-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY14.8 Bln via OMO Friday

MNI BRIEF: Canada Interest Cost 11% Of Revenue, Most Since '12

MNI ASIA OPEN: Fed Harker Urges Cautious Policy Approach

MNI ASIA MARKETS ANALYSIS: Rate Slide Falters Ahead Dec NFP

MNI US OPEN: RBA Hawkish Surprise

EXECUTIVE SUMMARY:

- RBA CITES INFLATION PRESSURE IN 50BPS HIKE

- MNI ECB PREVIEW: TIME TO ACT

- GERMAN FACTORY ORDERS SEE SURPRISE DECLINE, OUTLOOKS STILL PESSIMISTIC

- INFLATION PUTS THAI CBANK UNDER PRESSURE (MNI STATE OF PLAY)

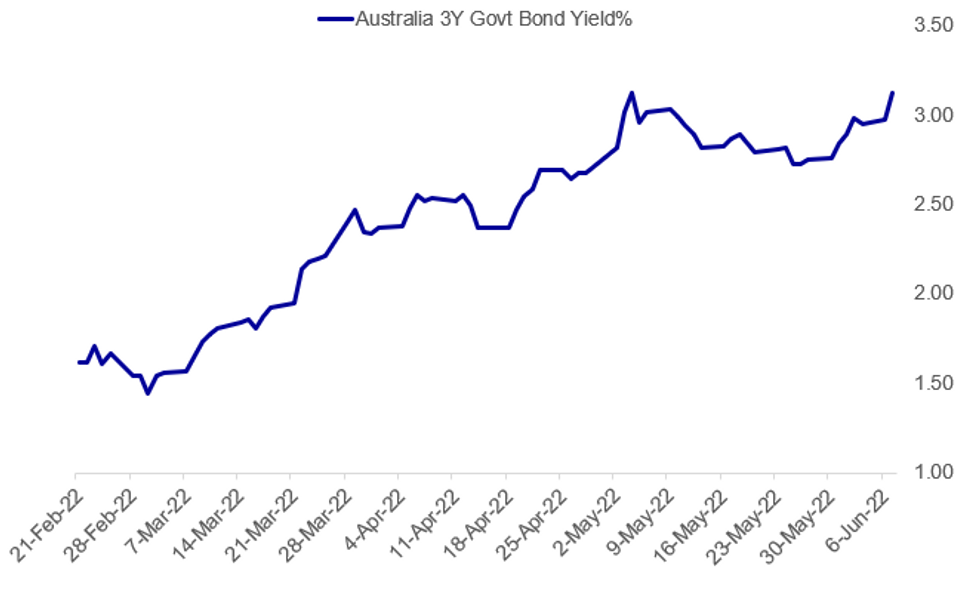

Fig. 1: RBA Hawkish Surprise

Source: BBG, MNI

Source: BBG, MNI

NEWS:

RBA: The Reserve Bank of Australia has cited inflation pressures in its decision to hike official interest rates by a higher than expected 50 basis points on Tuesday. The RBA board decided to hike rates to 0.85% in the second rate rise in as many months, (See MNI STATE OF PLAY: Inflation To Drive Another RBA Hike). The central bank said that given the resilience of the Australian economy and current inflation pressures a 50bps rise was appropriate as it withdrew monetary support needed during the pandemic lockdowns. Australian second quarter CPI inflation came in at 5.1% and trimmed mean inflation, the RBA’s preferred measure, is at 3.7% and outside the target range of 2% to 3% for the first time in more than a decade.

ECB (MNI PREVIEW): The ECB is now clear that the APP will end in early July, policy rate lift-off will occur in the same month and policy rates will reach zero by September. A 50bp hike in July is a low, but increasing, risk. However, the probability is rising of a one-off 50bp hike or a series of such hikes from September onward.

BOJ (RTRS): Bank of Japan Governor Haruhiko Kuroda apologised on Tuesday about his remarks a day earlier that Japanese households were growing accustomed to price increases, Jiji news agency reported. "I'm sorry that the expression caused misunderstanding," Jiji quoted Kuroda as telling reporters.

CHINA: Chinese offshore borrowers are increasingly eyeing euro-denominated bonds as dollar yields rise on Fed tightening, market analysts said. Some previous dollar bond issuers have turned to the euro and other currencies, according to analysts, including China International Capital Corp. Data from China Central Depository & Clearing Co. shows the yield on the 10-year China euro bond rated A+ is 2.19% at present, compared with 3.98% of its dollar counterpart and 3.58% of the domestic company bond with a AAA rating.

BANK OF THAILAND (MNI STATE OF PLAY): Thailand is experiencing a 14-year high inflation rate and the baht is weakening, but this is not expected to result in a change of policy settings at this week's meeting of the Bank of Thailand. The BoT has held its policy rate steady at 0.50% since May 2020, and while it had been expected to continue to hold rates unchanged for most of this year there are mounting pressures to tighten

DATA:

GERMANY: Factory Orders See Surprise Decline, Outlooks Remain Pessimistic

GERMANY APR FACTORY ORDERS -2.7% M/M, -6.2% Y/Y; MAR -4.2r%

- German factory orders came in substantially weaker than forecast in April, dashing the expected recoveries by contracting 2.7% m/m (vs +0.4% expected) and diving to -6.2% y/y (-4.1% expected).

- The German Statistics Office stated that this third month of contraction is on the back of escalations in the Ukraine war, as demand for capital goods slumped a further 4.3% as economic uncertainty grew. Consumables also saw a decline, of 2.6%.

- The latest factory orders release foreshadow the closely watched German IP due tomorrow and imply downside surprises to the data set.

- March readings were upwardly revised by 0.5pp for the month-on-month to -4.2% and by 0.2pp to -2.9% y/y.

UK: Employment looks better in final PMIs

The services PMI picked up and we have now seen the employment components look better in both the final services and final manufacturing reports than was the case in the flash. This had been something that we thought was a bit of an early warning flag from the flash PMI data, and that flag is still waving but less vigorously. The details behind the upward revision on the whole look pretty positive.

Below are the parts of the press release relating to the labour market:

- Flash: "That said, the rate of job creation eased slightly since April and was the least marked for 13 months. Some businesses noted that a desire to reduce costs had led to the non-replacement of voluntary leavers."

- Services final: "The latest survey highlighted another robust increase in staffing numbers. The rate of job creation was unchanged since April, with many firms commenting on efforts to rebuild business capacity and realign workforce numbers with the recovery in client demand. Survey respondents once again commented on severe shortages of candidates to fill vacancies, which led to rising wages and acted as a brake on growth."

- Manufacturing final: "UK manufacturing employment rose for the seventeenth successive month in May, albeit at the slowest pace since last October."

FIXED INCOME: Bunds lead the way higher, partially retracing yesterday's moves

- After reaching new cycle lows, Bunds have headed higher over the past couple of hours with yields now down 3.4bp on the day. There was no real headline driver to trigger the reversal but we still remain some way below levels seen 24 hours ago. We have seen a similar move in the Euribor strip while peripheral spreads are all generally a bit tighter on the day.

- Treasuries and gilts have been dragged higher, but to a much smaller extent. Gilts have showed no real reaction to the confidence vote that saw PM Boris Johnson survive but with a smaller majority than Theresa May (who was out of office within 6 months of winning a confidence vote).

- Today's calendar is relatively light with the highlight of the morning having been an upward revision to the UK service PMI (with the employment component in particular looking better).

- TY1 futures are up 0-7+ today at 118-05 with 10y UST yields down -3.2bp at 3.010% and 2y yields down -1.5bp at 2.714%.

- Bund futures are up 0.57 today at 149.75 with 10y Bund yields down -3.4bp at 1.285% and Schatz yields down -2.3bp at 0.650%.

- Gilt futures are up 0.18 today at 114.88 with 10y yields down -1.8bp at 2.228% and 2y yields down -0.9bp at 1.758%.

FOREX: Greenback Extends Bounce Off 50-dma Support

- The RBA surprised markets overnight, raising rates by 50bps against expectations of a 25bps move, initially providing a considerable leg higher for the AUD. AUD/USD spiked to touch 0.7246 before fading in the subsequent hour or so, putting AUD/USD in minor negative territory ahead of the NY crossover. The decision has prompted a number of sell-side analysts to bring forward forecasts for the next 50bps hike, putting the bank on a faster, quicker approach to policy than expected.

- Outside of the AUD, the USD is on the front foot, extending the late recovery seen during Monday hours as the USD Index bounces further off key support at the 101.81 50-dma. USD/JPY remains a key pair to watch, with Y133.00 the nearest handle as the JPY remains at the lower levels of the G10 table despite softer equity markets this morning.

- Trade data takes focus going forward, with US and Canadian trade balance figures for April on the docket. Canada's Ivey PMI follows shortly afterwards.

EQUITIES: Tech Underperforming Amid Broader Weakness

- Asian markets closed mostly higher: Japan's NIKKEI closed up 28.06 pts or +0.1% at 27943.95 and the TOPIX ended 7.92 pts higher or +0.41% at 1947.03. China's SHANGHAI closed up 5.391 pts or +0.17% at 3241.763 and the HANG SENG ended 122.23 pts lower or -0.56% at 21531.67.

- European equities are down slightly, with tech and communications services stocks underperforming: German Dax down 118.42 pts or -0.81% at 14544.52, FTSE 100 down 4.1 pts or -0.05% at 7609.57, CAC 40 down 30.42 pts or -0.46% at 6519.9 and Euro Stoxx 50 down 26.58 pts or -0.69% at 3811.5.

- U.S. futures are weaker, with the Dow Jones mini down 110 pts or -0.33% at 32802, S&P 500 mini down 13.25 pts or -0.32% at 4107.25, NASDAQ mini down 51.75 pts or -0.41% at 12553.25.

COMMODITIES: Oil And Copper Reverse Early Gains

- WTI Crude up $0.44 or +0.37% at $119.02

- Natural Gas up $0.09 or +0.95% at $9.36

- Gold spot up $6.52 or +0.35% at $1844.74

- Copper down $3.5 or -0.79% at $438.25

- Silver down $0.05 or -0.24% at $21.9596

- Platinum down $11.31 or -1.11% at $1005.33

LOOK AHEAD:

| Date | GMT/Local | Impact | Period | Flag | Country | Release | Prior | Consensus | |

| 07/06/2022 | 1230/0830 | ** | Apr |  | CA | Prev Trade Balance, Rev | 3.081 | -- | CAD (b) |

| 07/06/2022 | 1230/0830 | ** | Apr |  | CA | Trade Balance | 2.486 | -- | CAD (b) |

| 07/06/2022 | 1230/0830 | ** | Apr |  | US | Previous Trade Deficit Revised | -89.8 | -- | USD (b) |

| 07/06/2022 | 1230/0830 | ** | Apr |  | US | Trade Balance | -109.8 | -89.2 | USD (b) |

| 07/06/2022 | 1255/0855 | ** | 04-Jun |  | US | Redbook Retail Sales y/y (month) | 12.4 | -- | % |

| 07/06/2022 | 1255/0855 | ** | 04-Jun |  | US | Redbook Retail Sales y/y (week) | 12.6 | -- | % |

| 07/06/2022 | 1400/1000 | * | May |  | CA | Ivey PMI (SA) | 66.3 | -- | |

| 07/06/2022 | 1700/1300 | *** | Jun |  | US | Bid to Cover Ratio | -- | -- | |

| 07/06/2022 | 1900/1500 | * | Apr |  | US | consumer credit | 52.4 | 32.75 | USD (b) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.