-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI US OPEN

MNI US OPEN: EU Bans Most Russian Oil Imports

- EU Bans Most Russian Oil Imports

- US Will Not Supply Ukraine With Long-Range Missiles

- China Covid Restrictions Easing

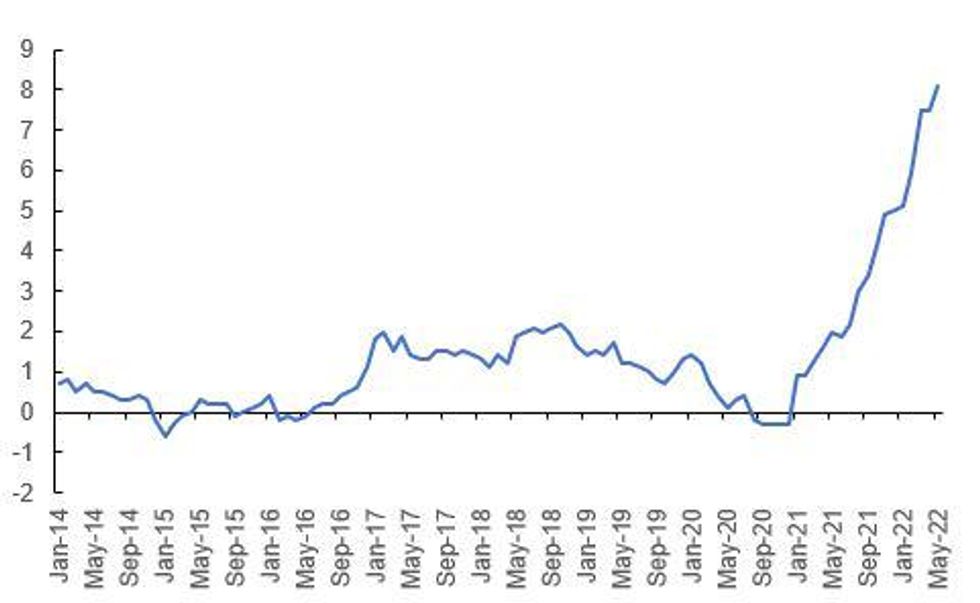

Fig 1. Eurozone CPI

Source: MNI, Eurostat, Bloomberg

NEWS

EU-RUSSIA (FT): EU leaders have struck a deal to ban most Russian oil imports as they seek to deprive Russian president Vladimir Putin of revenues to fund his war in Ukraine. The embargo, which was agreed after weeks of difficult negotiations, will include oil and petroleum products but contains a temporary exemption for oil delivered from Russia by pipeline. This was intended to grant Hungary, Slovakia and the Czech Republic extra time to wean themselves off crude oil supplies from Russia. The agreement signed late on Monday evening paved the way for the EU to enact a heavily delayed sixth package of sanctions, which includes measures to hit Russian banks and individuals.

EU-RUSSIA (REUTERS): Russia widened its gas cuts to Europe on Tuesday with energy giant Gazprom turning off supplies to top Dutch trader GasTerra escalating the economic battle between Moscow and Brussels. The move comes a day after Denmark flagged a potential end to its Russian gas supply and the European Union's toughest measure yet against Russia for its invasion of Ukraine, an agreement to halt sea-borne imports of its oil. GasTerra, which buys and trades gas on behalf of the Dutch government, said it had contracted elsewhere for the 2 billion cubic metres (bcm) of gas it had expected to receive from Gazprom through October. "This is not yet seen as a threat to supplies," said Economy Affairs Ministry spokesperson Pieter ten Bruggencate.

US-UKRAINE (GUARDIAN): Joe Biden has said the US will not supply Ukraine with rockets that can reach into Russia, in an attempt to ease tensions with Moscow over the potential deployment of long-range missiles with a range of about 185 miles. The White House has been weighing up pleas from Ukraine – which is losing ground in the battle for Donbas – for multiple-launch rocket systems (MLRS) to offset Moscow’s increasingly effective use of long-range artillery, amid Russian warnings that doing so would cross a red line. “We are not going to send to Ukraine rocket systems that can strike into Russia,” Biden told reporters on Monday after arriving back at the White House after a weekend in Delaware.

CHINA (REUTERS): Shanghai authorities on Tuesday began dismantling fences around housing compounds and ripping police tape off public squares and buildings, to the relief of the city's 25 million residents, before a painful two-month lockdown is lifted at midnight.

DATA

SWISS APR UNEMPLOYMENT RATE 2.4%; MAR 2.4%

SWISS APR UNEMPLOYMENT RATE 2.4%; MAR 2.4%

FOREX: Greenback Back Above 50-DMA Support

- The greenback is clawing back recent losses in Tuesday trade, with the USD Index back above the 50-dma - which remains a key support with the level not convincingly broken so far this cycle. As a result, the USD is the firmest in G10, while NZD, SEK and the EUR are among the weakest.

- Eurozone May CPI estimate was the data highlight - mimicking the Spanish, German and Italian inflation readings in coming in ahead of expectations: 8.1% vs. Exp. 7.8%. The release resulted in pressure on core Eurozone bond markets, with Bund futures and Italian BTPs both dropping lower upon release. EUR, however, has failed to follow suit, with the single currency drifting against most others in G10. EUR/USD has erased the Monday upside, with EUR/GBP narrowing the gap with support at 0.8500 and Friday's 0.8481.

- MNI Chicago PMI is the data highlight going forward, with markets expecting the figure to moderate to 55.1 fom 56.4 previously. May consumer confidence follows, with Canadian GDP also due.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.