-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: South Korea Deals With Martial Law Fallout

MNI: PBOC Net Drains CNY227 Bln via OMO Wednesday

MNI US MARKETS ANALYSIS - Russia Drives Strength in 'Friendly' CNH

Highlights:

- CNH spikes as Russia mull spending $70bln on 'friendly' currencies

- MoF watch JPY weakness with 'urgency'

- ISM Manufacturing, weekly jobless claims on the docket

RUSSIA: FX Buying Plan Prompts USD/CNH to Shoot Lower

- Bloomberg reports that Russia are mulling buying as much as $70bln in so-called 'friendly' currencies to stem the RUB rally this year. The piece adds that buying would focus on the Chinese yuan.

- USD/CNH shoots lower on the Russia headline, with the pair slipping through yesterday's lows to touch 6.8886 and partially reverse some of the late August strength. Key support at 6.8817 sits just below, marking the 23.6% retracement for the late August upleg in USD/CNH

- Not the first time we've heard of this concept of buying 'friendly' currencies - late June the idea was first raised, but the new detail here is that it would specifically focus on CNH.

- The piece does add that TRY and AED are on the friendly currencies list, but they add there are more notable issues with buying these currencies specifically.

- The move to buy FX would theoretically work the RUB's unwanted strength so far this year, and reportedly has the support of the CBR governor Nabiullina.

NOK the Worst Performer in G10 For Second Session

- NOK is sliding for a second session and again taking the place as worst performing currency in G10. Both USD/NOK and EUR/NOK are now through the psychological 10.00 handle and extending the recovery off the August lows to 6.1% and 4.7% respectively.

- Today marks the beginning of the Norges Bank's sized-up FX buying programme, with the bank upping their daily NOK sales to NOK 3.5bln from NOK 1.5bln across August to meet the needs of the sovereign wealth fund.

- Key levels to watch include the 100-dma in EURNOK at 10.0707 and 10.1442 in USDNOK, the 76.4% retracement of the July - August downleg.

- Norwegian Manufacturing PMI crosses at 0900BST and governor Wolden Bache speaks at a Swedbank seminar at 1200BST. Longer-term focus is on August's CPI release on Sept 9th and the Norges Bank decision on Sep 22nd.

BTPS: Key Support Breaks As Pressure From ECB Tightening Builds

BTPs are under increasing pressure amid hawkish ECB rhetoric and market pricing ahead of next week's meeting. Political risk ahead of the September 25 election, waning economic growth prospects, and soaring core EGB yields are also factors - but the withdrawal of ECB accommodation appears to be the key driver to watch.

- A 75bp hike is increasingly consensus for next week's ECB meeting, and cumulative pricing for this cycle continues to rise - bringing BTP yields higher with it.

- See chart below: March 2023 ESTR-implied rates are seen at 2.09%, up from 0.92% a month ago; BTP yields have risen more or less in tandem.

- Our tech analyst notes that Wednesday's move for BTP futures through key support at the Jul 21 low of 119.57 reinforces the current bearish cycle, and puts focus on the Jun 22 low at 118.60.

- It's not simply broader bond weakness pushing BTPs lower, as Italian debt is underperforming. The 10Y spread to Bunds hit a high of 241.5bp today (up 5+bp). While the spread has pulled back to flat on the session, the trend is still upward and the 250bp June high is in sight.

- Spreads above 250bp would augur a return to early pandemic (May 2020) levels; beyond that to the high 200s/low 300s seen amid previous political uncertainty in 2018-19.

ECB March 2023 Pricing And 10Y BTP Yield %Source: BBG, MNI

ECB March 2023 Pricing And 10Y BTP Yield %Source: BBG, MNI

Market Insight: North Asia PMIs Flash Global Trade Warning

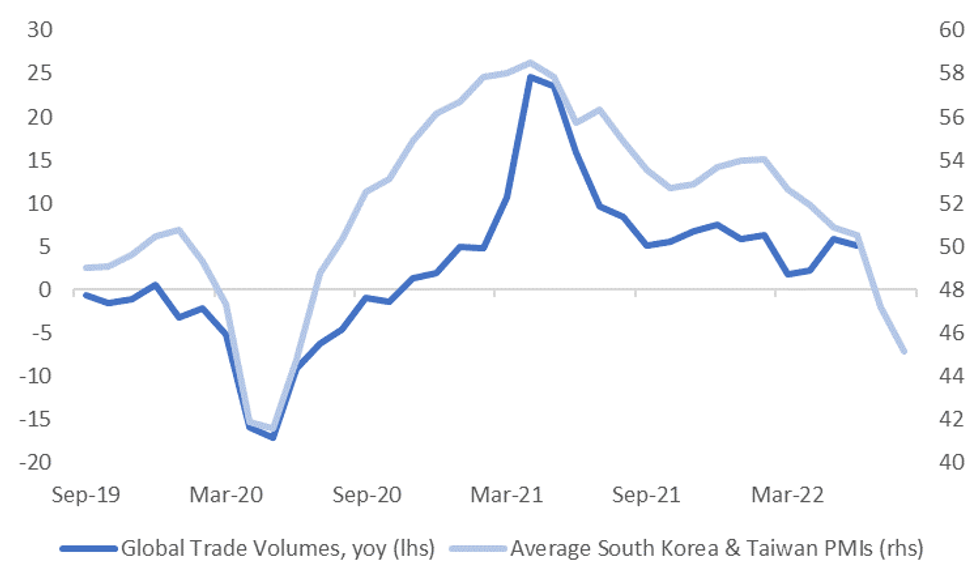

Today's South Korean and Taiwan PMI prints for August point to downside risks for the global trade outlook. The first chart below plots the average PMI reading for each country against the YoY change in global trade volumes growth. Note global trade volume figures are only reported up until June of this year.

- Both economies are key bellwethers for the global outlook, so it isn't surprising to see a firm relationship between the two series in the chart below.

- There are of course potential caveats. Today's PMI weakness could reflect greater exposure to both economies to China. Also out today was South Korean export figures for August. This data showed export growth to China continued to ease (-5.4% YoY), while growth to the US and EU remained positive, albeit down from early 2022 highs.

- Aggregate export growth for South Korea continues to moderate though, while Taiwan's export order print fell in July to -1.9%.

Fig 1: North Asia PMIs Flash Global Trade Warning

Source: CPB Netherlands Bureau for Economic Policy Analysis/MNI- Market News/Bloomberg

Source: CPB Netherlands Bureau for Economic Policy Analysis/MNI- Market News/Bloomberg

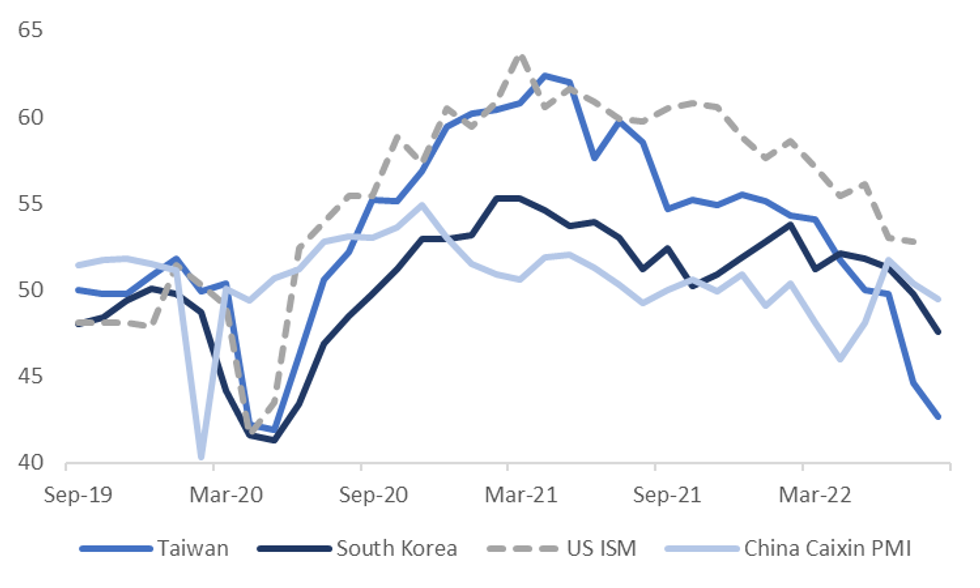

- The South Korean and Taiwan PMIs also maintain a reasonable correlation with the US ISM reading, more so than the China Caixin PMI, see the chart below. We get a fresh update on the ISM later this evening.

- The market consensus expects a further cooling in the print (51.9 is forecast, versus 52.8 previously).

- Today's weaker PMI prints add to the downside risks to the US ISM print, and PMI prints elsewhere, at face value.

- Of course, in levels terms the US ISM remains comfortably above PMI prints for these North East Asian economies, which still may serve the USD well on a relative value basis.

- It's noteworthy today that both USD/KRW and USD/TWD both printed at fresh cyclical highs.

Fig 2: NEA PMIs & The US ISM

Source: MNI- Market News/Bloomberg

Source: MNI- Market News/Bloomberg

Official-'We Are Looking At Energy Price Caps': Wires

Wires carrying comments from an unnamed European Commission official saying that the body is looking at the potential for energy price caps to be implemented in the bloc amid a surge in electricity and gas prices for EU households.

- Also confirms that the Commission is looking at ways to lower electricity demand across the EU, and at the potential for windfall profit taxes in the context of high energy prices. Windfall taxes on energy firms remain a very popular move both inside and outside the EU with the general public.

- Earlier this morning, MNI reported that the Commission is looking to have a draft reform plan for the EU electricity market ready before an emergency meeting of EU energy ministers on 9 September.

- The article states: "Officials expect a draft reform aimed at decoupling the retail electricity price from gas prices by the end of this week, to be discussed by EU ambassadors and then by the EU’s Energy Working Party next week."

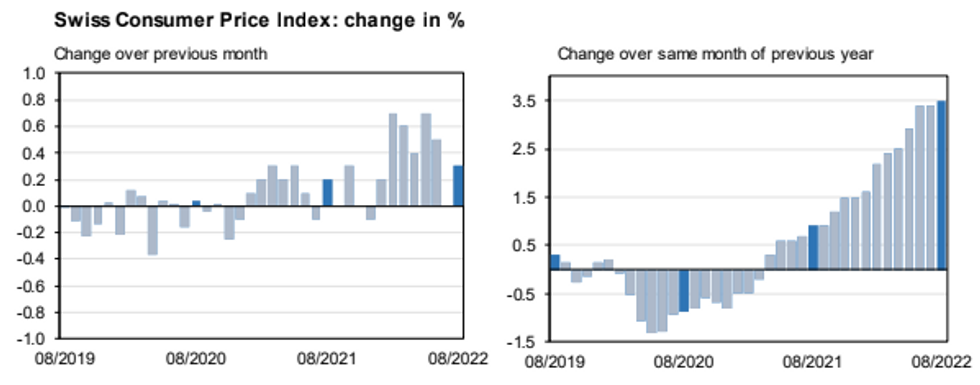

Swiss Inflation Uptick Underlines SNB's Likely Negative Rate Exit

SWISS AUG CPI +0.3% M/M (FCST +0.2%); JUL 0.0%

SWISS AUG CPI +3.5% Y/Y (FCST +3.4%); JUL 3.4%

- Swiss CPI ticked up a further 0.1pp to +3.4% y/y in August, and accelerated by +0.3% m/m after remaining flat at 0.0% m/m in July.

- Both readings are marginally higher than forecast, where Swiss inflation was expected to stall.

- With core inflation reaching the SNB's threshold of +2.0% y/y in both July and August (and a series high for Switzerland), this underscores the need for further tightening by the SNB in upcoming months as inflation becomes more broad-based. The SNB is likely to exit negative rates at the September 22 meeting (the key policy rate was hiked to -0.25% from -0.75% back in June).

- Food prices alone expanded by +1.0% m/m, whilst largely imported clothing was up by 3.5% m/m as imported inflation rises.

Source: Swiss Federal Statistic Office

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/09/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/09/2022 | 1230/0830 | * |  | CA | Building Permits |

| 01/09/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 01/09/2022 | 1230/0830 | ** |  | US | Non-Farm Productivity (f) |

| 01/09/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/09/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/09/2022 | 1400/1000 | * |  | US | Construction Spending |

| 01/09/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 01/09/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 01/09/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 01/09/2022 | 1930/1530 |  | US | Atlanta Fed's Raphael Bostic | |

| 02/09/2022 | 0600/0800 | ** |  | DE | Trade Balance |

| 02/09/2022 | 0800/1000 |  | EU | ECB Consumer Expectations Survey | |

| 02/09/2022 | 0900/1100 | ** |  | EU | PPI |

| 02/09/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 02/09/2022 | 1230/0830 | *** |  | US | Employment Report |

| 02/09/2022 | 1400/1000 | ** |  | US | factory new orders |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.