-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

MNI US OPEN: Payroll Deceleration Expected

EXECUTIVE SUMMARY:

- MNI JULY NONFARM PAYROLLS DEALER MEDIAN: +270K

- CHINA ANNOUNCES SANCTIONS ON US HOUSE SPEAKER PELOSI: MOFA

- BOE'S BAILEY DENIES BANK WAS TOO SLOW TO ACT ON INFLATION

- EUROZONE INDUSTRIAL PRODUCTION DATA MOSTLY BETTER THAN EXPECTED; ITALY SLUMPS

- BOJ CONCERN GROWS OVER MEGABANK INVESTMENT LOSSES (MNI INSIGHT)

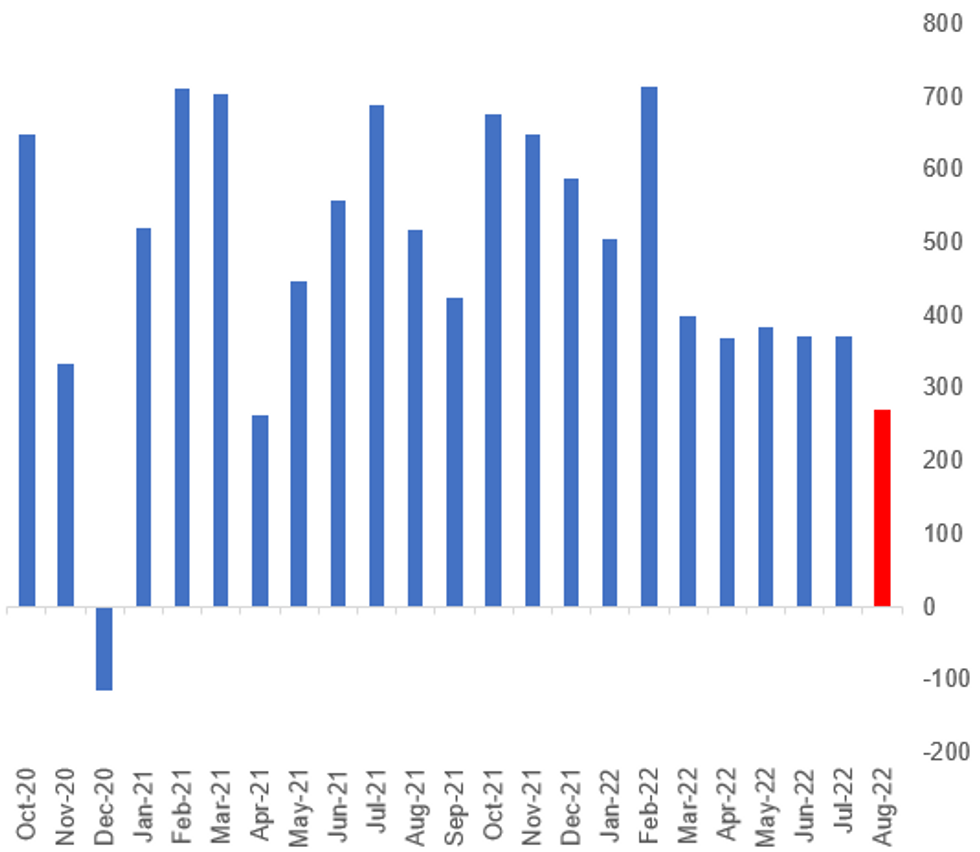

Fig. 1: US Nonfarm Payroll Gains Seen Decelerating In July

Source: BLS, MNI Dealer Median in Red

Source: BLS, MNI Dealer Median in Red

NEWS:

US NONFARM PAYROLLS (MNI PREVIEW): Consensus sees nonfarm payrolls growth moderating in July in a resumption of a downward trend after four remarkably steady months as the gap on pre-pandemic employment levels is almost completely shut. Particular focus is likely on the strength of jobs growth plus any differences between establishment and household surveys, with FOMC speakers putting weight on labour market strength as evidence against the economy already being in recession.

CHINA - US (BBG): China said it would sanction US House Speaker Nancy Pelosi, after she defied Beijing by becoming the highest-ranking American politician to visit Taiwan in 25 years. The Chinese Foreign Ministry announced the measures on Pelosi and her immediate family members in a statement late Friday. Pelosi is the highest ranking US official to face Chinese penalties. Last year, Beijing sanctioned former US Secretary of State Michael Pompeo, just as President Joe Biden was being inaugurated. Pompeo, who has called for Taiwan to be recognized as a “free and sovereign nation” since leaving office, didn’t visit the self-ruled island until finishing his stint.

BOJ (MNI INSIGHT): The Bank of Japan is increasingly concerned that the nation's so-called megabanks could face big losses on their overseas financial investments as the U.S. faces both higher rates and a likely recession, possibly crimping lending in Japan and adding to downward pressure on the economy, MNI understands.

BOE (BBG): Bank of England Governor Andrew Bailey denied that officials allowed inflation to get out of control by acting too slowly, saying interest-rate increases a year ago would have damaged the recovery from the pandemic. The remarks in an interview on BBC radio on Friday respond to growing attacks on the UK central bank from the ruling Conservative Party. Inflation is at a 40-year high and forecast to climb further in coming months.

BOE (BBG): Bank of England Chief Economist Huw Pill said a surge in natural gas prices since May is the biggest factor likely to drive UK inflation past 13% this year. Speaking in an interview on Bloomberg TV, Pill also said: Investors should be cautious about assuming the BOE will hike rates another 50 basis points in September; there’s risks the BOE raises rates too much or too little to combat inflation, and there’s a diversity of views on the Monetary Policy Committee about how to respond; the BOE isn’t expecting a return to the “sky high” interest rates prevailing in past decades.

GLOBAL FOOD PRICES (BBG): Global food prices dropped for a fourth month after hitting a record on the war in Ukraine, as concerns over supplies of grains and vegetable oils eased. A United Nations index of world food costs plunged more than 8.6% in July. The index fell to the lowest since January, before Russia’s blockade of ports in Ukraine -- a major food exporter -- pushed up food costs. Still, prices remain elevated, and people on low incomes are feeling the pinch as a cost-of-living crisis deepens.

DATA:

US: Primary Dealer NFP Estimates

| Primary Dealer | Estimate | Primary Dealer | Estimate |

|---|---|---|---|

| Amherst Pierpoint | +325K | RBC | +320K |

| Citi | +300K | Credit Suisse | +300K |

| Morgan Stanley | +300K | TD Securities | +300K |

| Scotiabank | +290K | BNP Paribas | +280K |

| Bank of America | +275K | Barclays | +275K |

| Daiwa | +275K | NatWest | +270K |

| Jefferies | +260K | Deutsche Bank | +250K |

| HSBC | +250K | Nomura | +240K |

| Wells Fargo | +240K | Goldman Sachs | +225K |

| Societe Generale | +225K | J.P.Morgan | +200K |

| Mizuho | +200K | BMO | +150K |

| UBS | +150K | ||

| Dealer Median | +270K | BBG Whisper | +226K |

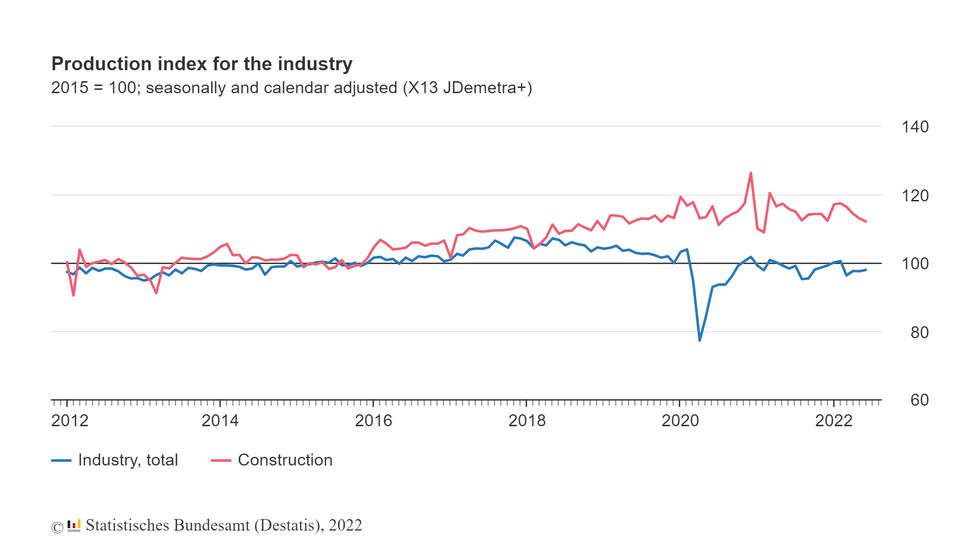

GERMANY: Industrial Production Sees Softer Decline in June

GERMANY JUN IP +0.4% M/M (FCST -0.3%); MAY -0.1%r M/M

GERMANY JUN IP -0.5% Y/Y (FCST -1.3%); MAY -1.7%r Y/Y

- German industrial production was more resilient than anticipated in the June report, seeing a small +0.4% m/m increase and a softer fall in the annualised print at -0.5% y/y (vs. May -1.7% y/y and the forecasted slide of -1.3% y/y).

- Both May readings saw downwards revisions of 0.2-0.3pp.

- Energy and construction industries were the key downwards drivers of the headline number, with energy production stalling at 0.0% m/m in June and Production declining by -0.8% m/m. Excluding energy and construction, IP would've expanded by a stronger +0.7% m/m.

- Supply bottlenecks and extreme shortages continue to hamper German production due to distortions caused by the Ukraine war and the lasting effects of the pandemic, highlighted by 3/4 of firms expressing persisting issues.

- Following this data is French IP at 0745 BST and Italian at 0900 BST. Expectations of further substantial slowdown into the end of the year would feed into the ECB’s calculations regarding the resilience of a fragile euro area economy.

FRANCE Robust June IP Sees Energy Sector Resurgence, as in Germany & Spain

FRANCE JUN INDUSTRIAL PROD. +1.4% Y/Y (FCST -0.3%); MAY -0.3%r Y/Y

FRANCE JUN INDUSTRIAL PROD. +1.4% M/M (FCST -0.3%); MAY +0.2%r M/M

- French industrial production saw surprise growth in June, expanding by 1.4% in both the month-on-month and annualised print.

- This is above the anticipated forecast of -0.3% contractions for both readings and adds to German and Spanish IP data from this morning which also came in more robust than forecasts.

- France experienced a broad-based solid month-on-month rebound across capital goods production (+3.5% in June vs +0.2%), agriculture (+2.2% in June vs -0.7%), other transport equipment (+6.2% vs -5.7%) and most notably extractive industries and energy (+2.4% in June vs -4.1%).

- Diving into the detail of German and Spanish reports highlights a recurrent theme of substantially stronger energy production in June, likely linked to efforts in generating gas stocks ahead of Winter as supply from Russia has become increasingly concerning over the past months. Italian IP data due at 0900 BST will likely confirm this.

FIXED INCOME: World awaits the US NFP release

- A slow start for EGBs and Bund and across assets, which is not too surprising, with the majority of investors sitting on the sideline, ahead of the awaited US NFP.

- Bund closed the small opening gap up to 158.18, printed 158.21 high, and this was followed by a dip lower, down to 157.67.

- Bund is back to flat at the time of typing.

- Peripheral spreads lean tighter against the German 10yr, Greece leads by 1.8bps.

- German, French and Spanish IPs beat expectations, but limited impact on Govies.

- Gilt/Bund spread continues to widen, after it broke through the April high yesterday, that was 106.10.

- Next psychological level is at 110.00bps, but better is seen towards 112.00bps.

- The spread is now widest since 25th March.

- US Treasuries are trading small in the red in early European trade.

- The 5/30s curve, leans flatter, but well within yesterday's range.

- Looking ahead, ALL EYES on NFP, range is 50k to 325k.

- Median is 250k, whisper is 226k.

- The 10 top ranked Bloomberg Economists surveyed, have a range of 180k to 280k.

FOREX: USD is in the green ahead of the NFP

- The Dollar trades in the green ahead of the US data, some of the move lower in Equities, has underpinned the USD.

- Desk are also likely positioning, but low turnovers, suggest that most market participants are on the sideline.

- The British Pound, saw early initial buying interest, and led against the Yen, but was still well short of pre BoE levels.

- Similar story against the EUR, would need the latter to drift back towards 0.8359, for pre BoE level.

- Closest cross was Cable, after making an attempt yesterday afternoon, it failed at 1.2175, today printed a 1.2169 high.

- Cable was trading circa 1.2193 pre BoE.

- The Pound has since given back some of its gains, mostly a function of the USD, but also some suggestion of a fix trade (seller) earlier.

- The Pound is now mixed versus G10s.

- Looking ahead, US NFP's range is 50k to 325k.

- Median is 250k, whisper is 226k.

- The 10 top ranked Bloomberg Economists surveyed, have a range of 180k to 280k.

EQUITIES: Holding Pattern Ahead Of Payrolls

- Asian markets closed higher: Japan's NIKKEI closed up 243.67 pts or +0.87% at 28175.87 and the TOPIX ended 16.44 pts higher or +0.85% at 1947.17. China's SHANGHAI closed up 37.988 pts or +1.19% at 3227.027 and the HANG SENG ended 27.9 pts higher or +0.14% at 20201.94.

- European stocks are a little weaker, with most sectors in the red (energy the weakest): the German Dax down 23.61 pts or -0.17% at 13641.64, FTSE 100 down 11.43 pts or -0.15% at 7437.6, CAC 40 down 25.43 pts or -0.39% at 6494.04 and Euro Stoxx 50 down 14.98 pts or -0.4% at 3740.79.

- U.S. futures are trading flat, with the Dow Jones mini up 21 pts or +0.06% at 32702, S&P 500 mini down 0.75 pts or -0.02% at 4151.5, NASDAQ mini down 6.5 pts or -0.05% at 13320.25.

COMMODITIES: Dollar Gains Drag On Precious Metals

- WTI Crude up $0.29 or +0.33% at $88.75

- Natural Gas up $0.01 or +0.09% at $8.122

- Gold spot down $3.8 or -0.21% at $1786.67

- Copper up $2.45 or +0.7% at $350.5

- Silver down $0.07 or -0.35% at $20.0974

- Platinum up $8.02 or +0.86% at $938.99

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/08/2022 | 1115/1215 |  | UK | BOE Pill Monetary Policy Report National Agency Briefing | |

| 05/08/2022 | 1200/0800 |  | US | Richmond Fed's Tom Barkin | |

| 05/08/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 05/08/2022 | 1230/0830 | *** |  | US | Employment Report |

| 05/08/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 05/08/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.