-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: ECB Tool Talk In Sintra

EXECUTIVE SUMMARY:

- NEW TOOL WILL AID FUTURE RATE RISES: ECB'S LAGARDE

- ECB SUPPORT SHOULD BE LIMITLESS IF FRAGMENTATION UNWARRANTED: WUNSCH

- KAZAKS SAYS WORTH LOOKING AT 50 BPS ECB HIKE IN JULY

- EARLY EXIT FOR BANK OF ITALY'S VISCO NOT BEING CONSIDERED, DESPITE PRESS REPORTS

- WEAK READINGS FOR GERMAN, FRENCH CONSUMER CONFIDENCE

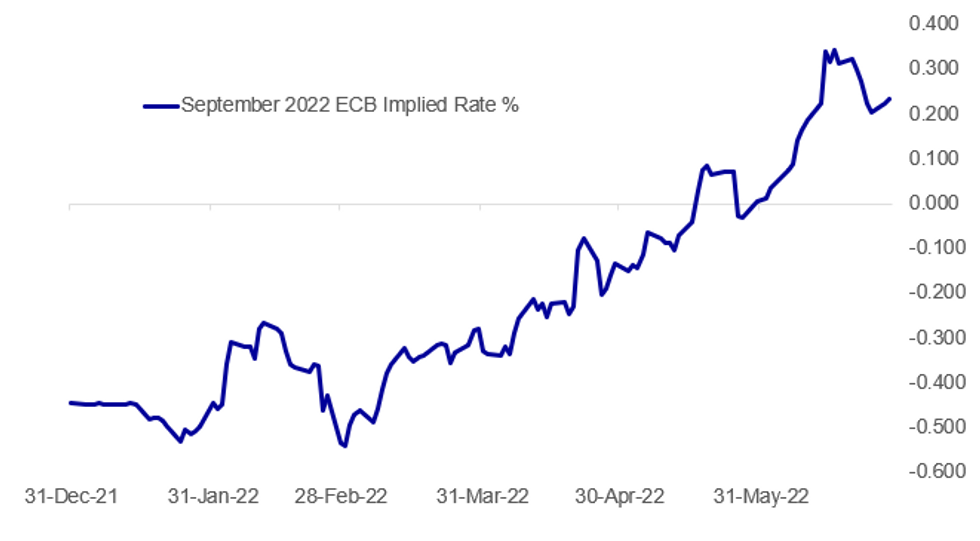

Fig. 1: Sintra Not Moving The Needle On Hike Pricing So Far

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ECB: Any ECB new anti-fragmentation must be effective, proportionate and contain “sufficient safeguards to preserve the impetus of Member States towards a sound fiscal policy,” president Christine Lagarde said in a speech Tuesday, with the right transmission mechanism allowing rates to rise as far as necessary throughout the eurozone. “Measures to preserve transmission could be used at any level of interest rates – so long as they were designed not to interfere with the monetary policy stance,” she said. “Preserving policy transmission throughout the euro area will allow rates to rise as far as necessary. In this sense, there is no trade-off between launching this new tool and adopting the necessary policy stance to stabilise inflation at our target. In fact, one enables the other.” Flexibility, gradualism and optionality remain at the core of the ECB's approach to monetary policy normalisation, Lagarde said. But there are clearly conditions in which gradualism would not be appropriate, she added, including higher inflation that could de-anchor inflation expectations.

ECB (RTRS): The European Central Bank should offer limitless support without onerous conditions to euro zone members facing an unjustified surge in borrowing costs but should be careful in granting eligibility for this aid, ECB policymaker Pierre Wunsch said. Facing a surge in yields on Europe's southern rim that resurrected memories of the bloc's debt crisis a decade ago, the ECB decided this month to devise a new bond buying instrument to contain the divergence in borrowing costs while it presses ahead with rate hikes to contain inflation. "I would even say there should be no limits," Wunsch, Belgium's central bank chief, said in an interview. "There will be legal limits, of course, but conceptually, if it’s clearly unwarranted, there should not be limits."

ECB (BBG): The European Central Bank should consider an initial increase in interest rates above the planned quarter-point hike if there are signs that high inflation readings are feeding expectations, according to Governing Council member Martins Kazaks. “If we see that the situation has worsened, that inflation is high and we see negative news in terms of inflation expectations, then in my view front-loading the increase would be a reasonable choice” Kazaks, the hawkish head of Latvia’s central bank, told Bloomberg Television in Sintra, Portugal.

ECB / BANK OF ITALY (BBG): Bank of Italy Governor Ignazio Visco may leave his post in October, paving the way for the appointment of a high profile executive close to Premier Mario Draghi, daily Il Foglio reported. Visco might leave a year ahead of schedule to allow his successor to take the helm of the country’s central bank before general elections next year, the newspaper said, citing sources close to the matter. European Central Bank board member Fabio Panetta is a likely candidate, they said.

ECB (MNI): Bank of Italy Governor Ignazio Visco is not currently considering leaving his position, bank sources tell MNI, as they play down reports circulating in the Italian press Tuesday. Leaving the central bank "it is not on the agenda now" for the governor, the source said. Visco, has served as Governor at the Bank since 2011, stepping up to replace Mario Draghi when he left to become President at the ECB.

RIKSBANK (MNI): Sweden's central bank is expected to raise its policy rate by 50 basis points to 0.75% at its June meeting, accelerating its pace of tightening after ending its zero-rate policy in April when it hiked by 25 bps. The Riksbank's Executive Board also looks set to raise its projection for the most likely path of rates after its target target CPIF inflation measure jumped by 7.2% in May, exceeding expectations and way above the 2.0% goal.

BOE (MNI): Financial market expectations are an input, rather than a driver in the Bank of England's policymaking process, a senior bank official said Tuesday. Andrea Rosen, head of the BOE's Market Intelligence and Analysis team, said markets can be noisy, and the Monetary Policy Committee are invested in attempting to understand and navigate them as best as possible. (See: MNI INSIGHT: Fed Rates Speculation Double-Edged Sword For BOE). Accepting the importance of the market transmission mechanism is to the Bank, the market analysis and intelligence activities continually evolve, Rosen said. Importantly, "we wish to continue expanding our network of market contacts, so that they are even more diverse and reflective of the market setup," she added.

DATA:

GERMANY: Soaring Inflation Hits German Consumer Confidence

GfK's consumer confidence projection for July sees sentiment weakening a further 1.2 points to a fresh record low -27.4, with the economic and income expectations, as well as propensity to buy sub-indices all falling further than recorded in June. Income expectations suffered the greatest loss, falling to an almost 20-year low

Escalations in the Ukraine war alongside persistent supply-chain issues and steep energy and food price inflation continue to drive sentiment down as consumers grapple with inflation at nearly 8%.

Wednesday will see the release of the June CPI print, anticipated to be unchanged. The European Central Bank said its July meeting will almost certainly see a 25bp lift-off in rates, and continued inflation pressures underscore the likleihood that a 50bp hike may follow in September as implied by President Lagarde at the June 9 meeting.

FRANCE: Consumer Sentiment Slides Further in June

- French consumer confidence weakened for the sixth consecutive month. The indicator fell a further three points to 82 in June, significantly below the long-term average of 100. Sentiment is around seven points lower than seen at the onset of the pandemic.

- Households saw their future personal financial situations declining further, alongside their propensity to make major purchases and future saving capacities. Inflation expectations climbed further and is at at 2008 high and remain the underlying source of pessimism. The June inflation flash is due on Thursday and is anticipated to jump another 0.5pp to 5.7% y/y, offering no relief to consumer confidence in the coming months..

- Concerns regarding unemployment increased slightly, albeit remaining very low.

- This follows the German GfK sentiment reading this morning, which plunged to a historic low on the back of looming recession fears.

FOREX: JPY Fading Last Week's Gains

- JPY is fading early Tuesday, with USD/JPY touching the week's best levels and continuing to work its way through the pullback from last week's highs. This keeps the cycle best at Y136.71 in view over the medium-term, with the RSI fading back below the technically overbought levels seen early June.

- Commodity markets have been the movers so far Tuesday, with oil, precious metals and iron ore posting sizeable gains and underpinning the CAD, AUD strength into the NY crossover. USD/CAD weakness has put the pair at the lowest levels since June 13th, narrowing in on the 50-dma support at 1.2811.

- The single currency is mid-table, despite ECB's Kazaks this morning arguing in favour of a 50bps hike at the upcoming ECB July meeting. Lagarde argued a different path however, stating that 25bps should be the base case.

- US trade balance data takes focus going forward, with wholesale inventories, consumer confidence and S&P Case Shiller house price indices also due. The ECB's Sintra policy forum continues, with appearances from Elderson and Panetta due. Fed's Daly speaks at a separate event.

FIXED INCOME: A very choppy start, wide ranges

- A very choppy start for EGBs and Bund.

- Another massive range session for Bund, with a 164 ticks range on lighter volumes.

- The contracts swing 10, 20 ticks at a time.

- Bund has reversed the whole of last week's rally post PMIs, but is off the lows at the time of typing.

- Peripheral spreads are all tighter against the German 10yr, Greece is in the lead by 6.5bps to 220.9bps.

- ECB Lagarde reaffirmed the ECB's intention of hiking rates by 25bps in July, and left the door opened for a higher hike in September depending on the data.

- Gilt is mostly trading in line with Germany, the Gilt/Bund is just 0.5bp tighter.

- US Treasuries are also in the red, but have moved to a far lesser extend versus Europe, as such the Tnotes/Bund spread has tightened 4.8bps in early trade.

- Looking ahead, US Wholesale Inventories is the only notable data.

- In terms of supply, US $40bn 7yr notes, and the remaining speakers for the session are ECB Panetta and Fed Daly.

EQUITIES: Energy And Financial Stocks Boost Europe Early

- Asian markets closed stronger: Japan's NIKKEI closed up 178.2 pts or +0.66% at 27049.47 and the TOPIX ended 19.96 pts higher or +1.06% at 1907.38. China's SHANGHAI closed up 30.025 pts or +0.89% at 3409.21 and the HANG SENG ended 189.45 pts higher or +0.85% at 22418.97.

- European equities are being driven higher by energy stocks and financials, with the German Dax up 122.35 pts or +0.93% at 13229.78, FTSE 100 up 63.83 pts or +0.88% at 7327.65, CAC 40 up 70 pts or +1.16% at 6119.04 and Euro Stoxx 50 up 37.64 pts or +1.06% at 3547.84.

- U.S. futures are higher too, with the Dow Jones mini up 200 pts or +0.64% at 31621, S&P 500 mini up 24.5 pts or +0.63% at 3928.25, NASDAQ mini up 73 pts or +0.61% at 12113.5.

COMMODITIES: Copper Continues To Regain Ground

- WTI Crude up $1.41 or +1.29% at $111.63

- Natural Gas up $0.05 or +0.75% at $6.5

- Gold spot up $4.06 or +0.22% at $1826.08

- Copper up $5.95 or +1.58% at $382.75

- Silver up $0.14 or +0.65% at $21.2471

- Platinum up $6.79 or +0.75% at $916.03

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/06/2022 | 1100/1300 |  | EU | ECB Panetta on Digital Currencies at ECB Forum | |

| 28/06/2022 | 1100/1200 |  | UK | BOE Cunliffe Panels ECB Forum | |

| 28/06/2022 | 1200/0800 |  | US | Richmond Fed President Tom Barkin | |

| 28/06/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 28/06/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 28/06/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 28/06/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 28/06/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 28/06/2022 | 1630/1230 |  | US | San Francisco Fed's Mary Daly | |

| 28/06/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.