-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Russia Stands Alone In Cutting Rates

EXECUTIVE SUMMARY:

- RUSSIAN CENTRAL BANK CUTS RATES; KOREA HIKES

- UK'S SUNAK SET TO ANNOUNCE LUMP-SUM PAYMENTS TO HOUSEHOLDS

- NO "SPIRALLING" INFLATION: RBA'S HARPER (MNI INTERVIEW)

- APPLE TO KEEP IPHONE PRODUCTION FLAT AS MARKET GROWS TOUGHER

- BOJ's KURODA: 2% CPI UNLIKELY SUSTAINED LONG-TERM

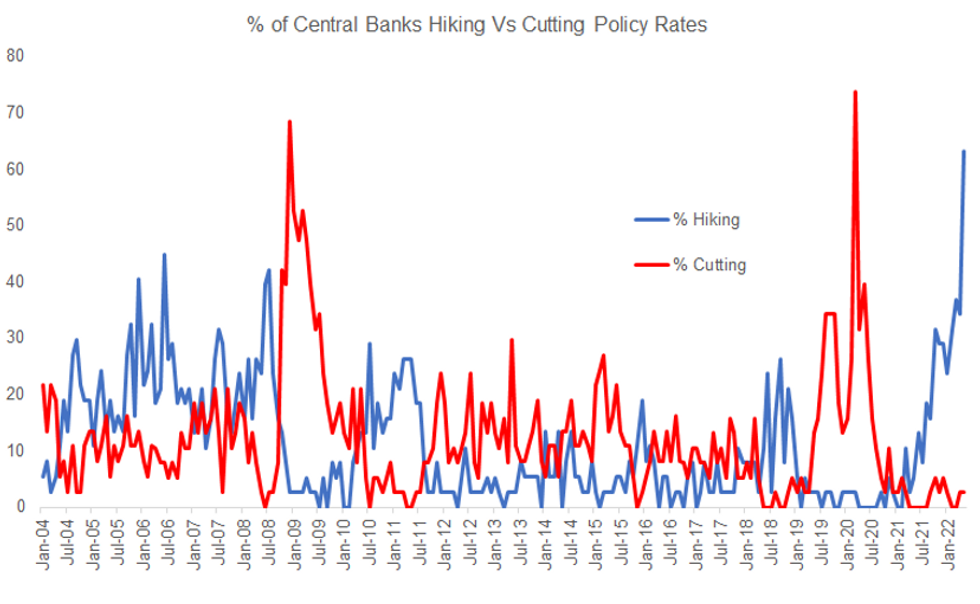

Fig. 1: Russia Stands Out As The Only Rate Cutter

Source: BiS, MNI Calculations

Source: BiS, MNI Calculations

NEWS:

RUSSIA: CBR cuts rates by 300bps to 11.00%, from 14.00% previously, a slightly larger cut relative to median consensus, but the estimates were wide-ranging. Full policy statement here: https://www.cbr.ru/eng/press/pr/?file=26052022_103...

CENTRAL BANKS: With today's rate cut, Russia has the only major central bank (of 38 tracked by the BiS) cutting their benchmark rate this month. 24 of those have hiked this month, the highest proportion of any month in at least 18 years.

KOREA: The Bank of Korea on Thursday, as expected, decided to raise its policy interest rate to 1.75% from 1.50% amid ongoing concern over inflationary pressures, Yonhap News Agency reported.

UK: Chancellor of the Exchequer Rishi Sunak is set to deliver a statement to the House of Commons at around 1230BST (0730ET, 1330CET). Sunak is expected to announce further gov't measures to assist households amidst rising inflationary pressures. Times Reporter Steven Swinford via Twitter: "Rishi Sunak to announce lump-sum payments worth up to £600 for 8.4million households on means-tested benefits. It's on top of new £400 discounts on energy bills for every household. Sunak's package today thought to be in excess of £30billion."

EU (MNI): The European Union is heading for a light-touch revision of its fiscal rules, with an emphasis on sustainable debt reduction combined with scrutiny of states' spending and investment plans, EU officials told MNI, after the European Commission said it would not reveal its proposals for reform of economic governance until the autumn. For full article contact sales@marketnews.com

RBA (MNI INTERVIEW): Both surveys of consumers and financial market pricing indicate that inflation expectations remain within the Reserve Bank of Australia's 2%-3% target range while a weakening housing market should dampen future price increases, RBA board member Ian Harper told MNI.

TURKEY: The CBRT is expected to leave its 1-week repo rate steady at 14% on May 26 despite de-anchoring inflation expectations and renewed TRY weakness. The Ukraine war shock combined with the renewed TRY weakness could delay the ‘disinflation process’ that the CBRT has been referring to in its latest meetings. For our comprehensive previewclick here.

APPLE (BBG): Apple Inc. is planning to keep iPhone production roughly flat in 2022, a conservative stance as the year turns increasingly challenging for the smartphone industry.The company is asking suppliers to assemble roughly 220 million iPhones, about the same as last year, according to people familiar with its projections, who asked not to be named as they’re not public. Market forecasts have hovered closer to 240 million units, driven by an expected major update to the iPhone in the fall. But the mobile industry has gotten off to a difficult start to the year and production estimates are down across the board.

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Thursday that inflation will stay around 2% for now, but that level is unlikely to be sustained. He added that the BOJ will have to keep the stability of markets when the bank proceeds to an exit of easy policy in the future. "It is not easy (for the BOJ) to proceed an exit strategy, while maintaining the stability of markets. But I believe the BOJ can do it," Kuroda said

TWITTER (BBG): Twitter shares up 5% in premarket trading on Thursday after billionaire Elon Musk dropped plans to partially fund his purchase of Twitter with a margin loan tied to his Tesla stake and increased the size of the deal’s equity component to $33.5 billion.

DATA:

MNI: ITALY ISTAT MAY CONSUMER CONFIDENCE 102.7 VS APR 100.0

MAY M/M CONSUMER GDS UP; INTERMED. & CAPITAL GDS DOWN --ISTAT

FIXED INCOME: Core FI bull steepening

- Small risk-off feeling to markets today, with core fixed income markets bull steepening as rate expectations get pared back.

- The front-end of the gilt curve is moving in line with Schatz while 10y gilts are moving in line with USTs.

- Very little in the way of market-moving headlines this morning or data, except for the UK where it has been confirmed that Chancellor Sunak will make a statement at 12:30BST where he is expected to outline the government's updated cost of living strategy.

- Speakers: Most are scheduled for the tail end or after the European session with ECB's Centeno and Fed's Brainard and Daly all due.

- Data: Second print of US GDP as well as pending home sales and the Kansas City Fed manufacturing index.

- TY1 futures are up 0-6+ today at 120-25+ with 10y UST yields down -1.3bp at 2.734% and 2y yields down -2.7bp at 2.468%.

- Bund futures are up 0.33 today at 154.25 with 10y Bund yields down -2.8bp at 0.921% and Schatz yields down -3.8bp at 0.292%.

- Gilt futures are down -0.24 today at 118.37 with 10y yields up 2.2bp at 1.930% and 2y yields up 0.8bp at 1.424%.

FOREX: Kuroda Doesn't See Risk to JPY From Fed Policy

- JPY takes the early lead in G10 currencies after a generally subdued overnight session, after comments from BoJ governor Kuroda livened up the currency. Kuroda opined that a tightening Federal Reserve would not necessarily translate into a weaker JPY, with a number of other global factors also a determinate in FX rates. The governor defended the bank's exit strategy, stating that the bank would manage the course effectively - possibly surprising markets that aren't considering an exit from easy policy in Japan any time soon.

- In response, markets sold USD/JPY through the Y127.00 handle, putting the pair at 126.55 and nearer key support of the 50-dma at 126.39 as well as the May 24 low at 126.36.

- Elsewhere, trading is far more muted, with the greenback and EUR posting furtive early gains, but respecting recent ranges more broadly. Focus remains on recent tumult in equity markets, with front-end implied vols across DM and EM currencies still elevated.

- Weekly jobless claims data alongside the secondary reading for US Q1 GDP is the data highlight Thursday, with Canadian retail sales also due. Fed's Brainard, Daly and ECB's Centeno make up the central bank speaker slate.

EQUITIES: Energy Continues To Lead Gains; Tech Lagging

- Asian markets closed mixed: Japan's NIKKEI closed down 72.96 pts or -0.27% at 26604.84 and the TOPIX ended 1 pts higher or +0.05% at 1877.58. China's SHANGHAI closed up 15.644 pts or +0.5% at 3123.108 and the HANG SENG ended 55.07 pts lower or -0.27% at 20116.2.

- European markets are a little higher, with the German Dax up 52.57 pts or +0.38% at 14088.74, FTSE 100 down 3.7 pts or -0.05% at 7540.83, CAC 40 up 19.87 pts or +0.32% at 6339.16 and Euro Stoxx 50 up 13.81 pts or +0.38% at 3701.35.

- U.S. futures are flat/lower, Dow Jones mini up 2 pts or +0.01% at 32078, S&P 500 mini down 3.5 pts or -0.09% at 3973.25, NASDAQ mini down 46.75 pts or -0.39% at 11895.5.

COMMODITIES: NatGas Prices Continue To Gain

- WTI Crude up $0.68 or +0.62% at $111.02

- Natural Gas up $0.16 or +1.77% at $9.13

- Gold spot down $6.23 or -0.34% at $1847.54

- Copper down $2.65 or -0.62% at $422.8

- Silver down $0.19 or -0.87% at $21.7978

- Platinum down $5.35 or -0.56% at $944.79

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/05/2022 | 1100/1300 | * |  | TR | Turkey Benchmark Rate |

| 26/05/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 26/05/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 26/05/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 26/05/2022 | 1230/0830 | *** |  | US | GDP (2nd) |

| 26/05/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 26/05/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 26/05/2022 | 1400/1000 |  | MX | Mexican central Bank policy meet minutes | |

| 26/05/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 26/05/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 26/05/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 26/05/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 26/05/2022 | 1600/1200 |  | US | Fed Vice Chair Lael Brainard | |

| 26/05/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 27/05/2022 | 2330/0830 | ** |  | JP | Tokyo CPI |

| 27/05/2022 | 0130/1130 | ** |  | AU | Retail Trade |

| 27/05/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 27/05/2022 | 0800/1000 | ** |  | EU | M3 |

| 27/05/2022 | 1135/1335 |  | EU | ECB Lane Panelist at BOJ-IMES Conference | |

| 27/05/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 27/05/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 27/05/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 27/05/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.