-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US OPEN: Half-Point BoE Hike Eyed

EXECUTIVE SUMMARY:

- BANK OF ENGLAND SET TO HIKE RATES BY 25BP OR 50BP

- CHINA TEST-FIRES MISSILES IN MILITARY DRILLS AROUND TAIWAN

- EUROZONE CONSUMER INFLATION EXPECTATIONS RISE

- GERMAN FACTORY ORDERS DROP AS INFLATION, SUPPLY DISRUPTIONS PREVAIL

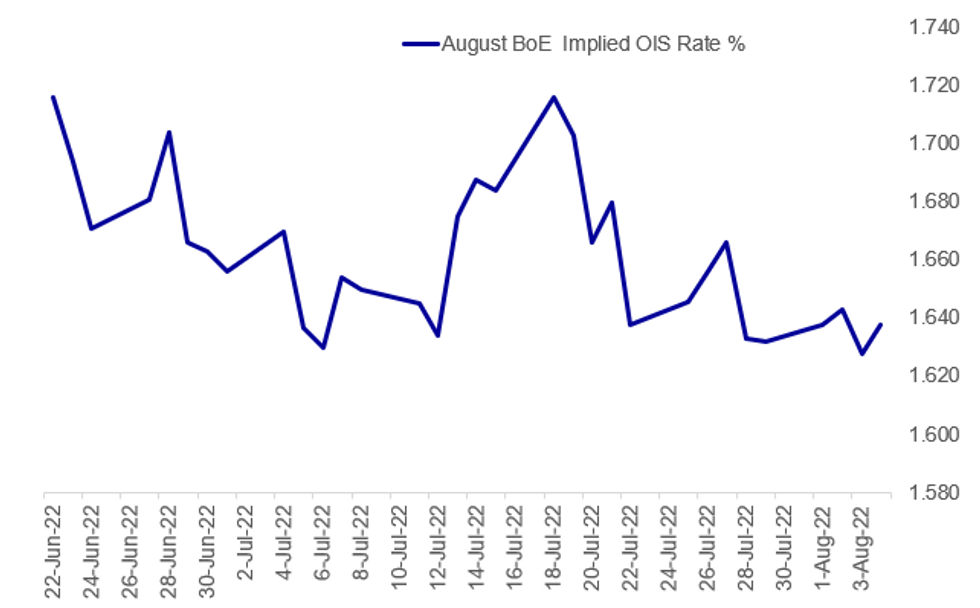

Fig. 1: BoE 50bp Hike Today Mostly Priced

Source: BBG, MNI

Source: BBG, MNI

NEWS:

BOE (MNI MARKETS PREVIEW): The main event of the day will be the release of the Bank of England Monetary Policy Report and policy decision. The MNI Markets team sees a subjective 70%probability of a 50bp hike today, with a 25bp hike if not. Inflation remains high, the PMIs have held up, other central banks have pivoted hawkishly and Bailey hinted towards a 50bp hike at his Mansion House speech. The decision, statement and MPR will be released at 12:00BST / 13:00CET with the press conference due to begin at 12:30BST / 13:30CET.

CHINA / TAIWAN / US (BBG): China’s military fired missiles into the sea on Thursday in live-fire military exercises around the island in response to US House Speaker Nancy Pelosi’s visit, even as Taipei played down the impact on flights and shipping. China tested several Dongfeng missiles northeast and southwest of Taiwan from 13:56 pm local time, according to a statement from the island’s Defense Ministry. Sun Li-fang, a ministry spokesman, said the missiles were fired from land and they hit the sea. China separately said the missiles accurately hit targets in seas east of Taiwan. The statement by the Eastern Military Command of the People’s Liberation Army said it had completed the drills, and that it had lifted air and sea controls.

CHINA / TAIWAN / US (RTRS): Using force won't solve problems and differences, Taiwan's Mainland Affairs Council said at a regular news briefing on Thursday, the same day China filed multiple missiles around the self-ruled island in unprecedented military drills. The drills followed a visit by U.S. House of Representatives Speaker Nancy Pelosi on Tuesday and Wednesday to Taiwan, which Beijing regards as its sovereign territory. The Council said these drills will not change the fact that the two sides don't belong to each other, and urged the Communist Party to immediately stop intimidating Taiwan.

GERMANY (BBG): German factory orders sank for a fifth month in June as rampant inflation and global supply disruptions continued to weigh on the outlook in Europe’s largest economy. Demand slipped 0.4% from May, driven by a decline in orders for investment goods, particularly from abroad. That brought the annual number down 9%. Economists had predicted a drop of 0.9% on the month. “In view of the increased uncertainty caused by the war and an impending gas shortage, demand development remains weak,” the statistics office said Thursday in a statement. “The outlook for industrial activity remains restrained as the business climate has cooled.”

EUROPE ENERGY: European gas is on track to meet storage targets after finishing July at 69% full despite flows on Nord Stream 1 at zero for 10 days of maintenance in July and now only operating at 20%. The EU target is for 80% by November 1 and 90% by December 1.

CHINA (BBG): Dollar bonds of a state-backed Chinese builder fell by record amounts Thursday, following several months of declines as repayment worries have circled even developers partially owned by the government. Some notes issued by Sino-Ocean Group Holding Ltd. dropped about 10 cents on the dollar, according to Bloomberg-compiled prices, putting most in deeply distressed territory at below 25 cents. The firm led weakness among other higher-rated builders, with bonds from China Vanke Co. and Country Garden Holdings Co. poised to notch their biggest declines in weeks.

CANADA REAL ESTATE (RTRS): Home prices in the Greater Toronto Area (GTA) fell for the fifth straight month in July, as rapidly rising interest rates further doused the city's once-red-hot housing market, data from the Toronto Regional Real Estate Board (TRREB) showed on Thursday. The average price of a GTA home fell to C$1.07 million ($833,528) in July, down 6.2% from June and 19.5% from February's peak, according to a TRREB statement, but up 1.2% from a year ago. Sales nearly halved from a year ago, compared with only a 4.1% decline in listings.

DATA:

MNI BRIEF: Euro Area Consumer Inflation Expectations Rise

inflation expectations amongst the general public are edging higher across the eurozone, the European Central Bank's June Consumer Expectations Survey shows, with the outlook for the coming 12 months edging up to 5.0% from 4.9% in April. Over the longer three year horizon, prices are seen rising 2.8%, up from 2.5% in the previous report.

The survey, which uses high-frequency data on household perceptions and expectations, currently focuses on Germany, France, Italy Spain, Belgium and The Netherlands, with plans to add further countries in months ahead.

ECB policymakers will be looking closely at consumer price expectations, as they look to cut off higher prices becoming embedded. The bank hiked 50 bps in July to bring the deposit rate out of of negative territory for the first time since 2014.

GERMANY JUN FACTORY ORDERS -0.4% M/M; -9.0% Y/Y; MAY -3.2%R Y.Y

MNI: EUROZONE JUL CONSTRUCTION PMI 45.7, JUN 47.0

FIXED INCOME: Short-end yields moving higher ahead of BOE decision

- STIR futures continue to push lower in both Europe and the UK, with short-dated govvie yields seeing upward pressure as a result. However, these move are only really pushing yields back to levels seen last week. As a result, curves are bear flattening.

- The BOE monetary policy decision is the highlight of the day, with the decision and MPR due at 12:00BST / 7:00ET and the press conference at 12:30BST / 7:30ET. The MNI Markets team sees a subjective 70% probability of a 50bp hike today, with a 25bp hike if not. 64% of the analyst previews we have read look for a 50bp hike while markets price in around an 80% probability of a 50bp hike today. In addition, we will receive an update regarding balance sheet policy. It is unclear how much detail we will receive this week with the MPC expected to hold a September confirmatory vote before beginning active gilt sales. See the full MNI BOE Preview here.

- Elsewhere we have US trade balance and weekly jobless claims as well as Fed's Mester speaking.

- TY1 futures are up 0-1+ today at 120-04+ with 10y UST yields up 3.2bp at 2.738% and 2y yields up 4.3bp at 3.111%.

- Bund futures are down -0.08 today at 156.88 with 10y Bund yields up 0.7bp at 0.878% and Schatz yields up 3.3bp at 0.413%.

- Gilt futures are up 0.01 today at 117.64 with 10y yields up 1.9bp at 1.929% and 2y yields up 7.2bp at 1.890%.

FOREX: Attention turns to the BoE

- Market participants await the BoE decision.

- Early European flows have seen the EUR gaining this morning on the margin, with the USD mostly offered, driven by a tilted Risk On tone.

- EU cash Equities opened higher and dragged futures on the follow, but upside momentum has lost some steam, and price action has been more mixed.

- Yen has in turn seen selling interest, and at session low against USD, EUR, AUD. GBP.

- USDJPY eye 134.55 High Aug 3 next.

- EUR is mostly in the green against G10, besides the AUD and NZD.

- The EUR tested intraday high vs CAD, JPY, GBP, and NOK, but off its best levels at the time of typing.

- USD sits in the red in G10s, besides the Yen, and circa flat against the NOk and Swissy.

- Looking ahead, there's no Tier 1 data left for the session, out of the US sees IJC, but no longer a market mover, with ALL EYES on NFP tomorrow.

- All the attention is now on the BoE decision, with most sell side going for a 50bps hike.

- This is also widely expected by Economist's estimates, with 13 out of 43 economists surveyed by Bloomberg going for a 25bps hike.

- A 50bps hike to 1.75% is the median call.

- The decision, statement and MPR will be released at 12:00BST / 13:00CET with the press conference due to begin at 12:30BST / 13:30CET.

EQUITIES: Off Session Highs Ahead Of BoE

- Asian stocks closed higher: Japan's NIKKEI closed up 190.3 pts or +0.69% at 27932.2 and the TOPIX ended 0.04 pts lower or 0% at 1930.73.China's SHANGHAI closed up 25.365 pts or +0.8% at 3189.039 and the HANG SENG ended 406.95 pts higher or +2.06% at 20174.04.

- European equities are fading earlier highs, with tech and consumer discretionary stocks leading, and defensives lagging: German Dax up 100.68 pts or +0.74% at 13688.96, FTSE 100 down 17.65 pts or -0.24% at 7427.36, CAC 40 up 25.99 pts or +0.4% at 6496.96 and Euro Stoxx 50 up 16.55 pts or +0.44% at 3749.02.

- U.S. futures are a touch lower, with the Dow Jones mini down 26 pts or -0.08% at 32745, S&P 500 mini down 4 pts or -0.1% at 4152.25, NASDAQ mini down 16 pts or -0.12% at 13255.5.

COMMODITIES: Copper Lags Broader Gains

- WTI Crude up $0.38 or +0.42% at $91.03

- Natural Gas up $0.07 or +0.82% at $8.334

- Gold spot up $11.34 or +0.64% at $1776.63

- Copper down $2.65 or -0.76% at $344.05

- Silver up $0.08 or +0.4% at $20.1444

- Platinum up $6.18 or +0.68% at $908.44

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/08/2022 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 04/08/2022 | 1130/1230 |  | UK | BOE Press Conference | |

| 04/08/2022 | 1230/0830 | * |  | CA | Building Permits |

| 04/08/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 04/08/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 04/08/2022 | 1400/1000 | ** |  | US | WASDE Weekly Import/Export |

| 04/08/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 04/08/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 04/08/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 04/08/2022 | 1600/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 05/08/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 05/08/2022 | 0645/0845 | * |  | FR | Industrial Production |

| 05/08/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 05/08/2022 | 0645/0845 | * |  | FR | Current Account |

| 05/08/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 05/08/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 05/08/2022 | 1115/1215 |  | UK | BOE Pill Monetary Policy Report National Agency Briefing | |

| 05/08/2022 | 1200/0800 |  | US | Richmond Fed's Tom Barkin | |

| 05/08/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 05/08/2022 | 1230/0830 | *** |  | US | Employment Report |

| 05/08/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 05/08/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.