-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS: Stock Sell-Off Resumes

Highlights:

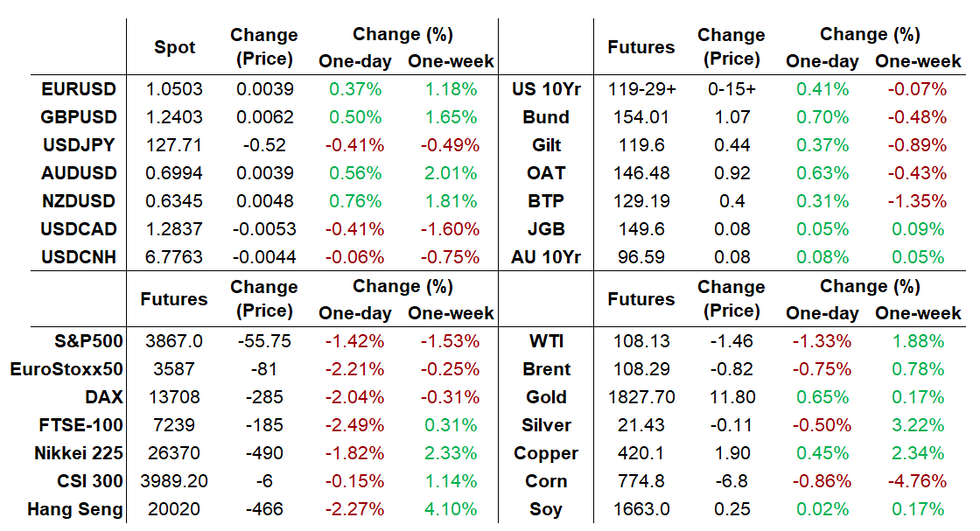

- A continuation of the global risk-off move sees European stocks 2+% lower and U.S. futures testing last week's lows.

- Safe-haven bonds have benefited from risk aversion, but the US dollar has not.

- The accounts of the ECB's April meeting, US jobless claims, and Philly Fed Business Outlook are coming up.

US TSYS: Treasuries Resume Yesterday’s Surge, 10Y TIPS Later

- Cash Tsys have resumed yesterday’s surge (led by US retailer cost pressure warnings) through the European session after a brief period of respite overnight on throughput ticking up at the Shanghai port and positive developments surrounding Shanghai’s removal of Covid restrictions.

- In a change to yesterday where resilient Fed hike expectations somewhat pinned the front-end of the curve and drove a sizeable flattening, this morning’s rally has been largely across the curve (2s10s 21bps).

- 2YY -5.2bps at 2.618%, 5YY -6.3bps at 2.828%, 10YY -6.0bps at 2.824% and 30YY -5.1bps at 3.013%.

- TYM2 sits 15 ticks higher at 119-29 on strong volumes from an earlier high of 119-30+. They move within touching distance of resistance at 120-00+ (May 12 high) after which lies 120-18+ (Apr 27 high).

- Bond issuance: US Tsy $14B 10Y TIPS auction re-open (91282CDX6) – 1300ET

- Bills issuance: US Tsy $35B 4W, $30B 8W bill auctions – 1130ET

- Data: Philly Fed of note as a similar slide to that seen in Monday’s Empire mfg survey could add fuel to the rates rally, along with existing home sales for April.

EGB/Gilt: European FI Rallies Amid Equity Fall

European government bonds have rallied sharply today alongside broad selling of equities in a more characteristic risk-off move.

- Gilts have firmed with the curve bull flattening. Cash yields are now 2-4bp lower on the day while the curve is 3bp flatter.

- Bunds have outperformed gilts, particularly at the longer end, with the benchmark 30-year yield down 10bp The 2s30s spread has narrowed 8bp.

- The long-end of the OAT curve has similarly rallied sharply. Yields are down 1-9bp.

- BTPs have underperformed core EGBs with yields 2-6bp lower.

- German Chancellor Olaf Scholz stated that Ukraine's application to join the EU would not be fast-tracked.

- Supply this morning came from France (OATs, EUR1.497bn) Spain (Bono/Oblis/Green Obli, EUR5.477bn & OATei/OATi, EUR1.497bn), Ireland (IRTBs, EUR750mn).

- The European data slate was light this morning. Focus now shifts to US initial jobless claims and the Philly Fed Business Outlook update.

STIR FUTURES: Fed Hike Expectations Fade On Continued Risk-Off

- Having proved resilient to yesterday’s risk-off pivot, Fed Funds implied hikes move lower on today’s continuation through the European session.

- The 2x50bp hikes per broad FOMC member guidance remains in place (52bp Jun, 102bp Jul) with larger falls later in the year with 142bp for Sep (148bp high yday) and 193bp for Dec (201bp high yday).

- Harker late yesterday joined another ‘23 voter in Evans in expecting 50bps at Jun and Jul meetings before a more measured pace thereafter.

- The only scheduled appearance is from Kashkari (’23) at 1600ET.

Source: Bloomberg

Source: Bloomberg

EUROPE BOND AUCTION RESULTS

SPAIN:

- E1.352bln of the 0% May-25 Bono (bid-to-cover 1.86x)

- E1.117bln of the 0.80% Jul-27 Obli (bid-to-cover 1.37x)

- E1.988bln of the 0.70% Apr-32 Obli (bid-to-cover 1.27x)

- E1.02bln of the 1.00% Jul-42 Green Obli (bid-to-cover 1.39x)

FRANCE:

- E3.445bln of the 0% Feb-25 OAT (bid-to-cover 2.49x)

- E3.435bln of the 0% Feb-26 OAT (bid-to-cover 2.1x)

- E4.617bln of the 0.75% Feb-28 OAT (bid-to-cover 2.46x)

- E738mln of the 0.10% Jul-31 OATei (bid-to-cover 2.78x)

- E527mln of the 0.10% Mar-32 OATi (bid-to-cover 2.47x)

- E232mln of the 0.10% Mar-36 OATi (bid-to-cover 2.81x)

BOND / RATES OPTIONS

Europe:

- RXN2 139p, was bought for 4.5 in ~10k

US:

- TYN2 122c, bought for 17 in 10k

- EDN2 97.375c, bought for 10 and 11 in 30k (ref 97.33)

FOREX: Risk Off leads cross Assets

- All the action has been in the Swissy this morning in FX, with the currency extending gains across the board this morning, a continuation from yesterday, after SNB Jordan noted that the SNB is ready to act if inflation pressures continue.

- Risk off tone this morning has also provided further strength for the CHF.

- The currency lead against the USD up 1.12%%, with next support now seen towards 0.9785.

- Below the latter, opens to 0.9733, the 38.2% retrace of the March/May rally.

- The USD trades in the red today, taking its cue from the lower yield, as investors move into safer Haven, on the back of the risk off tone.

- US Retailers warned of rising cost pressures yesterday, and Global inflation concerns have put pressure in Equities.

- Looking ahead, there's no market moving data of note.

- Focus turns to the ECB Accounts (minutes).

- Speakers include, ECB Guindos, de Cos, Holzmann, Riksbank Floden, and Fed Kahskari

FX OPTION EXPIRY

Of note: EURUSD 2.08bn between 1.0435/1.0450- EURUSD: 1.0435 (684mln), 1.0440 (656mln), 1.0445 (537mln), 1.0450 (209mln), 1.0480 (240mln), 1.0495 (301mln).

- USDJPY: 127.60 (466mln), 128 (330mln), 128.40 (241mln), 128.50 (713mln).

Price Signal Summary - S&P E-Minis Bear Trigger Remains Exposed

- In the equity space, S&P E-Minis found resistance at yesterday’s high of 4095.00. This leaves initial key resistance - 4099.00, the May 9 high - intact. The reversal lower yesterday signals a resumption of the primary downtrend and attention is on support and bear trigger at 3855.00, May 12 low. A break would resume the downtrend and open 3843.25, the Mar 25 2021 low (cont). The primary trend direction in EUROSTOXX 50 futures remains down. However, the contract is currently in a corrective cycle following the recovery from 3466.00, May 10 low. Price has probed resistance at 3736.70, the 50-day EMA. A clear break of this EMA would improve a short-term bullish theme. On the downside, key support and the bear trigger is 3466.00.

- In FX, EURUSD remains in a downtrend and recent gains are considered corrective. A resumption of weakness would open 1.0341, the Jan 3 2017 low and a key support. Resistance to watch is at 1.0569, the 20-day EMA. GBPUSD traded higher Tuesday and the pair cleared 1.2406, the May 9 high. This move was reversed on Wednesday as resistance around the 20-day EMA capped gains. The average intersects at 1.2494 where a clear break is required to signal potential for a stronger recovery. A deeper pullback would expose key support at 1.2156, May 13 low and the bear trigger. USDJPY remains above initial firm support at 127.52, May 12 low. A resumption of gains would refocus attention on the bull trigger at 131.35, May 9 high. A break would open 131.96, the 1.00 projection of the Feb 24 - Mar 28 - 31 price swing. Sub 127.52 levels would expose support at 126.95, Apr 27 low.

- On the commodity front, Gold remains vulnerable and short-term gains are considered corrective. The yellow metal traded through $1800.0 on Monday. The focus is on $1780.4, the Jan 28 low. In the Oil space, WTI futures maintain a firm note, following recent gains, and despite the current pullback. The contract has this week breached resistance at $111.37, May 5 high and $113.51, the Mar 24 high. A resumption of gains would open $118.13, the Mar 9 high and the $120.00 handle. Initial support is at $106.50, the 20-day EMA.

- In the FI, Bund futures remain in a downtrend and the contract has pulled away from recent highs. Resistance has been defined at $155.33 May 12 high. An extension lower would open 150.49, the May 9 and the bear trigger. The broader trend condition in Gilts remains down. The contract has found resistance at 121.07, May 12 high. The bear trigger is at 116.87, May 9 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/05/2022 | 1130/1330 |  | EU | ECB April meeting Accounts | |

| 19/05/2022 | - |  | EU | ECB Lagarde & Panetta in G7 Meeting | |

| 19/05/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/05/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 19/05/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 19/05/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 19/05/2022 | 1230/1430 |  | EU | ECB de Guindos Keynote Address at Harvard | |

| 19/05/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 19/05/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 19/05/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 19/05/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 19/05/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 19/05/2022 | 2000/1600 |  | US | Minneapolis Fed's Neel Kashkari | |

| 20/05/2022 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 20/05/2022 | 0600/0800 | ** |  | DE | PPI |

| 20/05/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 20/05/2022 | 0730/0830 |  | UK | BOE Chief Economist Huw Pill speech | |

| 20/05/2022 | - |  | EU | ECB Lagarde & Panetta in G7 Meeting | |

| 20/05/2022 | 1200/1400 |  | EU | ECB Lane in Discussion at Stockholm Uni | |

| 20/05/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/05/2022 | 1400/1000 | * |  | US | Services Revenues |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.