-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Central Bankers Size Up September Rate Moves

EXECUTIVE SUMMARY:

- NORGES BANK HIKES 50BP AS EXPECTED, NOTES "MOST LIKELY" RAISING FURTHER IN SEPTEMBER

- ECB'S SCHNABEL SUGGESTS SHE FAVOURS ANOTHER LARGE RATE HIKE IN SEPTEMBER (RTRS INTERVIEW)

- XI SAYS CHINA WILL PERSIST WITH OPENING UP ITS ECONOMY: CCTV

- CHINA STRONGLY OPPOSES U.S. TRADE TALKS WITH TAIWAN

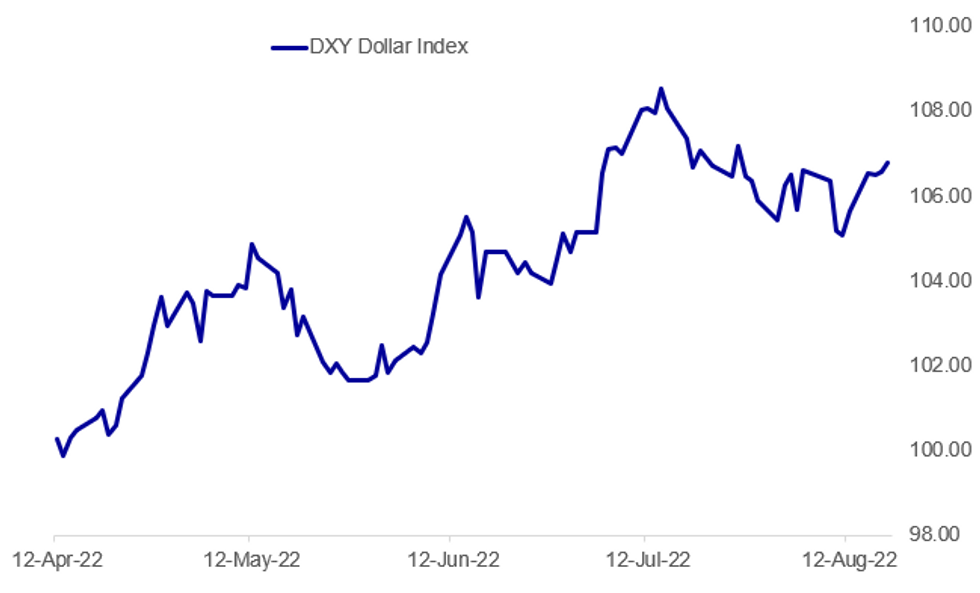

Fig. 1: Dollar Gains Resume, But Off Session Highs

Source: BBG, MNI

Source: BBG, MNI

NEWS:

NORGES BANK: Norges Bank raises the policy rate by 50bp to 1.75% as expected. Statement link:

- "Norges Bank’s Monetary Policy and Financial Stability Committee has decided to raise the policy rate by 0.5 percentage point to 1.75 percent. Based on the Committee’s current assessment of the outlook and balance of risks, the policy rate will most likely be raised further in September."

- "Inflation has been considerably higher than projected and markedly above the 2 percent target. Activity in the Norwegian economy is high, with little spare capacity. Unemployment has fallen a little more than expected and is at a very low level."

- The prior projections saw four further 25bps hikes into end-2022 – which as MNI noted in our preview, looked out of date going into the decision given higher than expected July inflation.

- Reminder that Governor Ida Wolden Bache will give a speech on the outlook for the Norwegian economy and the policy rate decision in Arendal, on 18 August at 1200BST - livestreamed (in Norwegian); text published on the Norges Bank website.

CHINA (BBG): President Xi Jinping said China will persist with opening up its economy even as globalization has encountered countercurrent, and protectionism prevails, according to the state-run CCTV. Xi said some regions are suffering from severe drought and called on local government to make practical efforts on drought relief

CHINA - U.S. - TAIWAN (RTRS): China firmly opposes trade talks between the United States and Taiwan and says it will take all necessary measures to firmly safeguard its sovereignty, security and development interests, the commerce ministry said on Thursday. Taiwan and the U.S. have said they will start trade talks under a new initiative. "One China" policy is a prerequisite for Taiwan's participation in economic cooperation with foreign countries, Shu Jueting, spokeswoman of the ministry, said at a regular press conference.

AUSTRIA (MNI BRIEF): Austria has yet to decide whether to adjust its 2022 funding target following the announcement of a raft of measures to cushion the effects of increased energy costs, Treasury officials told MNI, with analysts exploring the extent to which additional costs can be offset by rising tax revenues.

PHILIPPINES (MNI): The BSP decided to hike its policy rate by 50bps to 3.75% (as expected) this morning, its highest level since February 2020, to continue to ease inflationary pressures. BSP Governor Medalla mentioned that the central bank is ready to take more actions to steer CPI to target; Medalla made it clear that the main concern is bringing inflation back down. CPI inflation has been accelerating in the past few months, currently standing at 6.4%, which is far above the 2%-4% target range.

NORWAY (BBG): Norway needs to cut the amount it spends of its oil and gas riches in order to reduce pressure on the central bank to raise interest rates, Norwegian Prime Minister Jonas Gahr Store said in an interview with VG. “We must do what we can to protect people from interest rates rising more than what Norges Bank otherwise assumes,” the prime minister said in the interview. “After many years where the answer to everything from the previous government has been to spend more oil money, there must be a turnaround.”

MNI: EZ FINAL JULY HICP +0.1% M/M, +8.9% Y/Y

EZ FINAL JULY CORE HICP -0.2% M/M, +4.0% Y/Y

MNI: NORWAY JUN MAINLAND GDP +0.3% M/M, AGG GDP -0.5% M/M

FIXED INCOME: Bonds and Rates futures remain heavy

- A busier start for Govies and Rates, which saw further early selling pressure into Bund, EGBs and Euribor.

- Futures markets have since bounced off their respective lows, but remains in the red and heavy.

- Bund trades in a 123 ticks range, and the German curve initially bear flattened and tested the July low at 32.090.

- The level has held, and the curve unwinds the early price action.

- Peripherals spreads are wider, and Portugal and Spain lead, by 1.3 and 1.5bp respectively.

- EU final CPI was leaked and came inline with consensus.

- Gilt future outperforms Bund somewhat, although still trade in the red.

- The small divergence has brought the Gilt/Bund spread 1bp tigher, after the spread found resistance at the 22nd March high at 120.05bps, now trading at 119.1bps.

- With Tnotes Future outperforming Bund, the Tnote/Bund yield spread has moved another 5.4bps tighter.

- The spread is below the August low, with next support seen at 175.62bps, 38.2% short term retrace of the June/August widening, now trading at 176.0bps.

- Looking ahead, US Existing home sales and Leading index are the economic releases.

- Fed George and Kashkari are the scheduled speakers.

- And US. will sell $8bn 30y TIPS Reopening.

FOREX: USD fades, Norges Bank delivers

- The Dollar was in the green against all the majors, a continuation from the overnight session.

- The Greenback extended gains on the European Govie open, with selling going through in Equity futures.

- Cross assets have since reversed some of the early price action, and the bounce in Equity, has seen market participants fading some of the USD strength.

- Main early event for the Norges bank rate decision, which saw the expected 50bps hike to 1.75%.

- Part of the Policy statement: "Based on the Committee’s current assessment of the outlook and balance of risks, the policy rate will most likely be raised further in September".

- Broader base of NOK buying went through, and USDNOK has fully reversed the initial move higher, to trade through the session low.

- USDNOK is nonetheless still trading yesterday's range and off the lows at the time of typing.

- Looking ahead, US Existing home sales and Leading index are the economic releases.

- Fed George and Kashkari are the scheduled speakers.

EQUITIES: Defensives Lag, Energy Leads As Europe Posts Modest Gains

- Asian markets closed weaker: Japan's NIKKEI closed down 280.63 pts or -0.96% at 28942.14 and the TOPIX ended 16.49 pts lower or -0.82% at 1990.5. China's SHANGHAI closed down 14.982 pts or -0.46% at 3277.544 and the HANG SENG ended 158.54 pts lower or -0.8% at 19763.91.

- European stocks are mostly higher, with energy names and industrials pulling indices higher and defensives (consumer staples, utilities) lagging: German Dax up 63.94 pts or +0.47% at 13847.56, FTSE 100 down 8.73 pts or -0.12% at 7521.73, CAC 40 up 9.81 pts or +0.15% at 6573.53 and Euro Stoxx 50 up 6.24 pts or +0.17% at 3795.33.

- U.S. futures are off just slightly, with the Dow Jones mini down 5 pts or -0.01% at 33957, S&P 500 mini down 0.75 pts or -0.02% at 4276, NASDAQ mini down 7.25 pts or -0.05% at 13486.25.

COMMODITIES: Crude Rebounds From Week's Lows

- WTI Crude up $1.13 or +1.28% at $86.35

- Natural Gas up $0.1 or +1.03% at $9.234

- Gold spot up $5.22 or +0.3% at $1774.56

- Copper up $1.35 or +0.38% at $358

- Silver down $0.03 or -0.15% at $19.7124

- Platinum up $0.82 or +0.09% at $922.3

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/08/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 18/08/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/08/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 18/08/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 18/08/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 18/08/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 18/08/2022 | 1400/1000 | * |  | US | Services Revenues |

| 18/08/2022 | 1400/1000 | ** |  | US | leading indicators |

| 18/08/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 18/08/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 18/08/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 18/08/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

| 18/08/2022 | 1715/1915 |  | EU | ECB Schnabel Presentation at IHK Reception | |

| 18/08/2022 | 1720/1320 |  | US | Kansas City Fed's Esther George | |

| 18/08/2022 | 1745/1345 |  | US | Minneapolis Fed's Neel Kashkari | |

| 19/08/2022 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 19/08/2022 | 2330/0830 |  | JP | Natl CPI | |

| 19/08/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 19/08/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 19/08/2022 | 0600/0800 | ** |  | DE | PPI |

| 19/08/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 19/08/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 19/08/2022 | 1300/0900 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.