-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI US OPEN: Safe Havens Gain As Stocks Drop Again

EXECUTIVE SUMMARY:

- FINLAND'S PRESIDENT, PRIME MINISTER SUPPORT JOINING NATO

- ECB'S KAZIMIR: "READY TO HIKE IN JULY"

- UK GDP GROWTH SLOWS IN MARCH

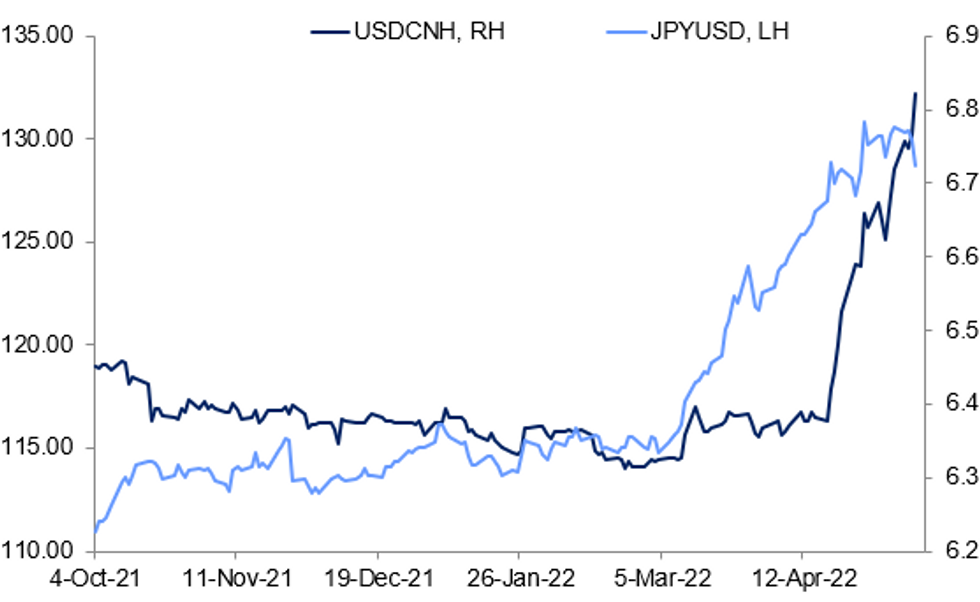

Fig. 1: Yuan Keeps Weakening, But Yen Benefits From Safe Haven Move

Source: BBG, MNI

Source: BBG, MNI

NEWS:

FINLAND / NATO (BBG): Finland’s highest-ranking policy makers threw their weight behind an application to join NATO, expected within a few days.President Sauli Niinisto and Prime Minister Sanna Marin said in a statement Thursday that they favor membership in the North Atlantic Treaty Organization. “Finland must apply for NATO membership without delay,” they said. The shift in Finland’s defensive position was spurred by a full-scale war Russia is waging in Ukraine, and neighboring Sweden is also nearing a decision in the coming days.

SWEDEN/NATO: Speaking to Swedish radio, Foreign Minister Ann Linde states that the announcement from the Finnish president and PM that the country should seek NATO membership without delay 'naturally affects' Sweden. She does not confirm whether Stockholm will follow suit, but it appears increasingly likely that both Nordic nations will seek to have a fast-track application process in place.

ECB (RTRS): European Central Bank policymaker Peter Kazimir dropped a hint about a July interest rate increase on social media on Wednesday, joining a growing number of colleagues in calling for a hike to tackle record-high inflation. "(I am) ready to hike in July -- and not just the beautiful Atlas Mountains here in #Morocco," the Slovak governor wrote on Twitter. He added he was in the North African country for the annual meeting of the European Bank for Reconstruction and Development (EBRD).

BOE: Ramsden's comments in a recently published Bloomberg interview probablyaren't too surprising. Recall that he was one of the four MPC members who had voted for a 50bp hike in February. He said that "we're not there yet in terms of how far monetary policy has to tighten... I'm still very, very supportive of the forward guidance that there may well need to be further tightening in the coming months."

GERMANY / RUSSIA / ENERGY (BBG): German Economy Minister Robert Habeck says Gazprom Germania GmbH and its subsidiaries are getting alternative supplies of gas after Russia imposed sanctions on the company and halted deliveries. “The situation is that the gas market can compensate for the loss of gas from Russia”: Habeck says in speech to lower house of parliament in Berlin. “We are monitoring the situation closely. We have prepared for the situation and I, and the federal network agency, will inform you through the course of the day”

CHINA/RUSSIA (BBG): Russian setbacks in Ukraine have begun to prompt more explicit warnings in China about Moscow’s value as a diplomatic partner, in a sign of growing unease over President Xi Jinping’s strategic embrace of Vladimir Putin. Russia was headed for defeat and being “significantly weakened” by the conflict, a former Chinese ambassador to Ukraine told a recent Chinese Academy of Social Sciences-backed seminar in remarks widely circulated online. The comments, which Bloomberg News was unable to verify, were attributed to retired diplomat Gao Yusheng, who served as China’s top envoy in Kyiv from late 2005 to early 2007.

UK-EU (BBG): EU is “willing to be extremely flexible” in terms of how Brexit deal’s Northern Ireland Protocol is implemented, Irish Foreign Minister Simon Coveney tells RTE Radio.UK rhetoric on EU’s actions on protocol “isn’t reflective of the reality”While there is a “way forward,” we can’t do it “under threat” of UK unilateral action.

CRYPTO REGULATION (BBG): “Fast-paced developments in DeFi and cryptoassets necessitate a proactive and forward-looking regulatory and supervisory approach,” according to Bank of Spain Governor Pablo Hernandez de Cos. “In deciding how best to harness the potential benefits from such developments while mitigating their risks in a world of uncertainty, it makes sense to err on the side of caution and prudence,” De Cos, who’s also chairman of the Basel Committee on Banking Supervision, says in speech in Madrid.

DATA:

MNI BRIEF: UK March Growth Slows As Test & Trace Ends

UK GDP rose by 0.8% in the opening months of the year, higher despite a 0.1% decline in March output. That takes output 0.7% above Q4 2019 -- the best quarterly measure of pre-pandemic growth, the Office for National Statistics said Thursday. Services expanded by a much-lower-than expected 0.4% in Q1, well below the 0.8% predicted by City economists, contributing 0.36 percentage points to quarterly GDP. Manufacturing rose by 1.3%, while construction jumped by 3.8%.

On the expenditure side, consumption rose by 0.6%, adding 0.33 percentage points to growth. Business investment declined by 0.5%, while government spending fell by 1.7%. Net exports subtracted a whopping four percentage points from quarterly growth. Output declined by 0.1% in March, a bit below expectations, while February growth was revised to zero from the previously-reported 0.1% gain.

Lower growth in March, the first full month of the Ukraine invasion by Russia, will come as no surprise to the Bank of England, as they see growth slowing sharply through 2022, weighed largely by higher inflation, slowing household spending and the impact of the war.

MNI BRIEF: UK Q1 Trade Deficit Hits Record High

The UK trade gap — excluding precious metals — widened to a record GPB25.2 billion in the first quarter, the largest since record began, from £10.3 billion in Q4.

Over the first quarter, total adjusted exports rose by 2.1%, with EU exports rosing by 1.7%. Total imports jumped by 9.3%, with EU imports rising 8.6%. Net trade subtracted 4 percentage points from GDP growth.

Excluding non-monetary gold, the trade gap rose to GBP10.0 billion in March from GBP6.2 billion in February.

SWEDEN: CPIF Hits 1991 High

MNI: SWEDEN APR CPI +6.4% Y/Y, +0.6% M/M; MAR +6.0% Y/Y

SWEDEN APR CPIF +6.4% Y/Y; MAR +6.1% Y/Y

- CPIF accelerated by 0.3pp in April to a 1009 high of +6.4% y/y, beating the consensus forecast of a 0.1pp uptick. On the month, prices accelerated by 0.6% m/m, a slowdown from +1.7% m/m recorded in March.

- Food prices saw further upwards pressure (+1.3% m/m), whilst energy prices decreased in April from March (-3.9% m/m, albeit remaining elevated in year-on-year readings). Widespread price increases were seen across the board.

- Core CPIF (ex energy) saw a substantial 0.4pp uptick to 4.5% y/y.

- This data increases the probability of a 50bp hike by the Riksbank at the June 29 meeting (see previous bullet).

FOREX: USD and the Yen lead in FX

- A busy start for FX during the early European session.

- The standout has been the Yen, extending decent gains throughout the session acting as a safer haven, with risk tilted to the downside.

- Similar drive for the USD, with market participants favouring the USD, the Dollar is in the green across the majors, besides the Yen.

- UK GDP miss, also Ukraine, Brexit (back in the mix), are keeping USD, and Govies bid.

- Yesterday's US CPI, saw Airfare as the big outlier, but desk still expect for inflation to soften in the coming Months.

- Despite the UK GDP miss this morning, the Pound is still mixed in G10, down 1.64% versus the Yen ( like most Currencies), while holding gains against the NOK, NZD, AUD, EUR, and the SEK.

- BITCOIN has cleared the big 28,824.32 support.

- Next psychological support is at 20,000, and below the latter, would open to 19,272.91 (76.4% retrace of the 2020/2021 rally).

- Bitcoin printed a 25,424.51 low, and has found some demand to trade at 27,480.00 at the time of typing.

- Looking ahead, on the data front, sees US PPI, and the only speaker left, will be ECB Makhlouf.

FIXED INCOME: Rally continues

Core fixed income has been grinding higher this morning, continuing yesterday's reversal which began following the release of US CPI and breaking through a number of key technical levels in the process.

- TY1, Bund and BTP futures are all at their highest levels of May while gilt futures were last higher on 7 April. Bunds and gilts have seen larger moves today than Treasuries with curve bull flattening.

- This morning saw the release of disappointing UK activity data - showing that Q1 growth was weaker than expected with March monthly GDP data moving into negative territory (the first full month following the Ukraine war but ahead of the increase in consumer energy prices or national insurance rises which both came in in April).

- The focus shifts back to US inflation with PPI due for release at 13:30BST / 8:30ET, alongside jobless claims.

- TY1 futures are up 0-18 today at 119-26+ with 10y UST yields down -9.4bp at 2.824% and 2y yields down -6.9bp at 2.571%.

- Bund futures are up 2.03 today at 154.94 with 10y Bund yields down -12.1bp at 0.862% and Schatz yields down -7.2bp at 0.062%.

- Gilt futures are up 1.62 today at 120.63 with 10y yields down -12.3bp at 1.701% and 2y yields down -8.7bp at 1.185%.

EQUITIES: No Relief For Tech Stocks

- Asian markets closed weaker: Japan's NIKKEI closed down 464.92 pts or -1.77% at 25748.72 and the TOPIX ended 21.97 pts lower or -1.19% at 1829.18. China's SHANGHAI closed down 3.709 pts or -0.12% at 3054.994 and the HANG SENG ended 444.23 pts lower or -2.24% at 19380.34.

- European stocks are down sharply, with the with the German Dax down 339.38 pts or -2.45% at 13556.36, FTSE 100 down 161.12 pts or -2.19% at 7205.7, CAC 40 down 135.97 pts or -2.17% at 6152.34 and Euro Stoxx 50 down 99.56 pts or -2.73% at 3564.91.

- U.S. futures continue to head lower, again led by tech stocks, with the Dow Jones mini down 186 pts or -0.59% at 31561, S&P 500 mini down 29.25 pts or -0.74% at 3901.25, NASDAQ mini down 142 pts or -1.19% at 11828.5.

COMMODITIES: Oil And Copper Down Sharply On Global Growth Concerns

- WTI Crude down $2.68 or -2.54% at $103.4

- Natural Gas down $0.37 or -4.84% at $7.418

- Gold spot down $1.9 or -0.1% at $1848.57

- Copper down $16.25 or -3.86% at $405.45

- Silver down $0.27 or -1.27% at $21.2932

- Platinum down $16.4 or -1.65% at $982.05

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/05/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 12/05/2022 | 1230/0830 | *** |  | US | PPI |

| 12/05/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 12/05/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 12/05/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 12/05/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 12/05/2022 | 1535/1135 |  | CA | BOC Deputy Gravelle speech on commodity shocks. | |

| 12/05/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/05/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 12/05/2022 | 1800/1400 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.