-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US OPEN: The (Political) Heat Is On In Europe

EXECUTIVE SUMMARY:

- EUROPEAN GAS PRICES JUMP AS HEAT WAVE BOOSTS COOLING DEMAND

- BOE SAUNDERS: 2% BANK RATE OR HIGHER NOT "IMPLAUSIBLE OR UNLIKELY"

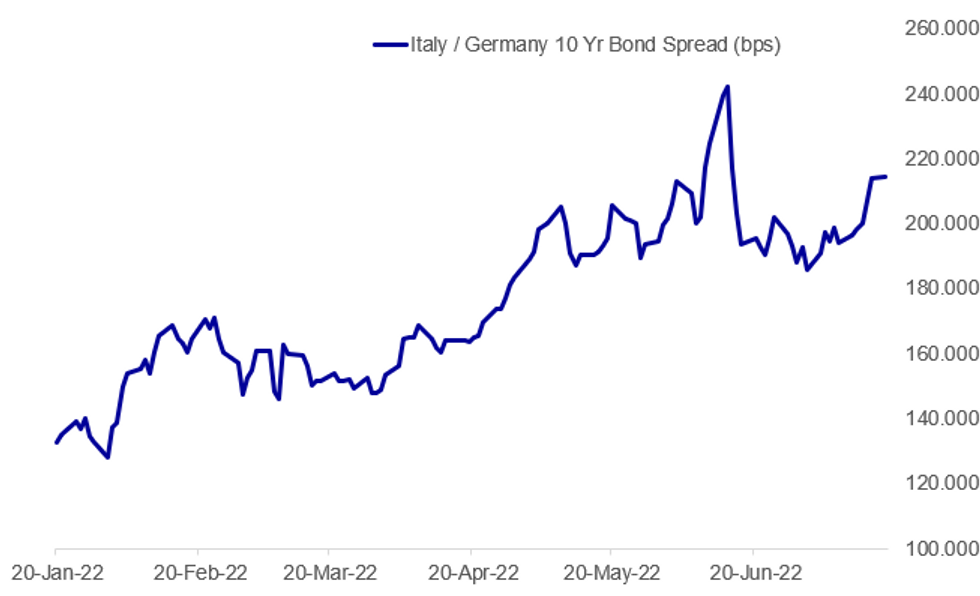

- NO SIGN OF RESOLUTION TO ITALIAN POLITICAL CRISIS AS DRAGHI VISITS ALGERIA

- EU FOREIGN MINISTERS MEET TO SIGN OFF ON LATEST RUSSIA SANCTIONS ENHANCEMENTS

Fig. 1: Italian Spreads Remain Wider Amid Political Uncertainty

Source: BBG, MNI

Source: BBG, MNI

NEWS:

EUROPE / ENERGY (BBG): European natural gas prices jumped with a heat wave scorching the western half of the region, boosting demand for cooling and pushing energy costs higher. Temperatures in parts of the UK and France could rise to record levels Monday and Tuesday, according to forecaster Maxar. Germany produced a record amount of electricity from solar energy Sunday and is set to exceed that level Tuesday.

BOE: SONIA futures at their lows of the day after BOE Saunders's speech - even though his last meeting is in 2.5 weeks and he's a recognized hawk. To be fair, the direction of travel was lower before he spoke, but we are ow seeing Reds/Greens down 6-7 ticks on the day. His key quote:

- "Without wishing to endorse those views too strongly, I do not regard such an outcome (ie that Bank Rate will have to rise to 2% or higher during the next year to return inflation to target) as implausible or unlikely. But, rather than focus on a precise forecast for Bank Rate over the next year, the key point is that the tightening cycle may (in my view) still have some way to go."

ITALY POLITICS: Prime Minister Mario Draghi visits Algeria today to meet with gov't officials to discuss a potential gas supply deal amidst an ongoing political crisis in Rome.

- At present it seems likely that Draghi is set to announce his resignation on Wednesday 20 April when he delivers addresses to the Chamber of Deputies and the Senate. Comes after the populist 5-Star Movement refused to back a gov't financial aid decree in a confidence vote in the Senate last week.

- Draghi stated that without full support from all gov't participants he would resign from office. He attempted to do so in the immediate aftermath of the Senate vote, but this offer was rebuffed by President Sergio Mattarella.

- On Friday, MNI reported that Draghi fully expects to resign on 20 July, according to a source within the gov't close to Draghi (see: https://marketnews.com/homepage/mni-italy-pm-dragh...)

- Should Draghi resign, an early general election is on the cards given that finding a suitable alternative PM is unlikely. Moreover, the right-wing League and centre-right Forza Italia have indicated that they will not work with the 5-Stars again, stating over the weekend "it is to be excluded the possibility of governing again with 5-Stars due to their incompetence and unreliability".

- Despite this uncertainty, Draghi is in Algeria today where he is looking to sign off on gas deals to assist in diversifying Italy's energy mix away from Russian dependency (BBG reports Mattarella's rejection of Draghi's resignation came in order to ensure PM could sign this deal).

GERMANY / UNIPER (BBG): Uniper SE said it has used up all 2 billion-euro ($2 billion) credit line from German state-owned lender KfW Group, increasing the urgency for a government bailout.Uniper first disclosed bailout talks with the German government at the end of June. Since then, discussions to plug its 9-billion euro hole have been tense. Finnish parent Fortum Oyj wants the German state to take a stake in a ring-fenced part of Uniper that includes only businesses key to the country’s security of supply.

EUROPE / ENERGY: It is looking unlikely that the Nord Stream 1 pipeline will fully restart this week after Kommersant reported that a turbine needed for full flow rates will not arrive in Russia until July 24.

- Gazprom were running the Nord Stream 1 pipeline at 40% in the weeks leading up to planned maintenance July 11-21, claiming they required the turbine to be returned from repairs in Canada.

- Canada signed a sanctions waiver and have delivered the turbine to Germany, who will then send the turbine to Russia.

- Kommersant reports that if the turbine arrives by July 24, it will take a further 3-4 days to fit and will not be ready to pump gas until early-August.

EU/RUSSIA: European Union foreign ministers meeting presently in Brussels as part of the Foreign Affairs Council. Ministers are set to approve the latest round of 'enhancements' to the sixth package of sanctions against Russia, including the implementation of a ban on the import of Russian gold. EU High Representative for Foreign Affairs Josep Borrell:

- "We will discuss [...] improving the implementation of the already existing sanctions...The most important [proposal] is the ban on Russian gold, but [also] to be sure that the sanctions are effective. Because there is a big debate about “are the sanctions effective? Are the sanctions affecting us more than Russia?” Some European leaders have been saying that the sanctions were an error, were a mistake. Well, I do not think it was a mistake, it is what we had to do and we will continue doing."

DATA:

No key data released in the European morning session.

FIXED INCOME: Core fixed income lower as markets look ahead to the ECB meeting

- Core fixed income has moved lower this morning with equities higher. Expectations of ECB hike 6-18 months ahead were higher on the open while the SONIA strip has moved lower following outgoing MPC member Michael Saunders stating that a 2% Bank Rate was not implausible.

- Curve moves in both Germany and the UK have been largely parallel with the German curve continuing to underperform, gilts moving lower following Saunders but still outperforming and Treasuries seeing the smallest moves lower.

- Looking ahead we will have the results of the next round of the Tory leadership contest at around 20:00BST / 15:00ET today where the candidates will be reduced from 5 to 4. There is also a no confidence vote for the UK government scheduled - but it is almost certain to fail - the results will be around 22:00BST / 17:00ET.

- TY1 futures are down -0-6+ today at 118-14 with 10y UST yields up 4.0bp at 2.959% and 2y yields up 2.3bp at 3.148%.

- Bund futures are down -1.18 today at 151.92 with 10y Bund yields up 7.8bp at 1.207% and Schatz yields up 6.5bp at 0.505%.

- Gilt futures are down -0.37 today at 115.27 with 10y yields up 4.2bp at 2.130% and 2y yields up 3.9bp at 1.944%.

FOREX: Greenback Softer While Equity Picture Improves

- The greenback trades lower early Monday, extending the downtick off last week's highs. Early dollar weakness is accompanied general strength in equities at the European open, with cash markets on the continent universally higher, while US stock futures indicate a positive open later today.

- Greenback weakness has put the USD Index well through last Wednesday's lows to extend the pullback from the Thursday high to around 1.75%.

- The main beneficiaries so far have been GBP (ahead of key political and data risks later this week) and the single currency. EUR/USD now trades just shy of 1.0150 and the 20-day EMA at 1.0270. A break here would highlight the possibility of a short-term correction from the base of the bear channel. This makes Thursday's ECB rate decision key going forward, with any hawkish turn from the central bank likely to prompt a sharp upside move in the currency.

- GBP's outperformance today marks an extension of the corrective bounce in the pair, but markets need to top 1.2049, the 20-day EMA to secure any further move higher. For now, however, the outlook remains bearish, with the downtrend still initially targeting 1.1673, the 1.00 proj of the May 27 - Jun 14 - 16 price swing.

- Data releases are few and far between Monday, with the central bank speaker slate similarly quiet. Both the ECB and the Fed have entered their pre-decision media purdah, which could mute volatility headed into both their respective rate announcements this week and the next.

EQUITIES: Europe Rebounding On Cyclical Gains

- China / Hong Kong markets closed higher: SHANGHAI closed up 50.042 pts or +1.55% at 3278.103 and the HANG SENG ended 548.46 pts higher or +2.7% at 20846.18. (Japanese markets were closed for holidays.)

- European equities are stronger across the board, with the pro-cyclical Energy, Materials, and Consumer Discretionary categories leading: German Dax up 183.39 pts or +1.43% at 12653.8, FTSE 100 up 102.72 pts or +1.43% at 7138.78, CAC 40 up 81.25 pts or +1.35% at 5957.96 and Euro Stoxx 50 up 50.93 pts or +1.46% at 3425.01.

- U.S. futures are higher, with the Dow Jones mini up 305 pts or +0.98% at 31552, S&P 500 mini up 42.25 pts or +1.09% at 3907.25, NASDAQ mini up 158 pts or +1.32% at 12165.5.

COMMODITIES: Broad Rally Led By Energy And Copper

- WTI Crude up $2.2 or +2.25% at $98.24

- Natural Gas up $0.17 or +2.45% at $6.737

- Gold spot up $11.04 or +0.65% at $1726.17

- Copper up $10.3 or +3.18% at $324.5

- Silver up $0.24 or +1.29% at $18.6795

- Platinum up $17.12 or +2.01% at $851.23

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/07/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 18/07/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 18/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 18/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 18/07/2022 | 2000/1600 | ** |  | US | TICS |

| 19/07/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 19/07/2022 | 0800/1000 |  | EU | ECB Bank Lending Survey | |

| 19/07/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 19/07/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 19/07/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 19/07/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 19/07/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 19/07/2022 | 1700/1800 |  | UK | BOE Bailey at Mansion House Dinner |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.