-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Treasuries And Stocks Gain Ahead Of CPI

EXECUTIVE SUMMARY:

- MNI U.S. CPI PREVIEW: STRONG CORE NUMBER SEEN ON SMALLER AUTOS DRAG

- LAGARDE: HIKE COULD COME "A FEW WEEKS" AFTER NET ASSET PURCHASES END

- E.U. STATES MUST PREPARE FOR NIRP EXIT: BUBA'S NAGEL

- HUNGARY REJECTS LATEST EU PROPOSALS ON RUSSIA OIL SANCTIONS

- TERRAUSD STABLECOIN PLUNGES TO AROUND 35 CENTS

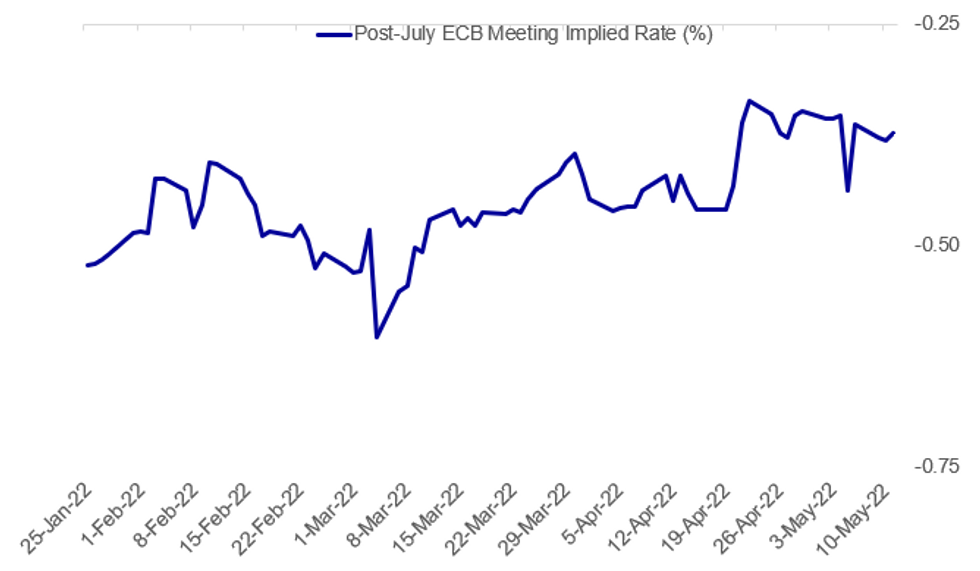

Fig. 1: 20bp Of ECB Hikes Still Priced By July Meeting

Source: BBG, MNI

Source: BBG, MNI

NEWS:

US INFLATION: Consensus has core inflation firming to +0.4% M/M from the +0.32% M/M in March, driven by a smaller decline or possibly a rise in used autos after sliding nearly 4%.

- Headline is seen weaker at +0.2% M/M as large declines in gasoline weigh on energy whilst food inflation maintains its recent strong pace.

- FOMC consensus appears increasingly set on 2x50bp hikes in Jun/Jul but implications further along the rate path will depend on the usual breadth of inflationary pressure and what happens to stickier rent components.

- Click for full preview.

ECB: ECB President Lagarde's speech this morning gave a survey of inflation and policy since the 2008 global financial crisis, differentiating the road ahead by saying "it looks increasingly unlikely that the disinflationary dynamics of the past decade will return".

- Most market focus is on prospects for an initial hike in July - she didn't push back on the widespread expectation (and pricing) for that timing, with the key paragraph on forward guidance below. Note "only a few weeks" would basically be compatible with a July 21 meeting hike after ending asset purchases July 1. As such, pricing didn't adjust much on her comments (still a little over 20bp in cumulative hikes priced by the July meeting):

- "Judging by the incoming data, my expectation is that [net asset purchases] should be concluded early in the third quarter. The first rate hike, informed by the ECB’s forward guidance on the interest rates, will take place some time after the end of net asset purchases. We have not yet precisely defined the notion of “some time”, but I have been very clear that this could mean a period of only a few weeks. After the first rate hike, the normalisation process will be gradual."

ECB: The disinflationary dynamics of the past decade appear increasingly unlikely to return, European Central Bank president Christine Lagarde said in a speech Wednesday, but consumption and investment are both still below their pre-crisis levels, while the war in Ukraine has tempered growth rates at the same time as further pushing up inflation, creating a challenge for central banks. As reported by MNI (MNI SOURCES:ECB To Hold Course For Tightening Amid Uncertainty), flexibility and gradualism will be key to ensuring both price stability and the smooth transition of monetary policy to normal, she said. “Actions that demonstrate our commitment to price stability will be critical to anchor inflation expectations and contain second-round effects,” Lagarde said.

ECB: The overall number of interest rate hikes undertaken by the European Central Bank this year "remains to be seen," Bundesbank president Joachim Nagel said in a speech Wednesday, although he believes negative interest rate will be history in the euro area "relatively soon" following swift and smooth exit from very accommodative monetary policy. Having acted in concert during the Covid-19 pandemic, the interplay between monetary and fiscal policy could now change in high of rising inflation and the challenge of mitigating the distributional implications of rising energy and commodity prices, amid a slowing recovery and already diminished fiscal buffers, Nagel said.

EU/ENERGY (BBG): Hungary will only agree to sanctions on Russian oil imports if shipments via pipelines are excluded, Foreign Minister Peter Szijjarto said.He said the latest European Union proposals, which include giving Hungary and some other countries heavily reliant on Russian energy more time to comply with sanctions, fell short of the eastern European country’s energy-security needs.“If Brussels is serious about introducing this embargo, then that’s only possible if shipments via pipelines are excluded,” Szijjarto said in a Facebook video on Wednesday.

CRYPTO (BBG): TerraUSD, the algorithmic stablecoin whose 1-to-1 peg to the US dollar crashed in the past few days, tumbled on Wednesday as markets await a rescue by the token’s backers. TerraUSD fell as low as around 20 cents before recovering to about 40 cents at 9 a.m in London, Bloomberg pricing showed.

CZECH NATIONAL BANK (BBG): Czech policy maker Ales Michl, a vocal opponent of the central bank’s aggressive campaign to increase interest rates, was appointed to take over as the bank’s governor as the country struggles to contain its worst inflation in almost three decades. The decision by President Milos Zeman may herald a shift in the European Union nation’s approach toward monetary policy after an unprecedented push to cool consumer spending. Michl will take over in July from Jiri Rusnok, who will chair one last rate meeting before his term ends.

MALAYSIA: Malaysia's central bank on Wednesday surprised with a 25 basis point rise in its Overnight Policy Rate today, the first movement in rates since July 2020. Bank Negara Malaysia's Monetary Policy Committee increased the OPR to 2.0%, with the ceiling and floor rates of the OPR corridor correspondingly increased to 2.25% and 1.75%, respectively.

DATA:

FIXED INCOME: TY1 futures match May's highs

- After a relatively stable Asian session, core fixed income started moving higher again as Europe got into the office. TY1 futures matched last Thursday's high (which was also the high of May so far) and continues to challenge the 119-09+ level but has failed to break through as yet.

- The focus this morning has been on ECB speakers, with many more still due to come (the majority are speaking in Ljubljana). There has been little new from comments so far, however.

- The main highlight of the day, however, will be US CPI. The FOMC consensus appears increasingly set on 2x50bp hikes in Jun/Jul but implications further along the rate path will depend on the usual breadth of inflationary pressure and what happens to stickier rent components. For the full MNI CPI Preview click here.

- TY1 futures are up 0-14+ today at 119-07+ with 10y UST yields down -6.7bp at 2.927% and 2y yields down -4.3bp at 2.571%.

- Bund futures are up 0.64 today at 153.59 with 10y Bund yields down -4.0bp at 0.958% and Schatz yields down -5.5bp at 0.101%.

- Gilt futures are up 0.47 today at 119.61 with 10y yields down -4.4bp at 1.802% and 2y yields down -2.8bp at 1.287%.

FOREX: Greenback Softer as Markets Settle Ahead of CPI

- The greenback is taking a moderate leg lower in early Wednesday trade, with markets pre-positioning and squaring ahead of the much-watched inflation release from the US. The move lower in the dollar is providing some relief to recent underperformers, helping the likes of NZD and AUD to the top of the G10 table ahead of the NY crossover.

- In tandem, equity markets are improving off the lows, with the e-mini S&P back above 4,000 and helping risk proxy FX further. Scandi currencies also trade well for a second consecutive session as hot domestic inflation prints keep central banks on the front-foot and add to the hiking bias across both Norway and Sweden.

- The US inflation release takes focus going forward, with markets expecting a moderation in price pressures on a month-on-month basis (consensus is for 0.2% and 0.4% for the core reading). Full MNI CPI preview here: https://marketnews.com/mni-us-cpi-preview-strong-c... ). There remain a number of speakers due Wednesday, including ECB's Vasle, Centeno & Schnabel as well as Fed's Bostic.

EQUITIES: Cyclical Stocks Lead Early European Gains

- Asian markets closed mostly higher: Japan's NIKKEI closed up 46.54 pts or +0.18% at 26213.64 and the TOPIX ended 11.23 pts lower or -0.6% at 1851.15. China's SHANGHAI closed up 22.859 pts or +0.75% at 3058.703 and the HANG SENG ended 190.88 pts higher or +0.97% at 19824.57.

- European stocks continue to rebound, with the German Dax up 129.34 pts or +0.96% at 13611.41, FTSE 100 up 70.66 pts or +0.98% at 7243.22, CAC 40 up 88.52 pts or +1.45% at 6116.91 and Euro Stoxx 50 up 59.48 pts or +1.67% at 3588.99.

- U.S. futures are bouncing as well, with the Dow Jones mini up 273 pts or +0.85% at 32360, S&P 500 mini up 41 pts or +1.03% at 4037.75, NASDAQ mini up 154.75 pts or +1.25% at 12503.75.

COMMODITIES: Metals Bounce As Dollar Falters

- WTI Crude up $2.98 or +2.99% at $102.05

- Natural Gas up $0.06 or +0.85% at $7.385

- Gold spot up $11.31 or +0.62% at $1849.43

- Copper up $5.55 or +1.34% at $420.65

- Silver up $0.51 or +2.42% at $21.6746

- Platinum up $23.49 or +2.43% at $984.91

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 11/05/2022 | 1220/1420 |  | EU | ECB Schnabel Keynote Speech at Austrian National Bank | |

| 11/05/2022 | 1230/0830 | *** |  | US | CPI |

| 11/05/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 11/05/2022 | 1600/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 11/05/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 11/05/2022 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.