-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Dollar Keeps Pushing Higher

EXECUTIVE SUMMARY:

- UK RETAIL SALES VOLUMES BEAT EXPECTATIONS LED BY ONLINE DISCOUNTING

- MNI FEDSPEAK PODCAST: EX-KC FED PRES HOENIG PREVIEWS JACKSON HOLE

- 3% JAPAN CPI EYED BUT EASY POLICY TO REMAIN (MNI INSIGHT)

- UK COST-OF-LIVING SLAMS CONSUMER SENTIMENT: GFK (MNI INTERVIEW)

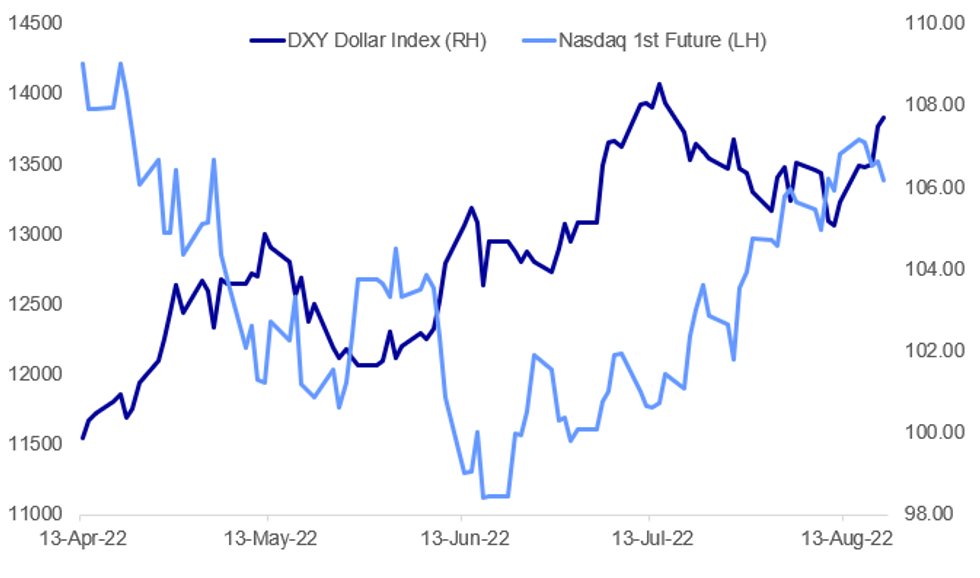

Fig. 1: Equities Pull Back As Dollar Rises

Source: BBG, MNI

Source: BBG, MNI

NEWS:

BOJ (MNI EXCLUSIVE): Japan’s core consumer price index rose 2.4% year-on-year in July, hitting the highest level since December 2014 when it rose 2.5% and there are expectations among Bank of Japan officials of it reaching 3% later this year, MNI understands.

MNI PODCAST (AVAILABLE HERE): Former KC Fed President Thomas Hoenig tells MNI he expects wide-ranging discussion of macroeconomic and policy constraints at next week's Annual Jackson Hole Symposium.

- Hoenig doesn't think Powell will show his cards on whether the Fed will hike 50 bps or 75 bps in September.

- He sees a high probability of recession next year if the Fed tightens policy enough to bring down inflation.

- The ex-FDIC vice chair says banks are not as well capitalized as regulators claim, and asset price declines linked to Fed tightening could accelerate losses.

UK CONSUMER CONFIDENCE (MNI INTERVIEW): Financial events begin to feel like they are moving "beyond the control" of most people, Joe Staton, Client Strategy Director at GfK told MNI Thursday after the GfK Consumer Confidence Index slumped to -44 in August, its lowest level since records began almost half a century ago. ”That reflects the acute concern concerns of consumers as the cost-of-living soars. A sense of exasperation about the UK’s economy is the biggest driver of these findings," Staton said, pointing out that all sub-indexes are falling. "These findings point to a sense of capitulation, of financial events moving far beyond the control of ordinary people," he added.

US EQUITIES (BBG): Bed Bath & Beyond Inc. shares tumbled as much as 44% in premarket trading, giving back some of this month’s huge gains, after top investor Ryan Cohen exited his stake in the retailer. Cohen’s RC Ventures sold millions of shares on Tuesday and Wednesday at a range of prices from $18.68 to $29.21, according to a filing with the US Securities and Exchange Commission. Bed Bath & Beyond traded down $7.55 at $11 as of 4:04 a.m. in New York.

ITALIAN POLITICS (BBG): The right-wing coalition led by Giorgia Meloni’s Brothers of Italy party neared a landmark level of support, registering 49.8% of voter approval for Italy’s Sept. 25 election, in a survey by the Tecne research institute. The poll, which measured voter support for the election to the country’s lower house of parliament, placed the Democratic party-led center-left bloc at 30% and the anti-establishment Five Star Movement -- once the country’s leading party -- at 10.2%. A recently formed centrist grouping was at 4.8%.

NETHERLANDS (BBG): Inflation is affecting more and more people in the Netherlands and is expected to bring consumption growth to a “grinding halt” in the coming quarters, Netherlands Bureau for Economic Policy Analysis CPB says in statement with latest projections on Dutch economy. CPB sees 4.6% GDP growth in 2022 and 1.1% growth in 2023Wage increases are lagging behind the rate of inflation, which is reducing average purchasing power by 6.8% in 2022.

CRYPTO (BBG): Cryptocurrencies suffered a sharp selloff as global markets retreated on the back of growing uncertainty about the direction of monetary policy. Bitcoin tumbled as much as 8.3%, reaching the lowest level since late July. The largest digital token pared some of the losses, and was trading down 6% at $21,990 as of 8:25 a.m. in London. Equity markets were down across Europe. Ether and smaller virtual coins saw sharper declines. Avalanche, Cardano and Solana fell more than 10% at one point.

GERMANY (BBG): The measured water level at a key German chokepoint on the Rhine River is forecast to surge early next week, easing the transportation concern that’s hit energy markets in recent days. The marker at Kaub, currently at 34 centimeters (13.4 inches), is expected to jump to 148 centimeters Tuesday morning, according to German government data. At that depth, it is economical for many -- if not all -- barges to sail through the waypoint carrying at least some cargo.

DATA:

MNI: UK JUL PSNCR GBP-4.69 BN

BBG: UK government borrowing came in higher than forecast in the first four months of the fiscal year as soaring inflation drove up debt costs. A larger-than-forecast £4.9 billion ($5.8 billion) budget deficit in July took the total for 2022-23 so far to £55 billion pounds -- £3 billion more than officials forecast in March. Debt-servicing costs surged by 81% from a year earlier.

MNI: UK JUL RETAIL SALES +0.3% M/M, -3.4% Y/Y

BBG: Britain’s surging inflation rate is forcing consumers to pay more for the same amount of goods, underscoring a dimming outlook for the economy. Retail sales volumes unexpectedly rose 0.3% last month, but the cost of those sales increased more rapidly by 1.3%, the Office for National Statistics said Friday. The volume gains came from a 4.8% surge from web-based stores, which offered discounts and promotions to draw in customers. The figures came hours after a separate report showed consumer confidence plunged to its lowest since 1974.

FIXED INCOME: Gilts early losers, but rest of core FI catching up with losses

- An early lurch lower for SONIA futures (which has since been around 50% retraced) saw gilts as the early movers in core FI space. Bunds and, to a lesser extent, Treasuries have since followed lower with moves in 10-year Bund yields now similar to those seen in 10-year gilts on the day.

- This was in response to a combination of factors: continued repricing of the UK curve due to the higher than expected wage and inflation data earlier this week, as well as this morning's better-than-expected retail sales print. Online sales were the driver with people driving less due to high fuel prices. Consumer confidence hit a new low, however, and the MPC is expected to act for inflation and in spite of activity data.

- The only event remaining on this week's calendar is a speech by Fed's Barkin. Markets will already start to look ahead to next week's Jackson Hole Economic Symposium.

- TY1 futures are down -0-9 today at 118-18 with 10y UST yields up 3.9bp at 2.922% and 2y yields up 4.0bp at 3.241%.

- Bund futures are down -1.23 today at 152.93 with 10y Bund yields up 7.2bp at 1.171% and Schatz yields up 5.5bp at 0.788%.

- Gilt futures are down -0.82 today at 113.42 with 10y yields up 6.9bp at 2.377% and 2y yields up 5.8bp at 2.484%.

FOREX: The Dollar remains favoured

- The USD remains king overnight and in early trade, as Equity are once again trading heavy.

- Hawkish comments from Fed speakers, and investors looking for more aggressive hikes, has also been supportive.

- The Dollar is still in the green against all G10, but has moved off its best levels at the time of typing.

- While UK rates price more aggressive hikes, the Pound remains under pressure, as desk look for a faster pace towards a recession.

- Cable tested support at 1.1890 Low Jul 21, printing a 1.1880 low so far.

- Below the latter, opens to the 1.1850 area. Followed by the 1.1800 figure.

- Further out, sees 1.1760 Low Jul 14 and the bear trigger, also the lowest print since March 2020.

- The Yen has been under renewed pressure across the board in early trade but is off the lows at the time of typing.

- USDJPY printed a 136.76 high, ahead of next psychological target at 137.00.

- The SEK is still heading south since the Swedish CPI last week.

- USDSEK has now over 5.42% from the August low, and around 4.66% post CPI.

- Next immediate resistance is at 10.5568, the short term 76.4% retrace of the July/August fall.

- EURSEK is up 2.93% from the August low and 2.44% post CPI.

- Next resistance is seen at 10.66.

- Looking ahead there's no data of note, and the only speaker will be Fed Barkin.

EQUITIES: Pullback In Futures As Cyclicals, Tech Weaken

- Asian markets closed mixed: Japan's NIKKEI closed down 11.81 pts or -0.04% at 28930.33 and the TOPIX ended 4.02 pts higher or +0.2% at 1994.52.China's SHANGHAI closed down 19.466 pts or -0.59% at 3258.078 and the HANG SENG ended 9.12 pts higher or +0.05% at 19773.03.

- European equities are lower, with real estate, financials and consumer discretionary stocks down sharply in early trade: the German Dax down 126.21 pts or -0.92% at 13847.56, FTSE 100 down 16.59 pts or -0.22% at 7521.73, CAC 40 down 44.55 pts or -0.68% at 6573.53 and Euro Stoxx 50 down 31.33 pts or -0.83% at 3795.33.

- Tech is leading losses in US futures: Dow Jones mini down 200 pts or -0.59% at 33781, S&P 500 mini down 33 pts or -0.77% at 4253.5, NASDAQ mini down 127 pts or -0.94% at 13396.25.

COMMODITIES: WTI Pulls Back Below $90, Silver Sinks As USD Strengthens

- WTI Crude down $1.27 or -1.4% at $89.32

- Natural Gas down $0.11 or -1.22% at $9.07

- Gold spot down $4.04 or -0.23% at $1774.56

- Copper down $0.7 or -0.19% at $362.85

- Silver down $0.29 or -1.47% at $19.2462

- Platinum down $6.91 or -0.76% at $907.44

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/08/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 19/08/2022 | 1300/0900 |  | US | Richmond Fed's Tom Barkin | |

| 22/08/2022 | 0115/0915 |  | CN | PBOC LPR announcement | |

| 22/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 22/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.