-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Bonds And USD Underpinned By Risk-Off Tone

EXECUTIVE SUMMARY:

- SWEDEN RIKSBANK HIKES 50BP, FRONT-LOADS TIGHTENING

- RUSSIAN TROOPS WITHDRAWN FROM KEY ISLAND BASE

- OFFICIAL CHINA PMI IN EXPANSION, BUT MORE STIMULUS NEEDED (MNI)

- GERMAN UNEMPLOYMENT RISES ON UKRAINIAN REFUGEE INFLUX

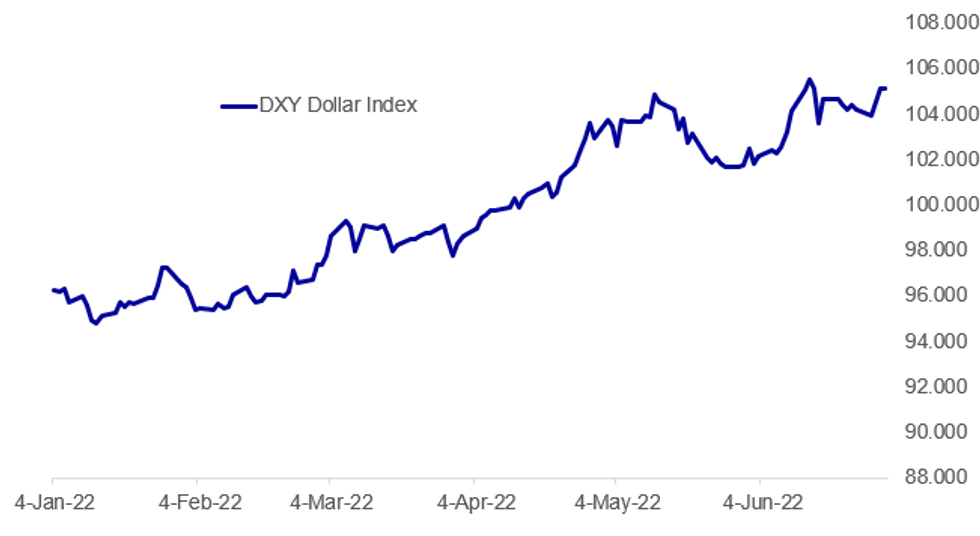

Fig. 1: Dollar Continues To Gain Amid Risk-Off Trade

Source: BBG, MNI

Source: BBG, MNI

NEWS:

RIKSBANK (MNI): The Riksbank delivered its widely expected 50 basis point hike, taking the Policy Rate to 0.75% at its June meeting and published a projected rate path that showed it front-loading tightening. The newly renamed Policy Rate was shown rising to close to 2% by the start of the next year and then only drifting up very gradually, to stand at 2.06% at the end of the three year forecast period. The profile suggests tightening at each meeting through early 2023 and leaves the door open to another 50 bps hike.

RIKSBANK (MNI): Policy report highlights:

- Prices for goods, food and services have been rising considerably faster than expected since the start of the year

- Policy rate will be close to 2 per cent at the start of next year

- Asset holdings shall shrink faster than was decided in April

- During the second half of the year, the Riksbank will purchase bonds for SEK18.5 billion instead of the earlier decided SEK 37 billion

- Inflation is expected to fall back next year and be close to 2 per cent from2024.

RUSSIA-UKRAINE (BBG): Russia confirmed it withdrew troops from a strategically important island in the Black Sea, after Ukraine said they were forced to leave by its missile and artillery strikes.Moscow said the decision was a gesture aimed at facilitating grain exports from Ukraine, though there was no sign of a deal on shipments that would help ease a global food crisis. President Vladimir Putin earlier reacted to NATO’s decision to take in Sweden and Finland by warning Russia would respond in the event of a military buildup there.

CHINA PMI (MNI): The Chinese economy is accelerating from months of strict pandemic restrictions, with the latest view on manufacturing and services now well into expansion territory, but further pro-growth policies are required to keep the momentum, according to analysts. The official manufacturing purchasing managers index rose to 50.2 in June from May’s 49.6, the first time since February for the index to rise back above the breakeven 50, data by the National Bureau of Statistics showed on Thursday.

BOJ (MNI): The Bank of Japan on Thursday left the scale of its purchase of Japanese government bonds per an auction and the frequency of bond buying operations in the third quarter unchanged from the second quarter. The BOJ also said, "the bank may change the frequency as needed, taking account of market conditions."

UK-EU (MNI): Tony Connelly at RTE tweets comments from UK Cabinet Office minister Michael Ellis, speaking at the EU-UK Forum after EU Commission Exec VP Maros Sefcovic gives a damning assessment of UK gov't actions regarding the Northern Ireland Protocol bill. Select comments below:

- "Despite the difficulties of the last few years, the United Kingdom and European Union are on the same side."

- "It makes no sense to put [cooperation] at risk over the NI protocol. "our overriding priority has been preserving peace and stability. The situation as it stands is undermining the GFA" there is no Executive as a direct result of the Protocol"

CHINA-US (MNI): The U.S. should stop sanctioning Chinese companies for reasons related to Russia and Iran, Shu Jueting, spokeswoman of the Ministry of Commerce said at a briefing on Thursday, adding that China will take necessary measures to resolutely safeguard the legitimate rights and interests of its enterprises. Beijing opposes such wrongdoing, which is a typical act of economic coercion, seriously undermining the international economic and trade order and rules, according to Shu, calling for the U.S. to meet China halfway to contribute more to global supply chain stability and economic recovery.

GLOBAL TAXES (BBG): French Finance Minister Bruno Le Maire said the European Union can deliver the global minimum corporate tax with or without the support of Hungary, circumventing Budapest’s veto earlier this month just as the bloc was on the brink of a agreement. “This global minimum tax will be implemented in coming months with or without the consent of Hungary,” Le Maire told journalists at a briefing in Paris. “Europe can no longer be held hostage by the ill will of some of its members.”

DATA:

EUROZONE: Tightening EZ Labour Market Underlines ECB Concerns

Eurozone unemployment fell to a record low 6.6% in May, falling 0.1 pp from April's 6.7%. This is down from 8.1% seen in May 2021. Youth unemployment across the region saw another substantial decrease, down 0.7pp to 13.1%.

Continued improvement in the Eurozone unemployment rate implies increased wage pressures, potentially adding pressure to second round inflation effects, further complicating the ECB's hiking cycle which is set to commence in July.

With the German labour market registering a 0.3pp increase in their June unemployment rate as a result of accounting for the influx of registered Ukrainian refugees, upcoming labour reports could show increasing unemployment rates despite having remained otherwise stable, depending how stats agencies handle the influx.

GERMANY: June Unemployment Rises On Ukrainian Refugee Influx

GERMANY JUNE UE RATE (SA) 5.3%; MAY 5.0%

GERMANY JUNE UE NET CHANGE (SA) +133K; MAY -5Kr

- German unemployment saw a 0.3pp uptick to 5.3% in June. The rise in employment reflects the influx of Ukrainian refugees, who have been accounted for in the June labour statistics.

- This led to a net employment change of +133,000, following -5,000 seen in May. The German Labour Office noted that the labour market remained otherwise stable in June.

- At the end of May 966,000 Ukrainian nationals were registered, 811,000 more than before the onset of the war. Of the registered Ukrainian refugees, around 75% are between 15-65.

- The tight labour market conditions will likely welcome the stark increase in employable persons currently being processed by German job centres, however, the struggling manufacturing industry remains hampered by supply disruptions and is unlikely to offer the extent of new employment opportunities in previous months.

Unemployment in Germany rises nationally:

French Inflation Sees No Relief at +5.8%

FRANCE JUNE FLASH CPI +0.7% M/M, +5.8% Y/Y; MAY +5.2% Y/Y

FRANCE JUNE FLASH HICP +0.8% M/M, +6.5% Y/Y; MAY +5.8% Y/Y

- French inflation continued to climb in June, up 0.6pp on the headline CPI print at +5.8% y/y. This is a 0.1pp beat of forecast expectations, reaching the highest annual rate since September 1985.

- The harmonised print saw a larger 0.7pp jump as forecasted. The acceleration in energy and food prices were once again the key upwards drivers, energy increasing 33.1% y/y (up from 27.8%) and food by 5.7% y/y (up from 4.3% in May). Manufacturing price growth saw the only slowing upwards pressure.

- With Eurozone inflation prints beginning to diverge, following the German downside surprise and Spanish upside beat seen yesterday, the ECB will be focused on the aggregate Euro area print due Friday.

FIXED INCOME: Yields fall across the board

- Another wide trading session for EGBs and Bund, but very choppy with 20 ticks swings at a time in Bund (and 172 ticks range).

- Govies have extended gains, pushing Yields lower.

- The French CPI, was inline, but didn't beat the estimates, which helps underpinned Bonds.

- German 2yr tested lowest level since the 9th June, with most of the action centred in the shorter part of the Curve 2yr and 3 Months Euribor.

- Schatz future is off the session, Yield off the low.

- Next support in 2yr is seen at 0.65%, reference 109.075, would equate to 109.185.

- Peripherals are wider this morning, as Bund outperforms its peers.

- Italy is in the lead so far today, by 5.7bps at 191.9bps.

- Gilt is taking its cue from the European price action, but is somewhat lagging Germany, pushing the Gilt/Bund spread 5.8bps wider.

- US Treasuries have followed suit, and trade in the green, but volumes are fairly subdued, with 340k lots traded at the time of typing.

- Looking ahead, Out of the US, PCE deflator and MNI Chicago PMI are the notable release, but Europe are already turning their attention to the EU CPI release tomorrow.

- Also today, includes OPEC meeting.

FOREX: USD/JPY Fading Alongside Equities

- USD/JPY has faded off the cycle highs posted yesterday at 137.00, but still holds comfortably above yesterday's lows. Nonetheless JPY is the strongest currency across G10, moving in sympathy with fading equity markets. This puts the e-mini S&P on track to test first support at 3757.8 - the 61.8% Fib retracement for the late June rally.

- Elsewhere, the SEK trades weaker, with EUR/SEK toward the top end of the daily range following the Riksbank rate decision. There were mixed messages in the release, with the bank hiking 50bps (potentially disappointing markets that had seen a decent chance of a 75bps move) and pointing to an elevated rate path across 2023 - this puts the repo rate path north of 2% by mid-2023.

- The USD Index is inching higher, mirroring the general risk-off theme so far present in markets Thursday, with 105.229 the next upside level ahead of June's cycle high of 105.788.

- Alongside the weekly jobless claims data, personal income/spending data is due as well as Monthly Canadian GDP. The MNI Chicago PMI follows, expected to show a drop to 58.0 from 60.3.

EQUITIES: S&P Futs Below 3,800 Again As Global Stocks Struggle

- Asian markets closed weaker: Japan's NIKKEI closed down 411.56 pts or -1.54% at 26393.04 and the TOPIX ended 22.75 pts lower or -1.2% at 1870.82. China's SHANGHAI closed up 37.098 pts or +1.1% at 3398.616 and the HANG SENG ended 137.1 pts lower or -0.62% at 21859.79.

- European equities are down sharply in a broad risk-off move (cyclicals leading the way lower, with tech and consumer discretionary stocks underperforming): the German Dax down 254.93 pts or -1.96% at 12723.14, FTSE 100 down 122.84 pts or -1.68% at 7174.75, CAC 40 down 121.27 pts or -2.01% at 5885.88 and Euro Stoxx 50 down 65.39 pts or -1.86% at 3442.74.

- U.S. futures are also pointing lower, with the Dow Jones mini down 260 pts or -0.84% at 30739, S&P 500 mini down 42 pts or -1.1% at 3779.25, NASDAQ mini down 163 pts or -1.39% at 11528.

COMMODITIES: Renewed Growth Concerns Sends Copper Lower Again

- WTI Crude up $0.18 or +0.16% at $109.51

- Natural Gas up $0.01 or +0.11% at $6.509

- Gold spot down $1.91 or -0.11% at $1816.37

- Copper down $4.5 or -1.19% at $374.25

- Silver down $0.01 or -0.07% at $20.803

- Platinum down $3.69 or -0.4% at $916.98

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/06/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 30/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 30/06/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 30/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 30/06/2022 | 1330/1530 |  | EU | ECB Lagarde Speech at Simone Veil Pact | |

| 30/06/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 30/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 30/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 30/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 30/06/2022 | 1600/1200 | *** |  | US | USDA Acreage - NASS |

| 30/06/2022 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 01/07/2022 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/07/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/07/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0800/1000 | * |  | NO | Norway Unemployment Rate |

| 01/07/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 01/07/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/07/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 01/07/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 01/07/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 01/07/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/07/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/07/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/07/2022 | 1400/1000 | * |  | US | Construction Spending |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.