-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: BOE And ECB Up Shortly

EXECUTIVE SUMMARY:

- EUROPEAN PMIS MISS EXPECTATIONS AS COVID FEARS RETURN

- NORGES BANK HIKES RATES; SNB KEEPS POLICY LOOSE AS FRANC STRENGTHENS

- BANK OF ENGLAND, EUROPEAN CENTRAL BANK DECISIONS UP LATER TODAY

- ECB HANDS BANKS E59BLN IN FINAL ROUND OF TLTROS

- U.K. TRAVELERS TO FRANCE FACE QUARANTINE TO SLOW OMICRON SPREAD

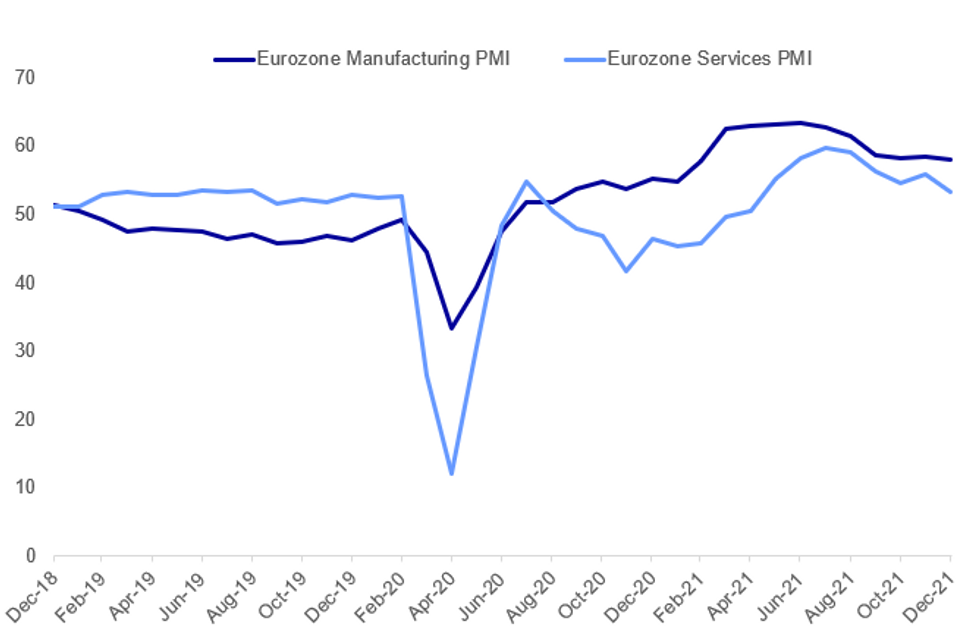

Fig. 1: Weaker Services Drive Eurozone PMI Miss

Source: IHS Markit, MNI

Source: IHS Markit, MNI

NEWS:

NORGES BANK: The Norges Bank has again led the way on the tightening path by hiking its policy rate for the second time, raising it by 25 basis points to 0.5% and projecting gradual increases to take it to 1.7% by the end of its forecast period in 2024. The onset of the new Covid variant, Omicron, had no impact on the rate projection which was little changed from September's path. The policy rate projection for 2022 was nudged down 0.1 percentage point to 0.8% while the 2023 forecast was nudged up 0.1 points to 1.5%. Governor Oystein Olsen said that while there was considerable uncertainty around the pandemic "if economic developments evolve broadly in line with projections the policy rate will most likely be raised in March," as noted in the latest MNI State of Play.

SNB: Interest on sight deposits held by the Swiss National Bank was kept at -0.75% Thursday, as chairman Thomas Jordan stressed the need for Switzerland to maintain an expansionary monetary policy despite other central banks' moves towards policy normalisation. Even following its recent nominal appreciation, the CHF remains only "highly valued", Jordan explained, with the real effective exchange rate remaining "more or less stable over the last couple of quarters."

BOE: The Bank of England meeting today will be closely watched, particularly after yesterday's inflation prints (3 tenths higher than expected with headline at 5.1%Y/Y, core at 4.0%). Markets are now pricing in around a 45% probability of a hike today, up from around 30% at the end of last week. Only 4/21 analyst previews we read look for hikes, however.

ECB: The ECB also meets today and had set the meeting up to announce what wouldreplace PEPP when the programme is due to end in March. A beefed-up APP is expected to be the replacement but we think we might not get all the details in terms of the exact size of APP purchases at this juncture. Given the uncertainty of Omicron and potential further lockdowns across Eurozone economies, setting the purchase pace for April seems to be a long way away and the ECB may prefer to wait until the February meeting to give more details.

ECB (BBG): Euro-area lenders took almost 52 billion euros ($59 billion) in the final round of ultra-cheap funding from the European Central Bank as the Frankfurt-based institution prepares to announce how it will phase out stimulus enacted to ease the pandemic.Bids for the loans, known as TLTROs, came from 159 banks, the ECB said Thursday in a statement. Officials haven’t indicated yet whether they plan to continue the measure in some form next year.

U.K. - FRANCE / COVID (BBG): France will impose tougher rules on people traveling from the U.K., including a ban on non-essential trips and a requirement to self-isolate, as it tries to slow the spread of the omicron variant. “We are going to put in place more drastic controls at the border with the U.K.,” government spokesman Gabriel Attal said on Thursday in an interview with BFM television.The plan comes after the U.K. recorded on Wednesday its highest number of positive Covid-19 cases since the beginning of the pandemic, with 78,610 infections. The new French rules will kick in at midnight on Friday.

BANK INDONESIA: Indonesia's central bank has cited the stability of the rupiah in its decision on Thursday to maintain its benchmark interest rate as the economic recovery continues. As expected, Bank Indonesia's Board of Governors has kept the seven-day reverse repo rate unchanged at 3.50%.

FRANCE FLASH DEC MFG PMI 54.9; NOV 55.9

PMI data points to hopes price pressures starting to ease

- December flash prints: Services a little higher than expected, manufacturing a bit lower; but both lower than in November.

- Some concern regarding Omicron starting to show up, while some price pressures expected to ease soon - which would be in line with the ECB's hopes that inflation will peak at the end of this year.

- "Higher activity levels were supported by new business wins, although a new wave of COVID-19 infections and the emergence of the Omicron variant reportedly weighed on the upturn. Meanwhile, manufacturers attributed lower output at their units to shortages of raw materials and semifinished components"

- "The increase in overall new orders was the softest for three months amid rising COVID-19 cases across France, which some firms, particularly in the service sector, linked to weaker sales performances. Encouragingly, new manufacturing orders rose at the quickest pace for four months, but growth was still subdued in comparison to earlier in the year"

- "Elsewhere, steep price pressures persisted in December, with input costs and output charges rising notably. However, there were signs of these steep inflation rates abating, having slowed since November. Nevertheless, rising staff costs and higher prices for raw materials continued to exert upward pressure on business expenses, which firms reportedly passed onto their clients by raising selling charges."

GERMANY FLASH DEC MFG PMI 57.9; NOV 57.4

German flash PMIs not as expected

- German flash PMIs did not follow market expectations this morning, with the toll of the fourth wave on services grossly underestimated.

- Flash manufacturing surprised markets with a slight recovery, coming in a whole point above the Bloomberg consensus at 57.9 (forecast: 56.9, previous: 57.4) as supply chain disruptions saw some easing and input output cost inflation eased somewhat.

- On the other hand, the German prelim services PMI dropped over four points to a 10-month low of 48.4 (forecast: 51.0, previous: 52.7), signaling a contraction in the industry at 2.6 points below the forecast.

- The stark contraction in services saw the flash composite PMI reading drop to an 18-month low at the breakeven point of 50.0 (forecast: 51.1, previous: 52.2).

EZ FLASH DEC MFG PMI 58.0; NOV 58.4

Eurozone Growth At 9-Month Low On Weaker Services

Eurozone Manufacturing PMI beat expectations (58.0 vs 57.8 exp) in December's flash reading, but Services missed (53.3 vs 54.3 exp), leaving Composite a little weaker than survey (53.4 vs 54.4 exp).

- The Composite figure was the lowest since March and points to a "marked" weakening of growth in Q4, per IHS Markit's report, "albeit with the rate of growth remaining above the survey’s pre-pandemic long-run average of 53.0".

- Services saw the weakest rate of growth since April "led by a steep fall in tourism and recreation activity of a similar magnitude to the declines seen at the start of the year amid rising COVID-19 infection rates and associated restrictions across the region."

- The survey showed that Manufacturing supply chain problems may have eased somewhat, with the largest expansion of production since September, and the lowest increase in delivery times since January. Indeed this was the first time in five months that Manufacturing output growth exceeded that of Services.

- Inflationary pressures "cooled", in part due to easing of supply constraints, but this was only relative to November, and December saw the 2nd fastest rates of increase in survey history.

- German growth "stalled", France "continued to grow at a solid pace, albeit down on November", while the rest of the eurozone grew at the slowest since April.

UK FLASH DEC MFG PMI 57.6; NOV 58.1

UK PMI services hit by Omicron concerns

Omicron concerns hit the UK PMI services, as consumer confidence appears to have been hit.

- "Worst month for the UK economy since February as private sector output growth eased considerably in response to tighter pandemic restrictions and renewed business uncertainty. The slowdown was centred on the service sector, which more than offset a modest acceleration in manufacturing production at the end of 2021."

- In services: "Survey respondents widely cited a negative impact on consumer demand from tighter COVID-19 stringency measures and renewed travel restrictions. There were also reports that business uncertainty related to the Omicron variant had led to a reluctance to spend."

- "Optimism regarding the year ahead outlook for business activity eased for the fourth consecutive month in December. This largely reflected a slump in confidence among consumer-facing service providers."

- "Smallest rise in backlogs of work for nine months"

- "The latest increase in average cost burdens was much softer than November's survey-record high. At the same time, prices charged inflation moderated to its weakest since August. Reports from survey respondents highlighted that sharply rising wages, transport bills and raw material prices remained the main sources of cost inflation."

FIXED INCOME: BOE and ECB meetings due up shortly

After yesterday's Fed meeting, we now await policy announcements from the ECB and BOE.

- Treasuries have pared moved higher with the 2s10s curve steepening as markets reduce the probability of hikes further out the curve. 10-year UST yields are higher than expected morning while 2-year yields are lower.

- Gilts have moved a little lower, as the market prices in a greater chance of a hike today following yesterday's higher-than-expected inflation data (and in spite of worsening Omicron case data in the UK). Markets are now pricing a close to 50% probability of a hike today, up from around 40% yesterday. The MNI Markets team expects an on hold decision today as the uncertainty from Omicron in our view seems higher than the uncertainty due to the end of furlough in November.

- Bunds have stayed within yesterday's ranges. Today's ECB meeting will announce the follow-up to PEPP from April, but we are not sure we will get too much in the way of details until February meeting.

- TY1 futures are up 0-9+ today at 130-24+ with 10y UST yields down -1.4bp at 1.445% and 2y yields down -2.4bp at 0.642%.

- Bund futures are down -0.18 today at 174.14 with 10y Bund yields up 0.8bp at -0.356% and Schatz yields down -0.2bp at -0.693%.

- Gilt futures are down -0.20 today at 127.10 with 10y yields up 1.1bp at 0.744% and 2y yields up 0.8bp at 0.484%.

FOREX: NOK Rolls Higher as Norges Bank Err Hawkishly

- NOK is comfortably the best performer across G10, with EUR/NOK fading to the 100-dma at 10.1197 as the Norges Bank proceeded with a 25bps rate hike despite some outside expectations that the Bank could stand pat given the looming omicron risks. Not only did the bank raise rates, but they also name-checked March as the next most likely point at which the bank would tighten further, underpinning today's NOK strength. Elsewhere, the SNB kept policy unchanged - as expected.

- The USD Index remains weaker ahead of the NY crossover, with the USD holding post-Fed losses as Powell painted a particularly confident picture of the US economy headed into 2022.

- The JPY is the poorest performer so far in G10, moving against the general strength in equities posted following the Federal Reserve rate decision late yesterday. This keeps resistance at 114.26 in view, as well as the 114.38 level - marking the 61.8% Fib for the late November downtick.

- Focus turns to the looming BoE and ECB rate decisions. A small - but not insignificant - minority of analysts see the Bank of England raising rates at today's decision, but the majority see the BoE unchanged in the face of omicron risks.

EQUITIES: S&P Futures Eye All-Time High

- Asian stocks closed higher, with Japan's NIKKEI closed up 606.6 pts or +2.13% at 29066.32 and the TOPIX ended 28.98 pts higher or +1.46% at 2013.08. China's SHANGHAI closed up 27.386 pts or +0.75% at 3675.016 and the HANG SENG ended 54.74 pts higher or +0.23% at 23475.5

- European bourses are higher, with the German Dax up 236.08 pts or +1.53% at 15712.07, FTSE 100 up 59.78 pts or +0.83% at 7230.3, CAC 40 up 61.47 pts or +0.89% at 6988.63 and Euro Stoxx 50 up 63.71 pts or +1.53% at 4223.32.

- U.S. futures are gaining, with the Dow Jones mini up 172 pts or +0.48% at 36098, S&P 500 mini up 25.75 pts or +0.55% at 4735.25, NASDAQ mini up 102.75 pts or +0.63% at 16390.75.

COMMODITIES: Energy And Industrial Metals Rally

- WTI Crude up $0.83 or +1.17% at $71.74

- Natural Gas up $0.13 or +3.52% at $3.94

- Gold spot up $10.13 or +0.57% at $1787.05

- Copper up $11.9 or +2.85% at $430

- Silver up $0.15 or +0.67% at $22.2202

- Platinum up $14.23 or +1.55% at $934.85

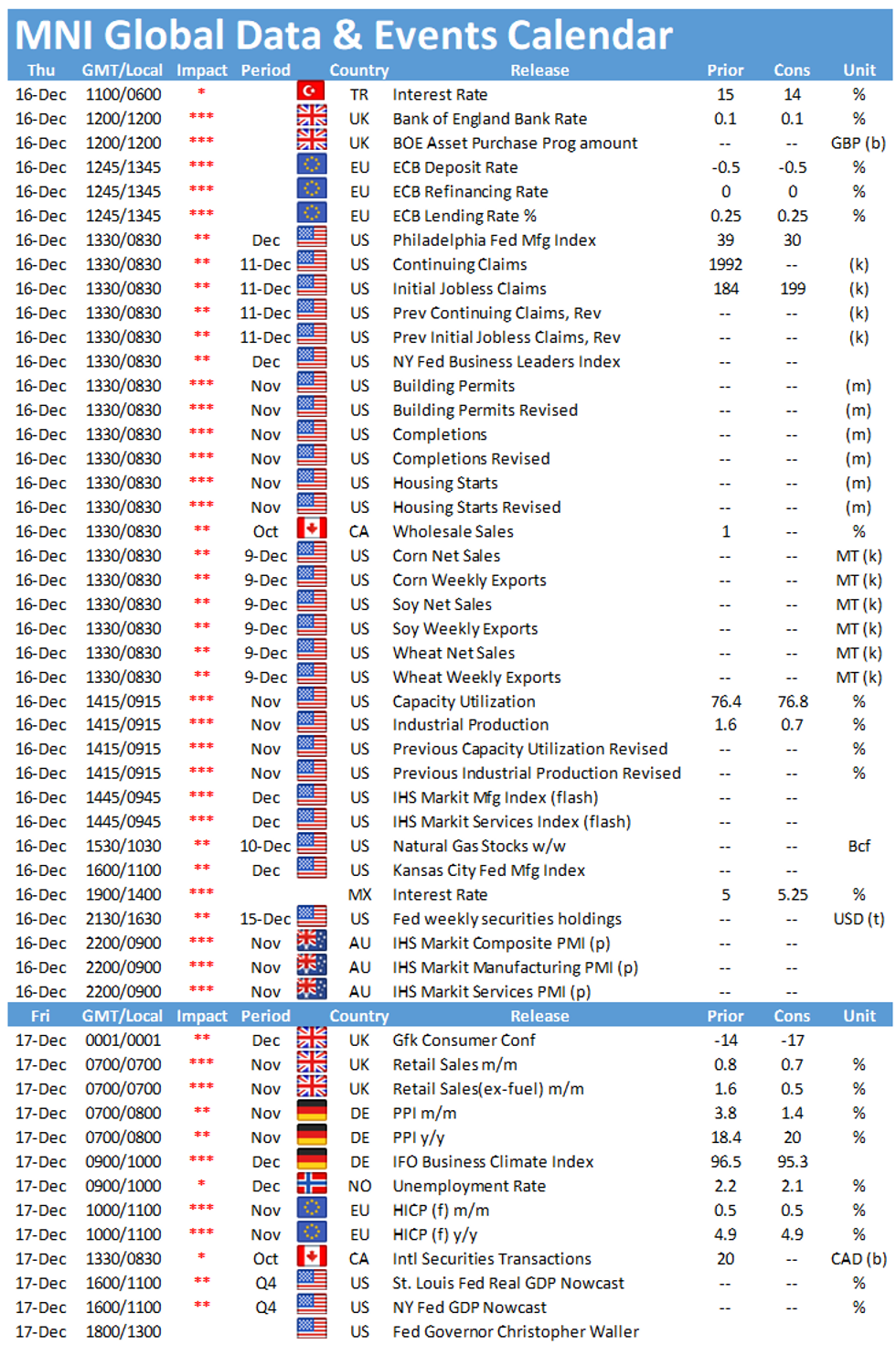

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.