-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US OPEN: UK Rate Hike Expectations Edge Higher

EXECUTIVE SUMMARY:

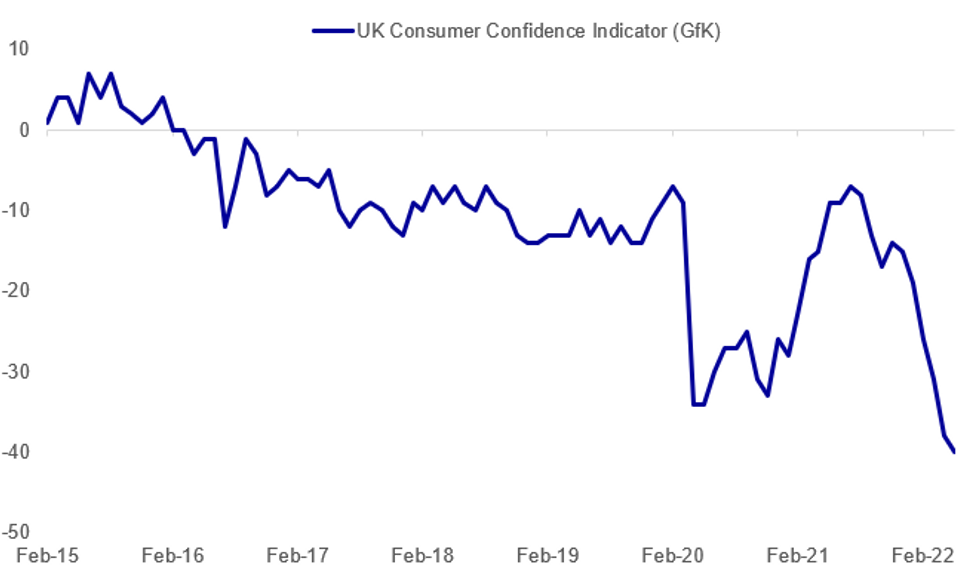

- UK RETAIL SALES IN UPSIDE SURPRISE, BUT CONSUMER CONFIDENCE CRUMBLING

- PBOC 5Y LPR CUT TO BOOST PROPERTY DEMAND (MNI STATE OF PLAY)

- BOE PILL BACKS FURTHER, BUT GRADUAL TIGHTENING

- BIDEN LANDS IN SOUTH KOREA ON FIRST TRIP TO ASIA AS PRESIDENT

Fig. 1: UK Consumer Confidence Hits Lowest On Record

Source: GfK, BBG, MNI

Source: GfK, BBG, MNI

NEWS:

PBOC: The People's Bank of China cut its long-term lending reference rate at an unexpected-pace, sending a clear signal to boost a soft property market, which is a key driving force to reach the growth target this year. The Loan Prime Rate, guiding lenders' actual loan interest rates, was lowered by 15bps to 4.45% for the five-year maturity, the second cut this year after a 5bps reduction in January, but the central bank kept the one-year LPR unchanged at 3.7% this month. This is the third cut that for the five-year and above tenors of LPR after it was introduced in 2019, and the 15bps cut is the largest pace on record.

BOE: The Bank of England's Chief Economist Huw Pill defended the Monetary Policy Committee's gradual approach to tightening while stating that more would be needed. The MPC was split in May between those seeking a 50 basis point hike and a 25 bps one and Pill made the case for the MPC to tread carefully along the tightening path, with uncertainties high and much depending on the evolution of energy prices. "This tightening still has further to run," Pill said, while setting out the case for gradualism.

UK CONSUMER (MNI INTERVIEW): UK consumer confidence is crumbling under the weight of 40-year high inflation despite one of the strongest jobs markets ever seen, according to Joe Staton at GfK, whose survey published Friday showed household sentiment at the lowest on record and with sub-measures even gloomier. For full article contact sales@marketnews.com

BOJ (MNI INSIGHT): A weak economy and limited wage hikes will keep the Bank of Japan focused on easy policy even as a flatter base comparison for mobile phone charges in consumer prices will add to already stubborn cost-push prices to keep headline inflation above 2% , MNI understands. For full article contact sales@marketnews.com

ECB (BBG): The European Central Bank might be ready to increase interest rates for the first time in more than a decade in July, Governing Council member Ignazio Visco said. “We can move gradually, raising interest rates in the coming months,” Visco said in an interview with Bloomberg Television on Friday. While June is too early as that is when the ECB will end net bond purchases, “we will move after that -- after that, means perhaps July.”

US (BBG): President Joe Biden arrived in South Korea, where he’s set to visit a Samsung Electronics Co. semiconductor complex Friday as he seeks to bolster supply chains that reduce reliance on China.Biden’s first trip to Asia as president, which runs through Tuesday, also includes Japan. He’ll meet with regional leaders in a bid to firm up support for his plans to help Ukraine fend off Russia’s invasion and counter security threats posed by China and North Korea, which may conduct its first nuclear test since 2017 with Biden nearby.

DATA:

MNI BRIEF: UK Retail Sales In Upside Surprise

UK retail sales recovered in April, outpacing market expectations for a further modest decline, data released Friday by the Office for National Statistics showed. Month-on-month, sales volumes both including and excluding fuel, rose by a seasonally adjusted 1.4%. However, year on year, sales fell 4.9% and 6.1% respectively.

Despite the strong rebound in monthly comparisons, the ONS noted the overall picture continued to show "a longer term downward trend." There was a strong showing by clothes retailers as the summer season came into view and by supermarkets/off licenses. The ONS suggested some of the pick-up in food retailing may be "due to people staying in more to save money".

The plight of the consumer as inflation rises to 40-year highs is certainly impacting on sentiment, as MNI have reported (MNI INTERVIEW: Rising Prices Spooking UK Consumer-GFK's Staton).

FIXED INCOME: UK hiking probabilities reassessed (again)

- UK market pricing has continued to bounce around this week, with expectations of hikes increasing again today, helping gilts to underperform both Bunds and Treasuries. The triggers include a better than expected retail sales print (which is still very disappointing in the details and showing a downtrend) and more sellside outfits increasing their BOE hike expectations after the strong labour market data earlier this week. BOE Chief Economist Huw Pill also spoke this morning and sounded as though he would back 25bp hikes at the next two meetings and potentially then continue voting for 25bp. He sounded far away from voting for a 50bp hike, though, in our opinion. For more on Pill's speech click here.

- The gilt curve has largely seen a parallel move with US and German curves bear steepening a little - reversing some of yesterday's moves.

- The rest of the day's calendar looks rather light with ECB's Centeno and de Cos both due to speak again (but unlikely to say much new). We also have Eurozone consumer confidence data at 15:00BST / 16:00CET.

- TY1 futures are down -0-3 today at 119-19+ with 10y UST yields up 2.4bp at 2.864% and 2y yields up 2.1bp at 2.631%.

- Bund futures are down -0.52 today at 153.36 with 10y Bund yields up 3.5bp at 0.982% and Schatz yields up 1.9bp at 0.376%.

- Gilt futures are down -0.53 today at 118.58 with 10y yields up 4.7bp at 1.910% and 2y yields up 4.7bp at 1.525%.

FOREX: The Dollar remains mixed in G10

- A mixed start for FX and across assets, with USD up against JPY, NOK, EUR and CHF, down versus NZD, CAD, AUD, GBP and SEK.

- There's been no spillovers onto the USD from the Risk tilted to the upside this morning.

- European Equities are leading the US higher, but moves have been limited in very low volumes.

- AUD tested a new session high against the USD and the EUR.AUDUSD saw yesterday's high at 0.7073 holding so far, printed 0.7074 high.

- Yesterday's low in EURAUD comes at 1.4950, but better would be seen towards 1.48882.

- AUDNZD has pared most of yesterday afternoon bounce and now target 1.0982, the 12th May low and the lowest level since the 3rd May.

- USDCAD is down 0.33%, still well within range, trading at 1.2780 at the time of typing, but note that further push lower will highlight the large option expiry at 1.2730, with 2.63bn.

- Looking ahead, the only notable data for the session will be the EU Consumer Confidence.

- Speakers, sees ECB de Cos and Centeno, and on the other side of the pond Fed Bullard interview on Fox.

EQUITIES: Tech And Energy Names Leading Early Europe Gains

- Asian stocks closed stronger: Japan's NIKKEI closed up 336.19 pts or +1.27% at 26739.03 and the TOPIX ended 17.29 pts higher or +0.93% at 1877.37. China's SHANGHAI closed up 49.602 pts or +1.6% at 3146.567 and the HANG SENG ended 596.56 pts higher or +2.96% at 20717.24.

- European equities are higher, with Info Tech and Energy sectors leading, and Consumer (both Staples and Discretionary) lagging: the German Dax up 238.83 pts or +1.72% at 14121.52, FTSE 100 up 123.22 pts or +1.69% at 7425.46, CAC 40 up 73.66 pts or +1.17% at 6346.12 and Euro Stoxx 50 up 51.26 pts or +1.41% at 3691.4.

- U.S. futures are higher, led by tech: Dow Jones mini up 286 pts or +0.92% at 31488, S&P 500 mini up 44.5 pts or +1.14% at 3942.25, NASDAQ mini up 190.25 pts or +1.6% at 12067.5.

COMMODITIES: Broadly Higher, Oil Lagging

- WTI Crude down $0.56 or -0.5% at $111.65

- Natural Gas down $0.22 or -2.62% at $8.095

- Gold spot up $3.52 or +0.19% at $1845.16

- Copper up $1.85 or +0.43% at $430.05

- Silver up $0.08 or +0.34% at $21.9968

- Platinum up $2.6 or +0.27% at $967.45

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/05/2022 | - |  | EU | ECB Lagarde & Panetta in G7 Meeting | |

| 20/05/2022 | 1200/1400 |  | EU | ECB Lane in Discussion at Stockholm Uni | |

| 20/05/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/05/2022 | 1400/1000 | * |  | US | Services Revenues |

| 21/05/2022 | - |  | AU | Australian Federal Election | |

| 23/05/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 23/05/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 23/05/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 23/05/2022 | 1600/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 23/05/2022 | 1615/1715 |  | UK | BOE Governor Bailey Panels Discussion |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.