-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI US OPEN: Uncertainty In The UK

EXECUTIVE SUMMARY:

- UK GOV'T RESIGNATIONS CONTINUE WITH PM JOHNSON SET TO FACE PARLIAMENT TODAY

- BOE PILL WILLING TO TIGHTEN AT FASTER PACE IF NEEDED; CUNLIFFE HINTS AT FURTHER HIKES

- EUROZONE RETAIL TRADE STALLS, BUT GERMAN FACTORY ORDERS UNEXPECTEDLY RISE

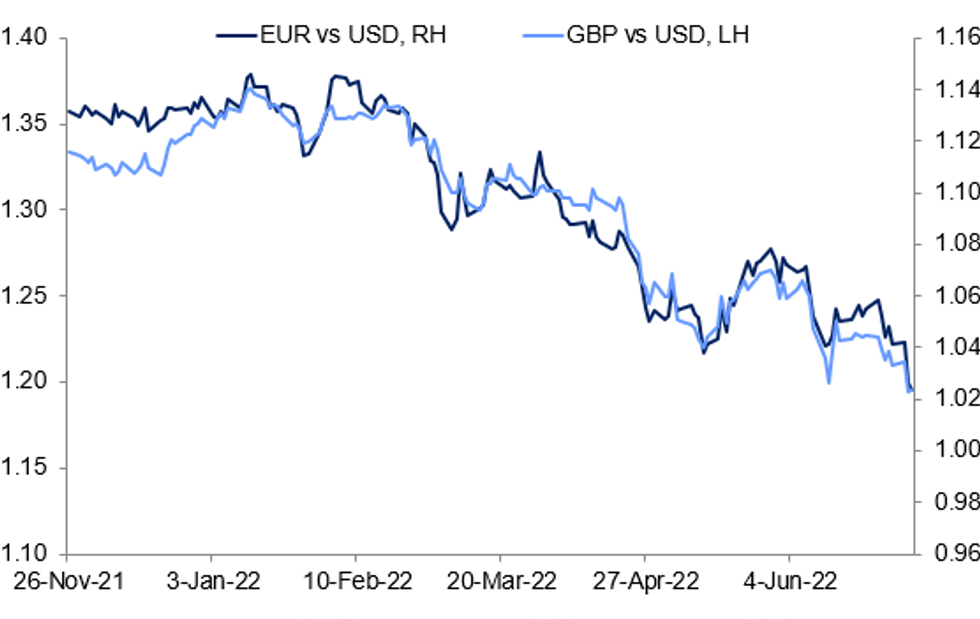

Fig. 1: EUR At New 20Y Low Versus USD, GBP Holding Up Slightly Better

Source: BBG, MNI

Source: BBG, MNI

NEWS:

UK (MNI): Two parliamentary private secretaries (PPS, junior figures in gov't who work as aides to ministers) have resigned from PM Boris Johnson's gov't this morning, continuing the flow of figures leaving No.10 Downing Street.

- Laura Trott (Dep't for Transport) and Will Quince (Dep't for Work and Pensions) have just announced their resignations, coinciding with new Chancellor of the Exchequer Nadhim Zahawi's interview on BBC Radio 4.

- Following the slew of resignations from gov't last night - triggered by those of Chancellor Rishi Sunak and Health Secretary Sajid Javid - Johnson's premiership is viewed as mortally wounded.

- The PM faces two very difficult parliamentary sessions today. At 1200BST (0700ET, 1300CET) PMQs in the Commons, where his remaining support (or lack thereof) will be clear to see and hear (link: https://parliamentlive.tv/Event/Index/dba0b829-748...).

- Then at 1500BST (1000ET, 1600CET) he faces the House of Commons Liaison Select Committee, where he faces questioning from senior backbench MPs from across the Commons (link: https://parliamentlive.tv/Event/Index/1f7d6322-7f6...)

- Betting markets now show 2022 as the overwhelming favourite year for Johnson's exit from No.10, with data from Smarkets showing an 84% implied probability. This is compared to 11% for 2023 and just 5.6% for 2024 or later (down from 33.3% before the Sunak/Javid resignations).

BOE (MNI): Bank of England Chief Economist Huw Pill said Wednesday he was willing to back more rapid rate hikes than the string of 25 basis point increases imposed so far, if he felt data showed it necessary, citing the Monetary Policy Committee's new policy statement. Pill, speaking at King's College Business School, said he was skeptical about forward guidance but the new policy statement covered the range of views on the MPC, with its openness on whether more tightening will occur and the line that the MPC ‘if necessary (will) act forcefully" in response to signs of more persistent inflation. "The statement reflects both my willingness to adopt a faster pace of tightening than implemented thus far in this tightening cycle, while simultaneously emphasising the conditionality of any such change," he said. He noted that there has been no unanimity of views on the MPC, and that any conventional forward guidance would be misleading.

BOE (MNI): BOE Chief Economist Huw Pill says "Much remains to be resolved before we vote on our August policy decision. How I vote on that occasion will be determined by the data that we see and my interpretation of it." Pill also notes there are four reasons for the change in forward guidance and his personal interpretation:

- "By focusing on the ‘scale, pace and timing’ of further changes in Bank Rate, the statement clearly widens the discussion beyond the interest rate decision at the next meeting.... this represents the desirable introduction of greater flexibility in our communication of the policy outlook... and the likelihood that we will have to take finely-balanced decisions over rates not just in August but also beyond that, in the face of two-sided risks to the economic outlook into next year."

- "The reference to ‘any’ increases allows for the possibility of remaining on hold, which helps to capture the potential breadth of opinions on the Committee"

- "The statement gives an indication of how the MPC intends to respond to future data developments... this places emphasis on identifying potential second-round effects in price and wage setting behaviour. This helps to clarify how the MPC defines it policy ‘reaction function’ at present, prioritising the more persistent component of inflation developments over the headline spot measure."

- "By signalling preparedness to ‘if necessary act forcefully in response’ to indications of greater persistence in inflation, the statement reflects both my willingness to adopt a faster pace of tightening than implemented thus far in this tightening cycle, while simultaneously emphasising the conditionality of any such change in pace on the flow of new data and analysis.

BOE (MNI): Cunliffe hints at further rate hikes by saying BOE will do what is "necessary" - Highlights from Cunliffe's BBC Radio 4 interview: He gives little away other than saying the BOE will do what is necessary to stop inflation expectations being embedded - he gave no more explicit expectation of future voting intentions or the path of Bank Rate, but did at least sound as though he would for a hike at the August meeting. As he is considered one of the most dovish MPC members (alongside Tenreyro) this in itself is notable, but probably expected already. Cunliffe asked if BOE is behind the curve - said they started hiking in December before other DM central banks.

MALAYSIA (MNI STATE OF PLAY): Malaysia’s central bank has cited the need to normalise monetary policy settings on Wednesday in a decision to hike official interest rates by 25 basis points. Bank Negara Malaysia increased its Overnight Policy Rate by 25bps, the second rise in as many meetings, and says the local economy is strengthening with higher levels of employment and the April re-opening of international borders driving demand.

CHINA - US (BBG): China denounced US efforts to stop ASML Holding NV and Nikon Corp. from selling key chipmaking technology to the country as “technological terrorism.” Chinese Foreign Ministry spokesman Zhao Lijian criticized the export curbs sought by Washington during a regular news briefing Wednesday in Beijing. He didn’t elaborate on whether China planned any response to the move. Washington’s proposed restrictions on ASML would expand an existing moratorium on the sale of the most advanced systems to China, in an attempt to thwart China’s plans to become a world leader in chip production. If the Netherlands agrees, it would broaden significantly the range and class of chipmaking gear now forbidden from heading to China, potentially dealing a serious blow to Chinese chipmakers from Semiconductor Manufacturing International Corp. to Hua Hong Semiconductor Ltd.

JAPAN (MNI/JIJI): Jiji Press is reporting that Japanese Prime Minister Fumio Kishida is considering a Cabinet reshuffle after elections to the upper chamber of the National Diet, the House of Councillors, takes place on Sunday 10 July.

- Jiji reports that Kishida will make a choice on 'the timing and scale' based on the outcome of the election.

- There are reports that some cracks are emerging in the long-running electoral alliance between Kishida's centre-right Liberal Democratic Party (LDP) and its conservative ally the Komeito party. Both sides have sought to play down any divisions.

- Latest poll from NHK carried out 25-26 June showed the Kishida gov'ts approval rating falling to 50% a week before the vote, down 5% on the previous reading. The disapproval rating rose two points to 27%.

- Says that this unfriendly position 'does not facilitate developing ties in trade and economy, including in the energy sector'.

- While Tokyo remains committed to supporting western sanctions on Russia at present, there is likely to be growing concern about the continued supply of LNG to Japan, which relies heavily on imported Russian hydrocarbons for its energy mix.

DATA:

EUROZONE: Retail Trade Stalls in May

EZ MAY RETAIL TRADE +0.2% M/M; +0.2% Y/Y; APR +4.0%r Y/Y

- Retail sales all but stalled in May at +0.2% m/m -1.4%r m/m in April.

- Compared with May 2021 a small +0.2% y/y improvement was seen, which beat the forecast of a -0.3% y/y dip.

- A significant disparity exists across EU member states, whereby retail growth was strong in more Eastern European states (Slovenia +25.0%, Poland +11.2% and Hungary +11.1% y/y) whilst more Central European states saw more significant declines (Austria -6.4% y/y, Denmark -5.6% y/y). The data is deflated and calendar adjusted.

- With June PMIs highlighting substantial drop-offs in demand as consumers see their real disposable income dissipating, retail demand outlooks for the upcoming months appear bleak.

MNI: GERMANY MAY FACTORY ORDERS +0.1% M/M; -3.1% Y/Y; APR -6.2% Y/Y

BBG: German factory orders unexpectedly rose in May, even as global momentum was affected by rampant inflation and uncertainty stoked by Russia’s war in Ukraine. Demand increased 0.1% compared to the previous month, compared to an economist estimate of -0.5%. The gain was driven by major orders and excluding those, orders fell 0.9%, according to a statement from the German statistics office on Wednesday.

FIXED INCOME: Divergence between gilts and Bunds

Relative to the past few sessions, fixed income is taking a bit of a breather but is still seeing what would usually be considered decent moves with the German curve bull steepening and the gilt curve bear flattening.

- The UK story has focused on a new Chancellor who may be more open to looser fiscal policy (and hence seeing yields rise at the front-end). We have also had comments from BOE's Cunliffe (one of the more dovish members) suggesting that the MPC will need to continue to act to keep inflation under control. The political turmoil of the UK with the resignation of a number of ministers including the Chancellor and the Health Secretary since last night has not really moved markets too much outside of this.

- The focus in Europe, by contrast, has been more on the prospects of a recession despite some better than expected German factory order and Spanish industrial orders data.

- Looking ahead we have the FOMC Minutes later as well as the final print of the US services PMI and JOLTs.

- TY1 futures are unch today at 119-29+ with 10y UST yields up 0.6bp at 2.814% and 2y yields up 1.7bp at 2.838%.

- Bund futures are up 0.07 today at 151.31 with 10y Bund yields up 0.7bp at 1.232% and Schatz yields down -4.4bp at 0.376%.

- Gilt futures are up 0.01 today at 116.09 with 10y yields up 2.3bp at 2.070% and 2y yields up 4.4bp at 1.699%.

FOREX: EUR/USD Downtick Extends, Working in Favour of Parity Calls

- The downtick in EUR/USD has extended Wednesday, with the pair touching new multi-decade lows and feeding directly into recent calls for parity in the pair. This put EUR/USD through first support at 1.0233, the 1.382 proj of Feb 10 - Mar 7 - 31 price swing and now exposes 1.0200 - not just psychological support but also the 1.00 projection of the Jun 9 - 15 - 27 price swing.

- Following yesterday's crushing rally in the USD Index, price action has moderated somewhat, but the greenback still holds the vast majority of the Tuesday gains.

- JPY is the outperformer of the day, with the risk-off hangover persisting despite the equity bounce in the US afternoon yesterday. This puts EUR/JPY well through the 50-dma at 139.00 and opens a the mid-June lows of 137.85 for direction.

- Pressure on energy prices has persisted for a second session, with WTI and Brent futures again under pressure ahead of the NY crossover. This works further against the NOK, which remains one of the poorest performers of the week.

- Focus turns to the ISM Services Index for June, with markets watching for any clues ahead of Friday's jobs report - particularly in the absence of the ADP Employment Change report, which has been discontinued this month while the methodology is being reassessed.

EQUITIES: US Futures A Little Softer After Tuesday's Late Rally

- Asian markets closed weaker: Japan's NIKKEI closed down 315.82 pts or -1.2% at 26107.65 and the TOPIX ended 23.15 pts lower or -1.23% at 1855.97. China's SHANGHAI closed down 48.675 pts or -1.43% at 3355.35 and the HANG SENG ended 266.41 pts lower or -1.22% at 21586.66.

- European markets are recovering some of yesterday's losses, with tech stocks leading the way higher (and financials and energy lagging): German Dax up 110.68 pts or +0.89% at 12518.32, FTSE 100 up 94.05 pts or +1.34% at 7119.71, CAC 40 up 64.08 pts or +1.11% at 5860.31 and Euro Stoxx 50 up 30.67 pts or +0.91% at 3392.77.

- U.S. futures are pulling back a little after Tuesday's late bounce: Dow Jones mini down 112 pts or -0.36% at 30824, S&P 500 mini down 14.5 pts or -0.38% at 3819.75, NASDAQ mini down 44.25 pts or -0.37% at 11764.75.

COMMODITIES: Crude Enjoys Modest Bounce, But Copper Keeps Dropping

- WTI Crude up $0.89 or +0.89% at $100.39

- Natural Gas up $0.12 or +2.08% at $5.639

- Gold spot up $1.78 or +0.1% at $1766.66

- Copper down $2.3 or -0.67% at $339.2

- Silver up $0 or +0.01% at $19.2222

- Platinum down $3.48 or -0.4% at $865.24

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/07/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 06/07/2022 | 1230/1330 |  | UK | BOE Cunliffe Panels Qatar Centre Conference | |

| 06/07/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 06/07/2022 | 1300/0900 |  | US | New York Fed President John Williams | |

| 06/07/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 06/07/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 06/07/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 06/07/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 06/07/2022 | 1800/1400 |  | US | FOMC Minutes | |

| 07/07/2022 | 0130/1130 | ** |  | AU | Trade Balance |

| 07/07/2022 | 0545/0745 | ** |  | CH | unemployment |

| 07/07/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/07/2022 | 0600/0800 | ** |  | NO | Norway GDP |

| 07/07/2022 | 0945/1145 |  | EU | ECB Lane on Green Transition at OECD Forum | |

| 07/07/2022 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/07/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 07/07/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 07/07/2022 | 1300/1400 |  | UK | BOE Mann Speaks at LC-MA Forum | |

| 07/07/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 07/07/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 07/07/2022 | 1500/1100 | ** |  | US | DOE weekly crude oil stocks |

| 07/07/2022 | 1605/1705 |  | UK | BOE Pill Speaks at Sheffield Hallam University | |

| 07/07/2022 | 1700/1300 |  | US | Fed Governor Christopher Waller | |

| 07/07/2022 | 1700/1300 |  | US | St. Louis Fed's James Bullard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.