-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY273.8 Bln via OMO Thurs

MNI ASIA OPEN: Tsy Curves Rise to Mid-June'22 Highs

MNI ASIA MARKETS ANALYSIS: Projected Rate Cuts Gain Momentum

MNI Eurozone Inflation Preview - December 2024

MNI US OPEN: Sustained Pressure On The Yen

EXECUTIVE SUMMARY:

- FED HIKES WON'T SWAY USD UNLESS HIKE PACE MUCH FASTER THAN FORECAST: BOJ KURODA

- BOJ WILL CONSIDER DOWNGRADING ITS ASSESSMENT ON FACTORY OUTPUT (RTRS SOURCES)

- OECD DOUBLES CPI FORECAST, SEES GROWTH SUBDUED BY WAR

- EUROZONE Q1 GDP REVISED UP, BEATS EXPECTATIONS

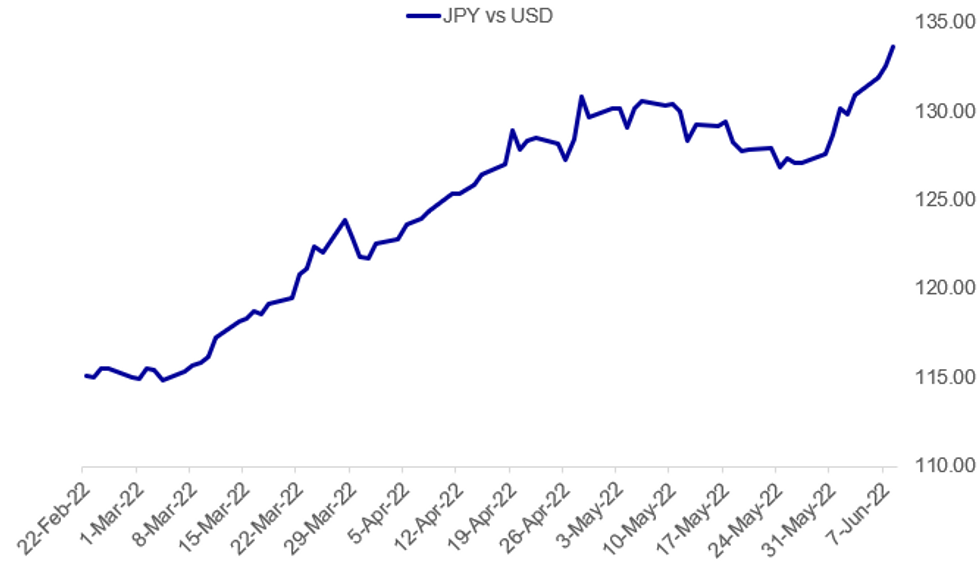

Fig. 1: BOJ Not Coming To Yen's Rescue

Source: BBG, MNI

Source: BBG, MNI

NEWS:

BOJ (RTRS): Bank of Japan Governor Haruhiko Kuroda said dollar moves may not be affected much by U.S. interest rate hikes unless the pace is much faster than expected, according to a recording of an online interview by the Financial Times aired on Wednesday. The U.S. Federal Reserve has made "quite clear" how much it would like to raise interest rates, which has been priced in well by markets, Kuroda said in the interview recording. "Unless the Fed raises interest rates must faster than, or more than what their forward guidance shows, the dollar rate may not be so much affected by (U.S.-Japanese) interest rate differentials," he said.

BOJ (RTRS): The Bank of Japan will consider downgrading its assessment on factory output at this month's policy meeting, sources said, as supply disruptions caused by China's strict COVID-19 lockdowns take a heavy toll on the economy. The central bank may also warn of heightening risks to the global economy and exports, as China's slowdown and the fallout from Russia's invasion of Ukraine cloud the outlook, they said. But the central bank is likely to maintain its view that the world's third-largest economy is "picking up as a trend", as an expected rebound in consumption offset some of the weakness in output, said three sources familiar with its thinking. "While the economy may have experienced temporary weakness in April-June, the economy's recovery path remains intact," one of the sources said on condition of anonymity, a view echoed by two more sources.

GLOBAL ECONOMY/OECD: The OECD doubled inflation forecasts through next year and slashed its growth projection blaming the Ukraine invasion, and the Paris-based group's chief economist said cutting off Russian energy dollars is "essential" to ending the conflict. Consumer prices will rise 8.5% this year and 6% next year according to the OECD Economic Outlook. This year's global growth forecast was cut to 3% from about 4.5% and next year's expansion will slow further to 2.8%. GDP climbed 5.8% last year after contracting 3.4% in 2020 amid the Covid pandemic.

JAPAN: The Japanese sentiment index posted a third straight rise in May while the outlook index posted a fourth increase as the government raised its assessments from the previous month, according to the Economy Watchers data released by the Cabinet Office on Wednesday. The Economy Watchers sentiment index for the current economic climate rose a seasonally adjusted 3.6 points to 54.0 in May from 50.4 in April.

RUSSIA-UKRAINE (RTRS): Russian Foreign Minister Sergei Lavrov on Wednesday the onus was on Ukraine to solve the problem of resuming grain shipments by de-mining its ports. Lavrov said no action was required on the Russian side because it had already made the necessary commitments. "We state daily that we're ready to guarantee the safety of vessels leaving Ukrainian ports and heading for the (Bosphorus) gulf, we're ready to do that in cooperation with our Turkish colleagues," he said after talks with his Turkish counterpart. "To solve the problem, the only thing needed is for the Ukrainians to let vessels out of their ports, either by demining them or by marking out safe corridors, nothing more is required."

FRANCE POLITICS: Opinion polling from France ahead of the first round of the legislative election taking place on Sunday 12 June shows President Emmanuel Macron's centrist 'Ensemble' bloc on the cusp of retaining its majority in the National Assembly. Over the course of the past six weeks, the mean average seat projection for Macron's Ensemble alliance has declined steadily, to the point where the seat projection range in the latest Ifop-Fiducial poll from 6 June has the alliance between 250 and 290 seats, with the highest end of this range only a seat above the 289 required for an overall majority.

DATA:

EZ Q1 GDP Revised Higher, Beats Expectations

Euro area growth was stronger than originally forecast in Q1 2022, with GDP rising 0.6% Q/Q in the three months to end March. Year-on-year, GDP rose 5.4% in the first quarter, outpacing both Eurostat's preliminary estimate and the forecasts of financial market analysts, which both saw y/y growth at 5.1%.

The upwardly-revised GDP in Q1 left volumes in the euro area 0.8% above the level recorded in the fourth quarter of 2019, before the COVID-19 outbreak.

The data will make interesting reading for the European Central Bank ahead of their June policy meeting, confirming that growth remained strong in the first three months of the year. However, the data only covered the first month of the war in Ukraine and will likely not be as strong in Q2.

Source: Eurostat

FIXED INCOME: Looking ahead to tomorrow's ECB meeting

- Core fixed income has been drifting lower this morning, but moves have been more muted than the first couple of days of the week, and remain well within yesterday's ranges.

- Economic data this morning has done little to move the needle.

- There is not much else on the data calendar for the rest of the day, with the highlight being US wholesale inventories.

- Markets are probably starting to look towards tomorrow's ECB decision. We published our ECB preview yesterday and note that while a 50bp hike in July is still a low probability, the risk is increasing. The probability of 50bp hikes in September or later is also increasing. Any language hinting at policy beyond September or at 50bp hikes is likely to be market moving tomorrow. Markets are now pricing a cumulative26bp by July and 71bp by September (i.e. over an 80% probability is priced into the market of a 50bp hike by September. For the full MNI ECB Preview click here.

- TY1 futures are down -0-9+ today at 118-04 with 10y UST yields up 3.3bp at 3.009% and 2y yields up 1.9bp at 2.749%.

- Bund futures are down -0.70 today at 149.11 with 10y Bund yields up 4.2bp at 1.332% and Schatz yields up 3.3bp at 0.690%.

- Gilt futures are down -0.49 today at 114.65 with 10y yields up 4.0bp at 2.253% and 2y yields up 3.1bp at 1.764%.

FOREX: JPY Dive Deepens, 2002 Lows in View

- USD/JPY trades markedly higher for the seventh session in eight, with the pair narrowing in on the Y134 handle as well as the next key upside level at the 2002 highs of Y135.15. The focus in the near-term is on 134.48, a Fibonacci projection. The JPY is weaker against all others in G10, with the EUR/JPY also notable: the cross is nearing Y143.00 and is trading at levels last seen in 2015.

- The latest leg lower for JPY comes as the BoJ governor acknowledged some of the outcry around the weaker currency, but pledged that the BoJ will firmly support the economy with the current monetary easing strategy. He also added that "stable" JPY weakness is a positive for the Japanese economy.

- Aided by the JPY's decline, the greenback is the firmest currency in G10 ahead of the NY crossover, reversing the weakness seen through NY hours on Tuesday. For the USD Index, a rise through 102.84 would mark the strongest USD since May 23rd. The single currency also trades well, rising against most others and receiving a minor tailwind from an unexpected revision higher in Q1 GDP, which doubled to 0.6% on the quarter vs. Exp. 0.3%.

- Data and central speakers are few and far between Wednesday, with the Fed and the ECB both in their respective media blackout periods. US wholesale inventories and trade sales data are the sole highlight at 1500BST/1000ET.

EQUITIES: Mixed European Performance After Asia Closes Stronger

- Asian stocks closed higher: Japan's NIKKEI closed up 290.34 pts or +1.04% at 28234.29 and the TOPIX ended 22.95 pts higher or +1.18% at 1969.98. China's SHANGHAI closed up 22.03 pts or +0.68% at 3263.793 and the HANG SENG ended 482.92 pts higher or +2.24% at 22014.59.

- European equities are mixed, with few discernable themes (Energy and Tech are leading, Financials and Consumer Staples lagging): the German Dax down 28.14 pts or -0.19% at 14530.97, FTSE 100 up 3.8 pts or +0.05% at 7601.13, CAC 40 down 13.01 pts or -0.2% at 6486.79 and Euro Stoxx 50 up 3.23 pts or +0.08% at 3810.79.

- U.S. futures are a little weaker, with the Dow Jones mini down 130 pts or -0.39% at 33034, S&P 500 mini down 15 pts or -0.36% at 4143.75, NASDAQ mini down 32.25 pts or -0.25% at 12680.

COMMODITIES: WTI Edges Back Above $120

- WTI Crude up $0.9 or +0.75% at $120.22

- Natural Gas up $0.06 or +0.61% at $9.343

- Gold spot down $5.03 or -0.27% at $1847.48

- Copper down $1.85 or -0.42% at $441.75

- Silver down $0.24 or -1.06% at $22.0009

- Platinum down $4.95 or -0.49% at $1009.56

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/06/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 08/06/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/06/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 08/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 08/06/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 09/06/2022 | 2301/0001 | * |  | UK | RICS House Prices |

| 09/06/2022 | 0600/0800 | ** |  | SE | Private Sector Production |

| 09/06/2022 | 1145/1345 | *** |  | EU | ECB Deposit Rate |

| 09/06/2022 | 1145/1345 | *** |  | EU | ECB Main Refi Rate |

| 09/06/2022 | 1145/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 09/06/2022 | - | *** |  | CN | Trade |

| 09/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 09/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 09/06/2022 | 1230/1430 |  | EU | ECB Press Conference Following Governing Council Meeting | |

| 09/06/2022 | 1400/1000 |  | CA | BOC Financial System Review | |

| 09/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 09/06/2022 | 1500/1100 |  | CA | BOC Governor press conference | |

| 09/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 09/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 09/06/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.