-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - PBOC Makes First Major Policy Tweak Since 2011

MNI BRIEF: China Passenger Car Sales Up In November Y/Y

MNI US OPEN: Energy Crisis Drags Down German Confidence

EXECUTIVE SUMMARY:

- UK REAL EARNINGS FALL AT FASTEST PACE ON RECORD

- GERMAN POWER PRICES HIT RECORD AS GAS CONTINUES TO SURGE

- BOJ SEES RISK OF SLOWING CONSUMER DEMAND IN Q3 (MNI INSIGHT)

- GERMAN INVESTOR CONFIDENCE FALLS FURTHER IN AUGUST

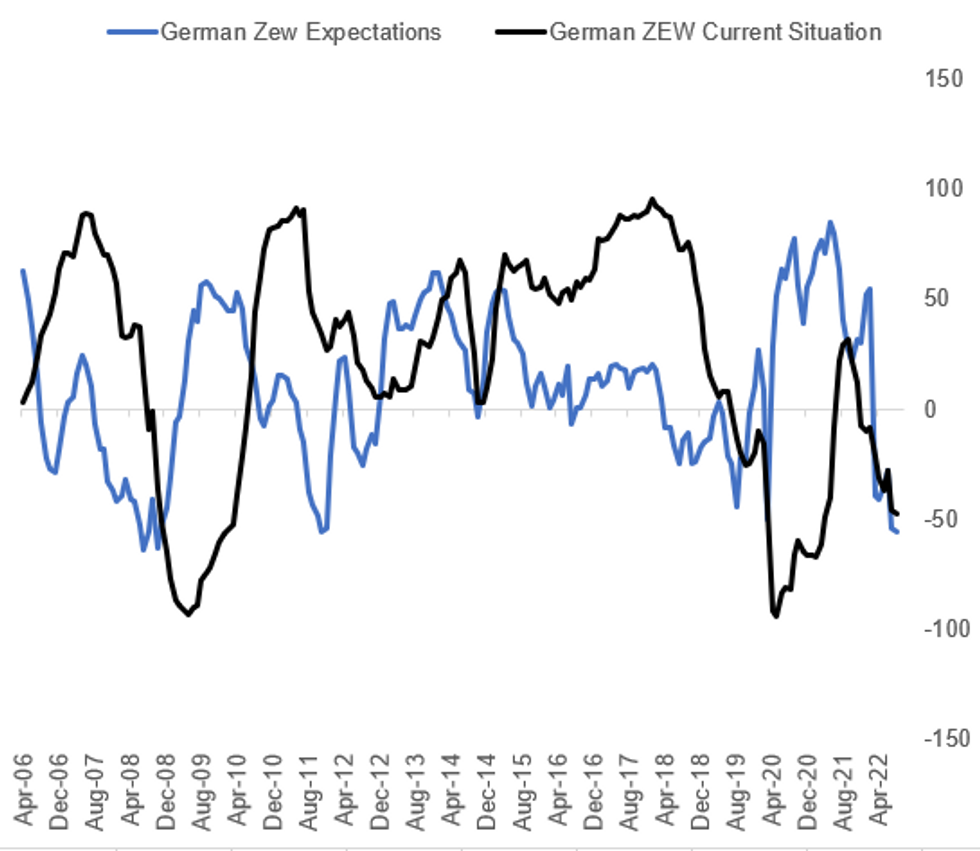

Fig. 1: German Investor Confidence Continues To Deteriorate

Source: ZEW, BBG, MNI

Source: ZEW, BBG, MNI

NEWS:

EUROPE / ELECTRICITY (BBG): Europe’s benchmark power price rose to a record for a fifth consecutive trading session as there are no signs of the natural gas rally slowing down. German year-ahead power rose as much as 2.7% to 490 euros per megawatt-hour on the European Energy Exchange AG in early trading on Tuesday. The price has more than doubled since June, driving up prices for consumers and industrials suffering from the highest inflation in decades as everything from food to petrol costs are surging too.

EUROPE / GAS (BBG): Natural gas extended gains as a scorching summer in Europe triggers higher-than-normal demand, exacerbating an energy crisis that’s threatening to push major economies into recession. Benchmark futures increased as much as 6.5%, after settling 6.8% higher on Monday. Hot and dry weather is causing river water levels to drop rapidly, hampering the transport of energy commodities. It’s likely to force utilities to use more gas as replacement at a time when supply from Russia continues to be curbed.

BOJ (MNI INSIGHT): Bank of Japan officials see a risk that private sector spending could slow in Q3 as the cost-of-living crisis and a fresh rise in Covid cases weigh on sentiment, impeding the recovery from the pandemic after the economy started to pick up in the second quarter, MNI understands.

GERMAN ZEW (BBG): Investor confidence in the German economy fell further from already depressed levels as the burden of higher energy costs filters through to companies and households. The ZEW institute’s gauge of expectations slipped to -55.3 in August from -53.8 in the previous month, missing economists’ estimates for a slight uptick. An index of current conditions also deteriorated. “The still high inflation rates and the expected additional costs for heating and energy lead to a decrease in profit expectations for the private consumption sector,” ZEW’s Michael Schroeder said Tuesday in a statement.

IRAN (MNI POLITICS): Abas Aslani at the Center for Middle East Strategic Studies: "Asked on if EU has received Iran’s response, [EU spox Nabila Massrali] said “we have received the Iranian response last evening. We are studying it and are consulting with the other JCPOA participants and the US on the way ahead.” Iran International: "Iran’s response to the text proposed by EU to revive JCPOA will probably fail to satisfy the Western sides, esp. US, IranIntl has learned. Iran has apparently accepted the proposed solution to Safeguards issues, but still insists on obtaining economic guarantees."

DATA:

MNI: UK JULY PAYROLLS +73,000 AT 29.7 MLN: HMRC/ONS

- **UK JUN ILO UNEMPLOYMENT RATE +3.8%

- *MNI: UK JUL CLAIMANT CHG -10600

- *UK JUL CLAIMANT RATE +3.9%

- **UK JUN AVE WEEKLY EARNINGS +5.1% YY

- *UK JUN AVE WEEKLY EARNINGS EX-BONUS +4.7% YY

MNI BRIEF: UK Real Earnings Fall At Fastest Pace On Record

UK real earnings fell sharply in the three months to June, with inflation adjusted pay excluding bonuses falling at the fastest rate since comparable records began, the Office for National Statistics said Tuesday. Ex-bonuses, wages declined 3.0% year-on-year, while wages including bonuses declined by 2.5%. Unadjusted total wages rose 5.1% y/y, slightly exceeding analysts expectations.

The ONS data is inflation adjusted again the CPIH inflation measure. Against CPI, real wages ex-bonuses fell 4.1% y/y, also a record decline.

"Excluding bonuses, it is still dropping faster than at any time since comparable records began in 2001,” ONS director of economic statistics Darren Morgan said.

The data underlines the difficulties both the Bank of England and the government face, with the cost-of-living crisis being amplified by slowing real incomes. With inflation not set to peak until later in Q4 - even Q1 2023 in some estimates - the squeeze on household budgets is unlikely to improve anytime soon.

Source: ons

GERMAN DATA: ZEW Mixed, Expectations Drops to Lowest Since GFC

- German ZEW Survey Expectations (Aug) M/M -55.3 vs. Exp. -52.7 (Prev. -53.8)

- Current Situation (Aug) M/M -47.6 vs. Exp. -49.0 (Prev. -45.8)

FIXED INCOME: EGBs Under Early Pressure Amid Supply, Firm Equities

- Core EGBs traded under pressure from the open, with bond supply from Germany and the UK weighing on prices as well as the late rally in US equities Monday, which put the e-mini S&P above 4,300 for the first time since late April.

- The UK DMO sold GBP 2.75bln in 2029 Gilts this morning, with the auction producing a modest tail of 0.5bps. Decent demand was noted, bumping the bid/cover up to 2.65x from 2.48x at the previous sale. Germany aim to allot EUR 4bln in 5y bonds imminently.

- Core/Peripheral yield spreads trade wider, with the Italian/German 10y spread wider by close to 5bps on further signs of a deteriorating economy on the continent: The German ZEW survey fell below forecast, with the expectations component dropping to its lowest level since the Global Financial Crisis.

Latest levels:

- Germany: The 2-Yr yield is up 2.3bps at 0.553%, 5-Yr is up 2.9bps at 0.707%, 10-Yr is up 2.7bps at 0.927%, and 30-Yr is up 2.8bps at 1.183%.

- UK: The 2-Yr yield is up 5.5bps at 2.087%, 5-Yr is up 3.9bps at 1.894%, 10-Yr is up 4bps at 2.057%, and 30-Yr is up 4.9bps at 2.484%.

- Italy / German 10-Yr spread 4.5bps wider at 212bps

FOREX: EUR Sinks as ZEW Points to Lowest Expectations Since GFC

- The greenback makes modest progress early Tuesday, putting the USD Index north of the Monday highs and nearing the August highs of 106.93.

- EUR trades under pressure against most others, with EUR/USD printing a new intraday low of 1.0125 following another dire read for the German ZEW survey. The expectations component was a particular source of weakness, dropping to -55.3 from -53.8, the lowest level for the index since the Global Financial Crisis. Today's -55.3 read came in just above the -63.0 from Oct'08. A break below 1.0123 for EUR/USD would be fresh August lows, opening 1.0097 as the next support.

- USD/JPY is making solid gains on the day, breaking back above the Y134 handle for the first time since the US CPI release last week. JPY is weaker against all others in G10 so far Tuesday. CAD/JPY eyes the 50-dma at 104.98 for direction, a break above which could see the cross break out of the tight August range.

- US building permits data for July cross later today, as well as Canadian and US housing starts and the July Canadian CPI release. Prices are expected to have risen 0.1% on the month, and 7.6% on the year. US industrial production follows a little later in the session. There are no central bank speakers of note.

EQUITIES: European Stocks Continue To Edge Higher

- Asian markets closed flat/lower: Japan's NIKKEI closed down 2.87 pts or -0.01% at 28868.91 and the TOPIX ended 3 pts lower or -0.15% at 1981.96. China's SHANGHAI closed up 1.798 pts or +0.05% at 3277.885 and the HANG SENG ended 210.34 pts lower or -1.05% at 19830.52.

- European stocks continue to gain, with Utilities, Communications, Energy and Financials stocks leading: German Dax up 92.49 pts or +0.67% at 13797.86, FTSE 100 up 27.58 pts or +0.37% at 7492.74, CAC 40 up 33.11 pts or +0.5% at 6552.29 and Euro Stoxx 50 up 19.01 pts or +0.5% at 3781.1.

- U.S. futures are off just a touch, with the Dow Jones mini down 11 pts or -0.03% at 33861, S&P 500 mini down 6 pts or -0.14% at 4292.25, NASDAQ mini down 18.25 pts or -0.13% at 13663.

COMMODITIES: Oil Extends Decline Amid Broader Weakness

- WTI Crude down $0.84 or -0.94% at $88.54

- Natural Gas up $0.23 or +2.59% at $8.687

- Gold spot down $4.14 or -0.23% at $1776.99

- Copper down $1.15 or -0.32% at $361.5

- Silver down $0.16 or -0.78% at $20.3164

- Platinum down $7.7 or -0.82% at $938.94

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/08/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 16/08/2022 | 1230/0830 | *** |  | CA | CPI |

| 16/08/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 16/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 16/08/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 17/08/2022 | 0130/1130 | *** |  | AU | Quarterly wage price index |

| 17/08/2022 | 0200/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 17/08/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 17/08/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 17/08/2022 | 0600/0800 | ** |  | NO | Norway GDP |

| 17/08/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 17/08/2022 | 0900/1100 | * |  | EU | Employment |

| 17/08/2022 | 0900/1100 | *** |  | EU | GDP (p) |

| 17/08/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 17/08/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 17/08/2022 | 1330/0930 |  | US | Fed Governor Michelle Bowman | |

| 17/08/2022 | 1400/1000 | * |  | US | Business Inventories |

| 17/08/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 17/08/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 17/08/2022 | 1820/1420 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.