-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI US Open: 3rd Wave Takes Its Toll On European Growth

EXECUTIVE SUMMARY:

- EUROZONE GDP CONTINUED TO CONTRACT IN Q1 ON THIRD COVID WAVE ...

- BUT INFLATION CONTINUED TO RISE INTO APRIL

- E.U. TO WARN APPLE OVER APP PAYMENT RULES IN ANTITRUST COMPLAINT

- ASTRAZENECA C.E.O. ON E.U. LEGAL ACTION: "WE NEVER OVERPROMISED"

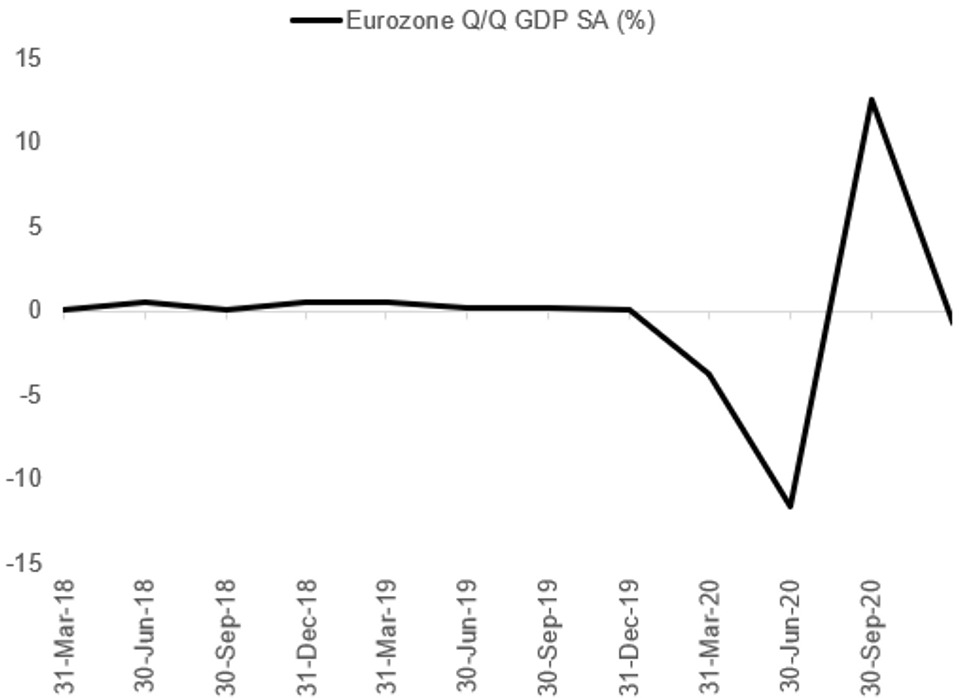

Fig. 1: Eurozone GDP Continues To Contract

Source: Eurostat, MNI

Source: Eurostat, MNI

NEWS:

APPLE/E.U./TECH (BBG): Apple Inc. will be formally warned by the European Union that its app payment system and marketing rules may violate antitrust rules as regulators escalate an investigation later Friday, according to a person familiar with the matter.Apple will be accused of abusing a dominant position when it requires apps to use its own in-app purchase system that allows it impose fees of as much as 30% on subscription services, the person said on condition of anonymity because the EU hasn't yet announced its so-called statement of objections laying out its arguments. Margrethe Vestager, the EU's antitrust chief, will speak at a press conference at 1 p.m. in Brussels, according to an email from the European Commission's press office. She's expected to explain why an EU investigation has found Apple abused its power over its App Store to unfairly squeeze music-streaming service Spotify Technology SA.

ASTRAZENECA: AstraZeneca CEO Pascal Soriot issued comments on the EU's legal action against the firm over alleged breach of contract in not delivering enough COVID-19 vaccines to the EU. Below are more comprehensive remarks

- " [...] we don't regret anything, we haven't been perfect but we did the very best, we should be proud of what we did in the world [...] we never overpromised the supply of vaccine doses [...] some countries have said they don't need our vaccine, but the world needs it. AZ welcomes the possibility to resolve discussion with EU on supply, but we are committed to increasing supply [...] if we see the glass full, without AstraZeneca there would have been no supply of Covid vaccines in India or for the Covax program. Our vaccine has already saved over 10,000 lives in the UK."

SNB: The Swiss National Bank's decision to increase to CHF 6 billion the amount its annual profits distributed to the public sector represents a "balanced solution" to strengthening a growing balance sheet, not a response to the coronavirus crisis or higher government debt, chairman Thomas Jordan said in a speech Thursday

BOJ: The negative contribution from lower mobile phone charges on Japan's CPI is within the forecast range and underlying trends -- excluding special factors -- remains solid, according to officials at the Bank of Japan. Prices for mobile phone charges fell 26.5% y/y in April as operators cut costs, worsening from a rise of 1.9% in March. The April Tokyo core CPI was lowered by 0.45 pp due to cuts and bank officials forecast negative contribution from the lower charges to April nationwide CPI to widen to 0.56 pp, which is within the BOJ forecast of between -0.5 and -1.0 pp.

SWEDEN / COVID VACCINE (BBG): Sweden's government has decided to postpone its vaccination target, following the decision to pause the use of Johnson & Johnson's vaccine, health minister Lena Hallengren says in a press conference.All adults are to be offered at least one dose of vaccine before Sept. 5, a three-week delay from previous target of Aug. 15.

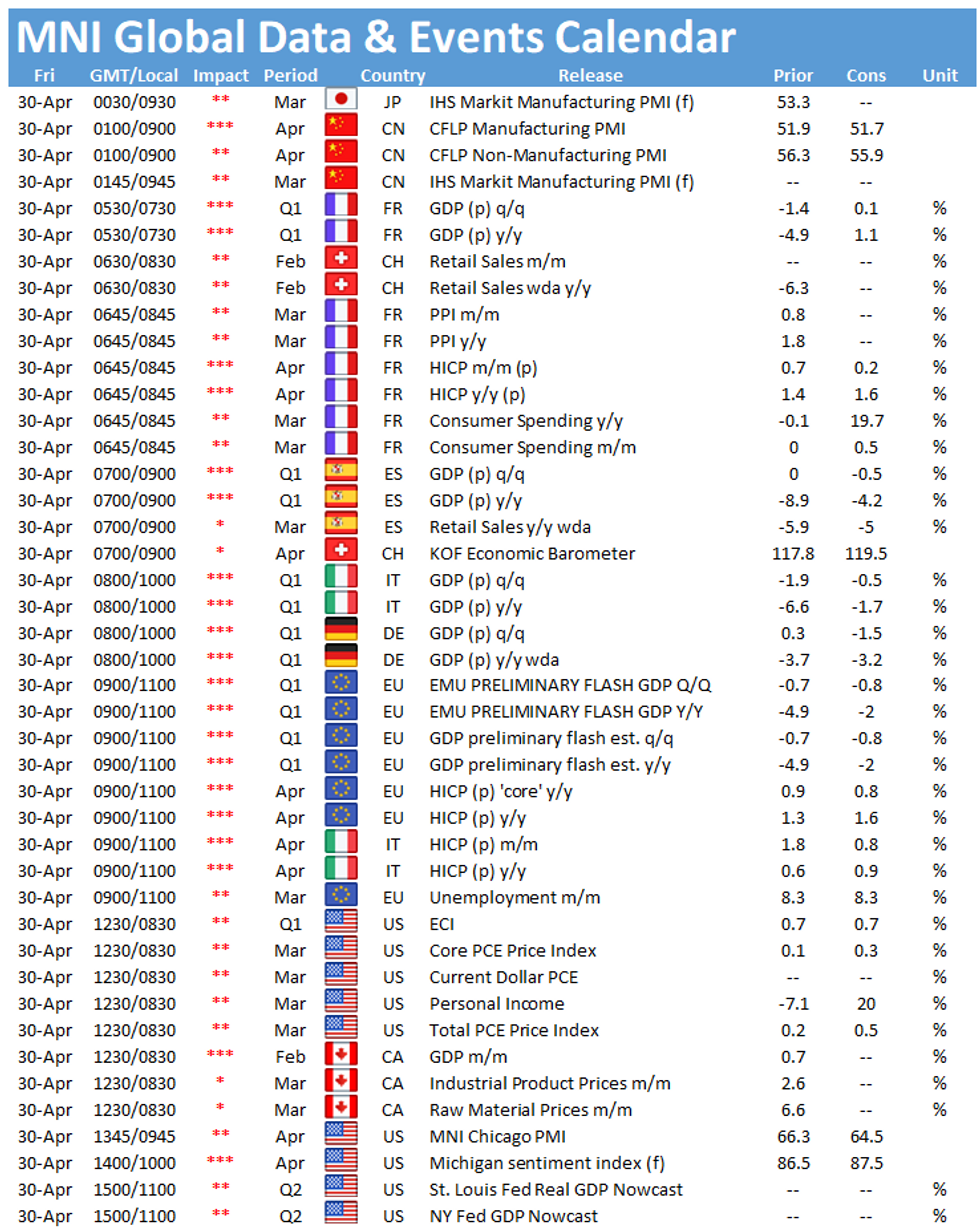

DATA:

German GDP Contracted in Q1

GERMANY FLASH Q1 GDP -1.7% Q/Q SA, -3.0% Y/Y WDA

GERMANY Q4 GDP +0.5% Q/Q, -3.3% Y/Y

- The German economy contracted by 1.7% in Q1, coming slightly below expected (BBG: -1.5%).

- The third wave weighed heavily on business activity as lockdown measures were renewed in the first quarter of 2021.

- Q4 growth was revised up to 0.5% q/q from 0.3% reported previously.

- The annual rate deteriorated/improved to 3.0% in Q1, after recording 3.3% in the previous quarter.

- Compared to Q4 2019, the last quarter before the crisis, GDP is still 4.9% lower in Q1 2021.

- Destatis noted that the decline was mainly driven by private consumption, while exports supported the economy.

- Looking ahead, with vaccinations gaining momentum and surveys signalling strong business activity, the second quarter is likely to be characterized by a consumption driven rebound.

Italian GDP Declines in Q1 Amid Third Wave

- Preliminary 1Q21 GDP -0.4% q/q, -1.4% y/y, slightly better than expected (Median: -0.5%)

- 4Q20 GDP real SA WDA revised up -1.8% q/q; confirmed -6.6% y/y

- 1Q21 q/q industry, ag., forestry/fishing up; services down--ISTAT

- Italy prelim GDP +1.9% 'acquired' net growth for 2021--ISTAT

Spanish GDP Lower in Q1

SPAIN Q1 FLASH GDP -0.5% Q/Q SA, -4.3% Y/Y WDA

SPAIN Q4 GDP UNREVISED 0.0% Q/Q; -8.9% Y/Y

- Spanish economic growth declined by to 0.5% in Q1, in line with market expectations.

- The first quarter was characterized by rising infection rates and renewed tight restrictions which weighed on economic activity.

- The annual rate dropped by 4.3% in Q1after recording -8.9% in the previous quarter and showing the highest level since Q1 2020.

- Q4 growth rates have been unrevised, showing a flat reading after Q3's sharp rebound.

- Household consumption slowed to -1.0% in Q1 after a flat reading in Q4, reflecting the impact of the pandemic.

French Q1 GDP Stronger Than Expected

FLASH Q1 GDP +0.4% Q/Q SA, +1.5% Y/Y WDA

Q1 HH CONSUMPTION EXPENDITURE +0.3% Q/Q

Q1 GOVT CONSUMPTION EXPENDITURE +0.5% Q/Q

Q1 EXPORTS -1.5% Q/Q; IMPORTS -0.1% Q/Q

- The French economy expanded by 0.4% in Q1 after the contracting 1.4% in Q4 2020.

- Q1 growth came in stronger than market expectations (median 0.1%).

- Annual GDP rose by 1.5% in Q1 following Q4's drop by -4.8% and marking the highest level since Q3 2019.

- Despite the Q1 uptick, GDP remains 4.4% below the level seen in Q4 2020, the last quarter before the pandemic impacted GDP.

- Q1's gain was driven by an increase of government and household spending, up 0.5% and 0.3%, respectively, amid rising infection rates and a tight restrictions.

- Meanwhile, exports fell by 1.5% and imports declined by 0.1% in Q1, as a result foreign trade contributed negatively to GDP growth, shaving off 0.4pp.

EZ GDP Declines in Q1 Amid Third Wave

EZ Q1 PRELIM. FLASH GDP -0.6% Q/Q SA, -1.8% Y/Y WDA

EZ Q4 GDP +0.7% Q/Q SA; -4.9% Y/Y WDA

- The EZ economy contracted in Q1 by 0.6% as the third wave of Covid-19 weighed on economic activity, coming in slightly better than markets expected (BBG: -0.8%).

- This marks the second consecutive quarterly decline, after a sharp rebound in Q3 2020.

- Annual GDP improved to -1.8% in Q1, up from -4.9% seen in Q4 2020.

- Among the member states for which data is available, Portugal (-3.3%), Latvia (-2.6%) and Germany (-1.7%) saw the largest declines, while Lithuania (+1.8%), Belgium (+0.6%) and France (+0.4%) saw the biggest quarterly gains.

- Eurostat noted that the year on year growth rates were negative for all countries except for France (+1.5%) and Lithuania (+1.0%).

French Flash Inflation At 15-month high

APR FLASH HICP +0.3% M/M, +1.7% Y/Y; MAR +1.4% Y/Y

APR FLASH CPI +0.2% M/M, +1.3% Y/Y; MAR +1.1% Y/Y

- Annual inflation jumped to 1.7% in April, up from 1.4% seen in March, recording the highest level since Jan 2020 where the index also stood at 1.7%.

- The headline HICP came in slightly stronger than markets expected (median 1.6%)

- Apr's uptick was driven by a sharp increase in energy prices, rising by 8.8% in Apr.

- Energy inflation recorded negative rates throughout the pandemic and registered the first increase in Mar 2021.

- Service inflation accelerated to 1.3% in Apr, up from 1.1% seen in Mar and showing the the highest level since Feb 2020.

- While tobacco prices remained at Apr's level of 5.8%, the decline of manufactured products continued at -0.2%.

- Food inflation dropped by 0.3% in Apr, its first decline since Oct 2016 and mainly driven by fresh food prices which fell by 4.1%

Italian Inflation Ticked Up in Apr

- Prel Apr HICP +0.9% m/m, +1.0% y/y (Mar +0.6% y/y); slightly stronger than expected (BBG: 0.9%)

- Main domestic index (NIC) Apr +0.4% m/m, +1.1% y/y (Mar +0.8% y/y)

- Apr core HICP inflation +0.2% y/y vs Mar +0.5% y/y.

- Net-of-energy Apr HICP index +0.2% y/y vs Mar +0.5% y/y

- Flash Apr HICP data provides +1.5% "acquired" inflation.

EZ Flash Inflation Higher Again in April

EZ APR FLASH HICP +0.6% M/M; +1.6% Y/Y; MAR +1.3% Y/Y

EZ APR FLASH CORE HICP +0.6% M/M; +0.8% Y/Y; MAR +0.9% Y/Y

- EZ inflation rose further to 1.6% in Apr, in line with market expectations (BBG: +1.6%), marking the highest level since Apr 2019.

- Core inflation decelerated to 0.8% in Apr, also confirming market forecasts and showing the lowest level since Dec 2020.

- Apr's uptick was driven by a sharp increase of energy inflation, rising by 10.3% in Apr.

- This marks the second successive positive rate, as energy prices are compared to the unusually low levels seen in 2020 at the beginning of the pandemic.

- While non-energy industrial goods prices ticked up to 0.5%, service and food inflation slowed to 0.9% and 0.7%, respectively.

- Among the member states, Luxembourg (3.3%), Lithuania (2.4%) and Germany (2.1%) recorded the largest rates, while Greece (-0.8%) and Portugal (-0.1%) saw a decline in consumer prices.

Swiss KOF At Record High in April

SWISS APR KOF ECON BAROMETER 134; MAR 118

- The KOF Economic Barometer surged 16pt in Apr to 134.0, surpassing market forecasts (BBG: 119.5) hitting a record high.

- The index already rose sharply in March to an 11-year high.

- The increase was driven by the strong manufacturing sector, boosted by international demand.

- But also the outlook for services, financial and insurance services as well as consumer demand improved significantly in Apr.

- "Unless the virus takes another volte, economic development is likely to get a strong boost in the near future" the report noted.

FIXED INCOME: Data and Month End in focus

A steady morning trading session for EGBs in general.

- Most contracts trades in the green, after yesterday's sell off, led by Bunds.

- Futures are better bid, underpinned, unwinding some of yesterday's sell off, which was boosted by some countries set to re-open, providing a more positive growth outlook, and a potential Summer Boom back on the table.

- Main early focus was on European data, which included French, EU, Portugal CPI/PPI, Spanish Retail sales and EU, German, Spanish and Portugal prelim GDP.

- But very little impacts in markets.

- Peripherals trade mostly close to flat against Germany, albeit leaning a touch wider.

- Gilts have traded inline with Bund, and trade 10 ticks up at the time of typing.

- US treasuries remains within the tight overnight range, but still lagging versus Core EGBs, to trade a touch in negative territory.

- Not much in terms of Month Flow noted so far, but some investors will be keeping an eye on any potential action going towards the European close.

- Looking ahead, plenty more data are scheduled for release ahead of the bank holiday weekend.

- This includes US PCE deflator, Chicago PMI, Michigan sentiment and Canadian GDP.

- Fed Kaplan is the only speaker left for the day.

- After markets, Fitch rating on Germany and DBRS on Italy

FOREX: CAD Moves From Strength-to-Strength Ahead of GDP

- CAD strength has persisted, with USD/CAD edging lower for the sixth session in eight, helping pressure the pair to its lowest level today since 2018. 1.2251 undercuts as decent support headed into today's Canadian GDP number.

- The USD Index has stabilised after hitting a new multi-month low yesterday, with 90.424 now seen as key support, while the 100-dma at 91.0394 the near-term target.

- Scandi FX is moderating, with NOK & SEK underperforming all others so far Friday. NOK is pulling off recent highs having traded solidly alongside commodities, while SEK has fallen out of favour after the Swedish health ministry pushed back their vaccination target for the country to September 5th from August 15th.

- A raft of US and Canadian data follows Friday, with personal income/spending and PCE numbers as well as the MNI Chicago Business Barometer from the US. Canadian GDP also crosses, with markets expecting a slight moderation in the pace of expansion across February. The speakers slate is very quiet, with just Fed's Kaplan on the docket.

EQUITIES: Europe Mostly In The Green, U.S. Futures Softer

- Asian equities closed lower, with Japan's NIKKEI down 241.34 pts or -0.83% at 28812.63 and the TOPIX down 10.82 pts or -0.57% at 1898.24. China's SHANGHAI closed down 28.045 pts or -0.81% at 3446.856 and the HANG SENG ended 578.38 pts lower or -1.97% at 28724.88

- European stocks are mostly higher, with the German Dax up 75.22 pts or +0.5% at 15154.2, FTSE 100 up 16.42 pts or +0.24% at 6961.48, CAC 40 down 2.06 pts or -0.03% at 6302.57 and Euro Stoxx 50 up 4.75 pts or +0.12% at 3996.9.

- U.S. futures are a little lower, with the Dow Jones mini down 51 pts or -0.15% at 33900, S&P 500 mini down 10.5 pts or -0.25% at 4193, NASDAQ mini down 41.75 pts or -0.3% at 13911.75.

COMMODITIES: Platinum Rises (As Palladium Hits All Time High Above $3k)

- WTI Crude down $0.64 or -0.98% at $64.37

- Natural Gas down $0.01 or -0.31% at $2.901

- Gold spot down $2.14 or -0.12% at $1772.87

- Copper up $1.15 or +0.26% at $449.8

- Silver down $0.1 or -0.4% at $25.9938

- Platinum up $9.7 or +0.81% at $1212.22

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.