-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Bond Slide Is Getting Real

EXECUTIVE SUMMARY:

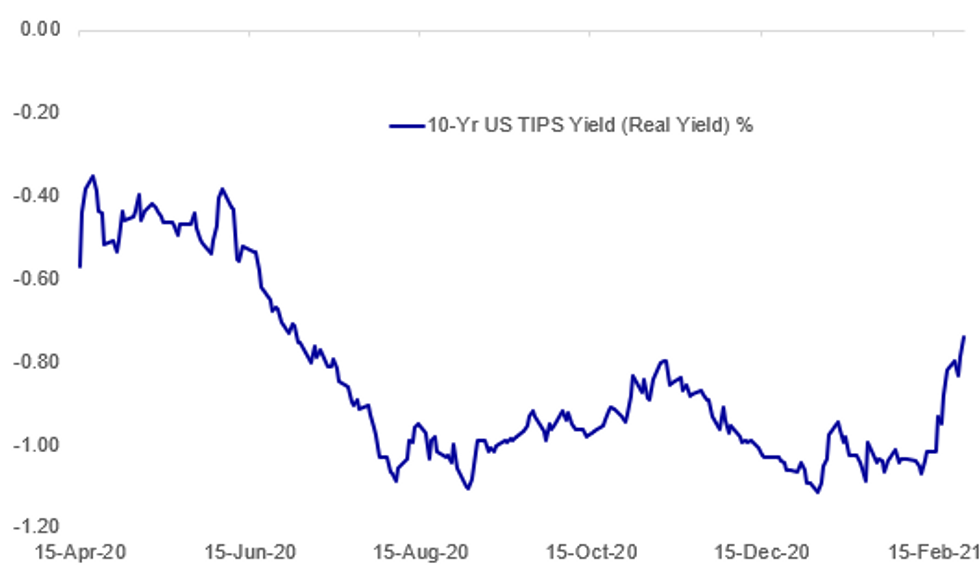

- 10-YR U.S. TSY REAL YIELDS HIT HIGHEST SINCE JULY 2020, AS AUSSIE, KIWI YIELDS SOAR

- EUROZONE ECONOMIC SENTIMENT BETTER THAN EXPECTED IN FEB

- GAMESTOP RESURGENCE EXTENDS AS MEME STOCK MANIA KICKS UP ANEW

- ECB'S SCHNABEL: WILL ENSURE NO UNWARRANTED TIGHTENING OF FINANCING CONDITIONS

Fig. 1: US Real Yields Break Out Overnight

BBG, MNI

BBG, MNI

NEWS:

ECB: LETA conducted an interview with ECB Executive Board Member Schnabel, there didn't appear to be any surprises in the text. "Looking ahead, fiscal and monetary policy support will remain crucial and must not be withdrawn prematurely. As regards monetary policy, we will ensure that there is no unwarranted tightening of financing conditions. A too abrupt increase in real interest rates on the back of improving global growth prospects could jeopardise the economic recovery. Therefore, we are monitoring financial market developments closely."

U.S. EQUITIES (BBG): GameStop Corp. continued its resurgence in U.S. premarket trading, rising as much as 83% after more than doubling on Wednesday in a move that spread to a host of other meme stocks at the center of last month's day trader-driven frenzy. The stock rose as high as $167.50 and traded at $135.57 at 4:15 a.m. in New York. Among other favorites of traders populating Reddit forums, AMC Entertainment Inc. rose 17% premarket after gaining 59% during the first three days of the week, while Express Inc. surged 26%.GameStop jumped 104% in Wednesday's cash session, spurred by a final-hour surge that brought its biggest advance since Jan. 29, the day Robinhood Markets restricted trading in it and 49 other stocks at the height of the frenzy.

CHINA: MNI speaks to Chinese policy advisors about the country's economic growth prospects ahead of key policy meetings -- On MNI Policy MainWire now, for more details please contact sales@marketnews.com

RBNZ (MNI REVIEW): The main challenge faced by the Reserve Bank was striking a fine balance between acknowledging a solid run of data readings while avoiding any tightening commitments. Unsurprisingly, the main monetary policy settings -the OCR as well as LSAP and FLP parameters - were left unchanged and the Committee focused on cautiously brushing away nascent hawkish speculation without losing credibility. Its preferred way out of this conundrum was by keeping a range of options on the table, even when it meant leaving some questions unanswered. For full analysis contact sales@marketnews.com

DATA:

French Consumer Confidence Dips Again in Feb

FRANCE FEB CONSUMER CONF IND 91; JAN 92

- Consumer sentiment eased 1pt to 91 in Feb, showing the second successive decline and coming in weaker than market expectations (BBG: 92)

- Feb's decline was driven by a 3pt-fall in household's view of the economic situation in the past 12 months, marking the lowest level since Oct 2014, while consumer opinion about their own past financial situation ticked up 1pt.

- Household's assessment of the future economic situation dropped 2pt, while their opinion about their future financial situation remained unchanged.

- Consumer's savings intentions were unchanged, while intentions to make major purchases edged 1pt higher.

- The fear of unemployment rose further in Feb, up 2pt to the highest level since Jun 2009.

- The pandemic continues to weigh on household confidence and consumers are continuously worried to loose their jobs and together with elevated savings intentions and low intentions to make purchases, this bodes ill with consumer spending going forward.

Italy Consumer Confidence Up In Feb

- Feb SA consumer confidence 101.4 vs Jan 100.7

- Consumers' sentiment on economy rose to 91.5 from Jan 83.4

- Confidence in future outlook climbed to 107.5 from Jan 103.2

- Sentiment on their personal climate down to 104.7 vs Jan 106.5

- Sentiment on the current climate fell to 97.3 from Jan 99.0

German Consumer Sentiment Boost In March: Gfk

German consumers are slowly recovering from 'lockdown shock' as Covid-19 infection rates decline, the vaccine rollout pick up and the general outlook brightens, Gfk's Rolf Buerkl, said Thursday, although he warned that downside risks remain. "Consumer sentiment in Germany will only recover sustainably when the strict lockdown ends and shops, hotels and restaurants reopen. If, on the other hand, the measures are extended once again, the chances of a swift recovery will disappear and consumer sentiment will face further tough times ahead." Buerkl added.

Consumer sentiment ticked up 2.6 points to -12.9 in March as both economic and income expectations improved. Household propensity-to-buy ratios also rose, while their savings intentions declined.

EZ ESI Better Than Expected in February

Economic Sentiment Indicator (ESI): 93.4; Prev (Jan): 91.5

Consumer: -14.8(Jan: -15.5); Industry: -3.3 (Jan: -6.1); Services: -17.1 (Jan: -17.7); Retail: -19.1 (Jan: -18.5); Construction: -7.5 (Jan: -7.7)

- The EZ ESI ticked up 1.9pt to 93.4 in Feb, showing the highest level since Mar 2020 and coming in stronger than markets expected (BBG: 92.0).

- Among the largest EZ economies, the ESI saw the largest gains in Poland (+4.7pt), Italy (+4.4pt) and Germany (+3.0pt), while it fell sharply in Spain (-3.2pt) and to a lesser extent in the Netherlands (-1.3pt).

- Industrial sentiment was the main driver of Feb's increase, rising to the highest level since Mar 2019 at -3.3.

- In line with the flash estimate, consumer confidence ticked up to -14.8, but remains well below the pre-pandemic level.

- While service confidence edged slightly higher by 0.6pt to -17.1, retail trade sentiment fell further to -19.1, its lowest level since Jun 2020.

- Both indicators remain far below the pre-crisis level as tight restrictions weigh on business activity in both sectors.

- The construction sector saw a small uptick in sentiment to -7.5, up from -7.7 seen in January.

- The employment expectations index increased to a four-month high of 90.9 in Feb, following Jan's decline to 89.1.

FIXED INCOME: Remains under pressure

The fixed income sell-off has continued this morning with 10-year Bund yields approaching the highs seen in June 2020, 10-year Treasury yields also moving through yesterday's highs with 10-year gilt yields lagging (higher on the day but not through yesterday's highs).

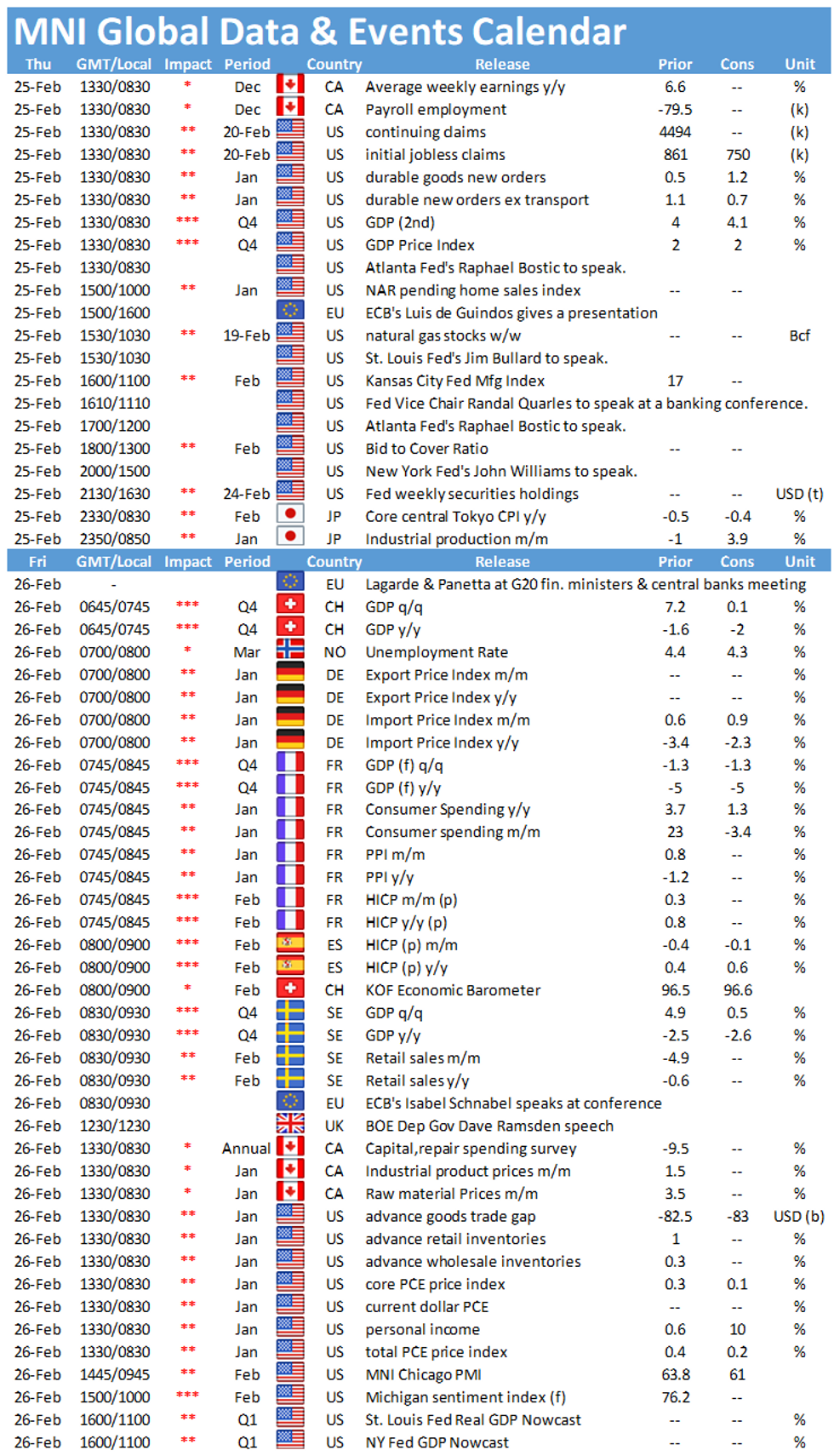

- Looking ahead there is a fair amount of US data - durable goods data for January, the second print of Q4 GDP and claims data. In addition we have speeches due from ECB's Lane and de Guindos and Fed's George, Bullard, Quarles and Williams.

- TY1 futures are down -0-13 today at 134-24 with 10y UST yields up 6.8bp at 1.445% and 2y yields up 0.9bp at 0.134%.

- Bund futures are down -0.56 today at 173.48 with 10y Bund yields up 4.0bp at -0.265% and Schatz yields up 1.0bp at -0.680%.

- Gilt futures are down -0.31 today at 128.12 with 10y yields up 5.1bp at 0.781% and 2y yields up 2.4bp at 0.050%.

FOREX: AUD Catching Up With Buoyant Commodities

The reflationary theme in currency markets continues, with AUD/USD shooting higher and topping $0.80 for the first time since 2018. The currency's taken the lead from commodity markets, whose persistent rally has extended this week and put AUD/USD within range of the key double top resistance from 2017/2018 at 0.8125/36.

The greenback is softer, but JPY is the weakest in G10 alongside CHF as risk sentiment and the reflationary theme continues to work against haven currencies.

Scandi currencies outperform, with NOK, SEK firmer. Both currencies are are new multi-month highs against the greenback.

Focus Thursday turns to weekly jobless claims, another revision for Q4 GDP data, prelim durable goods orders and January pending home sales data. The central bank speaker slate is once again busy, with comments scheduled from Fed's Bostic, George, Bullard, Quarles & Williams as well as ECB's Lane, Guindos and de Cos.

EQUITIES: Tech Turns Lower In European Trade

- Asian stocks closed higher, with Japan's NIKKEI up 496.57 pts or +1.67% at 30168.27 and the TOPIX up 23.16 pts or +1.22% at 1926.23. China's SHANGHAI closed up 20.966 pts or +0.59% at 3585.046 and the HANG SENG ended 355.93 pts higher or +1.2% at 30074.17.

- European stocks are mixed, with the German Dax down 19.47 pts or -0.14% at 13980.53, FTSE 100 up 22.66 pts or +0.34% at 6669.85, CAC 40 up 25.7 pts or +0.44% at 5816.03 and Euro Stoxx 50 up 3.32 pts or +0.09% at 3716.39.

- U.S. futures are also mixed, with the Dow Jones mini up 33 pts or +0.1% at 31949, S&P 500 mini down 7.6 pts or -0.19% at 3915, NASDAQ mini down 104.25 pts or -0.78% at 13197.75.

COMMODITIES: Mixed Picture

- WTI Crude up $0.19 or +0.3% at $63.65

- Natural Gas up $0.05 or +1.65% at $2.844

- Gold spot down $10.49 or -0.58% at $1789.85

- Copper up $2.25 or +0.52% at $432.15

- Silver up $0.02 or +0.07% at $27.8136

- Platinum down $15.08 or -1.19% at $1256.51

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.