-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Stocks At Fresh Lows, Yields / USD New Highs

EXECUTIVE SUMMARY:

- STOCKS DOWN AND DOLLAR UP IN RISK-OFF MOVE, YIELDS AT MULTI-YEAR HIGHS

- PUTIN'S SPEECH FOCUSES ON UKRAINE JUSTIFICATIONS, HIGHLIGHTS DONBAS AS KEY GOAL

- IRISH PM: N IRELAND PROTOCOL WON'T BE REMOVED

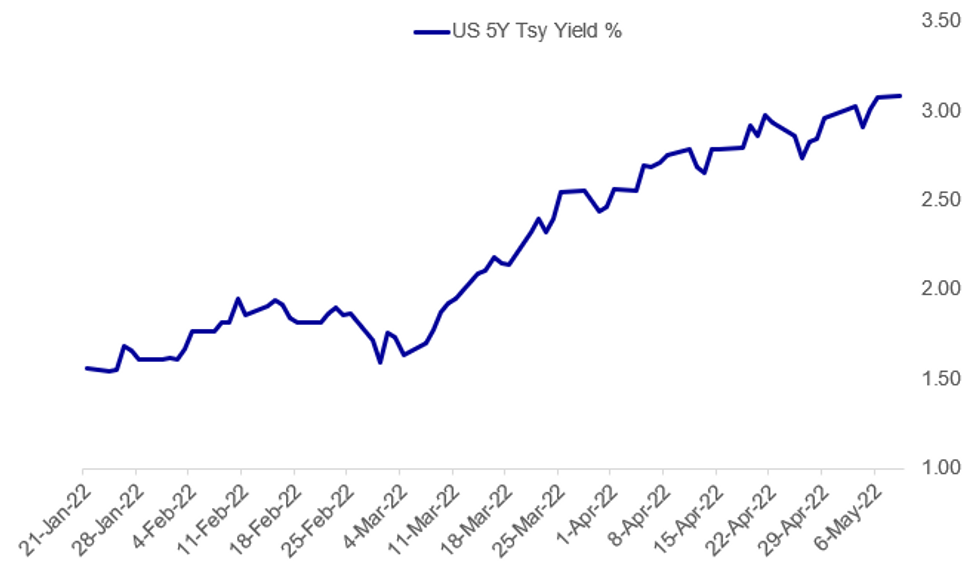

Fig. 1: 5 Year US Yields Hit Highest Since 2008

Source: BBG, MNI

Source: BBG, MNI

NEWS:

RUSSIA: FULL TEXT OF PUTIN'S VICTORY DAY SPEECH: http://kremlin.ru/events/president/news/68366

RUSSIA-UKRAINE (BBG): Russian President Vladimir Putin justified his faltering 10-week-old invasion of Ukraine as a battle comparable to the fight against Nazi Germany as he presided over his annual display of military might on Moscow’s Red Square. “Today, you’re defending what our fathers, grandfathers and great grandfathers fought for,” Putin said in a speech before the military parade on Monday, flanked by World War II veterans at the May 9 Victory Day celebration marking the German defeat in 1945. Some Western officials had suggested Putin might use the World War II anniversary to move to formally declare war in the conflict that the Kremlin calls a “special military operation.” This would allow Russia to order a mass mobilization, potentially helping to jump-start the stalled campaign. The Kremlin has denied any such plans and Putin made no mention of them in his speech.

IRELAND / UK (BBG): While Brexit deal’s Northern Ireland protocol won’t be removed, U.K. govt needs to “engage proactively” with EU to get issues around it resolved, Irish PM Micheal Martin tells RTE Radio. Says EU has been “flexible” on implementing the protocol but every time the EU “has demonstrated flexibility it hasn’t been reciprocated” by the U.K. Says EU now “more cautious” in discussions with U.K. govt. Now Northern Ireland elections are over it’s time for EU and U.K. to engage.

FED (FROM FRIDAY): Richmond Fed President Thomas Barkin tells MNI he would prefer not to pre-commit to raising interest rates by 50 basis points at every meeting: "You want to retain the optionality to make a decision at every meeting and with geopolitical risks being elevated." Barkin did not rule out a 75 basis point rate increase if inflation expectations were becoming unanchored, which he does not currently believe to be the case: "Anything would be on the table. I'll just say our pace is pretty accelerated right now." Asked about when the Fed should reduce the pace of easing or pause rate hikes, Barkin said "the time to reassess is when inflation starts to come down, or when underlying demand starts to come down."

CHINA (BBG - PUBLISHED OVERNIGHT): Chinese Premier Li Keqiang warned of a “complicated and grave” employment situation as Beijing and Shanghai tightened curbs on residents in a bid to contain Covid outbreaks in the country’s most important cities. Li instructed all government departments and regions to prioritize measures aimed at helping businesses retain jobs and weather the current difficulties, according to a late Saturday statement, which cited the premier’s comments in a nationwide teleconference on employment. “Stabilizing employment matters to people’s livelihoods, it is also a key support for the economy to operate within a reasonable range,” Li said, urging businesses to resume production with Covid-fighting measures in place, while reiterating the government’s policy to promote the healthy development of internet platform companies to support employment.

GERMAN POLITICS: The conservative CDU won by a landslide in this weekend's state election held in the northern state of Schleswig-Holstein in a contest seen as a litmus test of Chancellor Scholz's response to the Ukraine crisis. Official results put the CDU at 43.4%, well ahead of the runner-ups Greenswho won 18.3% of the vote. Scholz's SPD came third with 16.0%, whichrepresents their worst-ever result in the state and a loss of 11.3 percentagepoints from the previous poll. While the results are not representative for the national population, thedismal performance of the SPD bodes ill for Scholz's party ahead of thisSunday's state election in North Rhine-Westphalia, Germany's most populousstate currently governed by a CDU-FDP coalition.

DATA:

No key data released in the European morning.

FIXED INCOME: UST 5-year yields surpass 2018 highs

- Treasuries have moved to new cycle lows with 10-year yields now just 7.5bp off the 2018 highs while 5-year yields have surpassed their 2018 highs and are now at their highest levels since 2008. 10-year gilt yields have also reached cycle highs (highest levels since 2015) while 10-year Bund yields hit their highest level since 2014.

- Despite yields hitting new highs, the moves have been rather gradual, and have actually been at odds with the downward moves seen in equity markets.

- There has been some focus on Putin's comments during his Victory Day Parade speech today but he said little new. Hhe failed to declare a full mobilisation, but has not said Russia will back down - meaning potential for an extended campaign in Ukraine. He also said that Russia acted as the West was going to invade Russian land.

- There is little on the data calendar today and the only notable scheduled speech is at 14:00BST / 9:00ET from BOE's Saunders.

- TY1 futures are down -0-11 today at 117-14+ with 10y UST yields up 5.3bp at 3.184% and 2y yields down -1.2bp at 2.724%.

- Bund futures are up 0.21 today at 151.15 with 10y Bund yields up 0.7bp at 1.136% and Schatz yields down -4.0bp at 0.272%.

- Gilt futures are down -0.25 today at 117.32 with 10y yields up 3.3bp at 2.027% and 2y yields down -2.2bp at 1.465%.

FOREX: USD Remains Stronger as Equities Extend YTD Pullback to 15%

- Equity markets sit lower in early Europe, reinforcing the underlying risk-off tone as concerns continue to swirl over the direction of global monetary policy and the implications of a wave of stagflation across developed markets in H2 this year. Yields in the US continue to surge, with the 5yr yield now north of 2018 highs and briefly clearing 3.10%.

- There have been further notable moves in Chinese currency markets, with USD/CNH surging to new cycle highs following downbeat comments from Chinese Premier Li on the domestic labour market. The uncharacteristically candid speech reverberated across Asia, with the offshore yuan offered, even as the PBOC continued to lean against its depreciation via the daily fixing of USD/CNY mid-point.

- Russian President Putin spoke to mark his country's Victory Day parade, and staunchly defended his army's approach to their invasion of Ukraine. His persistent combative stance

- The greenback remains comfortably the firmest performer as markets continue to play catch-up with the hawkish Fedspeak during NY hours on Friday, as MNI interviewed Fed's Barkin - who stated "anything would be on the table," including an outsized 75bps rate hike.

- Canadian building permits and US wholesale inventories / trade sales numbers cross, but the central bank speaker slate is quiet, with no notable speeches due. Elsewhere, France's Macron meets his counterpart Scholz in the first foreign trip for the President since his re-election a few weeks ago.

EQUITIES: Losses Resume, With Tech Underperforming

- Asian markets closed lower: Japan's NIKKEI closed down 684.22 pts or -2.53% at 26319.34 and the TOPIX ended 37.52 pts lower or -1.96% at 1878.39. China's SHANGHAI closed up 2.58 pts or +0.09% at 3004.141.

- European stocks are under pressure and many indices at multi-month lows, with the German Dax down 131.05 pts or -0.96% at 13680.38, FTSE 100 down 80.87 pts or -1.09% at 7387.94, CAC 40 down 94.71 pts or -1.51% at 6258.36 and Euro Stoxx 50 down 46.04 pts or -1.27% at 3624.5.

- U.S. futures are down sharply, led by tech stocks, with the Dow Jones mini down 389 pts or -1.19% at 32420, S&P 500 mini down 58.75 pts or -1.43% at 4060.75, NASDAQ mini down 210.5 pts or -1.66% at 12485.25.

COMMODITIES: Broad Losses On Risk-Off, Dollar Gains

- WTI Crude down $1.45 or -1.32% at $108.86

- Natural Gas up $0.11 or +1.32% at $8.158

- Gold spot down $18.88 or -1% at $1871.11

- Copper down $11.4 or -2.67% at $419.05

- Silver down $0.24 or -1.08% at $22.1513

- Platinum down $13.66 or -1.42% at $954.88

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/05/2022 | 1230/0830 | * |  | CA | Building Permits |

| 09/05/2022 | 1300/1400 |  | UK | BOE Saunders Speaks at Resolution Foundation Event | |

| 09/05/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 09/05/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 09/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 09/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 10/05/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 10/05/2022 | 0130/1130 |  | AU | NAB Business Survey | |

| 10/05/2022 | 0600/0800 | * |  | NO | CPI Norway |

| 10/05/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 10/05/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 10/05/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 10/05/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 10/05/2022 | 1140/0740 |  | US | New York Fed's John Williams | |

| 10/05/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 10/05/2022 | 1315/0915 |  | US | Richmond Fed's Tom Barkin | |

| 10/05/2022 | 1345/0945 |  | US | Treasury Secretary Janet Yellen | |

| 10/05/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 10/05/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 10/05/2022 | 1700/1300 |  | US | Minneapolis Fed's Neel Kashkari and Governor Christopher Waller | |

| 10/05/2022 | 1720/1920 |  | EU | ECB de Guindos at IESE Banking Industry Meeting | |

| 10/05/2022 | 1900/1500 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.