetheless, investors believe the ECB will be forced to lift interest rates as early as its July meeting.

Source: Eurostat

FIXED INCOME: Euribor moving lower is the highlight of the session so far

- The most notable moves in core fixed income this morning have been in the Euribor strip. There has been downward pressure since 7:45BST when French HICP data came out 3 tenths higher than expected. The moves lower for Euribor have continued despite the pan-Eurozone and Italian HICP prints coming in in line with expectations and the strip is up to 9.0 ticks lower, with the Jun-23 contract seeing the biggest move. Eurodollar and SONIA strips have moved a little lower in sympathy, but both are outperforming the Euribor strip.

- Euribor futures have dragged Schatz yields higher, and we have also seen 2-year UST yields move higher this morning.

- Bund futures started to move lower around 9:30BST/4:30ET - there was little data released at that time (in what has been a very busy data session), so it seems as though the moves lower in Euribor are pulling the whole German curve lower.

- In the rest of the session we still have US PCE, personal income / spending, the MNI Chicago Business Barometer and the final print of Michigan confidence to be released.

- TY1 futures are up 0-1 today at 119-12+ with 10y UST yields up 3.5bp at 2.860% and 2y yields up 4.9bp at 2.668%.

- Bund futures are down -0.01 today at 154.14 with 10y Bund yields up 0.6bp at 0.904% and Schatz yields up 3.8bp at 0.232%.

- Gilt futures are up 0.12 today at 118.97 with 10y yields down -1.5bp at 1.860% and 2y yields up 0.1bp at 1.536%.

FOREX: USD Dips in Final April Trading Day

- Markets are bouncing early Friday, with this week's sharp moves in currency markets partially reversing on the final trading day of the month. The greenback is the poorest performer so far, providing some relief for the likes of EUR/USD and GBP/USD and allowing the pairs to ease their currently oversold technical conditions.

- Data out this morning gave markets a firm clue on today's higher-than-expected April Eurozone inflation release, with core CPI now reaching 3.50% - another series high and confusing further the monetary policy outlook for the ECB. Nonetheless, regional releases suggested this would be the case, keeping EUR/GBP slightly underwater and just above the 0.8400 mark.

- Oil prices hold the bulk of the Thursday rally, keeping Brent and WTI prices in the green and helping support the likes of NOK, which is the firmest currency so far Friday. A solid set of Norwegian retail sales figures (+3.3% in March) and Credit growth keep the Norges Bank on track to raise rates further this year - although a number of analysts have flagged the risk of a rate rise at next week's non-policy report meeting.

- Looking ahead, US personal income/spending data for March is the data highlight ahead of MNI Chicago PMI and the final read for April UMich confidence. Canada's February GDP also crosses.

EQUITIES: US Futures Fading Some Of Thursday's Late Gains

- Chinese stocks closed higher: SHANGHAI closed up 71.578 pts or +2.41% at 3047.063 and the HANG SENG ended 813.22 pts higher or +4.01% at 21089.39.

- European equities are a stronger, with the German Dax up 135.78 pts or +0.97% at 13898.71, FTSE 100 up 18.87 pts or +0.25% at 7484.19, CAC 40 up 72.92 pts or +1.12% at 6448.27 and Euro Stoxx 50 up 34.2 pts or +0.91% at 3752.11.

- U.S. futures are giving up some of Thursday's gains, with the Dow Jones mini down 120 pts or -0.35% at 33708, S&P 500 mini down 30.25 pts or -0.71% at 4253.25, NASDAQ mini down 140 pts or -1.04% at 13315.5.

COMMODITIES: Precious Metals Jump As Dollar Pulls Back

- WTI Crude up $1.08 or +1.03% at $103.89

- Natural Gas up $0.02 or +0.22% at $7.122

- Gold spot up $21.4 or +1.13% at $1887.33

- Copper up $3.35 or +0.76% at $439.6

- Silver up $0.39 or +1.69% at $22.974

- Platinum up $13.46 or +1.46% at $913.67

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/04/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/04/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 29/04/2022 | 1230/0830 | ** |  | US | Employment Cost Index |

| 29/04/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 29/04/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 29/04/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.