-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Friday, December 13

MNI US OPEN - UK Economy Contracts for Second Straight Month

MNI US OPEN: Italy Political Uncertainty Adds To Risk-Off Tone

EXECUTIVE SUMMARY:

- ITALIAN GOVERNMENT AT RISK OF COLLAPSE IN VOTE TODAY

- EUROPEAN COMMISSION SEES 2023 EUROZONE INFLATION AVERAGING +4%

- SWEDISH INFLATION AT NEW HIGH IN JUNE, WELL ABOVE EXPECTATIONS

- UK TORIES VOTE AGAIN IN LEADER RACE AS SUNAK, MORDAUNT AHEAD

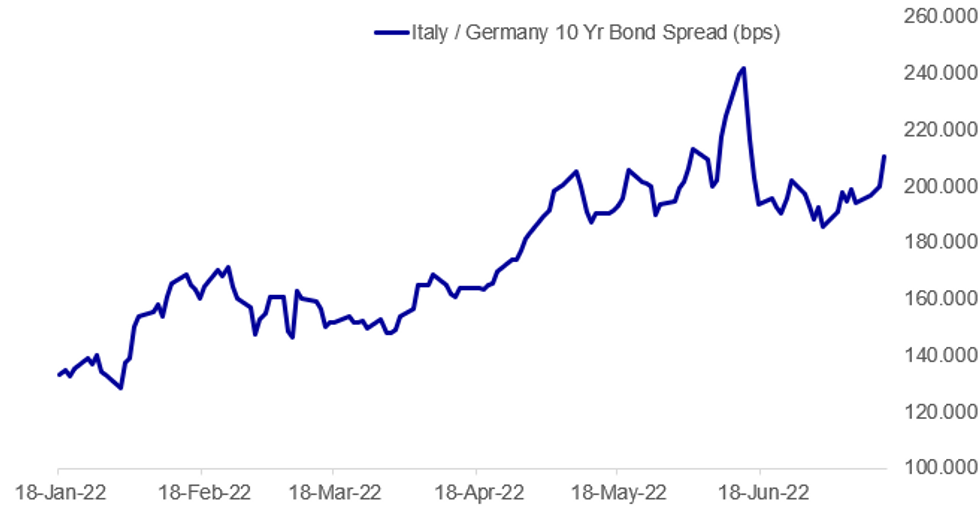

Fig. 1: Italian Political Risk Rising Again

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ITALY: Prime Minister Mario Draghi has confirmed that a confidence vote an an aid decree will go ahead in the Senate today, nixing supposed last-ditch efforts by 5-Star ministers to cancel the vote as reported by Bloomberg earlier.

- Draghi has stated that if the 5-Star Movement does not vote with the gov't he will resign as PM, bringing the broad coalition gov't down.

- Result had been due around 1200CET (0600ET, 1100BST), but not clear whether this timeframe will continue to hold after this morning's political wrangling.

- Should gov't collapse risk of significant political paralysis at a time of significant economic pressures facing Italy as well as the impact of the war in Ukraine and the subsequent energy price crunch. Early election possible, with few other candidates seen as able to hold broad coalition gov't together.

- President Sergio Mattarella's role could prove crucial in attempting to hold gov't together, or bring about another technocratic gov't to avoid early elections.

SWEDEN / RIKSBANK (BBG): Consumer prices in Sweden surged to a fresh record that continued to wrong-foot the Nordic country’s central bank, fueling bets it will raise interest rates faster than planned. The Riksbank’s target measure, CPIF, rose 8.5% from a year earlier in June, marking another three-decade high, according to data released by Statistics Sweden on Thursday. Economists surveyed by Bloomberg expected prices to rise by 8.1%, while the central bank had projected an 8% gain.

UK (BBG): The UK Conservative Party will hold a latest ballot Thursday in the contest to elect their new leader and Britain’s next prime minister, after the first round of voting saw ex-Chancellor Rishi Sunak and Trade Minister Penny Mordaunt emerge as the front-runners. At least one of the six-strong remaining field of contenders -- which also includes Foreign Secretary Liz Truss and Attorney General Suella Braverman -- will be knocked out after Thursday’s vote among Tory MPs, with the result due at about 3 p.m. in London. Any challenger who receives fewer than 30 votes will also be eliminated, so the field size could reduce further. Work and Pensions Secretary Therese Coffey, a key ally of Truss, told Sky News on Thursday that Braverman and the other candidate from the right, Kemi Badenoch, should merge their campaigns and endorse Truss. Other allies of Truss were also questioning Mordaunt’s credentials for the top job.

UK (BBG): Rishi Sunak, the frontrunner in the race to succeed Boris Johnson, warned there are “challenging” times ahead for the economy as he refused to put a timetable on when he could cut taxes. In an interview with BBC Radio 4 on Thursday, the former Chancellor of the Exchequer insisted that he was right to only promise tax cuts once inflation is under control, in contrast to Conservative leadership rivals including Foreign Secretary Liz Truss, who has vowed to slash taxes from day one. “Inflation is the enemy,” Sunak said, stressing that getting it down is his “number one priority.”

CHINA (BBG): Iron ore suffered severe losses as China’s authorities grappled with a wave of mortgage boycotts sweeping the property sector and casting fresh uncertainty over steel demand.An increasing number of home-buyers are refusing to pay mortgages on unfinished properties, triggering fears of a deeper financial squeeze across the sector that could spread to other areas of the economy. Iron ore slumped more than 8% to below $100 a ton as shares of property developers and banks also fell.

CHINA: China's government balance sheet deteriorated as the fiscal gap expanded in the first half of the year based on lower tax and land sale revenues and increased spending on stimulus measures. officials at the Ministry of Finance told reporters on Thursday in a briefing. General fiscal revenues decreased by 10.2% year-on-year in H1 to CNY10.5 trillion, while fiscal spending grew by 5.9% on year to CNY12.9 trillion, said Xue Xiaoqian, officials at the MOF.

DATA:

EUROZONE: European Commission Sees 2023 EA Inflation Averaging +4.0%

- The European Commission's Summer 2022 economic forecast projects EU economic growth at 2.7% in 2022 and 1.5% in 2023. Euro area growth is anticipated to be marginally softer at 2.6% in 2022 and 1.4% in 2023. The 2023 forecasts are substantial 0.8pp and 0.9pp cuts from the Spring report.

- Average inflation is forecasted to peak at 7.6% in the eurozone (8.3% for the EU) in 2022, easing to 4.0% (EA) and 4.6% (EU) in 2023.

- After reaching a historic high of +8.6% y/y in June and averaging at 7.1% y/y over the first six months of the year, the updated euro area forecast of a 7.6% average allows room for higher inflation in upcoming months, tapering into the end of the year.

- The report highlighted the jump in energy and food prices due to the Ukraine war, as well as slowing US growth and China's lockdowns as the key risks to growth.

- GDP expectations were revised down 0.1pp to flatline in the eurozone and contract by -0.1% q/q in the EU for Q2 2022. The tourism sector should remain robust this year. As such the growth forecast remains at 2.7% for 2022.

- Gas supply and the continued risk of pandemic resurgence cannot be ruled out. The only silver lining appears to be recent falls in commodity prices including oil, which may see inflationary pressures ease, whilst the record low unemployment could see household consumption remain robust.

FIXED INCOME: Continuing to adjust to US CPI

There have been big moves in core fixed income markets as market's continue to adjust to yesterday's US CPI print - with the bigger moves due to repricing of CB expectations in the UK and Europe. 2-year gilt and Schatz yields are both over 15bp higher on the day, while 2-year UST yields are only 4bp higher. Curves have bear flattened.

- At the time of writing, we have seen gilt/Schatz yields easily surpass yesterday's highs while 2-uyear UST yields are close to their post-CPI peak.

- In terms of other events today, we have an Italian confidence vote underway, with results expected around 11:00BST / 6:00ET. We also have the next round of the race to be next UK PM, with results expected around 17:00BST / 12:00ET with the bottom of the 6 candidates eliminated.

- In terms of data today we also receive US PPI and weekly claims data.

- TY1 futures are down -0-12 today at 118-17+ with 10y UST yields up 2.8bp at 2.963% and 2y yields up 4.2bp at 3.200%.

- Bund futures are down -1.27 today at 151.35 with 10y Bund yields up 10.1bp at 1.242% and Schatz yields up 15.4bp at 0.592%.

- Gilt futures are down -0.61 today at 115.32 with 10y yields up 6.0bp at 2.118% and 2y yields up 15.5bp at 1.939%.

FOREX: USD/JPY Uptrend Accelerates as Greenback Resumes March Higher

- USD/JPY has broken to fresh cycle highs early Thursday, with the price action not only breaking through yesterday's high, but accelerating the rally to open next resistance at 139.48 (the 1.00 proj of the Jun 16 - 22 - 23) ahead of the psychological 140.00 level.

- The resumption of risk-off trade in global equity markets has fueled appetite for the greenback, particularly in light of Wednesday's CPI release which has made the prospect of a 100bps hike from the Fed a tangible option going forward. Both Mester and Bostic have spoken since the inflation release, with each member issuing concern over hot CPI and stating that all options - including a 100bps rate move - are on the table.

- This puts the greenback above all others in G10 ahead of the NY crossover, putting the USD Index at new multi-decade highs.

- Outside of the USD and JPY, CAD and NZD also trade poorly despite the Bank of Canada's larger than expected rate hike yesterday. Commodity-tied currencies are trading soft inline with base metals and energy products, as broader concerns about a global recession swirl further as we head through the first few weeks of H2.

- Focus turns to US PPI data later today, to confirm whether pipeline inflation is as hot as the price pressures facing the consumer. Weekly jobless claims are also on the docket alongside a speech from Fed's Waller.

EQUITIES: Rising Yields Weigh On Stocks

- Asian markets closed mixed: Japan's NIKKEI closed up 164.62 pts or +0.62% at 26643.39 and the TOPIX ended 4.28 pts higher or +0.23% at 1893.13. China's SHANGHAI closed down 2.548 pts or -0.08% at 3281.744 and the HANG SENG ended 46.74 pts lower or -0.22% at 20751.21.

- European stocks are weaker, with losses focused in the Real Estate and Energy sectors: German Dax down 97.17 pts or -0.76% at 12653.8, FTSE 100 down 56.67 pts or -0.79% at 7138.78, CAC 40 down 62.79 pts or -1.05% at 5957.96 and Euro Stoxx 50 down 37.45 pts or -1.08% at 3425.01.

- U.S. futures are weaker, with the Dow Jones mini down 344 pts or -1.12% at 30414, S&P 500 mini down 46.5 pts or -1.22% at 3758, NASDAQ mini down 134.5 pts or -1.14% at 11627.75.

COMMODITIES: Crude Prices Continue To Drop

- WTI Crude down $2.65 or -2.75% at $95.34

- Natural Gas down $0.06 or -0.88% at $6.673

- Gold spot down $19.73 or -1.14% at $1726.17

- Copper down $6 or -1.81% at $332.05

- Silver down $0.31 or -1.59% at $19.2481

- Platinum down $21.63 or -2.52% at $863.36

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/07/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 14/07/2022 | 1230/0830 | *** |  | US | PPI |

| 14/07/2022 | 1400/1000 | ** |  | US | WASDE Weekly Import/Export |

| 14/07/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 14/07/2022 | 1500/1100 |  | US | Fed Governor Christopher Waller | |

| 14/07/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 14/07/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 15/07/2022 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 15/07/2022 | 0200/1000 | *** |  | CN | Retail Sales |

| 15/07/2022 | 0200/1000 | *** |  | CN | Industrial Output |

| 15/07/2022 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 15/07/2022 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 15/07/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 15/07/2022 | - |  | EU | ECB Lagarde & Panetta at G20 CB Meeting | |

| 15/07/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 15/07/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 15/07/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/07/2022 | 1245/0845 |  | US | Atlanta Fed's Raphael Bostic | |

| 15/07/2022 | 1300/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

| 15/07/2022 | 1300/0900 |  | US | St. Louis Fed's James Bullard | |

| 15/07/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 15/07/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 15/07/2022 | 1400/1000 | * |  | US | Business Inventories |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.